SKF First-quarter results 2015 Alrik Danielson, President and CEO 1 17 April 2015

SKF First-quarter results 2015

Alrik Danielson, President and CEO

17 April 2015

1

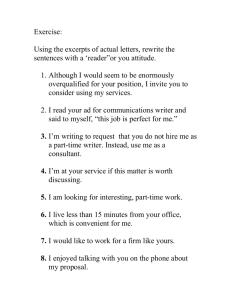

Examples of new business in Q1 2015

•

Chongqing General Industry (Group) Co and JiangSu High-speed permanent magnetic

Jin Tong Ling Fluid Machinery Technology Co, China blower solutions

•

Volvo Car Corporation, Sweden Wheel hub bearing units with low friction grease

•

Autopartes NAPA, Mexico Agreement to market

SKF’s product range

•

Citroen C4 Cactus, Peugeot 2008 and Fiat 500X Products and solutions

2

© SKF Group Slide 2 17 April 2015

Highlights

•

SKF has worked closely with Scuderia Ferrari to produce bearing sets manufactured from specially developed tool steel

•

Re-signed the contract as a Ducati Corse Official

Technical partner

•

Achieved the energy management ISO 50001 certification on a global scale

•

SKF will invest SEK 190 million to modernize its spherical roller bearing factory in Gothenburg, Sweden

© SKF Group Slide 3 17 April 2015

3

SKF Generalized Bearing Life Model

Surface vs sub-surface failure modes internal geometry load rating limiting speed steel composition heat treatment surface finish coatings lubrication contamination resistance wear resistance reduced vibration longer service life lower noise reduced friction reduced vibration corrosion resistance

© SKF Group

17 April 2015

4

Innovations at Hannover Fair

•

Two new oil-free bearing solutions for centrifugal compressors in chillers

•

A solution to improve the reliability, safety and performance of jack-up gearboxes used in the offshore oil and gas industry and in the renewable energy industry

•

A new shaft alignment tool , specifically designed for usage with smartphones or tablets

•

A new magnetic bearing control cabinet for turbo-machinery, for onshore, offshore and subsea turbo-machinery

•

SKF Enlight, combines a powerful new mobile app with a special

Bluetooth-enabled sensor

•

SKF Data Collect, a cloud-based solution to record and manage data

© SKF Group Slide 5

17 April 2015

5

6

Construction of a large-size bearing test centre in Schweinfurt, Germany

The test center will have two large size test rigs, one for wind turbines and one for other industries. The investment will total SEK 360 million, and is expected to be completed during the first half of 2017.

© SKF Group Slide 6

17 April 2015

Christian Johansson, new Senior Vice President and CFO

7

•

Bachelor of Science in Business

Administration, Stockholm University

•

Currently CFO at Gunnebo AB

•

Christian has solid executive experience managing global business services.

Before joining Gunnebo:

-Vice President Region Americas and EMEA for Volvo Business Services

-SVP and CFO for Volvo Trucks

-Regional Director, Central Eastern Europe within ABB Service World Wide.

•

Christian will start his new position in

SKF no later than October 2015.

© SKF Group Slide 7 17 April 2015

SKF Group – Q1 2015

Financial performance (SEKm)

Net sales

Operating profit

Operating margin, %

Operating margin excl. one-time items, %

Profit before taxes

Basic earnings per share, SEK

Cash flow after investments before financing

2015

19 454

1 721

8.8

12.2

1 592

2.46

988

2014

16 734

2 024

12.1

11.4

1 787

2.72

-63*

Organic sales change y-o-y:

SKF Group

Industrial Market

Automotive Market

Specialty Business

1.4%

1.8%

0.6%

0.7%

Europe

North America

Asia

1.0%

-2.4%

5.6%

Latin America 0.4%

Middle East and Africa 14.2%

Manufacturing was higher y-o-y and compared to last year.

* Previously published cash flow information is restated

© SKF Group

Slide 8 17 April 2015

8

Organic sales growth in local currency

% change y-o-y

8

6

4

-6

-8

-10

-2

-4

2

0

2013 2014

© SKF Group Slide 9 17 April 2015

2015

9

Organic sales growth in local currency

% y-o-y

6

4

2

0

-2

-4

-0.7%

3.9%

© SKF Group Slide 10 17 April 2015

2013 2014

Structure in 2013: 2.5%

Structure in 2014: 3.7%

Structure in 2015: 0%

1.4%

Q1 2015

10

Sales development by geography

Organic growth in local currency Q1 2015 vs Q1 2014

Europe

1.0%

North

America

-2.4%

Latin

America

0.4% Middle East

& Africa

14.2%

© SKF Group Slide 11 17 April 2015

Asia/Pacific

5.6%

11

Components in net sales

Percent y-o-y

2013

Q1 Q2 Q3 Q4

2014

Q1 Q2 Q3

Organic -8.0

-2.2

2.0

6.9

1.5

2.6

1.1

4.8

5.8

4.6

3.2

4.7

3.8

5.4

2.8

0.9

Structure

Sales in local currency

Currency

Net sales

-6.5

0.4

3.1

11.7

10.5

8.4

8.6

3.7

-4.0

-5.0

-2.2

-2.1

-0.1

1.1

5.3

8.9

-10.5

-4.6

0.9

9.6

10.4

9.5

13.9

12.6

Q4

2015

Q1

1.4

0

1.4

14.9

16.3

12

© SKF Group Slide 12 17 April 2015

Operating profit as reported

SEKm

2 500

2 000

1 500

1 000

500

0

-500

-1 000

-1 500

-2 000

2013

© SKF Group Slide 13 17 April 2015

2014 2015

13

Operating profit excluding one-time items

SEKm

2500

2000

1500

1000

500

0

2013

© SKF Group Slide 14 17 April 2015

2014 2015

14

Operating margin

8

6

4

2

0

%

16

14

12

10

© SKF Group Slide 15 17 April 2015

11.9*

5.8

2013 2014

11.7*

11.0

One-time items

* Excluding one-time items

12.2*

8.8

15

Q1 2015

Operating margin per business area as reported

12

9

6

%

18

15

Industrial Market

Specialty Business*

3

0

-3

Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4 Q1

2013 2014 2015

* Q4 2013, impacted by cost related to Kaydon acquisition

© SKF Group Slide 16 17 April 2015

Automotive Market

16

Operating margin per business area excl. one-time items

17

12

9

6

%

18

15

3

0

-3

Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4 Q1

2013 2014 2015

© SKF Group Slide 17 17 April 2015

Industrial Market

Specialty Business

Automotive Market

Operating profit bridge, Q1 2015

SEKm

2500

2000

+2 024 -700

1500

-1 547

1000

500

+120 0

+450 0 -173

+1 721

0

Q1 2014 One-time items at

2014 exchange rates

Organic sales growth in local currencies

Acquisitions/ divestments

Currency impact

* Includes general inflation, manufacturing and purchasing impacts, IT project and running costs, and R&D..

Savings from restructuring programme

Other*

© SKF Group Slide 18 17 April 2015

Q1 2015

18

Restructuring programme

•

Main activities:

- merging the two industrial businesses

- streamlining of supporting country organisations in all main countries

- general staff optimization and productivity improvements

•

Reduction of annual cost by SEK 1.2 billion by the end of 2016.

Total cost for the programme around SEK 1.4 billion, covering 1 500 people.

Major part of the programme expected to be implemented within 2015

•

After first quarter 2015 around 40% of planned activities are in progress

Cost, SEKm

People affected

Cost savings in Q1

Annual cost savings, SEKm:

Q1 2015

535

575

-

460 effective beginning 2016

© SKF Group Slide 19 17 April 2015

19

Net working capital as % of annual sales

Target: 27%

33

32

31

30

%

35

34

29

28

27

26

25

Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4 Q1

2013 2014 2015

© SKF Group Slide 20 17 April 2015

20

Return on capital employed

14.8*

13.9

One-time items

* Excluding one-time items

%

20

15

10

15.1*

14.5*

12.6

5 7.5

0

2013 2014 YTD 2015

ROCE: Operating profit plus interest income, as a percentage of twelve months rolling average of total assets less the average of non-interest bearing liabilities.

© SKF Group Slide 21 17 April 2015

21

Cash flow, after investments before financing*

SEKm

3 000

2 000

1 000

0

-1 000

-2 000

-3 000

-4 000

-5 000

-6 000

-7 000

1)

2013

Excl. acq. and div.:

© SKF Group Slide 22

Excl. EU payment

17 April 2015

2)

3)

1) Q1 2013

2) Q3 2013

3) Q4 2013

4) Q2 2014

2014

SEK -69 million

SEK 871 million

SEK 1 122 million

SEK 1 423 million

4)

2015

* 2013 and 2014 are restated

22

Net debt

SEKm

0

-5 000

-10 000

-15 000

-20 000

-25 000

-30 000

-35 000

AB SKF, dividend paid

(SEKm)

:

2013 Q2

2014 Q2

2 530

2 530

Cash out from major acquisitions (SEKm) :

2013 Q1

2013 Q4

823

7 900

2013 2014 2015

Net debt: Loans and net provisions for post-employment benefits less short-term financial assets excluding derivatives.

© SKF Group Slide 23 17 April 2015

EU payment (SEKm) :

2014 Q2 2 825

23

Debt structure, maturity years

EURm

900

800

700

600

500

400

300

200

100

0

100 100

110

2015 2016 2017

© SKF Group Slide 24

• Available credit facilities:

EUR 500 million 2019

SEK 3 000 million 2018

EUR 150 million 2017

17 April 2015

500 500

850

200

2018 2019 2020 2021

• No financial covenants nor material adverse change clause

24

April 2015: SKF demand outlook Q2 2015

Demand compared to the second quarter 2014

The demand for SKF’s products and services is expected to be relatively unchanged for the Group and for Europe. For Asia it is expected to be higher and for North and Latin America slightly lower. Per business area, for both Industrial Market and Automotive Market it is expected to be relatively unchanged, and for Specialty Business to be slightly higher.

Demand compared to the first quarter 2015

The demand for SKF’s products and services is expected to be relatively unchanged for the Group, Europe and North America. For Asia it is expected to be higher and for Latin America slightly lower. Per business area, for both Industrial Market and Automotive Market it is expected to be relatively unchanged, and for Specialty Business to be slightly higher.

Manufacturing

Manufacturing is expected to be relatively unchanged year over year and compared to the first quarter.

25

© SKF Group Slide 25 17 April 2015

Guidance for 2015*

Q2 2015:

• Financial net: around SEK -230 million

• Currency impact on operating profit vs 2014

Q2: SEK +800 million

2015:

• Tax level: below 30% for 2015

• Additions to PPE: around SEK 1 700 million for 2015

* Guidance is approximate and based on current assumptions and exchange rates.

© SKF Group

Slide 26

17 April 2015

26

Cautionary statement

This presentation contains forward-looking statements that are based on the current expectations of the management of SKF.

Although management believes that the expectations reflected in such forward-looking statements are reasonable, no assurance can be given that such expectations will prove to have been correct. Accordingly, results could differ materially from those implied in the forward-looking statements as a result of, among other factors, changes in economic, market and competitive conditions, changes in the regulatory environment and other government actions, fluctuations in exchange rates and other factors mentioned in SKF's latest annual report (available on www.skf.com) under the

Administration Report; “Important factors influencing the financial results", "Financial risks" and "Sensitivity analysis”.

27

© SKF Group Slide 27 17 April 2015