Chapter 7 Selecting and Financing Housing

advertisement

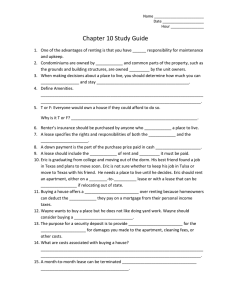

Chapter 7 Selecting and Financing Housing McGraw-Hill/Irwin Copyright © 2013 by The McGraw-Hill Companies, Inc. All rights reserved. Selecting and Financing Housing Chapter Learning Objectives LO7.1 LO7.2 LO7.3 LO7.4 Assess costs and benefits of renting Implement the home-buying process Determine costs associated with purchasing a home Develop a strategy for selling a home 7-2 Learning Objective LO7.1 Assess Costs and Benefits of Renting Evaluating Renting and Buying Alternatives • Your lifestyle and your choice of housing – How you spend your time and money – Every buying decision = lifestyle statement • Personal preferences vs. financial factors • Traditional financial guidelines: – Spend no more than 25-30% of take-home pay on monthly housing expense, or – No more than 2 1/2 times your annual income on mortgage 7-3 Renting vs. Buying Housing Choice should be based on: – Lifestyle – Financial Factors – Mobility vs. permanence – Renting = less costly in the short run – Home ownership = long-term financial advantage 7-4 Rent vs. Buy RENTING vs. BUYING Advantages Disadvantages Renting Easy to move Fewer responsibilities for maintenance Minimal financial commitment No tax benefits Limitations regarding remodeling Restrictions regarding pets, etc Buying Pride of ownership Financial benefits Lifestyle flexibility Financial commitment Higher living expenses than renting Limited mobility 7-5 Selecting an Apartment 7-6 Legal Details of a Lease • • • • • • • • • • • Description and address of property Name and address of the owner/landlord (lessor) Name of tenant (lessee) Effective date and length of the lease Amount of security deposit Amount and due date of rent Date and amount for late rent payments List of included utilities, appliances, etc. Restrictions on certain activities The right to sublet the unit; transfer clause Conditions under which landlord may enter the rental unit 7-7 Costs of Renting • Security deposit – Usually one month’s rent – Held against damages to the property – Returned at end of lease if unit undamaged – Any deductions must be documented • Utilities not covered in rent payment – Water frequently covered in apartment rent – If renting a house no utilities included • Renter’s insurance – Covers contents of rented property 7-8 Home Buying Activities Step 1: Determine Homeownership Needs • Evaluate Home Ownership – Stability of residence • American dream/norm – Financial benefits • Deduct property taxes and mortgage interest • Potential increase in value of your home • Building an equity in your home – Lifestyle flexibility - express your individuality 7-9 Home Buying Activities • Drawbacks of Homeownership – Financial uncertainty • Obtaining money for the down payment • Obtaining mortgage financing • Home values could drop – Limited mobility • Can take time to sell your home – Higher living costs • Maintenance, repainting, repairs, and home improvements • Rising real estate taxes 7-10 Home Buying Activities Types of Housing Available • Single-family dwelling • Multi-unit dwelling – Duplex (two homes) – Townhouse (2, 4, or 6 units) • Condominium – Individual ownership of a unit in a building – “Condominium” ≠ a type of building structure – “Condominium” = a form of homeownership 7-11 Home Buying Activities Types of Housing Available • Cooperative housing – Units owned by a non-profit organization – Shareholders purchase stock for the right to live in a unit in a building with multiple units • Manufactured homes – Fully or partially assembled in a factory, and then moved to the housing site – Prefabricated = components factory-built and assembled at the site – Mass production under factory conditions keeps costs lower than site built homes 7-12 Home Buying Activities Types of Housing Available • Mobile homes – – – – A type of manufactured home, often <1,000 sq. ft. Same features as a conventional house Safety is debated Tend to depreciate 7-13 Home Buying Activities Types of Housing Available • Building a custom home: – Does the contractor have needed experience? – Does contractor have a good working relationship with - Architect - Suppliers - Electricians - Plumbers - Carpenters and others? 7-14 Home Buying Activities Building a Custom Home – What assurance do you have about quality? – What are payment arrangements? – What delays will be considered legitimate? – Is the contractor licensed and insured? – Are there any complaints about this contractor? – Contract should have a time schedule, cost estimates, description of work, and a payment schedule 7-15 Home Buying Activities Determine What You Can Afford – Consider both price and quality – Look at your income, your current living expenses, and how much you have for a down payment – Have a loan officer prequalify you – Purchase what you can afford - you can always move up – Buy a “fixer-upper” at a lower price, if you have the time, skills, and money to fix it up 7-16 Home Buying Activities Step 2: Find and Evaluate a Home • Select a location, location, location – Be aware of zoning laws – Assess the school system if you have children • Services of real estate agents – Will (1) show homes that meet your needs, (2) present your offer, (3) negotiate the price, (4) assist in obtaining financing, and (5) represent you at the closing – Commission paid by seller; built into price – Seller’s agent, Dual agent or Buyer’s agent 7-17 Home Buying Activities Step 2: Find and Evaluate a Home • The Home Inspection – Conduct a home inspection or hire an inspector – Mortgage company will require an appraisal 7-18 Home Buying Activities Step 3: Price the Property • Determine the home price – Price affected by selling prices in the area – Current demand for housing – Time home has been on the market – Owner’s need to sell – Financing options – Features and condition of the home 7-19 Home Buying Activities Step 3: Price the Property • Negotiate the purchase price – Counteroffers are common – Earnest money • Portion of the price deposited as evidence of good faith – Contingency clause • Offer dependent on certain events: –Obtaining financing –Sale of current home 7-20 Learning Objective LO7.3 Determine Costs Associated with Purchasing a Home The Finances of Home Buying Step 4: Obtain Financing Determine down payment amount • Private Mortgage Insurance if < 20% down (PMI) • Automatic PMI termination when equity =>22% – Required by Homeowners Protection Act 7-21 Home Buying Activities The Mortgage • • • Long-term loan on a specific piece of property Usually 10, 15, 20, 25, or 30 years Three main phases 1. Complete application and meet with lender to provide evidence of qualification 2. Lender obtains credit report and verifies application 3. Mortgage is approved or denied – Approval usually locks rate for 60-90 days 7-22 Home Buying Activities The Mortgage • Qualifying for a mortgage includes: – – – – – – Income Debts Credit history (620+ score) Down payment amount Length of the loan Current mortgage rates • “Points” = prepaid interest as a % of loan amount – Each point =1% of the loan amount – Premium paid to obtain a lower mortgage rate 7-23 Home Buying Activities The Mortgage • Loan for which you qualify will be greater when rates are lower • Calculating the monthly principal and interest payment: – Example: • 30-year, 7%, $223,000 mortgage • Payment = Principal repayment + interest • PITI = payment + taxes + insurance 7-24 Home Buying Activities Types of Mortgages • Fixed-Rate, Fixed-Payment Mortgage – Fixed rate, fixed payment, amortized – 5%, 10% or 20% down – 15, 20 or 30 years of fixed payments • Government-guaranteed financing programs – Veterans Administration (VA) – Federal Housing Authority (FHA) – Lower down payment than conventional 7-25 Home Buying Activities Types of Mortgages • Adjustable rate mortgage (ARM) – Flexible-rate or variable-rate mortgage – Interest rate varies over the life of the loan – Rate cap restricts amount of change in rate – Payment cap restricts amount of change in payment • Can result in negative amortization (An increase in the principal balance of a loan caused by making payments that fail to cover the interest due.) 7-26 Home Buying Activities Creative Financing • Balloon mortgage – Fixed monthly payments – Large final payment after 3, 5, or 7 years • Interest-only mortgage – Lower payments for the first few years – Payments go towards interest only 7-27 Home Buying Activities Other Financing Options • Buy-down – Mortgage subsidy made to the homebuyer on behalf of the seller. – Reduces payments during first few years • Second mortgage – Home equity loan – Home = collateral – Interest may be tax deductible 7-28 Home Buying Activities Other Financing Options • Reverse mortgages – Home equity conversion mortgage – Provides homeowners who are 62+ with tax-free income based on home equity • Refinancing – Consider costs of refinancing in decision • Making extra payments – Reduces payoff time & interest paid 7-29 Home Buying Activities Step 5: Close the Purchase Transaction • Make arrangements for a walk through – Last-minute items for negotiation • Closing – Meeting including buyer, seller and lender – Document signing – Last-minute details settled – Closing costs = settlement costs – Real Estate Settlement Procedures Act • Requires buyers be given closing costs estimate before the closing 7-30 Home Buying Activities Closing Costs • • • • • • • • • • • Title insurance and search fee Attorney’s and appraisers fees Property survey Pest inspection Recording fees Transfer taxes Credit report Lender’s origination fee Escrow account for tax and insurance reserve Pre-paid interest Real estate broker’s commission 7-31 Home Buying Activities Closing Cost Components • Title Insurance – Title company defines boundaries of property – Title search to insure property is free of claims – Protects against future defects in title • Deed – Document that transfers ownership – Warranty deed guarantees the title is good • Seller is true owner with right to sell the property • No outstanding claims against the title • Escrow Account – Money deposited with lending institution for payment of taxes and insurance 7-32 Learning Objective LO7.4 Develop a Strategy for Selling a Home • Preparing your home – Repair, repaint, clean, reduce clutter – When showing home, “Stage It”: • Turn on lights • Open draperies • Bake bread or make coffee for a welcoming smell – Ideas from HGTV: • “Designed to Sell” • “Get It Sold” 7-33 Selling Your Home • Determining the selling price – Appraisal = estimate of the current value • “For Sale by Owner” – Use a lawyer or title company – Time-consuming for seller • Listing with a Real Estate Agent – Consider agent’s knowledge of the community – Various services and marketing efforts – Screens potential buyers 7-34 Chapter Summary Learning Objective LO7.1 • • Assess renting and buying alternatives in terms of their financial and opportunity costs. The main advantages of renting are: – – – • Mobility Fewer responsibilities Lower initial costs The main disadvantages of renting are: – – – Few financial benefits A restricted lifestyle Legal concerns 7-35 Chapter Summary Learning Objective LO7.2 Home buying involves five major stages: (1) Determining home ownership needs (2) Finding and evaluating a property to purchase (3) Pricing the property (4) Financing the purchase (5) Closing the real estate transaction 7-36 Chapter Summary Learning Objective LO7.3 • The costs associated with purchasing a home include: – The down payment – Mortgage origination costs – Closing costs, such as: • • • • • • Deed fee Prepaid interest Attorney’s fees Payment for title insurance A property survey An escrow account for homeowner’s insurance and property taxes 7-37 Chapter Summary Learning Objective LO7.4 • When selling a home, you must: – Decide whether to make certain repairs and improvements – Determine a selling price – Choose between selling the home yourself and using the services of a real estate agent 7-38