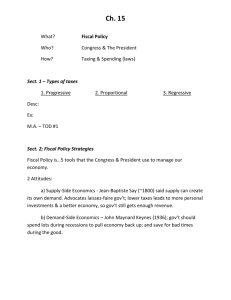

Chapter 30: Fiscal Policy

advertisement

Chapter 30: Fiscal Policy 1. Discretionary Fiscal Policy is the deliberate manipulation of taxes and government spend to alter GDP and employment, control inflation, and stimulate growth. 2. Stabilization Policies in the short run involve the following two options: a) Expansionary fiscal policy is used to eliminate a recessionary gap and stimulate AD in order to return the economy to full employment. b) Contractionary fiscal policy is used to counteract an inflationary gap and reduce AD in order to return the economy to full employment. 3. Fiscal Policy Options Effect on Budget Gov’t Spending a) expansionary increase toward deficit b) contractionary decrease surplus Taxes Effect on GDP Effect lower increase increase raise lower decrease on Prices toward effect on prices assumes in intermediate or vertical region of AS (horizontal, region, no change) 4. The crowding out effect is an argument that an expansionary fiscal policy (deficit spending) will increase the interest rate and reduce private investment, reducing the stimulus of the fiscal policy. Specifically, here are the linkages: a) b) c) d) government spending and/or tax reduction increases the budget deficit the budget deficit is finance through government borrowing of funds in the money market the increase in the demand for money raises the interest rate the higher interest rate discourages or “crowds out” private investment e) economic growth in long run (LRAS) will be reduced due to smaller private capital stock 5. The net export effect further reduces the impact of expansionary fiscal policy as higher domestic interest rates: a) b) c) d) increase foreign demand for dollars the increased demand for dollars results in an appreciated dollar the appreciated dollar makes exports more expensive and imports cheaper net exports decline partially offsetting the expansionary fiscal policy 6. Non discretionary fiscal policy or built-in stabilizers are counter cyclical government programs (e.g. progressive income tax and transfer payments such as unemployment compensation) that automatically counteract both recessions and high inflation. a) For example, as GDP rises during prosperity, tax revenues under a progressive income tax system automatically increase and transfer payments such as unemployment insurance automatically decrease, both reducing consumer spending and restraining economic expansion. The budget will automatically move toward a surplus. b) Conversely, as GDP falls during a recession, tax revenues automatically decline and transfer payments automatically increase, stimulating consumer spending and preventing a prolonged recession. The budget will automatically move toward a deficit.