CHAPTER 5 -- PART ONE INTRODUCTION TO BUSINESS EXPENSES I. WHAT IS DEDUCTIBLE

advertisement

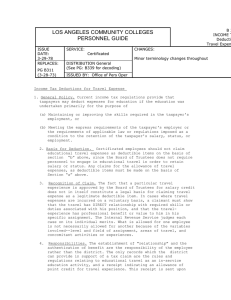

Chapter 5 - 1 CHAPTER 5 -- PART ONE INTRODUCTION TO BUSINESS EXPENSES I. WHAT IS DEDUCTIBLE A. Legislative Grace 1. Only deductions specifically allowed by the tax law. Congress’s attempt to implement the ability-to-pay concept. 2. All requirements for the deduction must be satisfied. B. Business Purpose -- In order to be deductible, there must be a business purpose for an expenditure that is unrelated to its tax effect. In most cases, a business purpose can be established by showing that an expense is related to a profit-motivated transaction. II. Reporting of Deductions by Individuals – A. Deductions “for” adjusted gross income (AGI) vs. deductions “from” AGI -- Deductions for AGI receive more favorable treatment. 1. Deductions FOR AGI are always deductible 2. Deductions FROM AGI are subject to various limitations Chapter 5 - 2 B. Exhibit 5-1 EXHIBIT 5-1 INDIVIDUAL INCOME TAX COMPUTATION FRAMEWORK All Sources of Income (Broadly Defined) Minus: Exclusions From Income Equals: Gross Income Minus: Deductions FOR Adjusted Gross Income Trade or Business Expenses Rental and Royalty Expenses Trade or Business Losses Capital Loss Deduction ($3,000 maximum) Other Specifically Allowable Deductions Equals: ADJUSTED GROSS INCOME Minus: Deductions FROM Adjusted Gross Income The Greater of: 1) Standard Deduction OR 2) Allowable Itemized Deductions Deductible personal expenditures Medical expenses Home mortgage interest / investment interest Property taxes / state income taxes Charitable contributions Personal casualty losses Other miscellaneous itemized deductions Investment expenses for the production of income Expenses related to tax return preparation and compliance Unreimbursed employee business expenses Minus: Personal and Dependency Equals: Taxable Income Exemptions Chapter 5 - 3 III. Conduit Reporting A. Conduit entities must report their "ordinary taxable income" separately from any items of income or expense that receives special treatment at the owner (partner, shareholder) level. This includes any deduction that is subject to a limitation or is not deductible on the owner's returns. Examples include miscellaneous expenses (subject to 2% of AGI limit), charitable contributions, investment interest, investment expenses, and nondeductible expenses. IV. Initial Categorization of Expenditures - Figure 5-1 Expenditure Profit-motivated business expense Trade or Business Expense Expense For the Production Of income Personal expense Specifically Allowed Itemized deduction Nondeductible Personal expense Chapter 5 - 4 A. Motivation for Expenditure 1. Profit Motivated v. Personal Expenditures a. Primarily Profit Motivated 2. Profit Motivated Expenditures are further classified as being: a. Trade or Business Expenses b. Production of Income Expenses (Investment Related Expenses) Note: Both types of expenses are related to activities that are profitmotivated. A trade or business activity will be identified by the extent of the taxpayer’s involvement and whether the intent is to earn a living from the activity. 3. Personal Expenditures a. General Disallowance b. Specifically Allowed Itemized Deductions B. Importance of correct categorization 1. Trade or Business Expenses - All ordinary and necessary business expenses that are reasonable in amount are deductible. 2. Production of Income Expenses - All ordinary and necessary investment expenses that are reasonable in amount are allowable as deductions. However, the amount of the actual deduction may be limited due to the nature of the investment activity (eg. passive loss limitations in Chapter 7) or through limitations put on deductions of individual investment expenses (miscellaneous itemized deduction limitation in Chapter 8). 3. Personal Expenditures - In general are disallowed; however, certain personal expenditures (medical, taxes, home mortgage interest) are allowed as a deduction. Some of these are also subject to limitations (medical, casualty and theft losses, miscellaneous itemized). Further, only individuals who have significant personal deductions can actually take advantage of the allowable deductions (i.e. individuals who use the standard deduction do not benefit from specific expenditures). Chapter 5 - 5 V. TRADE OR BUSINESS v. PRODUCTION OF INCOME ACTIVITY A. Trade of Business is a commonly used term in tax law - not well defined B. Provision of Goods & Services Test C. 1987 Supreme Court Decision - 3 Tests (Is gambling a TorB?) 1. Profit Motive - primary purpose for engaging in the activity must be to earn income or a profit 2. Continuity & Regularity of Activity – must be continuity and regularity in the taxpayer’s involvement in the activity 3. Must be a Livelihood/ Not a Hobby - activities that are sporadic, constitute a hobby or an amusement diversion are not TorB. D. Active Investor v. Active Trader 1. Investor who trades on own account for long-term appreciation and current dividends, interest, etc. is not engaged in a TorB. Therefore, the investor’s activities are related to production of income, and investment expenses are deductible only as miscellaneous itemized deductions. 2. Trader who trades for short-term profits and not long-term appreciation and current dividends, interest, etc. may be engaged in a TorB if the trader’s activities are frequent and substantial. Therefore, the expenses will be deductible FOR AGI. 3. Dealers in Securities who trade for other taxpayer's accounts and rely on the commissions from such trading for their livelihood are engaged in a TorB. Chapter 5 - 6 E. Rental Activities 1. May be either TorB or Production of Income activity depending on the scope of ownership and management activities. a. Classification does not affect deductibility of expenses. The main effect is the treatment of gains and losses on disposition. Losses on dispositions of TorB assets are ordinary losses. Losses on Production of Income assets are capital losses - subject to limits on deductibility. F. Mixed Use Assets/Expenditures 1. MUA - An asset that is used in one or more of the above uses. 2. MUE - An expenditure that has one or more of the above uses. a. Example - Automobile that is used 60% business/ 40% personal use. 1) Problem - Allocation between use is necessary due to different rules for deductibility of business use and personal use. 2) The automobile is considered to be two assets - one asset used for business/one asset used for personal purposes. Depreciation is allowed on the business use portion of the auto; not allowed on the personal use portion. 3) The expenditures made for gasoline, oil, repairs, maintenance, insurance, licensing fees, etc. are mixed use expenditures. They must be allocated between business and personal use on some reasonable basis. 3. Because of the potential for conversion of nondeductible personal expenditures into deductible business expenses on mixed use assets, the tax law contains very strict recordkeeping and substantiation requirements to verify the BUSINESS PURPOSE of expenditures where there is a personal use element. Chapter 5 - 7 CHAPTER 5 – PART TWO INTRODUCTION TO BUSINESS EXPENSES VI. REQUIREMENTS FOR DEDUCTIBILITY A. Ordinary & Necessary Requirement 1. Ordinary - An expense commonly incurred in the particular income producing activity. It is normal, common, and accepted as an expense in the business being conducted. The expense should be assignable to the current accounting period. Capital expenditures are not ordinary expenses - they must be capitalized and deducted through amortization, depreciation, or at disposition. 2. Necessary - The expense is "appropriate and helpful" to the taxpayer's business. A reasonable and prudent businessman would incur the same expense in the same situation. B. Reasonable in Amount 1. Related Party Problems C. Not a Personal Expenditure D. Not a Capital Expenditure 1. Repairs & Maintenance v. Improvements, Replacements, Betterments 2. Start-up Costs a. Up to $5,000 of start-up costs can be expensed in the year in which the TorB begins. The $5,000 is phased-out $ for $ when expenditures exceed $50,000 (i.e., no expensing available if expenditures > $55,000). Any amounts not expensed must be amortized over 180 months. b. Investigating a business 1) Same Line of Business 2) Different Line of Business Chapter 5 - 8 E. Not a Payment that Frustrates Public Policy 1. Fines, penalties, illegal bribes or kickbacks are specifically disallowed 2. Expenses of an illegal business - the ordinary and necessary expenses of an illegal business are deductible (drugs exception) 3. Political Expenses - not deductible 4. Lobbying Expenses - No deduction is allowed for lobbying activities. a. De minimis exception - taxpayers who incur less than $2,000 of inhouse lobbying expenses can deduct the expenses. F. Not for Production of Tax-Exempt Income -- Expenses incurred to earn tax-exempt income are not allowed as deductions. Violation of the abilityto-pay concept. 1. Allocation required if expenses are attributable to more than one class of income. G. Expenditure Must be for the Taxpayer's Benefit - Not Another's Expense VIII. Limited Mixed Use Expenses A. Hobbies, Vacation Homes, Home Offices all face special limitations due to their unique mixture of business and personal use. B. Commonalities 1. All three activities have deduction amounts limited to the income produced in the activity. The effect of this limitation is to not allow taxpayers to deduct losses on these activities. 2. All three activities require the allocation of the expenses of the activity between business and personal use. Chapter 5 - 9 a. The portion of the expenses that are allocated to the activity are subject to the income limits. The personal portion of the expenses are subject to the rules for deduction of personal expenses. i.e. certain expenses such as interest and property taxes may be deductible as an itemized deduction, while other personal expenditures (supplies, depreciation, maintenance) are not deductible. 3. Because of the commingling and allocation in (2), the tax law requires a strict order in which deductions are taken under the income limitation: a. Amounts that are otherwise deductible (interest, taxes, casualty losses) must be deducted first. b. Amounts that are deductible only as trade or business expenses (repairs, maintenance, insurance, supplies, etc) are deducted second. c. Amounts that affect the basis of a property (depreciation) are taken last. This category of expenses is usually not fully deductible under the income limitation. 4. The ordering above has two effects: a. Taking the otherwise allowable deductions first provides the least tax benefit from the activity. b. Taking depreciation last minimizes future gains C. Hobbies 1. An activity that produces income which does not meet the criteria for a trade or business or an income producing activity. That is, the activity is pursued mainly for recreation and personal enjoyment, with profitability of secondary (at best) concern. That is, the predominant motive for the activity is not a profit motive, it is personal. a. Factors considered - see page 195 2. The income received from a hobby must be included in gross income under the All-Inclusive Income Concept. Chapter 5 - 10 3. The deductions allowed for hobby expenses is limited to the gross income from the hobby. a. Hobby expense deductions are taken as miscellaneous itemized deductions. They are subject to the 2% of adjusted gross income limitation on miscellaneous itemized deductions. 1) If the taxpayer uses the standard deduction, there is no deduction benefit. Because of 2% limit most hobbies produce some taxable income. D. Vacation Homes 1. A property that is both rented out during the year and used for personal purposes by the taxpayer. 2. Objective Test - based on days of personal use a. If personal use is greater than the greater of 1) 14 days, or 2) 10% of rental days, the property is a vacation home and subject to the vacation home limitations. b. If the test above is not met, the property is considered a rental property and treated like any other rental property. i.e. it is not subject to the vacation home limitations. Note: you can use a property up to 14 days and not have it classified as a vacation home. 1) In this case, expenses must still be allocated between business and personal use. c. De Minimis Rule - If the property is rented less than 15 days, no income is reported and no deductions for the rental are allowed (other than the otherwise allowable expenses - interest, taxes, casualties). 3. Limitation - Deductions on vacation homes cannot exceed the gross rental income from the property. a. Deductions are taken in the same order as in hobbies. Chapter 5 - 11 4. Allocation basis - Interest Expense/Property Taxes - 2 views a. IRS - all costs including interest & property taxes should be allocated based on the number of days of actual use. NOTE: This is the approach assumed in the text. b. Courts - have held that the proper allocation of interest and property taxes is based on the total number of days in the year rather than number of days used. 1) The courts allocation method is more favorable as it allocates less to the rental and more to the personal use, resulting in a larger overall deduction (due to increased itemized deduction for mortgage interest and property taxes). E. Home Offices 1. A deduction is allowed for the use of an office in the home that is exclusively used continuously and regularly as a. A Principal Place of Business or b. A place for meeting and dealing with customers, clients, etc. 2. For an employee to deduct home office costs, the office must also be for the convenience of the employer. 3. Home office deductions are limited to the income after subtracting the other direct costs of the business (cost of goods sold, auto expenses, supplies, etc.) a. Any home office costs not deductible under the limitation may be carried forward and deducted in future years, subject to the income limitation. b. To deduct basic telephone costs, you must have a separate line (number). Business related long-distance is always deductible. Chapter 5 - 12 IX. WHEN TO DEDUCT A. Effect of Accounting Method B. Cash Method 1. In General a. When payment is made 2. Prepaid Expenses a. One year rule for prepayments C. Accrual Method 1. Requirements for Deductibility -- Only when all-events test and economic performance test have been met can an expense be accrued and deducted for tax purposes. a. All Events Test -- Met when all the events have occurred that determine that a liability exists and the amount of the liability can be determined with reasonable accuracy. b. Economic Performance Test -- Economic performance occurs when services or property are provided to the taxpayer or when the taxpayer uses property. 1) Exceptions for recurring payments a) Economic performance occurs shortly after the end of the year (but < 8 1/2 months) b) Item is recurring in nature and taxpayer consistently treats similar items as incurred in the year the all-events test is met c) Better matching occurs c. Effect on use of estimated expenses (bad debts, warranties) D. Related Party Accrued Expenses 1. The cash method must be used by an accrual basis taxpayer for recognition of expenses paid to a cash basis Related Party.