TRAVEL POLICIES AND PROCEDURES PURPOSE

advertisement

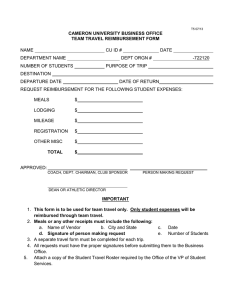

CG TRAVEL POLICIES AND PROCEDURES PURPOSE The purpose of this travel policy is to inform all campuses and individuals of the procedures for any and all travel associated with their assigned duties at South Plains College. APPROVAL All travel must be approved through the online Travel Requisition process in the DPS system. GENERAL PROCEDURES 1. Travel Request The purpose of the online Travel Requisition (TR) is: 1. Seek approval for travel in advance. 2. Initiate arrangements for coverage of classes/duties during absence. 3. Scheduling of college vehicles. 4. Verify that students are absent from classes while representing the college. 5. Provide information regarding itinerary and place of stay in case of emergencies. 6. Prepare cash advance when travel involves students. The online TR should be entered into the DPS system as soon as you determine that you would like to travel. The online TR takes the place of the “green” travel request form. All information about the travel is entered into one TR. You will need to enter “notes” on the TR to cover items that you have been sending by memo. This includes lists of students and SPC vehicle requests. The online TR will go through all approvals and the purchasing office will issue PO’s to the various vendors from this document to cover your registration, lodging, personal reimbursements, etc. A copy of the PO’s will be forwarded to the Purchasing Office. The Purchasing Office will provide the Dean of Students with the list of students that will be traveling and notify the Physical Plant Director of the need for an SPC vehicle. When you are ready to travel, you will check out credit cards from the Purchasing Office and upon your return the Travel Expense form (Attachment #1) supporting documents and receipts will be returned to her. Page 1 of 7 CG 2. Payment of Registration Fees. Registration fees can be processed 90 days in advance or earlier if payment discount applies. This should be included in the TR which you have entered into the DPS system for initial travel approval and the original registration form forwarded to the purchasing office for payment processing. 3. Travel by rented or public conveyance Air Airline reservations can be made directly with an airline website and also an approved travel agency 90 days in advance with an approved Travel PO. This expense should be included in the TR which you have entered into the DPS system. The purchase order number will be called to the travel agency within 24 hours. If an employee should prefer to pay for their own airline reservations, they can be reimbursed this cost after the travel has occurred. The college will reimburse an employee for the actual cost of commercial airfare. The amount of reimbursement shall not exceed the lowest available airfare, considering all relevant circumstances. Rented Vehicles The college has a direct bill service with Enterprise Rent-A-Car that includes insurance. The direct link to website is located on the MySPC website under Employees, Purchasing, and Shared Documents. The college will reimburse an employee for the actual cost of renting a motor vehicle. Reimbursement costs include applicable taxes, and similar mandatory charges. Charges for collision damage waiver charges, liability insurance supplements, personal accident insurance, safe trip insurance and personal effects insurance are not reimbursable. The college carries this type of insurance. Travel by Mass Transit, Taxi or Limousine The college will reimburse an employee for the actual cost of transportation by these modes of travel. The fares must be itemized on the Travel Expense Form and receipts attached. 4. Travel by College Vehicles Request for College Vehicles Vehicles reservations should be entered in the online TR as described earlier. In emergencies vehicles may be reserved by calling the Director of Physical Plant. Note that to insure getting a vehicle, requests should be made well in advance. Expenses When using a college vehicle, credit cards are issued for fuel, oil, etc. These credit Page 2 of 7 CG cards are the property of the college and may be used only for the operation of a college vehicle. Parking expenses shall be itemized on the Travel Expense Form and receipts attached. 5. Travel by Personal Vehicle The college will reimburse an employee for the mileage incurred during his use of a personally owned vehicle. With the exception of parking expenses, a mileage reimbursement is inclusive of all expenses associated with the operation of the vehicle. The mileage guides are found at www.mapquest.com and www.randmcnally.com . The college current mileage reimbursement rate is $.40 per mile. Rules for personal auto mileage reimbursement can be found in the Mileage Reimbursement Memo (Attachment #2). Mileage reimbursements should be submitted through the travel requisition process. For reimbursement, a Travel Expense Form should be completed, a itemized mileage report (Attachment #3) attached and forwarded to the Purchasing Office for payment processing. Coordination of Travel Coordination of travel should occur when two to four college employees are traveling to the same destination, at the same time, in a personally owned vehicle. In such instances, the college will reimburse only one of the employees for mileage. 6. Lodging Expenses South Plains College will reimburse an employee who travels with overnight stays for lodging expenses not to exceed the authorized travel reimbursement amounts set by the State Comptroller for both in-state and out of state travel. These reimbursement amounts can be found on this link: http://www.gsa.gov/portal/category/104711 The present reimbursement limit for instate lodging is $85 per night. If lodging is arranged through the conference/seminar provider, SPC will pay the conference/seminar rate per night per person regardless of the reimbursement limits Page 3 of 7 CG published by the State Comptroller’s office. When two or more employees’ share lodging, the college will pay each employee’s share of the actual lodging expense. Each employee must submit a Travel Expense Form in order to be reimbursed... When necessary an employee may reduce his meal expenses/reimbursement rate and use that reduction to increase his lodging rate. Most hotels will exempt college employees state sales tax provided a tax exemption certificate is provided. Hotel Tax Exemption Forms are available from the purchasing website under shared documents. All efforts must be made to make sure SPC is not charged sales tax. It is the responsibility of the employee to contact the hotel if tax is charged and provide them the necessary documentation to remove the charge. 7. Meal Expenses South Plains College will reimburse an employee for meal expenses, on a per diem basis not to exceed thirty dollars ($30) per day for in-state travel and the State of Texas meal rate for out-of-state travel. To qualify for per diem reimbursement, the employee must be away from the campus over night on college business. If meals are included as part of any conference or seminar fee, the meal expenses are fully payable or reimbursable, notwithstanding any maximum reimbursement limits established elsewhere. Meals included in conference/seminar fees are not chargeable against the $30 per diem allowance. The $30 per diem allowance is allocated based on the time the employee leaves campus. If departure from the city limits or airport is before 8:00 AM or return is after 8:00 AM you may claim 20% of the daily meal allowance for breakfast, or $6.00. For out of state meals, use 20% of the allowed expense. If departure from the city limits or airport is before noon or return is after 1:00 PM. you may claim 30% of the daily meal allowance for lunch or $9.00. For out of state meals, use 30% of the allowed expense If departure from the city limits or airport is before 5:00 PM or return is after 7:00 PM you may claim 50% of the daily meal allowance or $15.00. For out of state meals, use 50% of the allowed expense. Meals should be paid by the employee and reimbursed upon return. Meals may not be put on a SPC travel credit card. Reimbursement limits do not carry over from one day to another. Employees may also be reimbursed for meals incurred during travel on college business that does not require an overnight stay. The per diem rate per meal may be Page 4 of 7 CG used ($6 for breakfast, $9 for lunch, $15 for dinner) in lieu of receipts for actual meal expenses incurred. Otherwise, actual meal receipts must be furnished in order for reimbursement to be made to the employee. The college is aware that, in extraordinary circumstances, actual daily meal expense incurred by the employee may exceed the maximum daily allowable expense as previously set forth. Should that situation arise, meal receipts must be furnished and reimbursement approved by both the appropriate department head/director and the appropriate vice president/provost. In addition, those reimbursements may be subject to review by executive administration. All employees must submit a Travel Expense Form to claim reimbursement for meal expense. Employees may elect per diem reimbursement in lieu of submitting actual meal expense receipts. 8. Parking Expenses The college will reimburse an employee for parking expenses incurred when traveling in a personally owned or rented vehicle. The parking expenses must be itemized and receipts attached to the Travel Expense Form. PAYMENT METHODS 1. Travel Card South Plains College provides travel credit cards for use during job related travel. These cards are to be used for hotel, parking and other miscellaneous expenses incurred during your time away from the college. Rules for use of this card can be found in the Travel Card Guide (Attachment #4). If use of the college travel card is requested, this should be included in the TR entered into the DPS system when initial travel is approved. Cards will not be checked out without prior approval. These cards can be checked out from the Purchasing Office. The cards cannot be picked up by student workers, but can be picked up by department secretaries or the actual card user. See Attachment #4 for travel card rules. These expenses should be itemized on the Travel Expense Form, receipts attached and submitted to the Purchasing Office in the Business Office. 2. Travel Advances The college does not provide cash advances for meal expenses except when accompanying Page 5 of 7 CG student groups. The cash advance will be for the anticipated cost of faculty/student meals only. This expense should be included on the TR and a note attached with the date funds are needed. 3. Travel Reimbursements Personal Funds If an employee chooses to use personal funds while traveling on college business, they will be reimbursed their expenses after travel has occurred. These expenses should be included in the online TR entered into the DPS system for initial travel approval. A travel expense form must be completed for personal expenses. This form must be forwarded, with supporting documentation, to the Purchasing Office in the Business Office. TRAVEL EXPENSE FORM REQUIREMENTS: Complete documentation must accompany all Travel Expense Forms. This includes seminar itineraries, airline ticket receipts, lodging receipts, and receipts for other expenses, excluding meals. All forms must include reason for travel, the dates, times and places traveled and supporting documentation. Incomplete forms will be returned to the employee. TRAVEL INVOLVING STUDENT GROUPS Student Groups The college will reimburse student groups and their sponsors for travel when representing the college (such as judging teams, athletic teams, cheerleaders, music groups, etc.), provided specific budgetary funds have been approved. MISCELLANEOUS SITUATIONS Prospective Employees The college will reimburse prospective employees for travel expenses related to employment interviews. Travel expenses will be paid at the same rate as for college employees. Note that travel expenses will not be reimbursed for prospective employees who are offered employment, but do not accept. Page 6 of 7 CG Incidental Expenses The following is a partial list of reimbursable and non-reimbursable incidental expenses: 1. 2. Reimbursable Expense - (The following expenses are reimbursable if they are incurred for official college business reasons.) a. Hotel occupancy and similar taxes that a college employee is not exempt from paying. b. Telephone calls. c. Gasoline and toll charges when rented vehicles are used. d. Repair charges when college owned vehicles are used. NOTE - If charges are substantial, approval must be received from the Director of Physical Plant and/or Division Dean. e. Copying charges. f. Admittance fees to events related to purpose of travel. g. Postage. h. Emergency medical or health costs incurred on students while traveling. i. Tips and gratuities (Federal grant accounts do not allow this expenditure) Non-Reimbursable Expenses a. Expenses that do not relate to official college business. b. Any expenses, with the exception of parking expenses that are related to the operation of a personally owned vehicle. c. Personal expenses such as the rental or purchase of videotapes for personal entertainment, alcoholic beverages, and dry cleaning. Page 7 of 7