Health Insurance ERM Unique Aspects of Risk Faced by Health Insurers

advertisement

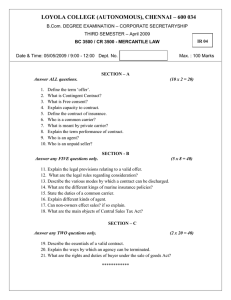

Health Insurance ERM Unique Aspects of Risk Faced by Health Insurers Topics Comments risk Health on the general nature of risks and how they differ from the risks that our life and P&C brethren accept Risk is a Four-Letter Word Negative connotation - something to be avoided Abstract yet concrete Actuaries have chosen to try to make sense out of risk 2 Types of Risk Measurable – Comfortable with this type of risk – Can apply incorrect models – Data is not available that reflects the given risk Unmeasurable – Unnerving – Want to be able to assess it – Need to accept it and deal with it Unique Aspects of Health Risk Not found in other types of insurance Have a much larger role in health insurance than in other types of insurance Mainly Employer-Based Insulates consumers from the true cost of services Employers decide what benefits to offer May shift as baby-boomers age and purchase Medicare Supplement coverage Viewed as a “Right” Entitlement Feeds mentality into other risks such as legislative and legal risks Benefits Can Be Used Over and Over and Over… Most people do not want to use life or P&C benefits frequently if at all. Illness When is a fact of life. people get sick they want the best care and fastest relief. Provider Networks Not unique to health insurance but they represent a much larger risk than for other types of insurance Represent one of a health carrier’s greatest assets. Stability Large enough to handle all of the carrier’s business Provider Networks (cont’d) Risks – Disgruntled providers – Financial viability of providers – Disagreements between providers and health insurers are very public – Growth Economy Slow Economy - Increased use of services before layoffs Tight Job Market - Firms offer richer benefits to attract and retain staff Legal, Regulatory, & Legislative Risks Health carriers, especially managed care firms, are more susceptible to lawsuits Mandated benefits Delays in rate approvals Life/P&C laws applied to health insurance Reserve Adequacy Based Data Fine on a carrier’s experience is critical line between adequate and excessive Reinsurance Some reinsurers pulled out of the market – Harder to find coverage – More expensive Insurers Can take on more risk affect new product offerings Anti-Selection Large Hard Can effect due to option sales to measure be positive or negative Reputational Risk More susceptible these days due to the stage provided by the internet Disgruntled member Rating agencies Stock analysts Lack of corporate governance Incentives Management Incentives – same issues for any other company Provider Incentives – Need to line up with the health insurer’s goals – Must not be perceived by the members as inhibiting care – Should we even have them?