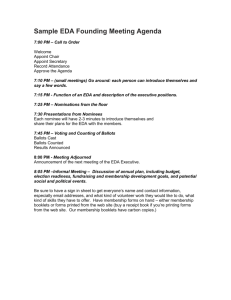

The Cotor Challenge, Round 2 Matthew Flynn (860) 633-4119 x8764

advertisement

The Cotor Challenge, Round 2

Matthew Flynn

(860) 633-4119 x8764

Matt.Flynn@sas.com

Copyright © 2003, SAS Institute Inc. All rights reserved.

A little EDA … Proc GCHART; The data are dominated by single large claim, dashed

horizontal lines are at the 95% and 99% percentiles

$10M

$5M

99th pctile

95th pctile

A little EDA … Proc BOXPLOT The data are dominated by single large claim

A little EDA continued… Proc UNIVARIATE;

A little EDA … Proc UNIVARIATE; Loss Histogram – very, very long tail

A little EDA … Proc UNIVARIATE; Losses verses Exponential distribution Large loss

(upper right)

A little EDA continued … Proc UNIVARIATE - logLoss; overall fits are unlikely to fit tails well.

A little EDA … Proc GCHART; The data are dominated by single large claim, vertical lines

are at $5m and $10m

A little EDA continued … Proc UNIVARIATE - logLoss;

A little EDA continued… - logLoss; Top loss = 60% of total dollars, 90% of all dollars are in

the top 25 (or 1%) losses

Sample Mean Excess Distribution

en

n

(

x

)

i k

( )

n k 1

The sample mean excess distribution is the sum of the excesses over

the threshold u divided by the number of data points, n − k + 1, which

exceed the threshold u.

The sample mean excess function describes the expected excess of a

threshold given that exceedance occurs and is an empirical estimate of

the mean excess function; e(u) = E [x − u|x > u].

If a graph of the sample mean excess function is horizontal, the tail is

exponential. An upward sloping graph is said to be ‘fat-tailed’, relative to

an exponential.

Extreme Value Theory – “Peaks Over Threshold” and the

Generalized Pareto distribution

G ,

1 (1 x / )1 / if ε 0

1 exp( x / ) if ε 0

{

Next, fitting A GPD fit the tail of the loss distribution via SAS Proc NLMIXED.

proc nlmixed data=Cotor(where=(logLoss>11.9));

parms sigma=1 xi=0.3;

bounds sigma >= 0;

if (1 + xi * ((logLoss – 11.9) / sigma)) <= 0 then lnlike = 11.9 ** 6;

else

lnlike = -log(sigma) - (1 + (1 / xi))*log(1 + xi * ((logLoss – 11.9) / sigma));

model logLoss ~ general(lnlike);

run;

Quantile or Tail Estimator – VaR (Value at Risk)

ˆ

ˆ n

1 p 1

xˆ p

ˆ Nu

See: McNeil, Alexander J. The Peaks over Thresholds Method for Estimating High Quantiles of Loss

Distributions, ASTIN Colloquium, 1997, equation 5, page 10.

Expected Shortfall – Tail VaR – Conditional Tail Expectation

If things go bad, how bad is bad?

ES p VaRp E x VaRp | x VaRp

y

p

Expected value of a layer from r to R

E y | x r ( x r ) f x dx ( R r )(1 Fx ( R))

R

GPD Model Fit – Parameter estimates

GPD Model Fit – additional estimates – estimated percentiles, expected shortfall

Sensitivity analysis – expected shortfall, varying size of single largest loss

$5M xs $5M layer price estimate $2,364

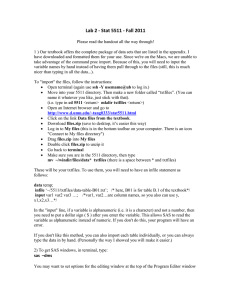

The entire analysis can be run directly from Excel

The entire analysis can be run directly from Excel

The entire analysis can be run directly from Excel

The entire analysis can be run directly from Excel

The entire analysis can be run directly from Excel

Bibliography/Resources

Beirlant, Jan and Gunther Matthys, G., Heavy Tailed Distributions and Rating, ASTIN

Bulletin, 2001, v.31, n.1, p.37-58, http://www.casact.org/library/astin/vol31no1/37.pdf

Cebrian, Ana C. , Michel Denuit, and Philippe Lambert, Generalized Pareto Fit to the

Society Of Actuaries Large Claims Database, North American Actuarial Journal, 2003,

v.7, n.3, p.18-36, http://www.soa.org/bookstore/naaj03_07.html#generalized

Chavez-Demoulin, Valerie and Paul Embrechts, Smooth Extremal Models in Finance

and Insurance, Journal of Risk and Insurance, 2001, v. 71, n. 2, p. 183-199,

http://statwww.epfl.ch/people/chavez/

Coles, Stuart, An Introduction to Statistical Modeling of Extreme Values , Springer,

2001, http://www.maths.bris.ac.uk/~masgc/ismev/summary.html

Corradin, Stefano, Economic Risk Capital and Reinsurance: an Application to Fire

Claims of an Insurance Company, WP, 2001,

http://pascal.iseg.utl.pt/~cemapre/ime2002/main_page/papers/StefanoCorradin.pdf

Bibliography/Resources, cont.

Cummins, J. David, Christopher M. Lewis and Richard D. Phillips, Pricing

excess-of-loss reinsurance contracts against catastrophic loss, Wharton WP,

1998, n. 98-9, http://fic.wharton.upenn.edu/fic/papers/98/9809.pdf

Joossens, Elisabeth and Johan Segers, Modeling large 3rd party claims in car

insurance with an extended GPD, WP, June 2004,

http://dad.ulyssis.org/~bettie/motorfleet/tekst.pdf

McNeil, Alexander J., Estimating the Tails of Loss Severity Distributions using

Extreme Value Theory, ASTIN Bulletin, 1997, v. 27, n. 1, p. 117-137,

http://www.casact.org/library/astin/vol27no1/117.pdf

McNeil, Alexander J., The Peaks over Thresholds Method for Estimating High

Quantiles of Loss Distributions, ASTIN Colloquium, 1997

Bibliography/Resources, cont.

Reiss, Rolf-Dieter and Michael Thomas , Statistical analysis of extreme values,

extended 2nd edition with applications to insurance, finance, hydrology and other

fields, Birkhauser, 2001, http://www.xtremes.math.uni-siegen.de/

Smith, Richard L., Statistics of extremes, with applications in environmental

science, insurance and finance, U. North Carolina, Statistics WP, July 2002,

http://www.stat.unc.edu/postscript/rs/semstatrls.ps

See also:

SAS Online Docs –

Proc NLMIXED

Matt Flynn

(860) 633-4119 x8764

Matt.Flynn@sas.com