Macroeconomics Chapter Four Outline US Economy is comprised of two sectors:

advertisement

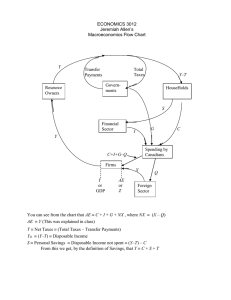

Macroeconomics Chapter Four Outline US Economy is comprised of two sectors: Private Sector: Comprised of households and businesses; Public Sector: “the Government”. Households: - 114 million households in US; Ultimate suppliers of all economic resources; Major spenders in the economy; Functional Distribution of income represents how the nation’s income is apportioned among wages, rents, interest and profits; wages/salaries paid to labor; rent and interest are paid to owners of property resources; and profits are paid to owners of corporations and unincorporated businesses. Largest source of income for households is the wages and salaries paid to workers (71% of total US income) goes to labor, not to capital. Personal Distribution of income indicates how the nation’s total income is divided among individual households. Households are divided into five numerically equal groups or quintiles. The poorest 20% of all households received 3.4% of total personal income and the richest 20% received 50.5%. This represents considerable income inequality. Households use income as follows: 1. Personal taxes (income tax) About 13% on income goes to personal taxes; 2. Personal saving (very minimal, about 1%) 3. Consumption – About 86% of income is spent on consumer goods ( 11% on durable goods – those that have a life span of three or more years; 29% on non-durable goods – those that have a life span of less than three years; and 60% on services) Business Population: 1. 2. 3. 4. 5. Plant Firm Industry Horizontal integrated Vertically integrated Legal Forms of Business: 1. Sole proprietorship (72% of all firms, generating 5% of sales) 2. Partnership (8% of all firms, generating 11% of sales) 3. Corporation (20% of all firms, generating 84% of sales) Wal-Mart is world’s largest corporation, based on dollar revenue in 2007. Principal – Agent Problem for corporations: Principals are the stockholders who own the corporation and who hire executives as their agents to run the business on their behalf. Problems have arisen with Bernie Ebbers of WorldCom and Ken Lay of Enron. Public Sector: Government’s Role 1. Provides legal structure 2. Maintains competition 3. Redistributes income through transfer payments (welfare checks, food stamps, unemployment compensation, etc.); market intervention through creation of price floors; and imposition of progressive personal income taxes 4. Reallocates resources through actions taken against externalities in the economy 5. Promotes stability through both fiscal and monetary policies in the economy Circular Flow Model must be Revisited to Insert the Public Sector (Government) Government Finance - Government purchases are exhaustive, i.e., they require the use of resources and are part of the domestic output; Government transfer payments are nonexhaustive, i.e., they do not directly absorb resources or create output. Think of social security payments – the persons receiving these payments from the government are likely retired or disabled and they are not currently making a contribution to domestic output in return for such payments. Government purchases declined from about 22% to 19% of total GDP from 1960 until 2007; while Government transfer payments more than doubled from 5% of total GDP to 13% of total GDP over the same time period. Bottom line, total Government purchases plus transfer payments increased from 27% of total GDP in 1960 to 32% of total GDP in 2007. Federal Finance Expenditures 1. Pensions and income security (Social security) 34% of total federal expenditures; 2. Health (Medicare) 24% of total federal expenditures; 3. National defense 21% of total federal expenditures. Revenues 1. Personal Income Tax comprises 45% of federal revenues; this is a progressive tax, meaning that people with higher incomes pay a larger percentage of their incomes as taxes than do people with lower incomes; 2. Payroll taxes (34%) are based on salaries and wages and include social security and Medicare contributions. 3. Corporate income taxes (14%) are taxes on a corporation’s profit – a 35% tax rate applies; 4. Excise taxes (3%) are taxes on commodities such as alcoholic beverages, tobacco and gasoline. State Finance Sources of revenues 1. Sales and excise taxes (47%) 2. State personal income taxes (35%) 3. Corporate income taxes (about 18%) (Note: About 39 states, including Mississippi have opted for legalized gambling, i.e., casinos as well as lotteries to generate additional funding.) Expenditures 1. Education (36%) 2. Public welfare (28%) 3. Health and hospitals (7 %) Local Finance Sources of revenues 1. Property taxes (72%) 2. Sales and excise taxes (16%) Expenditures 1. Education (44%) 2. Welfare, health and hospitals (12%) 3. Public safety (11%)