FINA 351 – Managerial Finance, Chapter 18, (Ref. 18c)

advertisement

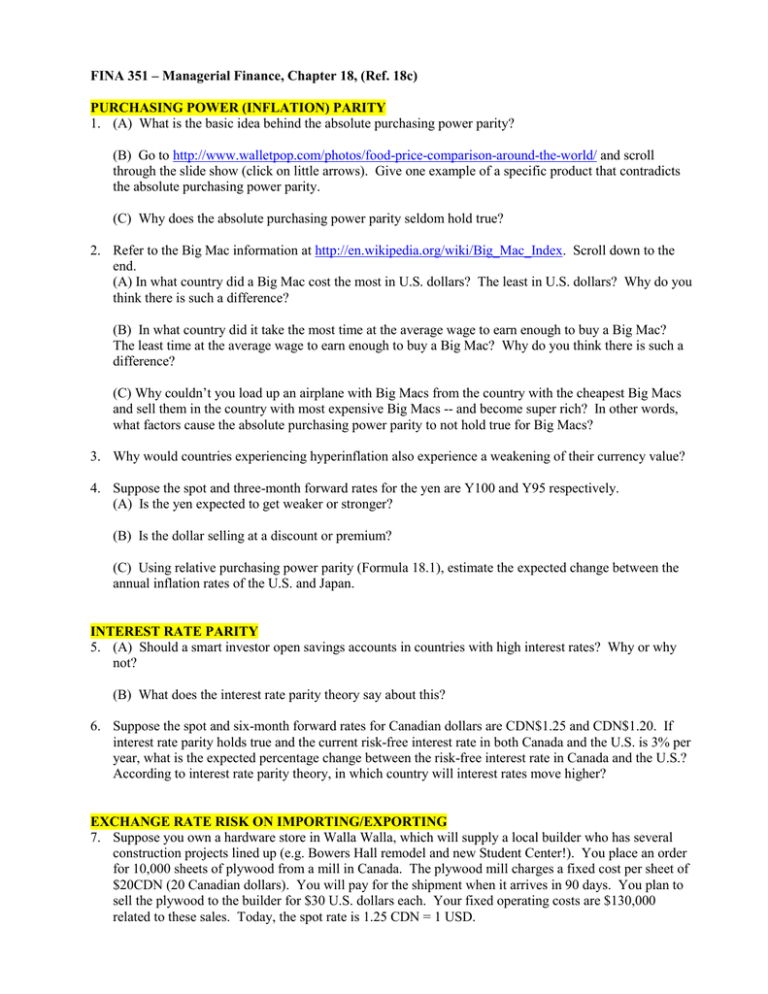

FINA 351 – Managerial Finance, Chapter 18, (Ref. 18c) PURCHASING POWER (INFLATION) PARITY 1. (A) What is the basic idea behind the absolute purchasing power parity? (B) Go to http://www.walletpop.com/photos/food-price-comparison-around-the-world/ and scroll through the slide show (click on little arrows). Give one example of a specific product that contradicts the absolute purchasing power parity. (C) Why does the absolute purchasing power parity seldom hold true? 2. Refer to the Big Mac information at http://en.wikipedia.org/wiki/Big_Mac_Index. Scroll down to the end. (A) In what country did a Big Mac cost the most in U.S. dollars? The least in U.S. dollars? Why do you think there is such a difference? (B) In what country did it take the most time at the average wage to earn enough to buy a Big Mac? The least time at the average wage to earn enough to buy a Big Mac? Why do you think there is such a difference? (C) Why couldn’t you load up an airplane with Big Macs from the country with the cheapest Big Macs and sell them in the country with most expensive Big Macs -- and become super rich? In other words, what factors cause the absolute purchasing power parity to not hold true for Big Macs? 3. Why would countries experiencing hyperinflation also experience a weakening of their currency value? 4. Suppose the spot and three-month forward rates for the yen are Y100 and Y95 respectively. (A) Is the yen expected to get weaker or stronger? (B) Is the dollar selling at a discount or premium? (C) Using relative purchasing power parity (Formula 18.1), estimate the expected change between the annual inflation rates of the U.S. and Japan. INTEREST RATE PARITY 5. (A) Should a smart investor open savings accounts in countries with high interest rates? Why or why not? (B) What does the interest rate parity theory say about this? 6. Suppose the spot and six-month forward rates for Canadian dollars are CDN$1.25 and CDN$1.20. If interest rate parity holds true and the current risk-free interest rate in both Canada and the U.S. is 3% per year, what is the expected percentage change between the risk-free interest rate in Canada and the U.S.? According to interest rate parity theory, in which country will interest rates move higher? EXCHANGE RATE RISK ON IMPORTING/EXPORTING 7. Suppose you own a hardware store in Walla Walla, which will supply a local builder who has several construction projects lined up (e.g. Bowers Hall remodel and new Student Center!). You place an order for 10,000 sheets of plywood from a mill in Canada. The plywood mill charges a fixed cost per sheet of $20CDN (20 Canadian dollars). You will pay for the shipment when it arrives in 90 days. You plan to sell the plywood to the builder for $30 U.S. dollars each. Your fixed operating costs are $130,000 related to these sales. Today, the spot rate is 1.25 CDN = 1 USD. Use the table below to answer the following questions: (A) Calculate your gross profit from the sale of plywood assuming the exchange rate does not change over the next 90 days (stays at $1.25 CDN dollars). (B) Calculate your gross profit if the exchange rate increases by 10% over the next 90 days (i.e. $1.25*1.10 = $1.375). (C) Calculate your gross profit if the exchange rate decreases by 10% over the next 90 days (i.e. $1.25*.90 = $1.125). (D) What could you do to insulate yourself from this exchange rate risk? Description Sales price per unit Cost in CDN Dollars Exchange Rate: (A) Unchanged USD $30.00 $20.00 Divided by exch. rate / 1.25 Exchange Rate: (B) Increases 10% USD $30.00 $20.00 Exchange Rate: (C) Decreases 10% USD $30.00 $20.00 / (1.25*1.1 = ?) / (1.25*0.9 = ?) /? /? Cost in US Dollars $16.00 ? ? Gross profit per unit # of mother boards $14.00 10,000 ? 10,000 ? 10,000 Total Gross Profit $140,000 ? ? Fixed Oper. Costs $130,000 $130,000 $130,000 $10,000 ? ? Net Profit 8. Many U.S.-based multinational corporations operate in dozens of different countries, with foreign business sometimes exceeding domestic business. In this environment, the corporation must be intentional in addressing the risk of doing business overseas. (A) What are ways to hedge exchange rate risk? (B) What is political risk and how can it be hedged? 9. The table at the end of this document shows the composite risk of doing business in 140 various countries, as measured by PRS Group (latest free data. They rank nearly two dozen components related to political stability (conflict, corruption, law/order, etc.), current economic stability (growth, inflation, employment, etc.), and financial stability (debt, trade, exchange rates, etc.). Higher scores mean smaller risk. They also forecast the risks under the best and worst case scenarios. (A) Using the Composite Risk Rating column (as of 1/15), list the country ranked as the most stable in which to do business. Would you agree that this is a safe country in which to do business? Why or why not? (B) Where does the U.S. rank? Why do you think the U.S. does not have a higher ranking? (C) Using the Composite Ratings column (as of 1/15), list the country ranked as the most risky in which to do business. Would you agree that this is a risky country in which to do business? Why or why not? http://epub.prsgroup.com/free-samples/