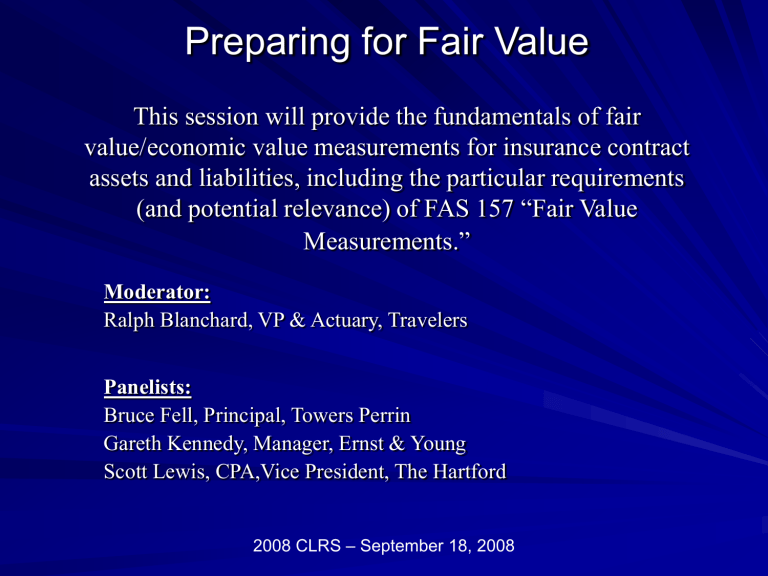

Preparing for Fair Value

Preparing for Fair Value

This session will provide the fundamentals of fair value/economic value measurements for insurance contract assets and liabilities, including the particular requirements

(and potential relevance) of FAS 157 “Fair Value

Measurements.”

Moderator:

Ralph Blanchard, VP & Actuary, Travelers

Panelists:

Bruce Fell, Principal, Towers Perrin

Gareth Kennedy, Manager, Ernst & Young

Scott Lewis, CPA,Vice President, The Hartford

2008 CLRS

– September 18, 2008

What is fair value (for a liability) ?

FAS 157

– Fair value is the price that would be … paid to transfer a liability in an orderly transaction between market participants at the measurement date.

IAS 39

– Fair value is the amount for which … a liability [could be] settled , between knowledgeable, willing parties in an arm's length transaction.

2

What is fair value (for a liability) ?

Key issues:

– Transfer versus settlement?

– Immediate versus orderly over time

How much do you reflect current market, if current market is in crisis

– Observed market values vs. entity specific assumptions

Final definition for insurance liabilities is still in play!

Heirarchy

– Level 1 – Observed values from a robust market

– Level 2 – Observed values for similar items (robust market)

– Level 3 – Discounted cash flow with risk margin

Risk margin based on what market requires for risk compensation

Fair value risk margin ≠ conservatism

3

Where does “fair value” apply?

FAS 157 - Fair Value Measurements

– Defines fair value and provides guidance on how to calculate it.

– Does not say when to use it.

FAS 159 - Fair Value Option

– Gives companies an option to use fair value

– Decision is made contract by contract.

– Does not require it anywhere.

FAS 141R – Business Combinations (revised)

– Requires fair valuing the acquired liabilities at fair value at their acquisition date .

– Initial difference between fair value and FAS 60 value treated as a separate intangible asset

– Intangible asset is “amortized on a basis consistent with the liability … consistent with the limited guidance provided by IFRS 4. “

4

Current debates

IASB (International Accounting Standards Board)

– Should insurance liabilities be at fair value? What is fair value?

– When do you recognize premium (i.e., when is it “earned”)

– When will they get done with insurance standard?

Board turns over in 2011 – Do they want to reeducate a new board if not done by then.

FASB (Financial Accounting Standards Board)

– Should they join in IASB insurance project, or watch from the sidelines?

SEC (Securities and Exchange Commission)

– When do they require U.S. registrants to use IFRS (International Financial

Reporting Standards)

– Transition rules?

– How long does accounting profession need to be ready?

(Note: privately held firms follow FASB but not the SEC.)

5

Panelists

Bruce Fell, Principal, Towers Perrin

Gareth Kennedy, Manager, Ernst & Young

Scott Lewis, CPA,Vice President, The Hartford

6