The ABC’s of Investment Fees

advertisement

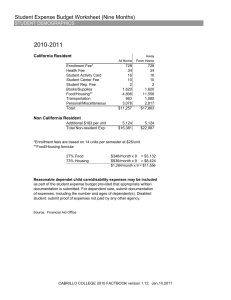

The ABC’s of Investment Fees Ed Hutton, CFA Assistant Professor Director, Niagara University Financial Markets Laboratory ehutton@niagara.edu 1 Before we start… • This seminar is intended to educate you on how to understand the required fee disclosure now being provided by investment companies. It’s not intended to give a recommendation or an evaluation regarding your personal investment selection or strategy. 2 Seattle Seahawks vs. Green Bay Packers • Did Seattle really win? • NFL Referees locked out by owners over issue of • Defined Benefit vs. Defined Contribution Pension Plans! • Defined Contibution-401(k), 403(b) its your responsibility 3 Investment Returns • Year to year increase in the value of your investment- My XYZ Fund increased by 5% last year; my $1,000 grew to $1,050 (1,000*1.05) • Compound Return- Each year the investment grows by the investment return multiplied by the new balance. My XYZ Fund grew 5% again last year, so now I have $1,081.50 (1,050*1.03) 4 Investment Risk • The possibility of having a negative or low investment return. My XYZ Fund went down by 10% last year- I went from $1,000 to $900! (1,000 * (1-.1)) • Money Market, least risk-Stocks, most risk • Large Cap, less risk – Small Cap, more risk • Risk can also be called volatility, or B (Beta) 5 Risk/Return Tradeoff • So, why would anyone invest in something with higher risk? • Higher risk = higher investment return • Factors to consider- Personality type, time until retirement, other investments 6 Investment Fees • 4 types: – Fund operating expenses: compensation to investment company for expenses and profits – Marketing Costs: commissions paid to the person or company you bought the fund from. – Service costs: charges for other services you decide to buy form the investment company, such as a loan or insurance – Recordkeeping: Charge paid by your employer for the costs of required paperwork. 7 How do you pay these fees? • Front-End Load: taken out from the amount you are investing I invested 1,000 in ABC Fund, after the 5% load was deducted, I only had an investment of $950. • Many funds are “No-Load”; no front end load. • Front-End loads reduce the amount you can accumulate for retirement, since less money is earning an investment return. 8 How do you pay these fees? • Back-End Load (also known as Redemption fee, or deferred sales charge): Deducted from your balance when you withdraw the money. • Back-end loads may decline over time, and even disappear if you hold fund long enough, 9 How do you pay these fees? • Annual investment fees, also known as annual operating expenses, deducted each year as long as you own your investment. • Basis Point = 1/100th of a percent; 100 bp is 1% • Actual Return = Investment Return – Annual Fees 10 The Effect of Fees • 8% investment return, 20 years, $5,000 per year • High fee: 220 bp; after 20 years total savings equal to $180,022 • Low fee: 40 bp; after 20 years total savings $218,919 • Difference of $38,897 11 Are High Fee Funds Worth the Cost? • If there are special considerations that require a lot of personal attention • If there is a particular investment strategy you want to implement • But• Not if you think that higher fees mean higher investment returns 12 Passive or Active Management? • Active- Try to find the best stocks to beat the benchmark • Passive- invest in the stocks in the benchmark, so will always perform at the benchmark level • Index funds- passive, should always be low cost 13