THE MERGERS AND ACQUISITION MARKET. AN OVERVIEW. Corporate Finance Lesson 10

advertisement

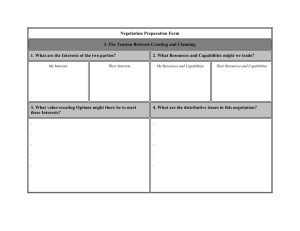

THE MERGERS AND ACQUISITION MARKET. AN OVERVIEW. INTRODUCTION TO COMPANY’S VALUE AND VALUATION TECHNIQUES. DCF AND COMPARABLES Lesson 10 Corporate Finance 10th Castellanza, November, 2010 2 Internal Growth vs. External Growth Internal growth investments plants, equipments investments technologies investments human resources External growth acquisitions mergers alliances joint ventures 3 External Growth ACQUISITION: one company taking over controlling interests in another company MERGER: combination of two or more companies into one PURCHASE: the amount paid over and above the acquired company’s book value is carried on the books of the purchaser A B CONSOLIDATION: a new company is formed to acquire the net assets of the combining companies A B C 4 External Growth (cont’d) MERGER horizontal: takes place between two firms in the same line of business vertical: involves companies at different stages of production conglomerate: involves companies in unrelated lines of business 5 External vs Internal Growth (benefits and costs) some benefits timing control over expenses control over results some costs difficult to maintain the equilibrium (and performance) within the company human resources different cultures an acquisition is never tailored 6 External Growth: characteristics High failure risk Difficulties in evaluating a company Difficulties in obtaining guarantees Synergies 7 Some Reasons to Merge economies of scale economies of vertical integration surplus of funds complementary resources tax shields 8 Some Reasons to Acquire entrepreneur’s ambition to increase market share to enter in a new market, in a new industry to obtain a royalty, know-how, trade mark to eliminate a competitor 9 Keys to Succeed Only by gaining a clear understanding of what and where value can be obtained from a deal, can companies hope to avoid ‘bad’ deals and be in a position to work out how this value extraction will be achieved. Hard keys synergy evaluation: in terms of revenue benefits, indirect and overhead cost reductions, direct operational cost reductions integration project planning due diligence Soft keys resolving cultural issues selecting the management team communications 10 Something you won’t find in books Whatever you’ll do in your life needs negotiations and you need to know how to negotiate Although negotiation courses are getting more and more in the way, you have to keep in mind: some common mistakes to avoid rational framework methods to simplify complex negotiations 11 Something you won’t find in books First of all you have to succed in getting a rational thinking in negotiation Negotiating rationally means: Making the best decisions maximize your interests Knowing how to reach the best agreement vs. just any agreement 12 Something you won’t find in books Sometime pervasive decision-making biases blind CEOs’ strategy and prevent them from getting as much as they can Examples: Irrationally escalating your commitment to an initial course of action, even when it is no longer the most beneficial choice Assuming your gain must come at the expense of the other party and missing opportunities for trade-offs Anchoring your judgments upon irrelevant information Being overly affected by the way information is presented to you Failing to consider you can learn by focusing on the other side perspective 13 Common Mistakes in Negotiation Irrational escalation of commitment To eliminate irrational escalation you must understand the psychological factors (perception and judgment) that feed it Do not assume your interests directly conflict with those of the other party The best negotiations end in a resolution that satisfies all parties Anchoring and adjustment To proceed both sides must adjust their positions throught the negotiation arriving at either agreement or impasse Initial positions may act as anchors and affect each side’s perception of what outcomes are possible Framing negotiations The way the options available in a negotiation are presented can strongly affect a manager’s willingness to reach an agreement Weigh up “status quo” and expectations 14 Common Mistakes in Negotiation Availability of information Pay attention to all the facts and avoid to ignore certain Identify and use truly reliable, not just available, information Distinguish what’s emotionally familiar to you from what’s reliable and relevant Overconfidence and Negotiator Behaviour Overconfidence may lead managers to think that their judgments are correct and wrongly estimate a neutral party’s opinion Overconfidence may inhibit a variety of possible and acceptable settlements Consider the suggestions of qualified advisers is a way to temper overconfidence 15 Rational Framework for Negotiation How should managers make decisions in a world where many people don’t always behave rationally? Most critical components of a rational negotiation process are: Evaluation of each party’s alternatives to a negotiated agreement, interest and priorities (i.e. potential consequences, reservation price, requirements) Understand the integrative components of negotiation (i.e. positions, priorities, preferences, deficiency) 16 Rational Framework for Negotiation To succed in structuring a rational framework you should: Assess what you will do if you don’t reach agreement with your current negotiation opponent Assess what your current negotiation opponent will do if they don’t reach an agreement with you Assess the true issues in the negotiation Assess how important each topic is to you Assess how important topic is to your opponent Assess the bargaining zone Assess where the trade-offs exist 17 Rational Framework for Negotiation In a negotiation maybe the most important thing is to identify and evaluate trade-offs Strategies about: how to collect information how to cope with different perceptions among parties how to go beyond simple trade-offs are very important to succeed in finding out the right balance 18 Rational Framework for Negotiation Some strategies for finding trade-offs are: Build trust and share information Ask lots of questions Give away some information Make multiple offers simultaneously Search for post-settlememnt settlements Use differences of expectations to create mutually beneficial perceived trade-offs Use differences of risk preferences to create mutually beneficial perceived trade-offs Use different time preferences to create mutually beneficial trade-offs Consider adding issues to the negotiation to increase the potential for making mutually beneficial trade-offs Consider whether there is some way to reduce costs to the other party of allowing you to get what you want and vice versa 19 Simplifyng Complex Negotiations Experience vs expertise Two main factors distinguish experience from expertise: The ability of an expert to adapt skills to get good outcomes The ability to transmit or transfer these skills A primary way to improve performance in a negotiation is the developement of expertise by combining experience with the ability to think rationally Thus, understanding the demands of a particular problem and thinking rationally improve your ability to analyze and restructure a proposed negotiation 20 Simplifyng Complex Negotiations Negotiating rationally requires to understand the impact of fairness and emotional consideration that profoundly affect bargaining Multiparty negotiation: More complexity due to: Richness of the interpersonal networks Multiple individual preferences More interests involved Look more carefully for integrative opportunities, be aware of barriers and be sensitive to the impact of decision rules on the quality of group outcomes 21 Simplifyng Complex Negotiations Negotiating through third parties: Consider their goals, interests and likely behaviour in order to develop effective strategies Active participant in the negotiation process Vested interests in particular outcomes Know managers or disputants, their incentives, constituency demands and goals 22 So… Audit your own decision processes Consider the decision processes of your opponent Make your best assessment of reservation prices, interest and the comparative importance of issues View the negotiation process as an opportunity to collect and update your information 23 So… Negotiation is not a science…… is an art!!!!!!!!!!!!!