Discussion Paper Presentation “An Exposure Based Approach to Automobile Authors:

advertisement

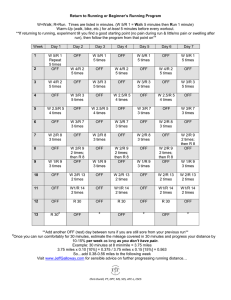

A New Exposure Base for Vehicle Service Contracts – Miles Driven Discussion Paper Presentation “An Exposure Based Approach to Automobile Warranty Ratemaking and Reserving” Authors: John Kerper, FSA, MAAA Lee M. Bowron, ACAS, MAAA Kerper and Bowron LLC www.kerper-bowron.com March 8, 2007 CAS Ratemaking Seminar – Atlanta 2007 Slide 1 A New Exposure Base for Vehicle Service Contracts – Miles Driven Vehicle Service Contracts – A Different Animal • Service Contracts are single premium, long term policies • These require special treatment on actuarial opinions • Insurance Company typically receives the premium after payment of expenses • In some cases, not considered insurance • Other times, only a “CLP” premium is remitted • However the legal treatment, establishing the liability and pricing the book are still issues March 8, 2007 CAS Ratemaking Seminar – Atlanta 2007 Slide 2 A New Exposure Base for Vehicle Service Contracts – Miles Driven Typical Cash Flow of Premium Remitted to Adminstrator Retail Price Agency Commission Dealer Markup March 8, 2007 Adminstrator Fee “CLP” Premium Warranty Reserve Remaining Warranty Reserve CAS Ratemaking Seminar – Atlanta 2007 Slide 3 A New Exposure Base for Vehicle Service Contracts – Miles Driven Claims Pattern for New Car Vehicle Service Contract • for example, 7 years/84,000 miles with a 3 year/36,000 mile basic and a 5 year/60,000 mile powertrain • Initial period of few claims due to manufacturer’s basic (bumper-to-bumper) warranty • A period of claims during the powertrain only manufacturer’s warranty • An increase in claims when the manufacturer’s warranty expires • A slowing of claims as the coverage “miles out” March 8, 2007 CAS Ratemaking Seminar – Atlanta 2007 Slide 4 A New Exposure Base for Vehicle Service Contracts – Miles Driven Earnings Curves • Earnings curves are predetermined amounts of earnings for system reports • Earnings curves are not the true earnings since the unearned premium reserve is subject to additional actuarial testing • Rule-of-thumb curves (pro-rata, reverse rule of 78s) should be avoided in most cases. March 8, 2007 CAS Ratemaking Seminar – Atlanta 2007 Slide 5 A New Exposure Base for Vehicle Service Contracts – Miles Driven Current Actuarial Practice • The most common method is to triangulate pure premiums at various evaluations • Pure premiums are then trended to the evaluation date • Tail factors are usually defaulted to earning curve assumptions. March 8, 2007 CAS Ratemaking Seminar – Atlanta 2007 Slide 6 A New Exposure Base for Vehicle Service Contracts – Miles Driven Pure Premium Method - Contract Count New Domestic 7/84 Term In-Force Contracts Policy Year Policy Age 12 24 36 48 60 2002 200 194 191 187 179 2003 600 583 557 542 2004 1,200 1,176 1,145 2005 1,500 1,455 2006 1,000 Total March 8, 2007 4,500 3,409 1,893 729 72 84 179 CAS Ratemaking Seminar – Atlanta 2007 Slide 7 A New Exposure Base for Vehicle Service Contracts – Miles Driven Pure Premium Method – Pure Premiums 7/84 Term New Domestic Policy Policy Age Year 12 24 36 48 60 2002 2.19 21.81 45.89 134.58 160.38 2003 1.16 47.90 58.93 172.62 2004 1.12 41.22 79.98 2005 2.34 63.00 2006 3.00 Average 1.96 43.49 61.60 153.60 160.38 Selected 1.96 43.49 61.60 153.60 160.38 March 8, 2007 CAS Ratemaking Seminar – Atlanta 2007 72 84 Slide 8 A New Exposure Base for Vehicle Service Contracts – Miles Driven Pure Premium Method – Future Pure Premiums New Domestic Future Values Trended 2% 7/84 Term Development Policy Year March 8, 2007 12 24 36 48 60 2002 2.19 21.81 45.89 134.58 160.38 2003 1.16 47.90 58.93 172.62 163.59 2004 1.12 41.22 79.98 156.67 166.86 2005 2.34 63.00 62.83 159.81 170.20 2006 3.00 44.35 64.09 163.00 173.60 CAS Ratemaking Seminar – Atlanta 2007 Slide 9 A New Exposure Base for Vehicle Service Contracts – Miles Driven Estimating the Total Costs New Domestic Future Values Trended 2% 7/84 Term Policy Reported Year Losses Contracts 2002 67,389 179 2003 154,921 542 2004 141,418 2005 2006 Earnings Total Losses Factor Estimated Future @60months @60months Losses Losses 0.78 86,396 19,007 88,589 0.78 312,191 157,271 1,145 370,447 0.78 656,237 514,819 95,195 1,455 571,639 0.78 854,915 759,720 3,004 1,000 663,318 0.78 854,259 851,255 2,763,998 2,302,072 461,926 March 8, 2007 Future 0 1,693,992 CAS Ratemaking Seminar – Atlanta 2007 Slide 10 A New Exposure Base for Vehicle Service Contracts – Miles Driven Issues with Pure Premium Method • Data may not be available in the tail • Older data may not be appropriate • Subdividing data will likely decrease credibility • Sensitive to outlier data points March 8, 2007 CAS Ratemaking Seminar – Atlanta 2007 Slide 11 A New Exposure Base for Vehicle Service Contracts – Miles Driven An Alternative Approach • Instead of claims as a function of time, claims as a function of miles driven • Claims = Miles Driven * Cost per mile * trend factor March 8, 2007 CAS Ratemaking Seminar – Atlanta 2007 Slide 12 A New Exposure Base for Vehicle Service Contracts – Miles Driven Estimating Miles Driven • Miles driven during a vehicle service contract can be modeled from observed events • Claims • Cancellations • Distributional approach to model the variability in the book • Segment observations into quintiles by average miles driven per month • triangulate the data and project to ultimate the average miles driven per year March 8, 2007 CAS Ratemaking Seminar – Atlanta 2007 Slide 13 A New Exposure Base for Vehicle Service Contracts – Miles Driven An Example - Assumptions • Coverage term – 6 years / 72,000 miles • Manufacturer warranty – 3 years / 36,000 miles • Basic and powertrain • Average miles driven per month by quintile • • • • • 8,400 12,000 14,400 18,000 22,800 • 3% of claims during manufacturer warranty March 8, 2007 CAS Ratemaking Seminar – Atlanta 2007 Slide 14 A New Exposure Base for Vehicle Service Contracts – Miles Driven An Example Adjusted Exposed Miles per year 8,400 12,000 14,400 18,000 22,800 Exposure Average Year 1 2 3 4 5 6 252 252 252 8,148 8,148 8,148 360 360 360 11,640 11,640 11,640 432 432 7,200 13,968 13,968 - 540 540 17,460 17,460 - 684 9,708 22,116 3,492 - 454 2,258 9,478 10,942 6,751 3,958 Total 25,200 36,000 36,000 36,000 36,000 33,840 March 8, 2007 CAS Ratemaking Seminar – Atlanta 2007 Slide 15 A New Exposure Base for Vehicle Service Contracts – Miles Driven Calculating the Cost per Mile • Calculate average historical rate • Develop relativities to adjust for contract / vehicle factors • • • • Type and term of coverage Deductible Initial mileage of vehicle when contract purchased Classification of vehicle (should reflect expected claims) • Type of business March 8, 2007 CAS Ratemaking Seminar – Atlanta 2007 Slide 16 A New Exposure Base for Vehicle Service Contracts – Miles Driven Calculating the Cost per Mile • Techniques • Minimum bias • Iterative approach starting with all relativities at 1, adjusting factors for variable with greatest variance (to expedite convergence) • (mostly) independent variables required • GLM • Tweedie distribution with parameter at or near 1 (1 is same as minimum bias) March 8, 2007 CAS Ratemaking Seminar – Atlanta 2007 Slide 17 A New Exposure Base for Vehicle Service Contracts – Miles Driven Trending the Miles • Miles should be trended for the increase in costs due to inflation and “wear-and-tear” • There is also a negative trend factor for: • preexisting conditions (typically on used cars) • decreasing claims consciousness or unreported disposition of vehicle • Apply the trend factor to the estimate of miles driven March 8, 2007 CAS Ratemaking Seminar – Atlanta 2007 Slide 18 A New Exposure Base for Vehicle Service Contracts – Miles Driven Calculating the Claim Rate • Impact of Cancellations • Claims Administration • Pricing the Book March 8, 2007 CAS Ratemaking Seminar – Atlanta 2007 Slide 19