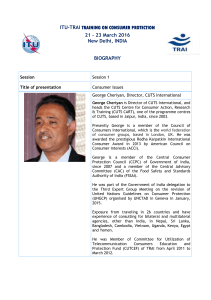

IP Asset Valuation and IP Audit T C James Director

advertisement

IP Asset Valuation and IP Audit T C James Director National Intellectual Property Organisation Objective • To give a general introduction to the concepts of IP valuation and IP Audit • To briefly explain IP valuation and the key definitions like assets, IP assets, value and IP valuation, the differences between various methods deployed to value IP assets, IP audit, the preparations, procedures and results of an IP audit. CUTS training programme 14 Jul 11 2 IP VALUATION CUTS training programme 14 Jul 11 3 Assets • An economic resource. • Anything tangible or intangible that is capable of being owned or controlled to produce value and that is held to have positive economic value is considered an asset. • An item of economic value owned by an enterprise that could be converted into cash • “An asset is a resource controlled by the enterprise as a result of past events and from which future economic benefits are expected to flow to the enterprise” CUTS training programme 14 Jul 11 4 Two Kinds of Assets • Tangible – Building – Machinery • Intangible – Goodwill – Intellectual Property CUTS training programme 14 Jul 11 5 IP Assets • • • • Intangible asset – knowledge based Legal Right to exclude others from using Limited duration Assignable/ Licensable/Transferable – Can be bought, sold, licensed, or given away free • Multi-usable • Use does not exhaust CUTS training programme 14 Jul 11 6 Factors driving the intellectual property • Intellectual property derives its value from a wide range of significant parameters such as – Market share – Barriers to entry – Legal Protection – IP’s profitability – Industrial and economic factors – Growth projections – New Technologies CUTS training programme 14 Jul 11 7 Risks in IP Assets • • • • • New Patents Revocation of Patents Infringement Suits Trade Secrets Weak Enforcement Regimes CUTS training programme 14 Jul 11 8 Valuation • Valuation is a process of determining value or worth of an asset • Valuation often combines objective and subjective considerations CUTS training programme 14 Jul 11 9 IP Valuation • IP valuation dependent on various factors – Use of the IP assets – Market share of company – Openness of economy – Legal protection of IP • Enforcement cost – Economic growth – Profile of economy CUTS training programme 14 Jul 11 10 Use of IP Valuation • • • • • • • • • • • For commercial transactions For pricing product For evaluating potential merger or acquisition candidates For identifying and prioritizing assets that drive value For strengthening positions in technology transfer negotiations For making informed financial decisions on IP maintenance, commercialization and donation For evaluating the commercial prospects for early stage Research & Development (R&D) For evaluating R&D efforts and prioritizing research projects For Financing securitisation For litigation For tax planning CUTS training programme 14 Jul 11 11 Benefits of IP Valuation • Can give a better idea of the overall value of the business • Can provide a tool to measure and manage the assets • Can provide security and backing for lenders • Can provide taxation benefits (taxation deductions) • Can reduce the proportion of business’ net worth attributed to goodwill – important when selling a business CUTS training programme 14 Jul 11 12 IP Valuation Methodologies • Transactional/Market Approach • Cost Approach • Income Approach CUTS training programme 14 Jul 11 13 Transactional Method • Sales comparison approach • It is based on actual price paid for a similar or comparable IP under similar/comparable circumstances • Need complete data • Problem in getting full details • Two steps: screening and adjustments • Screening is identifying third party transactions • Adjustments are in Location, Advertising support, IP strength and period of licence CUTS training programme 14 Jul 11 14 Market Approach • When – Focus is on market transactions – sales/licenses – IP transaction details highly confidential – Assets typically not comparable • • • • Different underlying IP assets Different compensation structures Different geographic territories Different market potentials/degree of success CUTS training programme 14 Jul 11 15 Income Method • Intrinsic value • Ability to generate cash flow – Income Approach: Based on the incomeproducing capability of underlying IP asset • Seeks to establish the net present value (hence use of discounted cash flow [DCF]) • Decision tree analysis (DTA)-based on an underlying DCF analysis and moves further to take into consideration flexibility available. CUTS training programme 14 Jul 11 16 Income Approach • • • • • PV = I1(1+r)-1 + I2(1+r)-2 + I3(1+r)-3….+ In(1+r)-n Where PV = Present value of IP asset I = Economic income projection r = Discount rate n = Year CUTS training programme 14 Jul 11 17 Variables in Income Approach • An income stream either from product sales or licensure of the patent • An estimate of the duration of the patent’s useful life • An understanding of patent specific risk factors and incorporating those into the valuation • A discount rate CUTS training programme 14 Jul 11 18 Discounted Cash Flow (DCF) Method • Attempts to determine the value of the IP by computing the present value of cash flows, attributable to that piece of IP, over the useful life of the asset. • Does not capture the unique independent risks associated with patents. All risks are lumped together and are assumed to be appropriately adjusted for in the discount rate and the probability of success, rather than being broken out and dealt with individually (i.e., such as legal risk, technological risk, piracy, etc.) • Further, often DCF fails to consider dependencies on properties held by others. In roughly 40 percent of cases, patents depend on other patents or property held in the public domain CUTS training programme 14 Jul 11 19 Cost Method • Estimates the value of underlying IP asset basing on historical cost incurred in developing the asset • Two approaches • Replacement cost • Reproduction cost • Replacement Cost: The cost to develop similar functionality to the subject IP outside the scope of the legal protection • Reproduction cost: Cost of reproducing the IP product or service or procedure CUTS training programme 14 Jul 11 20 Cost Approach: When? • Has limited value • Used for – Patents – Software – Designs • When – Asset is newly created with limited protection – Commercially untested – Where reproduction cost best estimate of value • Buyer unwilling to pay more than cost to recreate or engineer around protected design CUTS training programme 14 Jul 11 21 Cost Approach: Factors? • Components of Cost Value Assessment – Materials – Labour – Overhead – Developer’s/entrepreneur’s profit – Taxes CUTS training programme 14 Jul 11 22 Calculating Net Value • Net present value – Calculating the future value of intellectual asset (investment) at present time – NPV= A(1 + r)-n i.e. NPV = A[1/(1 + r)n] where: NPV= net present value (i.e. DCF); A= amount expected at year n; r = risk factor CUTS training programme 14 Jul 11 23 Factors Considered in Patent Valuation • Qualitative and quantitative characteristics of the patent(s), including the specific patent claim • Earnings capacity and profitability relating to the patent(s) • The impact of known blocking patents • Any current or previous licensing of the patent • Legal rights and restrictions to the patent(s), including foreign patent protection • Contracts associated with the patent(s) • Competition, barriers to entry and risks associated with the patent(s) • Product life cycles and positioning • Historical growth and prospects for the future • Alternative uses for the patent(s) CUTS training programme 14 Jul 11 24 Factors Considered in Trade Mark Valuation • • • • • • • Qualitative and quantitative characteristics of the trademark(s) Earnings capacity and profitability relating to the trademark(s) Market share supported by, or as a result of the trademark(s) Market recognition analysis of the trademark(s) Legal rights and restrictions to the trademark(s) Contracts associated with the trademark(s) Competition, barriers to entry and risks associated with the trademark(s) • Product life cycles and positioning • Historical growth and prospects for the future • Exploitation opportunities of the trademark(s) into new markets/products CUTS training programme 14 Jul 11 25 Factors Considered in Brand Valuation • • • • • • • Qualitative and quantitative characteristics of the brand name(s) Earnings capacity and profitability relating to the brand name(s) Market share supported by, or as a result of the brand name(s) Market recognition analysis of the brand name(s) Legal rights and restrictions to the brand name(s) Contracts associated with the brand name(s) Competition, barriers to entry and risks associated with the brand name(s) • Product life cycles and positioning • Historical growth and prospects for the future • Exploitation opportunities of the brand name(s) into new markets/products CUTS training programme 14 Jul 11 26 IP AUDIT CUTS training programme 14 Jul 11 27 IP Audit: What is It? • A systematic review of the IP assets owned, used or acquired by a business • IP Audit says – How the IP assets are being used or not used – Whether the IP assets used by it are owned by the company or others – Whether these IP assets are infringing the rights of others or others are infringing on those rights, and determine, in the light of all this information – What actions are required to be taken w.r.t. each IP asset, or portfolio of such assets to serve the relevant business goals of the company CUTS training programme 14 Jul 11 28 IP Audit: Objective • To uncover under-utilized IP assets • To identify any threats to a company’s bottom line • To enable business planners to devise informed strategies that will maintain and improve the company’s market position “Overall purpose of an IP audit is to identify and assess all of the company’s intangible assets in order to conduct a SWOT (Strengths, Weaknesses, Opportunities, and Threats) analysis to determine the valuable core assets and optimize their usage through a systematic long-term strategy” CUTS training programme 14 Jul 11 29 Steps ion IP Audit 1 • First Step: Investigation All things created, developed or used by the organisation such as, inventions, formulas, processes, devices or other technologies, creative works, such as music, books or computer video games, business information, including advertising, promotional materials, customer lists, prospect lists, pricing information, sales figures, financial projections and other materials CUTS training programme 14 Jul 11 30 Steps in IP Audit 2 • Second Step: Identification • Identify the readily identifiable IP – Trademarks – Copyrights – Designs – Patents – Product/process Know-how – Trade Secrets CUTS training programme 14 Jul 11 31 Steps in IP Audit- 3 • Third Step: Categorisation – Owner – Licensee – Licensor – Domestic – Foreign CUTS training programme 14 Jul 11 32 Steps in IP Audit 4 • Fourth Step: Itemize external or market influences – company brand – product brands – company and product get-up – Goodwill – product certification – export certifications – Regulatory approvals CUTS training programme 14 Jul 11 33 Steps in IP Audit - 5 • • • • Fifth Step: Examine Enforceability Legal Provisions and Economics Administrative Action Legal Steps – Civil Procedures – Criminal Procedures CUTS training programme 14 Jul 11 34 An Inventory of IP Audit • Whether or not your IP rights are registered; • Whether you have any intellectual property issues and what to do to address them; • Who owns the rights and, if you not, identify any conditions that apply to their use; • An assessment of whether your IP is being used effectively; • Whether your rights are being challenged or threatened by others; • Whether you have an effective IP management and maintenance plan in place; and • Records of your IP creation and ownership. CUTS training programme 14 Jul 11 35 Content of an IP Audit Report 1 • Inventory issues. – A catalogue of intellectual property assets, including disclosures, patents, trademarks, trade secrets, contracts, agreements, and so on • Rights issues. – An understanding of rights that have been acquired, and whether they have been properly maintained; an understanding of those rights that have not been acquired and whether or not they should be • Ownership issues. – Does the company have clear ownership over these assets? Has title been properly assigned by employees/consultants? CUTS training programme 14 Jul 11 36 Content of an IP Audit Report 2 • Infringement issues. – Are patents being used for which the company does not have rights? • Strategic issues. – Are these assets being properly managed and exploited in alignment with the strategic objectives of the company? Are there restrictions to their use? • Deficiency issues. – Are there patentable technologies currently not protected? Are there copyright and trademark registration applications to be filed? Are there affidavits of continued use of trademarks, maintenance fees to keep patents in force, and so on? CUTS training programme 14 Jul 11 37 When to do an IP Audit? • General Purpose Audit: – As part of an ongoing IP asset management programme • Event Driven: – When a business is being bought, or sold – When you are enforcing or defending your IP rights. CUTS training programme 14 Jul 11 38 Dow Chemical Company • IP Audit and asset management programme started in 1992 • Classified entire IP portfolio including 30,000 patents • A team of 9 people worked for 12 months analysing the patents and recommending maintenance or abandonment • $ 40 million saving by abandoning some patents • Started licensing which grew from $ 25 M to $ 250 M in 5 years. CUTS training programme 14 Jul 11 39 Remember ... • In 2005, Qualcomm generated about 58% of its $5.7 billion in revenue from the sale of Qualcomm‐designed wireless chips, which are manufactured by third parties under contract • Since 1993, IBM has been making some US$1 billion per year from licensing non‐core technologies, which otherwise would have remained unused. • Honeywell, in 2000, received a then record award of damages of US$127 million from Minolta for technology it hadn’t itself commercialized. CUTS training programme 14 Jul 11 40 Remember ... • The Coca‐cola brand is estimated to be worth US$80 billion. • US company Texas Instruments earns more from licensing its unused patent rights than from its products Need IP Valuation, Audit and an Asset Management strategy to optimise income and profit CUTS training programme 14 Jul 11 41 Questions For further information pl contact at tcjames@nipo.in CUTS training programme 14 Jul 11 42