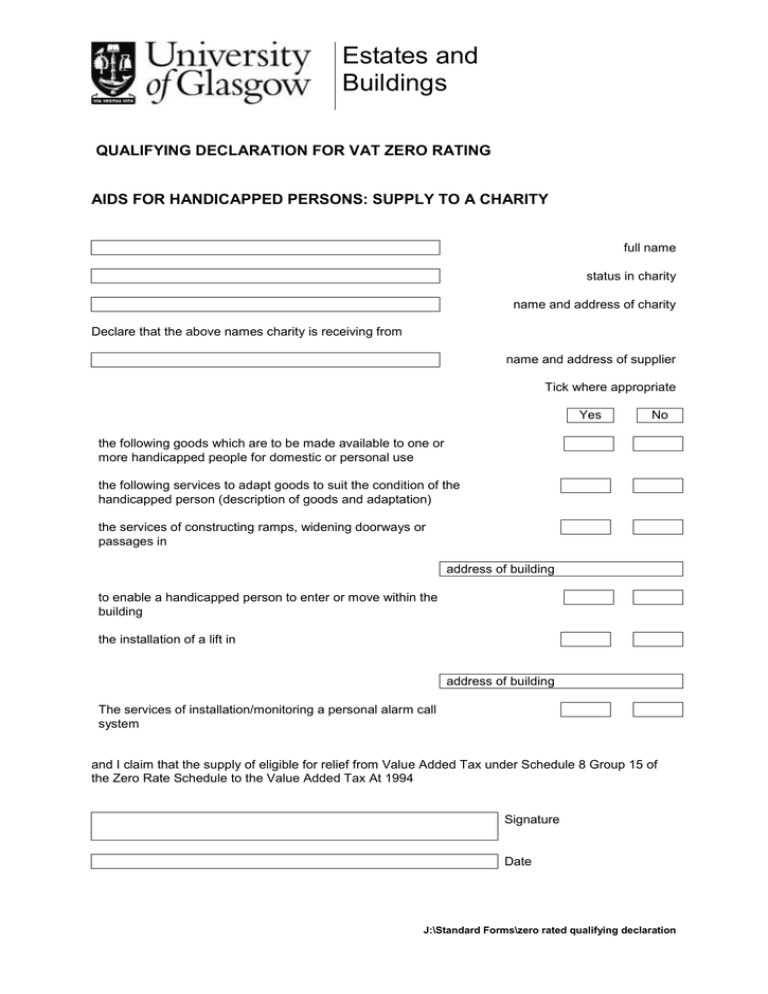

Estates and Buildings QUALIFYING DECLARATION FOR VAT ZERO RATING

advertisement

Estates and Buildings QUALIFYING DECLARATION FOR VAT ZERO RATING AIDS FOR HANDICAPPED PERSONS: SUPPLY TO A CHARITY full name status in charity name and address of charity Declare that the above names charity is receiving from name and address of supplier Tick where appropriate Yes No the following goods which are to be made available to one or more handicapped people for domestic or personal use the following services to adapt goods to suit the condition of the handicapped person (description of goods and adaptation) the services of constructing ramps, widening doorways or passages in address of building to enable a handicapped person to enter or move within the building the installation of a lift in address of building The services of installation/monitoring a personal alarm call system and I claim that the supply of eligible for relief from Value Added Tax under Schedule 8 Group 15 of the Zero Rate Schedule to the Value Added Tax At 1994 Signature Date J:\Standard Forms\zero rated qualifying declaration