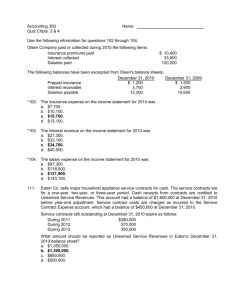

Accounting 350, Summer 2009 Quiz #2, Chpts. 3 & 4

advertisement

Accounting 350, Summer 2009 Quiz #2, Chpts. 3 & 4 Use the following information for questions 1 through 3: The income statement of Dolan Corporation for 2010 included the following items: Interest revenue $65,500 Salaries expense 85,000 Insurance expense 7,600 The following balances have been excerpted from Dolan Corporation's balance sheets: December 31, 2010 December 31, 2009 Accrued interest receivable $9,100 $7,500 Accrued salaries payable 8,900 4,200 Prepaid insurance 1,100 1,500 1. The cash received for interest during 2010 was a. $56,400. b. $63,900. c. $65,500. d. $67,100. 2. The cash paid for salaries during 2010 was a. $89,700. b. $80,300. c. $80,800. d. $93,900. 3. The cash paid for insurance premiums during 2010 was a. $6,500. b. $6,100. c. $8,000. d. $7,200. 4.On September 1, 2010, Lowe Co. issued a note payable to National Bank in the amount of $600,000, bearing interest at 12%, and payable in three equal annual principal payments of $200,000. On this date, the bank's prime rate was 11%. The first payment for interest and principal was made on September 1, 2011. At December 31, 2011, Lowe should record accrued interest payable of a. $24,000. b. $22,000. c. $16,000. d. $14,667. 5. Eaton Co. sells major household appliance service contracts for cash. The service contracts are for a one-year, two-year, or three-year period. Cash receipts from contracts are credited to Unearned Service Revenues. This account had a balance of $1,800,000 at December 31, 2010 before year-end adjustment. Service contract costs are charged as incurred to the Service Contract Expense account, which had a balance of $450,000 at December 31, 2010. Service contracts still outstanding at December 31, 2010 expire as follows: During 2011 $380,000 During 2012 570,000 During 2013 350,000 6. 7. 8. What amount should be reported as Unearned Service Revenues in Eaton's December 31, 2010 balance sheet? a. $1,350,000. b. $1,300,000. c. $850,000. d. $500,000. Gregg Corp. reported revenue of $1,100,000 in its accrual basis income statement for the year ended June 30, 2011. Additional information was as follows: Accounts receivable June 30, 2010 $350,000 Accounts receivable June 30, 2011 530,000 Uncollectible accounts written off during the fiscal year 13,000 Under the cash basis, Gregg should report revenue of a. $687,000. b. $700,000. c. $907,000. d. $933,000. Jim Yount, M.D., keeps his accounting records on the cash basis. During 2011, Dr. Yount collected $360,000 from his patients. At December 31, 2010, Dr. Yount had accounts receivable of $50,000. At December 31, 2011, Dr. Yount had accounts receivable of $70,000 and unearned revenue of $10,000. On the accrual basis, how much was Dr. Yount's patient service revenue for 2011? a. $310,000. b. $370,000. c. $380,000. d. $390,000. Gross billings for merchandise sold by Lang Company to its customers last year amounted to $15,720,000; sales returns and allowances were $370,000, sales discounts were $175,000, and freightout was $140,000. Net sales last year for Lang Company were a. $15,720,000. b. $15,350,000. c. $15,175,000. d. $15,035,000. 9. If plant assets of a manufacturing company are sold at a gain of $820,000 less related taxes of $250,000, and the gain is not considered unusual or infrequent, the income statement for the period would disclose these effects as a. a gain of $820,000 and an increase in income tax expense of $250,000. b. operating income net of applicable taxes, $570,000. c. a prior period adjustment net of applicable taxes, $570,000. d. an extraordinary item net of applicable taxes, $570,000. Use the following information for questions 10 and 11. At Ruth Company, events and transactions during 2010 included the following. The tax rate for all items is 30%. (1) Depreciation for 2008 was found to be understated by $30,000. (2) A strike by the employees of a supplier resulted in a loss of $25,000. (3) The inventory at December 31, 2008 was overstated by $40,000. (4) A flood destroyed a building that had a book value of $500,000. Floods are very uncommon in that area. 10. The effect of these events and transactions on 2010 income from continuing operations net of tax would be a. $17,500. b. $38,500. c. $66,500. d. $416,500. 11. The effect of these events and transactions on 2010 net income net of tax would be a. $17,500. b. $367,500. c. $388,500. d. $416,500. 12. During 2010, Lopez Corporation disposed of Pine Division, a major component of its business. Lopez realized a gain of $1,200,000, net of taxes, on the sale of Pine's assets. Pine's operating losses, net of taxes, were $1,400,000 in 2010. How should these facts be reported in Lopez's income statement for 2010? a. b. c. d. 13. Total Amount to be Included in Income from Results of Continuing Operations Discontinued Operations $1,400,000 loss $1,200,000 gain 200,000 loss 0 0 200,000 loss 1,200,000 gain 1,400,000 loss In 2010, Benfer Corporation reported net income of $350,000. It declared and paid common stock dividends of $40,000 and had a weighted average of 70,000 common shares outstanding. Compute the earnings per share to the nearest cent. a. b. c. d. $4.43 $3.50 $4.50 $5.00 Multiple Choice Answers—Computational Item 1 2. 3. 4. Ans. Item b b d c 5. 6. 7. 8. Ans. b c b c Item 9. 10. 11. 12. Ans. a a b c Item Ans 13. Item d. Ans Item Ans. . 3 DERIVATIONS — Computational No. Answer Derivation 1. b $7,500 + $65,500 - $9,100 = $63,900. 2. b $4,200 + $85,500 - $8,900 = $80,300. 3. d $7,600 – $1,500 + $1,100 = $7,200. 4. c ($600,000 – $200,000) × 12% × 4/12 = $16,000. 5. b $380,000 + $570,000 + $350,000 = $1,300,000. 6. c $1,100,000 + $350,000 – $530,000 – $13,000 = $907,000. 7. b $360,000 – $50,000 + $70,000 – $10,000 = $370,000. 8. c $15,720,000 – $370,000 – $175,000 = $15,175,000. 9. a 10. a $25,000 – $7,500 = $17,500. 11. b $17,500 + ($500,000 × .7) = $367,500. 12. c $1,400,000 – $1,200,000 = $200,000. 13. d ($350,000) ÷ 70,000 sh. = $5.00.