Your Financial Plan: Where It All Begins Unit 1B

advertisement

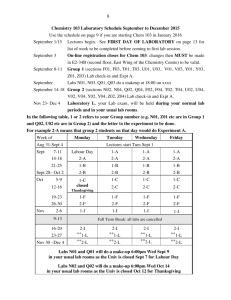

Your Financial Plan: Where It All Begins Unit 1B “Most people don’t plan to fail… They simply fail to plan!” The 5-Step Financial Planning Process Sample Wants and Needs NEEDS Food Clothing Transportation ______________ ______________ 1-C WANTS An iPod DVD Players Cell Phone Car ______________ ______________ Values 1-D Getting a good education Religious faith or beliefs Social causes Handling money responsibly Friendships / The people I hang out with ____________________________ ____________________________ Goals You can’t hit a target you cannot see. The basic rules: Goals must be written down Realistic plans must be made for their accomplishment Deadlines must be set and honored Goal setting is an art that makes everything else possible. Most successful people are obsessive goal setters. Once you have goals set, you have a pattern for opportunity Goals Successful people have a perfect balance between thought and action You must think before you act but you have to act Don’t be afraid to take a risk Failure is inevitable It just should not be linked with giving up How many chances do you give a baby to walk before you stop them from trying? Goals Problem with achieving goals is that we fall apart once we achieve our goal example: dieting Rewards of goal setting come not from earning $1 million but in having learned the lessons about what it takes to become a millionaire Term Goals Short-Term Goals • Within 3 months Intermediate-Term • 3-12 months Long-Term Goals • More than a year 1-E Delayed Gratification 1-F Saving money over time to make a major purchase. Waiting to buy a new product until the price goes down. Waiting to see the latest movie until the crowds get smaller and the lines shorter. S-M-A-R-T GOAL CRITERIA 1-G Specific Measureable Attainable • I will pass personal finance this summer • I will know I have met my goal when I get my report card • If I study hard and turn in all work, I will pass Realistic Time-Bound • IF I pay attention during class, I’ll get all the information to complete homework • I’ll evaluate my goal after our first test Spending Record $35.00 $5.00 $6.00 $4.00 $7.00 $8.00 $15.00 $15.00 $55.00 $40.00 $15.00 1-I Factors That Affect Decision Making Age Wants/Needs Family Time Money Values Habits Motivation Culture Society Education Attitude NEFE High School Financial Planning Program Unit One - Your Financial Plan: Where It All begins Decision Making and Financial Planning The Decision- Making The Financial Process Planning Process Identify Your Goal Set Goals Establish Criteria Weigh Pros and Cons Make a Decision Evaluate Results 1-L Analyze Information Create a Plan Implement the Plan Monitor & Modify the Plan The Decision-Making Process Remember… The 3 R’s Reality Responsibility Restraint The 3 S’s Saving Spending Sharing