Risk Loads A Historical Perspective Glenn Meyers ISO Innovative Analytics

advertisement

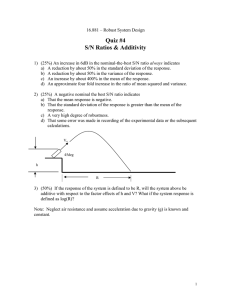

Risk Loads A Historical Perspective Glenn Meyers ISO Innovative Analytics CAS Ratemaking Seminar March 8 and 9, 2007 General Idea of Risk Loads • Less risk is better • For greater risk – Greater demand for transfer risk – Greater reluctance to accept risk – Higher price to transfer • The problem — Quantify the price of risk An Attempt to Quantify risk Buhlmann - 1970 Premium Calculation Principles • Standard deviation principle – Risk Load = a Std. Dev[Loss] • Variance principle – Risk Load = Var[Loss] • Expected utililty principle – U(Equity) = E[U(Equity + Premium - Loss)] An Early (Late 70’s) Use of a Mathematical Formula • ISO Increased Limits Ratemaking • Used the Variance Principle – Reference — Miccolis (PCAS 1977) – Replaced judgmental risk loads. Problem Answers were too high for high limits. Policy ILF W/O ILF With Limit Risk Load Risk Load 100,000 1.000 1.000 1,000,000 2.436 2.792 5,000,000 3.428 5.240 10,000,000 3.818 7.276 Response (Mid 80’s) Variance Standard Deviation Policy ILF W/O ILF With Limit Risk Load Risk Load 100,000 1.000 1.000 1,000,000 2.436 2.792 5,000,000 3.428 4.736 10,000,000 3.818 5.892 (Mid-Late 80’s) Tension between Risk Loads and CAPM • Interpretation of CAPM – No risk loads – Insurance risk is diversifiable – Profit loading depends upon the covariance of the line of insurance with the stock market. Another Interpretation of CAPM • H.H. Müller (ASTIN — Nov. 1987) • If a security is independent of all other securities in the market, then its price is given by the variance principle! • This apparently contradicts prior interpretation. ???? The Math Behind of Müller’s Assertion • Let: Ri Re turn on ith sec urity RM Re turn on market n w i Ri i1 The Math Behind of Müller’s Assertion Assume Cov Rk ,Ri 0 for all i k Cov Rk ,RM Then k Var RM n w i Cov Rk ,Ri i1 Var RM wk Var Rk Var RM Late 80’s Standard Deviation Risk Load Fell Apart • Variance principle – Good to spread risk among (re)insurers X2 Y X2 2 X Y Y2 X2 Y2 • Standard deviation principle – Good to have a diversified portfolio X Y 2 X Y 2 x 2 x 2 X Y X Y 2 x 2 x Hans Buhlmann • Use variance principle for individual risks • Use standard deviation principle for insurers Early 90’s • ISO Competitive Market Equilibrium (CME) Risk Load – Derived from constrained optimization • Maximize return subject to constraint on insurer standard deviation • Risk load proportional to marginal variance • Constant of proportionality determined by insurer’s total return objectives • Recognized correlation generated by parameter uncertainty • Motivated by CAPM constrained optimization • Still in effect today Earlier 90’s - Independently • Rodney Kreps – “Risk Load as the Marginal Cost of Capital” • C = Capital, V = Insurer Variance, T = Constant C T V dC T T2 C V dV 2 V 2C • Marginal Capital Marginal Variance • Equivalent to ISO CME Similar Derivations of CAPM and Risk Loads • Both derived by constrained optimization • CAPM (and successors) – Directed toward pricing securities – e.g. the expected return for an insurer – Requires capital allocation to apply to lines of insurance • Risk Load – Used to carve up insurer’s return to individual policies – Provides no guidance on total return to insurer – Equivalent to allocating capital in proportion to marginal capital Tying Risk Load to Capital • Long tailed lines need capital to support uncertain reserves. • Cost of holding (allocated) capital over time needs to be reflected in risk loads. • Long-tailed lines are not necessarily more risky, but if the distribution of ultimate losses are the same, the longer-tailed line should have higher risk load. Recent Developments • Solvency II and risk-based capital – British FSA and S&P internal models • Tail-Value at Risk TVaR is a leading candidate to replace Standard Deviation as a measure of insurer risk. – Regulatory Capital = TVaR – Expected Loss • Should we use marginal regulatory capital to calculate risk loads?