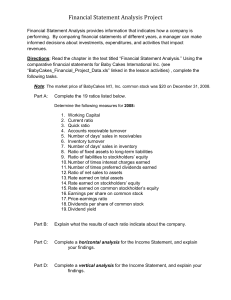

ACG 2071 Module 3: Financial Statement Analysis Basic Analytical Procedures

advertisement

ACG 2071 Module 3: Financial Statement Analysis Basic Analytical Procedures The basic financial statements provide much of the information users need to make economic decisions about businesses. In order to make decisions, we must analyze the financial statements. Horizontal Analysis o Percentage analysis of increases and decreases in related items in comparative financial statements. o Comparing of income statements for two years o Comparing of balance sheets for two years Example: Below is a excerpt from a comparative balance for Diaz Company. 2006 Assets Current assets Fixed assets Total assets Liabilities Current liabilities Long term liabilities Total liabilities Equity Common stock Retained earinings Total equity Total liab & equity 2005 Amount Percent $550,000 $445,000 $995,000 $533,000 $470,000 $1,003,000 $17,000 -$25,000 -$8,000 3.2% -5.4% -2.2% $200,000 $100,000 $300,000 $150,000 $125,000 $275,000 $50,000 -$20,000 $30,000 25% -20% 5% $500,000 195,000 $695,000 $995,000 $428,000 $300,000 $728,000 $1,003,000 $72,000 $105,000 $33,000 - $8,000 17% -35% -18% -2.2% More information is needed to evaluate the decreases and increases above. But we can see a significant change in liabilities but not in assets. Same can be done for an income statement Vertical Analysis Created by: M. Mari Fall 2007 Page 1 of 14 ACG 2071 Module 3: Financial Statement Analysis o A percentage analysis may also be used to show the relationship of each component to the total within a single statement. o Balance sheet Each asset is shown as percentage of total assets Each liability as percentage of total liabilities o Income statement Each item is shown as percentage of net sales. o Common size statements Can be used to compare to companies in the same industry Solvency Analysis Solvency is the ability of a company to pay its debts. Profitability is the ability of a business to earn income. o They are interrelated. Solvency analysis focuses on the ability of a business to pay or otherwise satisfy its current and noncurrent liabilities. o Assessed by examining balance sheet relationships o Major analyses are: Current position analysis Accounts receivable analysis Inventory analysis The ratio of fixed assets to long-term liabilities The number of times interest charges are earned. Example: Suppose the following balance sheet information is available for two companies: Company A 2006 Current Assets Cash Marketable Securities Accounts receivable Inventories Prepaid Expenses Total current assets Current liabilities $ $ $ $ $ $ $ 78,000.00 52,000.00 106,000.00 218,000.00 6,000.00 460,000.00 320,000.00 Company B 2006 2005 $ $ $ $ $ $ $ 82,500.00 60,000.00 152,000.00 260,000.00 4,200.00 558,700.00 480,000.00 $ $ $ $ $ $ $ 160,000.00 85,000.00 208,000.00 350,000.00 10,000.00 813,000.00 705,000.00 2005 $ $ $ $ $ $ $ Current Position Analysis o Measures to assess a business’s ability to pay its current liabilities Created by: M. Mari Fall 2007 Page 2 of 14 112,500.00 26,000.00 172,000.00 312,500.00 10,000.00 633,000.00 375,000.00 ACG 2071 Module 3: Financial Statement Analysis o Special interest to short-term creditors o Working Capital Current assets minus current liabilities Used in evaluating a company’s ability to meet currently maturing debts. o Current Ratio Working capital ratio or banker’s ratio Computed by dividing current assets by current liabilities. Example: Using the example above compute the working capital and the current ratio. Company A 2006 Working Capital Current assets current liabilities Current ratio current assets/current liabilities $ Company B 2006 2005 140,000.00 460000/320000 1.4 $ 78,700.00 558700/480000 1.2 $ 108,000.00 813000/705000 2005 $ 258,000.00 633000/375000 1.2 The companies in the above example, both have positive working capital and current ratios of over 1. Yet the ability of each company to pay its debts is significantly different. Monies tied up in inventory and receivables are harder to convert to cash than cash or securities. Therefore, the time factor may make the companies less solvent. o Quick Ratio: A ratio that measures the instant debt paying ability of a company Also called the acid test ratio Ratio of quick assets to total current liabilities Quick assets are cash and other current assets that can be quickly converted to cash such as marketable securities and accounts receivables. Created by: M. Mari Fall 2007 Page 3 of 14 1.7 ACG 2071 Module 3: Financial Statement Analysis Company Company A B 2006 2005 2006 2005 $ 78,000.00 $ 52,000.00 $ 106,000.00 $ 236,000.00 $ 320,000.00 $ 82,500.00 $ 60,000.00 $ 152,000.00 $ 294,500.00 $ 480,000.00 $ 160,000.00 $ 85,000.00 $ 208,000.00 $ 453,000.00 $ 705,000.00 $ 112,500.00 $ 26,000.00 $ 172,000.00 $ 310,500.00 $ 375,000.00 236000/320000 294500/480000 453000/705000 31500/375000 0.7 0.6 0.6 Current Assets Cash Marketable Securities Accounts receivable Total Quick Assets Total current liabilities Quick ratio quick assets/ current liabilities 0.8 o Accounts receivable analysis The size and makeup of accounts receivable change constantly during business operations Companies desire to collect receivables as promptly as possible Cash collected from receivables improve solvency Accounts receivable turnover Relationship between sales and accounts receivable Computed by net sales divided by average net accounts receivable Average of accounts receivable o Beginning balance plus ending balance divided by 2 Higher the turnover the better. Net sales Accounts receivable Beginning of year End of Year $ Company A 2006 1,500,000.00 $ $ 152,000.00 76,000.00 Average Accounts Receivable (152000+76000)/2 $ 114,000.00 (152000+208000)/2 $ 180,000.00 Accounts receivable turnover 1500000/114000 998000/180000 13.2 Created by: M. Mari Fall 2007 Page 4 of 14 $ 2005 998,000.00 $ $ 208,000.00 152,000.00 5.5 ACG 2071 Module 3: Financial Statement Analysis Number of days sales in receivables Ratio is computed by dividing the average accounts receivable by the average daily sales. Average daily sales is net sales divided by 365 days Lower the ratio the better Net sales Accounts receivable Beginning of year End of Year Average Accounts Receivable $ Company A 2006 1,500,000.00 $ 2005 998,000.00 $ $ 152,000.00 76,000.00 $ $ 208,000.00 152,000.00 (152000+76000)/2 $ 114,000.00 1500000/365 $ 4,109.59 Average daily sales Number of days sales in receivables (152000+208000)/2 $ 180,000.00 998000/365 $ 2,734.25 114000/4109.59 180000/2734.25 27.7 65.8 o Inventory Analysis Inventory has to be managed carefully Too little inventory can cause customers to seek the product from another supplier Too much inventory can increase storage costs, insurance, and obsolescence. Created by: M. Mari Fall 2007 Page 5 of 14 Inventory Turnover o Relationship between the volume of goods sold and inventory o Computed by cost of goods sold divided by average inventory o Average inventory is beginning inventory plus ending inventory divided by 2 o Higher the ratio the better ACG 2071 Module 3: Financial Statement Analysis Cost of goods sold Inventories Beginning of year End of year Average inventory Inventory Turnover $ Company A 2006 765,000.00 $ $ 312,000.00 $ 189,000.00 (312000+189000)/2 $ 250,500.00 765000/250500 2005 820,000.00 $ 423,000.00 $ 312,000.00 (312000+423000)/2 $ 367,500.00 820000/367500 3.1 2.2 Number of days’ sales in inventory Relationship between cost of goods sold and inventory Computed by dividing the average inventory by the average daily cost of goods sold ( COGS/365 days) Rough measure of the length of time it takes to acquire, sell, and replace inventory Lower the ratio the better Cost of goods sold Inventories Beginning of year End of year Average inventory Average COGS $ Company A 2006 765,000.00 $ $ 312,000.00 $ 189,000.00 (312000+189000)/2 $ 250,500.00 765000/365 2,095.9 Number of days sales in inventory 250500/2095.9 $ 423,000.00 $ 312,000.00 (312000+423000)/2 $ 367,500.00 820000/365 2,246.6 367500/2246.6 119.5 Created by: M. Mari Fall 2007 Page 6 of 14 2005 820,000.00 163.6 ACG 2071 Module 3: Financial Statement Analysis o Ratio of fixed assets to long-term liabilities Indicates the margin of safety of the noteholders or bondholders Indicates the ability of the business to borrow additional funds on a long-term basis. Higher the better Fixed assets (net) Long-term liabilities Ratio of fixed assets to long-term liabilities $ $ Company A 2006 350,000.00 175,000.00 2005 480,000.00 210,000.00 $ $ 2.0 2.3 o Ratio of liabilities to stockholder’s equity Claims against the total assets of a business are divided into two groups Claims of creditors Claims of owners the relationship between the total claims of the creditors and owners solvency measure that indicates the margin of safety for creditors indicates the ability of the business to withstand adverse business conditions when the claims of creditors are large in relation to the equity of the stockholders, there are usually significant interest payments. If earnings decline to the point that company is unable to meet interest payments, creditors may take over the business. lower the better Total liabilities Total stockholder's Equity Ratio of fixed assets to longterm liabilities Created by: M. Mari Fall 2007 Page 7 of 14 $ $ Company A 2006 425,000.00 680,000.00 $ $ 0.6 2005 375,000.00 503,000.00 0.7 ACG 2071 Module 3: Financial Statement Analysis o Number of times interest charges earned Called the fixed charge coverage ratio The relative risk of the debtholders is normally measured Higher the ratio, the lower the risk that interest payments will not be made if earnings decrease. Indicates general financial strength of the business Income before taxes Add interest expense Amount available to meet interest charges Number of times interest charges earned $ $ Company A 2006 150,000.00 4,500.00 $ $ 2005 145,500.00 6,300.00 154,500.0 154500/4500 151,800.0 151800/6300 34.3 24.1 Profitability Analysis o The ability of a business to earn profits depends of the effectiveness and efficiency of its operations as well as the resources available to it. o Focuses primarily on the relationship between operating results as reported in the income statement and resources available to the business as reported in the balance sheet o Major analysis used Ratio of net sales to assets Rate earned on total assets Rate earned on stockholder’s equity Rate earned on common stockholder’s equity Earnings per share on common stock Price-earning ratio Dividends per share Dividend yield o Ratio of net sales to assets Is a profitability measure that shows how effectively a firm utilizes its assets Higher the ratio is better Computed by dividing net sales by average total assets (beginning total assets + ending total assets)/2 Created by: M. Mari Fall 2007 Page 8 of 14 ACG 2071 Module 3: Financial Statement Analysis Company A 2006 765,000.00 2005 820,000.00 Net sales Total assets Beginning of year End of year Average Total Assets $ $ $ 980,000.00 $ 1,020,000.00 (980000+1020000)/2 $ 1,000,000.00 $ 800,000.00 $ 980,000.00 (980000+800000)/2 $ 890,000.00 Ratio of net sales to total assets 765000/1000000 820000/890000 0.8 0.9 o Rate earned on total assets Measures the profitability of total assets without considering how the assets are financed. Higher the ratio is better Computed by adding interest expense to net income and then dividing by average total assets Net income Plus interest expense TOTAL Total assets Beginning of year End of year Average Total Assets Rate earned on total assets $ $ $ Company A 2006 165,000.00 6,000.00 171,000.00 $ $ $ $ 980,000.00 $ 1,020,000.00 (980000+1020000)/2 $ 1,000,000.00 $ 800,000.00 $ 980,000.00 (980000+800000)/2 $ 890,000.00 171000/1000000 269000/890000 0.2 Created by: M. Mari Fall 2007 Page 9 of 14 2005 250,000.00 19,000.00 269,000.00 0.3 ACG 2071 Module 3: Financial Statement Analysis o Rate earned on stockholder’s equity The measures emphasizes the rate of income earned on the amount invested by the stockholders. Higher the ratio is better Computed by net income divided by average stockholder’s equity The rate earned by a business on the equity of its stockholders is usually higher than the rate earned on total assets. Occurs when the amount earned on assets acquired with creditors’ funds is more than the interest paid to creditors The difference in the rate on stockholder’s equity and the rate on total assets is called o LEVERAGE Net income Stockholder's equity Beginning of year End of year Average Total Assets Rate earned on stockholder’s equity Rate earned on assets LEVERAGE $ Company A 2006 165,000.00 $ $ 1,250,000.00 $ 1,500,000.00 (1500000+1250000)/2 $ 1,375,000.00 2005 250,000.00 $ 800,000.00 $ 1,250,000.00 (1250000+800000)/2 $ 1,025,000.00 171000/1000000 269000/890000 12% 20% 8% 24% 30% 6% o Rate earned on common stockholder’s equity Common stockholder’s have a residual claim on earnings This measure focuses only on the rate of profits earned on the amount invested by the common stockholders Computed by subtracting the preferred dividends requirements from the net income and dividing by the average common stockholder’s equity. . Higher the ratio is better Created by: M. Mari Fall 2007 Page 10 of 14 ACG 2071 Module 3: Financial Statement Analysis Net income Preferred dividends TOTAL Common Stockholder's equity Beginning of year End of year Average Total Assets Company A 2006 165,000.00 9,000.00 174,000.00 $ $ $ $ $ $ $ 850,000.00 $ 950,000.00 (850000+950000)/2 $ 900,000.00 Rate earned on common stockholder's equity 2005 250,000.00 9,000.00 259,000.00 $ 600,000.00 $ 850,000.00 (950000+600000)/2 $ 725,000.00 174000/900000 259000/725000 19% 36% o Earnings per share Normally reported in the income statement on corporate annual reports Computed by dividing net income by the number of shares of stock outstanding If preferred and common stock are outstanding, the net income is reduced by the amount of preferred stock dividends. Net income Preferred dividends TOTAL Shares of common stock EPS $ $ $ Company A 2006 165,000.00 9,000.00 174,000.00 50000 174000/50000 $ 3.48 2005 $ 250,000.00 $ 9,000.00 $ 259,000.00 45000 259000/45000 $ 5.76 o Price-Earnings Ratio Indicator of a firm’s future earnings prospects Computed by dividing the market price per share of common stock at a specific date by the annual earnings per share. Market price per share Earnings per share Price earnings ratio Created by: M. Mari Fall 2007 Page 11 of 14 $ $ Company A 2006 25.00 1.52 2005 $ $ 16.45 17.50 1.36 12.87 ACG 2071 Module 3: Financial Statement Analysis o Dividends per share and dividend yield Indicator of a firm’s future earnings prospects Computed by dividing the dividends per share by the market price Dividends per share Market price per share Dividend yield Created by: M. Mari Fall 2007 Page 12 of 14 $ $ Company A 2006 0.80 25.00 2005 $ $ 0.03 1.20 17.50 0.07 ACG 2071 Module 3: Financial Statement Analysis Formula Solvency Measures: Working Capital Current Assets – Current Liabilities Use To indicate the ability to meet current obligations Current Ratio Current Assets Current Liabilities Quick Ratio Quick Assets Current Liabilities To indicate instant debt paying ability Accounts receivable turnover Net sales Average accounts receivable To assess the efficiency in collecting receivables and in the management of credit Number of days’ sales in receivables Average accounts receivable Average daily sales Inventory Turnover Cost of Goods Sold Average Inventory Average inventory Average Daily COGS To assess the efficiency in the management of inventory Ratio of Fixed Assets to Long-term Liabilities Fixed Assets (net) Long-term liabilities To indicate the margin of safety to creditors Ratio of liabilities to Stockholders’ Equity Total liabilities Total stockholders’ Equity To indicate the margin of safety to creditors Number of times interest charges earned Income before income tax + Interest Expense Interest Expense To assess the risk to debtholders in terms of number of times interest charges were earned Net Sales Average total assets To assess the effectiveness in the use of assets Rate earned on total assets Net income + Interest Expense Average total assets To assess the profitability of assets Rate earned on Stockholders’ Equity Net income Average Total stockholders’ equity To assess the profitability of the investment by stockholders Rate earned on Common Stockholders’ Equity Earnings per share on common stock Net income- Preferred dividends Average Total common stockholders’ equity Net income – Preferred dividends Shares of common stock outstanding To assess the profitability of investment by common stockholders Price Earnings Ratio Market price per share of common stock Earnings per share of common stock Dividends per share of common stock Dividends Shares of common stock outstanding Dividend Yield Dividends per share of common stock Market price per share of common stock To indicate the future earnings prospects based on the relationship between market value of common stock and earnings To indicate the extent to which earnings are being distributed to common stockholders To indicate the rate of return to common stockholders in terms of dividends Number of Days’ Sales in Inventory Profitability Measures Ratio of Net Sales to Assets Created by: M. Mari Fall 2007 Page 13 of 14 ACG 2071 Module 3: Financial Statement Analysis Created by: M. Mari Fall 2007 Page 14 of 14