T 12 OPIC Consumer Protection Laws

advertisement

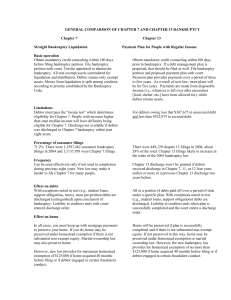

TOPIC 12 Consumer Protection Laws TOPIC 12: CONSUMER PROTECTION LAWS Learning Objectives Describe consumer laws that impact clients, including bankruptcy, banking, credit, privacy regulations, and other relevant laws. TOPIC 12: CONSUMER PROTECTION LAWS Topics Covered Bankruptcy Fair credit reporting laws Privacy policies Identity theft protection TOPIC 12: BANKRUPTCY – EXEMPT PROPERTY Life insurance Qualified retirement plans Homestead Limited equity in car or personal property TOPIC 12: BANKRUPTCY NONDISCHARGEABLE DEBTS Taxes Alimony Child support Student and government loans Crimes, fines, penalties, etc. TOPIC 12: BANKRUPTCY REFORM ACT OF 2005 Requires individuals who file for bankruptcy: To receive a briefing that outlines the opportunities for credit counseling Must receive within 180 days before the bankruptcy filing To receive information to help the individual perform a budget analysis To complete a financial management instructional course before discharge TOPIC 12: CHAPTER 7 BANKRUPTCY Chapter 7 Voluntary or involuntary Allows the person to keep certain assets, but all other assets are liquidated to satisfy claims of creditors Subject to a “means test” which determines whether the individual has a level of income that allows for repayment of debts Creditors can object to bankruptcy if the individual has income exceeding median income for the state Court decides whether the case should proceed TOPIC 12: CHAPTER 13 BANKRUPTCY Voluntary only A plan of restructuring of the person’s debt is created The restructuring might include reducing the amount of some debts or lengthening the original payment period The creditor may not foreclose on any assets or harass the debtor TOPIC 12: FAIR CREDIT REPORTING ACT Gives the consumer the right to see and correct errors in his or her credit file The file is confidential for all other persons except those who have a legitimate need for credit information, such as lenders, prospective creditors, creditors, prospective employers and life insurance underwriters TOPIC 12: CONSUMER CREDIT PROTECTION ACT The “Truth in Lending” Act provides A lender must inform borrowers of the “true” interest rate, the APR (Annual Percentage Rate) The cost of any credit life insurance must be disclosed A 3-day right of rescission must be included in any contract in which the borrower’s home is used for collateral The maximum amount that may be garnished for unpaid debts is 25% of take-home pay The maximum liability for lost or stolen credit cards is $50 TOPIC 12: GRAMM-LEACH-BLILEY ACT OF 1999 Provides customers with the right to not have their information shared with unrelated third parties Financial planners should not share any client information with any other person or business unless specifically requested to do so by the client TOPIC 12: IDENTITY THEFT PROTECTION To help protect clients from identity theft, financial planners should recommend that clients shred all documents containing Social Security numbers Credit card numbers Birth dates Usernames Passwords Financial planners should warn clients about providing this type of information over the phone or on websites unless the client is the one who initiated the contact with the company requesting the information END OF TOPIC 12