Financial Pricing Models in Property/Liability Insurance

advertisement

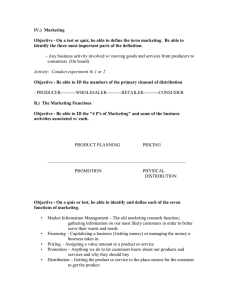

Financial Pricing Models in Property/Liability Insurance The Basic Formula • Financial Premium = • Present Value of Expected Loss & Expense (at risk-adjusted rate) • MINUS Present Value of Default Option • PLUS Cost of Capital • Actuarial Premium = • PV of Expected L&E (risk-free rate) + “Risk Load” • Financial Formula is an “Equilibrium Model” • Determines “fair” premium to compensate shareholders for investment risks and capital costs • Any higher premium results in value creation Pricing as a Two-Step Process • Step 1: Determine the Total Required Premium for the Entire Book of Business – Depends on Aggregate Loss Distribution – Compensates Shareholders for CorporateWide Risks and Capital Costs • Step 2: Allocate this Total Premium Down to Component PV of Expected Loss & Expense • Key Input: Aggregate Loss Distribution – Gives you expected value of loss • Where do you get the “risk-adjusted” discount rate? – Use a market model • CAPM • Fama-French 3-Factor Model • APT – Current Research in this area (RPP, et al.) PV of Default Option • Generally valued by Option Pricing Theory (e.g. Margrabe’s formula) • Potential Problems/Complications – Requires Complete Markets Assumption – Uncertain Impact of Guarantee Funds • Generally small portion of overall premium – Insurers manage risks to keep it small – But may be important in certain allocation procedures (e.g. Myers/Read) Capital Costs • Capital Costs = Total Capital x Frictional Capital Costs (as percentage) – Misconception Regarding Financial Pricing Models: “In financial models, the only risk that matters is systematic risk. The total variability of the loss distribution doesn’t impact premium.” Two Types of Frictional Costs of Capital • Costs of Holding Capital – Double taxation – Agency costs • Costs of Raising Capital – Underwriting spreads – Administrative costs – Asymmetric information Allocation to Line of Business • Determine risk-adjusted discount rate by line of business • Is the capital allocation problem solved? – Problems with Myers/Read • Homogeneity Assumption • Only considers costs of holding capital in allocation • Other practical difficulties • RMK as an alternative What doesn’t work: Expected Utility Approaches • TV’s Definition of Expected Utility Approach to P/L Insurance Ratemaking: The application of a criterion with no economic meaning to an object with no economic meaning. • Object = Probability distribution of NPV’s at risk-free rate • Criterion = “Corporate” utility-of-wealth function Probability Distribution of NPV’s • Common approach in actuarial literature • Two major problems – Ignores individual investor’s ability to diversify – No economic rationale for the discounting: It is very difficult to interpret a distribution of NPVs. Since the risk-free rate is not the opportunity cost of capital, there is no economic rationale for the discounting process. Because the whole edifice is arbitrary, managers can only be told to stare at the distribution until inspiration dawns. No one can tell them how to decide or what to do if inspiration never dawns. (Brealey/Myers, Chapter 11) “Corporate” Utility of Wealth Functions • Individual utility functions can be determined, in theory • But they are unique to individuals – interpersonal comparisons of utility functions not possible! • It is not possible to know how real-world utility functions for different individuals should be aggregated. It follows that group utility functions, such as the utility function of a firm, have no meaning. (Copeland/Weston) Moral of the Story • Financial theory works – use it! • Spreadsheet example of Froot/Stein Corporate ROE pricing with RMK allocation