A Universal Framework For Pricing Financial and Insurance Risks

advertisement

A Universal Framework

For Pricing Financial

and Insurance Risks

Presentation at the ASTIN Colloquium

July 2001, Washington DC

Shaun Wang, 2001

Shaun Wang, FCAS, Ph.D.

SCOR Reinsurance Co.

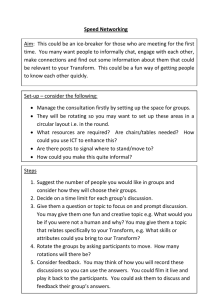

Outline: A Puzzle Game

Present a new formula

to connect CAPM with

Black-Scholes

Piece together with

actuarial axioms

Empirical findings

Capital Allocations

CAPM

Price Data

?

Black-Scholes

Market Price of Risk

Asset return R has normal distribution

r --- the risk-free rate

={ E[R] r }/[R]

is “the market price of risk” or excess

return per unit of volatility.

Capital Asset Pricing Model

Let Ri and RM be the return for asset i

and market portfolio M.

i ( Ri , RM ) M

The New Transform

F * ( x ) ( F ( x ))

1

is the standard normal cdf.

extends the “market price of risk”

in CAPM to risks with non-normal

distributions

F * ( x) ( F ( x))

1

If FX is normal(), FX* is another

normal( )

E*[X] =

If FX is lognormal( ), FX* is

another lognormal( )

Correlation Measure

Risks X and Y can be transformed to

normal variables:

1

X * [ FX ( X )],

1

Y * [ FY (Y )]

Define New Correlation

* ( X , Y ) ( X *,Y *)

Why New Correlation ?

Let X ~ lognormal(0,1)

Let Y=X^b (deterministic)

For the traditional correlation:

(X,Y) 0 as b +

For the new correlation:

*(X,Y)=1 for all b

Extending CAPM

The transform recovers CAPM for risks

with normal distributions

extends the traditional meaning of

{ E[R] r }/[R]

New transform extends CAPM to risks with

non-normal distributions:

i * ( Ri , RM ) M

Brownian Motion

dAi (t ) / Ai (t ) i dt i dWi

Stock price Ai(T) ~ lognormal

To reproduce stock’s current value:

Ai(0) = E*[ Ai(T)] exp(rT)

Implies

i T (i r ) / i

Co-monotone Derivatives

For non-decreasing f, Y=f(X) is comonotone derivative of X.

e.g. Y=call option, X=underlying stock

Y and X have the same correlation *

with the market portfolio

should be used for pricing the

underlying and its derivative

Same

Commutable Pricing

Co-monotone derivative Y=f(X)

Equivalent methods:

a) Apply transform to FX to get FX*,

then derive FY* from FX*

b) Derive FY from FX, then apply

transform to FY to get FY*

Recover Black-Scholes

Apply transform with same i from

underlying stock to price options

Both i and the expected return i drop

out from the risk-adjusted stock price

distribution!!

We’ve just reproduced the B-S price!!

Option Pricing Example

A stock’s current price = $1326.03.

Projection of 3-month price: 20 outcomes:

1218.71, 1309.51, 1287.08, 1352.47, 1518.84, 1239.06, 1415.00,

1387.64, 1602.70, 1189.37, 1364.62, 1505.44, 1358.41, 1419.09,

1550.21, 1355.32, 1429.04, 1359.02, 1377.62, 1363.84.

The 3-month risk-free rate = 1.5%.

How to price a 3-month European call

option with a strike price of $1375 ?

Computation

Sample data: =4.08%, =8.07%

Use =(r)/ =0.320 as “starter”

The transform yields a price =1328.14,

differing from current price=1326.03

Solve to match current price. We get

=0.342

Use the true to price options

Using New Transform (=0.342)

Sorted

Sample

x

1,189

1,219

1,239

Orig.

Prob.

f(x)

0.0500

0.0500

0.0500

1,519

1,550

1,603

0.0500

0.0500

0.0500

0.0318

0.0288

0.0235

1,380

1,360

1,346

1,326

Expected

Discounted

Trans.

Option

Prob.

Payoff

f*(x)

y(x)

0.0963

0.0774

0.0700

143.84

175.21

227.70

wtd

wtd

value

value

f(x) y(x) f*(x) y(x)

7.19

8.76

11.38

4.57

5.04

5.34

41.53

40.91

25.35

24.98

Loss vs Asset

Loss is negative asset: X= – A

New transform applicable to both assets

and losses, with opposite signs in

Alternatively, …

Loss vs Asset

Use the same without changing sign:

a) apply transform to FA for assets, but

b) apply transform to SX=1– FX for losses.

FA* ( x ) 1 ( FA ( x ))

S X* ( x ) 1 ( S X ( x ))

Actuarial World

Loss X with tail prob: SX(t) = Pr{ X>t }.

E X

S

X

(t )dt.

0

Layer X(a, a+h)=min[ max(Xa,0), h ]

E X ( a , a h )

a h

S

a

X

(t )dt.

Loss Distribution

Venter 1991 ASTIN Paper

Insurance prices by layer imply a

transformed distribution

– layer (t, t+dt) loss: SX(t) dt

– layer (t, t+dt) price: SX*(t) dt

– implied transform: SX(t) SX*(t)

Graphic Intuition

Theoretical Choice

F * ( x ) ( F ( x ))

1

• extends classic CAPM and

Black-Scholes,

• equilibrium price under more

relaxed distributional

assumptions than CAPM, and

• unified treatment of assets &

losses

Reality Check

Evidence

for 3-moment CAPM

which accounts for skewness

[Kozik/Larson paper]

“Volatility smile” in option prices

Empirical risk premiums for tail

events (CAT insurance and bond

default) are higher than implied by

the transform.

2-Factor Model

F * ( x) b ( F ( x))

1/b

1

is a multiple factor to the

normal volatility

b<1, depends on F(x), with smaller

values at tails (higher adjustment)

b adjusts for skewness &

parameter uncertainty

Calibrate the b-function

F * ( x ) Q ( F ( x ))

1

1)

Let Q be a symmetric distribution

with fatter tails than Normal(0,1):

Normal-Lognormal Mixture

Student-t

2)

Two calibrations lead to similar bfunctions at the tails

2-Factor Model: Normal-Lognormal

Calibration

gamma-parameter & b-function

1.1

1.0

b-value

0.9

0.8

0.7

gamma=0.2

0.6

gamma=0.3

gamma=0.4

0.5

0.0

0.1

0.2

0.3

0.4

0.5

0.6

F(x) value

0.7

0.8

0.9

Theoretical insights of bfunction

Relates closely to 3-moment CAPM.

Explains better investor behavior: distortion

by greed and fear

Explains “volatility smile” in option prices

Quantifies increased cost-of-capital for

gearing, non-liquidity markets, “stochastic

volatility”, information asymmetry, and

parameter uncertainty

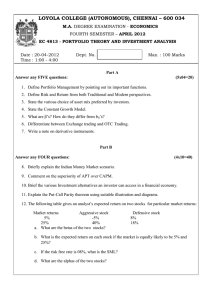

Fit 2-factor model to 1999 transactions

Date Sources: Lane Financial LLC Publications

Yield Spread for Insurance-Linked Securities

16.00%

Model-Spread

Empirical-Spread

12.00%

10.00%

8.00%

6.00%

4.00%

2.00%

Re

es

tic

C

on

R

ce

e

nt

ric

R

Ju e

no

R

es

R

id

e

en

Ke

tia

lvi

lR

n

e

1s

Ke

tE

lvi

ve

n

nt

2n

d

Ev

G

ol

en

d

t

Ea

gl

G

e

ol

A

d

Ea

gl

e

N

am

B

az

u

R

At

e

la

s

R

e

At

A

la

s

R

e

At

B

la

s

R

e

Se

ism C

ic

Lt

d

D

om

rd

2B

al

ya

ai

c

H

os

M

os

ai

c

2A

0.00%

M

Yield Spread

14.00%

Transactions

lp

A

ha

in

d

W

in

d

20

00

20

FR

00

R

N

es

Pr

id

ef

en

Sh

tia

s

lR

e

20

00

M

ed

ite

N

rr

eH

an

M

i

ed

ea

ite

n

R

rr

e

an

A

e

an

P

ri

m

R

e

e

B

H

ur

ri

ca

P

ri

ne

m

e

W

E

Q

es

E

te

W

rn

G

C

ol

ap

d

ita

E

S

a

l

R

gl

e

W

20

in

d

01

S

C

R

la

W

ss

in

A

d

-1

C

la

ss

A

-2

W

lp

ha

A

Yield Spread

Use 1999 parameters to price 2000 transactions

Fitted versus Empirical Spread

8.00%

7.00%

6.00%

5.00%

4.00%

3.00%

Model-Spread

2.00%

1.00%

Empirical-Spread

0.00%

Transactions

2-factor model for corporate bonds: same

lambda but lower gamma than CAT-bond

Bond Rating and Yield Spread

1,400

Model Fitted Spread

1,200

Spread (basis points)

Actual Spread

1,000

800

600

400

200

0

AAA

AA

A

BBB

Bond Rating

BB

B

CCC

Universal Pricing

Cross

Industry

Comparison

and by

industry: equity,

credit, CATbond, weather

and insurance

Cross

Timehorizon

comparison

Term-structure

of and

Capital Allocation

The pricing formula can

serve as a bridge linking

risk, capital and return.

Pricing parameters are

readily comparable to

other industries.

A more robust method

than many current ERM

practices