Merchandising Business Accounting: Income Statement & Transactions

advertisement

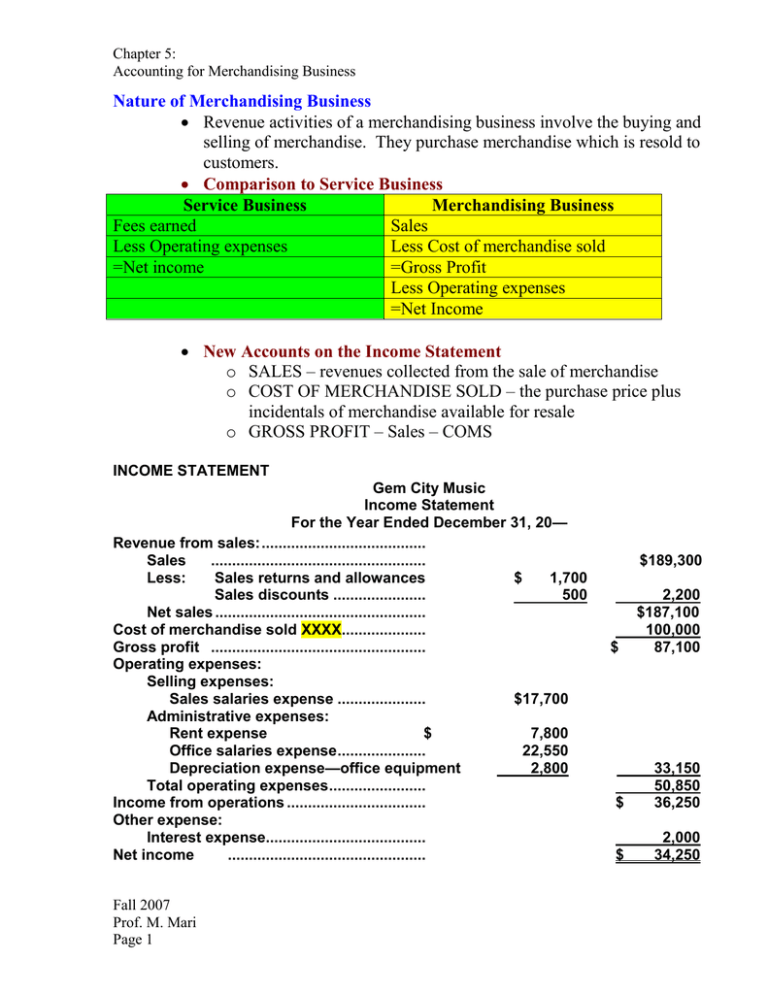

Chapter 5: Accounting for Merchandising Business Nature of Merchandising Business Revenue activities of a merchandising business involve the buying and selling of merchandise. They purchase merchandise which is resold to customers. Comparison to Service Business Service Business Merchandising Business Fees earned Sales Less Operating expenses Less Cost of merchandise sold =Net income =Gross Profit Less Operating expenses =Net Income New Accounts on the Income Statement o SALES – revenues collected from the sale of merchandise o COST OF MERCHANDISE SOLD – the purchase price plus incidentals of merchandise available for resale o GROSS PROFIT – Sales – COMS INCOME STATEMENT Gem City Music Income Statement For the Year Ended December 31, 20— Revenue from sales: ....................................... Sales ................................................... Less: Sales returns and allowances $ 1,700 Sales discounts ...................... 500 Net sales .................................................. Cost of merchandise sold XXXX.................... Gross profit ................................................... Operating expenses: Selling expenses: Sales salaries expense ..................... $17,700 Administrative expenses: Rent expense $ 7,800 Office salaries expense ..................... 22,550 Depreciation expense—office equipment 2,800 Total operating expenses ....................... Income from operations ................................. Other expense: Interest expense...................................... Net income ............................................... Fall 2007 Prof. M. Mari Page 1 $189,300 $ 2,200 $187,100 100,000 87,100 $ 33,150 50,850 36,250 $ 2,000 34,250 Chapter 5: Accounting for Merchandising Business XXXX Computation of Cost of Merchandise Sold Purchases Less merchandise inventory, December 31 =Cost of merchandise sold Computation of Cost of Merchandise Purchased Purchases Less: purchases returns and allowances Less: purchases discount =Net purchases Add: transportation in =Cost of merchandise purchased New Accounts on the Balance Sheet o Merchandise inventory – merchandise on hand at the end of an accounting period. Merchandising Transactions Chart of Accounts for Merchandising Business Assets Cash Accounts receivable Merchandise inventory Office Supplies Prepaid Insurance Store Equipment Acc. Depreciation Office Equipment Acc. Depreciation Liabilities Accounts payable Salaries payable Unearned rent Notes payable Stockholder’s Equity Capital stock Retained earnings Dividends Fall 2007 Prof. M. Mari Page 2 Chapter 5: Accounting for Merchandising Business Income Summary Revenues Sales Sales returns and allowances Sales discounts Costs and Expenses Sales salaries expense Advertising expense Depreciation expense Misc. selling expense Office salaries expense Rent expense Insurance expense Office supplies expense Other income Rent revenue Other expense Interest expense Accounting for Sales Under the perpetual inventory system, all sales require the reporting of the removal of inventory from the books at the same time. 1. CASH SALES Example 1: Sold merchandise for cash $5,000. Cost of merchandise sold $3,200 Date Account PR Debit Credit Cash $5,000 Sales $5,000 Cost of merchandise sold Merchandise inventory 3,200 3,200 Note: that sales are credited for the sales price and merchandise inventory is credited for the COST. 2. MASTERCARD OR VISA The transaction requires a debit to CASH since the money is deposited in the vendor’s account overnight. Fall 2007 Prof. M. Mari Page 3 Chapter 5: Accounting for Merchandising Business But a reduction of the cash account must be made for the service charge from the credit card company, which is directly taken out of the account. Example 2: Sold merchandise on VISA $10,000. Cost of merchandise sold is $4,000. Credit card expense is 3% of sales. Date Account PR Cash Sales Debit $10,000 Credit $10,000 Cost of merchandise sold Merchandise inventory 4,000 Credit card expense Cash 300 4,000 300 Example 3: Sold merchandise on VISA $6,000. Cost of merchandise sold is $3,000. Credit card expense is 3% of sales. Date Account PR Debit Credit 3. SALES ON ACCOUNT Includes sales to nonblank credit cards such as AMERICAN EXPRESS Example 4: Sold merchandise on account $6,000. Cost of merchandise sold is $3,000. Fall 2007 Prof. M. Mari Page 4 Chapter 5: Accounting for Merchandising Business Date Account Accounts receivable Sales PR Debit $6,000 Credit 6,000 Cost of merchandise Merchandise inventory 3,000 3,000 Recap: Under the perpetual inventory system, all sales transactions consist of at least two entries. The first entry records the sale at the selling price with a debit to how it will be paid and credit to sales. The second entry records the merchandise leaving the business with a debit to cost of merchandise sold and credit to merchandise inventory for the cost of the merchandise. Sales Discounts – A reduction in the price of the good for early payment. – This account is a contra – SALES – Upon payment of the account receivable, if the payment is within the discount period, we record the discount. – Credit terms – terms of when payments for merchandise are to be made. Net 30 days – full amount due in 30 days 2/10 – 2% discount if paid within 10 days Example 5: Sold merchandise on account $5,000, terms 2/10, n/30. Cost of merchandise sold is $4,000. Date Sales Discount Discount $ $5,000 2% $100 Sales Less discount Net amount $5,000 100 4,900 Account Cash Sales discount Accounts receivable Fall 2007 Prof. M. Mari Page 5 PR Debit 4900 100 Credit 5000 Chapter 5: Accounting for Merchandising Business Sales Returns and Allowances – – – – Merchandise sold may be returned to the seller Merchandise sold may be reduced in price due to defects This account is CONTRA – sales Increases with a debit Example 6: Sold merchandise on account $7,000, terms 1/15, n/30. Cost of merchandise sold is $3,800. Date Account Accounts receivable Sales PR Debit $7,000 Credit 7,000 Cost of merchandise Merchandise inventory 3,800 3,800 Return merchandise with sales price of $2,000 and cost of $1,000. Date Account Sales returns Accounts receivable Merchandise inventory Cost of merchandise sold PR Debit 2,000 Credit 2,000 1,000 1,000 Example 7: ABC Merchandising had the following transactions: a> Sold merchandise and received payment by VISA at $6,000, cost of merchandise sold is $4,000. b> Sold merchandise on account for $7,500 with credit terms 1/10, n/30. Cost of the merchandise is $4,500. c> Sold merchandise on account for $4,000, cost of merchandise is $2,500. d> Received a return of the merchandise in (c ) of sales price of $2,000 and cost of $1,750. e> Received payment within the discount period for merchandise in (b). Fall 2007 Prof. M. Mari Page 6 Chapter 5: Accounting for Merchandising Business f> Received payment for merchandise in (c ). Record the Transactions. Accounting for Purchases: – Under perpetual inventory system. Example 8: Purchase merchandise for resale $4,000 on account. Date Mar 1 Account Merchandise inventory Accounts payable PR Debit $4,000 Credit $4,000 Purchases Discounts – Purchases discounts are discounts taken by the buyer for early payment of an invoice. – These discounts reduce the cost of the merchandise purchased. – Should be taken when offered if not it is a LOSS to the business. Example 9: Purchase merchandise for resale $4,000, terms 2/10, n/30 on account. Invoice: Discount (2% x $4,000) Net of discount Account Date Mar 1 Mar 10 $4,000 80 3,920 PR Debit Merchandise inventory Accounts payable $4,000 Accounts payable Cash Merchandise inventory $4,000 Fall 2007 Prof. M. Mari Page 7 Credit $4,000 $3,920 80 Chapter 5: Accounting for Merchandising Business Reduction of the cost of the merchandise is reflected in the merchandise inventory account. Example 10: Purchase merchandise for resale $6,000, terms 1/15, n/30 on account. Date Account PR Debit Credit Purchases Returns and Allowances o Purchase returns – merchandise is returned to the seller o Purchase allowances – price adjustment o Debit memorandum – notification of the return or allowance by seller Example 11: Returned merchandise on account $2,500. Date Account Mar 09 Accounts payable Cash PR Debit $2,500 Credit $2,500 Example 12: Purchased merchandise of $8,000 on terms 2/10,n/30. Ennis pays the original invoice less a return of $2,500 within the discount period. Record the above entries. Date Fall 2007 Prof. M. Mari Page 8 Account PR Debit Credit Chapter 5: Accounting for Merchandising Business Recap of Purchasing Transactions Example 7: ABC Merchandising had the following transactions: Purchased merchandise and received payment by VISA at $6,000. Purchased merchandise on account for $7,500 with credit terms 1/10, n/30. Purchased merchandise on account for $4,000. Return of the merchandise in (c ) of sales price of $2,000. Paid within the discount period for merchandise in (b). Paid for merchandise in (c ). Transportation Costs – The terms of a sale should indicate when the ownership of the merchandise passes to the buyer. This point determines which party, the buyer or the seller must pay the transportation costs. o FOB – shipping point The ownership of the merchandise passes to the buyer when the seller delivers the merchandise to the transportation company. Buyer pays the transportation costs Example 13: Purchased merchandise for $4,000 with shipping costs of $50 FOB shipping point. Date Account Merchandise inventory Accounts payable Merchandise Inventory Cash PR Debit $4,000 Credit $4,000 $50 $50 o FOB – destination point The ownership of the merchandise passes to the buyer when the seller delivers the merchandise to the buyer. Seller pays the transportation costs Fall 2007 Prof. M. Mari Page 9 Chapter 5: Accounting for Merchandising Business Example 14: Sold merchandise for $4,000 with shipping costs of $50 FOB destination. Cost of merchandise sold is $2,000. Date Review for Test! Account Accounts receivable Sales PR Debit $4,000 Credit $4,000 Cost of merchandise sold Merchandise inventory 2000 Delivery expense Cash 50 2000 50 RECAP FREIGHT TERMS FOB Shipping Point FOB Destination Ownership (title) passes to buyer when merchandise is .................................................. Delivered to freight carrier Received by buyer Transportation costs are paid by................................................. Buyer Seller Risk of loss during transportation belongs to ................................... Buyer Seller Sales Taxes – Liability to the business – Create a SALES TAX PAYABLE account Example 15: Sold merchandise on account $7,000, plus 5% sales tax. Cost of merchandise sold is $3,800. Fall 2007 Prof. M. Mari Page 10 Chapter 5: Accounting for Merchandising Business Date Account Accounts receivable Sales Sales tax payable PR Debit $7,350 Credit 7,000 350 Cost of merchandise Merchandise inventory 3,800 3,800 RECAP of Sales and Purchases Transactions Seller Sold merchandise on account: Accounts receivable DR Sales CR Cost of merchandise sold DR Merchandise inventory CR Transportation costs Shipping point Transportation costs – Destination: Delivery Expense DR Cash CR Merchandise returned: Sales Returns & Allowances DR Accounts receivable CR Merchandise inventory DR Cost of merchandise sold CR Payment : Cash DR Accounts receivable CR Payment with discount: Cash DR Sales discount DR Accounts receivable CR Buyer Purchased merchandise on account: Merchandise Inventory DR Accounts Payable CR Transportation costs Shipping point: Merchandise Inventory DR Cash CR Transportation costs - Destination Merchandise returned: Merchandise inventory DR Accounts payable Payment: Accounts payable DR Cash CR Payment with discount: Merchandise inventory DR Cash CR Adjusting Entries: – Fall 2007 Prof. M. Mari Page 11 CR Inventory Shrinkage Difference between physical count and books Chapter 5: Accounting for Merchandising Business Example 16: Suppose that physical inventory shows balance of $20,000 and books show balance of $23,000. Record the shrinkage. Date Account Cost of merchandise sold Merchandise inventory Closing Entries: o Accounts that must be closed Sales Rent revenue Sales returns and allowances Sales discounts Cost of merchandise sold All expenses and revenues Dividends Fall 2007 Prof. M. Mari Page 12 PR Debit 3,000 Credit 3,000