Name _____________________________________

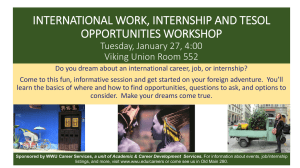

advertisement

Name _____________________________________ ACCT 350 - NFP & Gov't Accounting, Test 2, Final Exam, Chapters 6-7 and related material Note: This exam is a “take-home test.” You may use any non-human resources (text, notes, internet, etc.) but please do not consult with your classmates. Please enter your answers below and return this completed Word file via email no later than 5pm on Wed, June 8. I. MATCHING PROBLEM. Pacific University is a private university where all of its students automatically receive an “A” in each class for which they pay full tuition, a “B” in each class for which they pay three-quarters tuition, and so forth. Students can attend free for an “F” . In any case, PU is using old-style fund accounting internally on its books (Group II) but must prepare external financial statements by classifying its net assets into three classes (Group I). Instructions: Match the appropriate class of net assets or fund from Group I or II with each item listed below. One letter from each group must be used for each situation. All letters don't necessarily have to be used. A letter may be used more than once. Group I A. Unrestricted. B. Temporarily restricted. C. Permanently restricted. Gr. I Group II D. Current unrestricted funds. E. Current restricted funds. F. Loan funds. G. Quasi-endowment. H. Term-endowment. I. True, pure or permanent endowment. J. Annuity funds. K. Life income funds. L. Plant funds (all types) M. Agency funds. Gr. II 1. A gift of $10,000 cash is received from a donor with the understanding that it can only be spent on conferences and seminars to help faculty in the School of Business keep up-to-date. 2. Tuition for winter quarter is received and recorded here. 3. Phil N. Tropy gave $100,000 to the scholarship fund, the principal of which can never be spent. 4. According to Phil N. Tropy, the income earned on his $100,000 gift (#3 above) is restricted for scholarships for accounting juniors. Investment earnings of $8,000 are recorded here. 5. Chari Table gave $10,000 to PU to be used for student loans. When the loans are repaid, the proceeds will revolve back into the fund for future loans to students. The gift is recorded here. 6. Grandma Jones gave $100,000 with the understanding that PU would pay her a fixed amount of $500 a month until she died, at which time PU could keep any remaining balance. The gift is recorded here. 7. Alan Alumnus gave $100,000 to PU to be applied towards the cost of constructing a new School of Business Building. The gift is recorded here. 8. The PU board decided to set aside $50,000 of operating funds. The $50,000 principal will be invested and the income earned will pay for student scholarships. The principal is recorded here. 9. Grandma Jones gave another $100,000 (recorded here) with the stipulation that PU would pay her the income earned from her gift as long as she lives. When she dies, PU can keep the $100,000. 10. PU received a $100,000 “split interest” donation in the form of a charitable gift annuity with the stipulation that upon the death of the donor, the remainder be used to establish a fund of which the earnings only are used for accounting student scholarships. The estimated remainder is put in this fund. 11. The new School of Business building was constructed. The finished building and related debt are recorded here. II. TRUE OR FALSE. Please highlight or bold the appropriate letter T or F. 1. T F Because Blue Mtn. Credit Union is considered to be a tax-exempt NFP organization, you can donate money to the credit union and deduct it as a charitable contribution on your tax return. 2. T F GAAP for all NFPs is the same, regardless of whether they are governmental or non-governmental. 3. T F All NFP organizations must use fund accounting, according to GAAP. 4. T F A NFP organization’s balance sheet can also be called a Statement of Changes in Net Assets. 5. T F In order to show liquidity of assets and maturity of liabilities, NFP organizations must classify assets and liabilities as current and non-current. 6. T F A “restriction” cannot be made internally by a NFP but can only be made by an external third-party donor. 7. T F A NFP museum can choose whether to capitalize and depreciate its collections and works of art. 8. T F Contributions to be collected in future years should be recorded at discounted present values. 9. T F Richard Rich makes a written promise to give his stash of gold to WWU (worth $1 million today) when gold prices reach $2,000 per ounce. WWU should book this promise today by increasing contribution receivable and contribution revenue (net of any uncollectible amounts). 10. T F As part of a pledge drive, Peter Poorly promises over the telephone to give $10 to WWU within a month. Peter follows up by completing an online pledge form. WWU should book this promise today by increasing contribution receivable and contribution revenue (net of any estimated uncollectible amounts). 11. T F All NFPs must show expenses by functional classification as well as by natural classification. 12. T F Whitman College has a smaller endowment per student than WWU. 13. T F A hospital is subject to UBIT from the income earned in its cafeteria and gift store. 14. T F Because of their aggressive collection techniques, most hospitals today are able to collect at least 80% of their gross patient billings. 15. T F A broke, homeless drifter gets hit one night by a train when he is sleep-walking. The amount of hospital charges not covered by Medicaid should be charged to Bad Debt Expense. 16. T F Most hospitals are for-profit, and therefore can pay their executives high compensation packages. 17. T F A patron sends an email to the Metropolitan Opera Society promising to donate $1,000 to be used for general operations. Because this is an email pledge, the MOS will not record any contribution revenue until the pledge is actually received in cash. 18. T F A conditional contribution should be recorded as revenue under the accrual basis of accounting. 19. T F At a university, the allowance for estimated uncollectible amounts (as a percent of receivables) would likely be larger for donor pledges than for other types of receivable. 20. T F A donor who gives appreciated assets (real estate, stocks, etc.) to the Christian Aid Center should first sell the assets and then give the cash, in order to simplify the transactions for the CAC. 21. T F All tax-exempt organizations are required to make their three most recent Forms 990 available for public inspection, including churches and other religious organizations. 22. T F Net operating revenue at a state university should always be a negative figure. 23. T F Because the Boys Club of College Place has annual gross receipts less than $5,000, it will not have to file any type of information return (e.g. Form 990, 990-EZ or 990-N). 24. T F Pastor Alex Bryan can endorse Bernie Sanders for president from the pulpit or in the church newsletter without violating tax-exempt rules because the purpose of a pastor is to disseminate religious information and publicly express religious convictions. 25. T F NFP endowments typically spend all of their total return every year to support operations. 26. T F Suppose the WWU Chapter of Engineers Without Borders (EWB), a NFP organization, held a fundraising gala that raised 80% of its annual contribution revenue. If the 100 attendees paid $100 each to attend, and the dinner cost EWB $25 a head, then EWB should report on its Statement of Activities a single line that says “Net fund-raising income from this special event, $7500.” 27. T F The Joint Commission is the organization that evaluates accreditation for colleges and universities. 28. T F The New Era Philanthropic Foundation is currently one of the most popular places for small nonprofits to safely invest their endowment money at a decent return, which is a real “blessing from God.” 29. T F A $100,000 cash gift to WWU’s endowment should show up in the financing section on WWU’s statement of cash flows. 30. T F HMOs are usually more flexible than PPOs in terms of the type of care provided and who provides it. 31. T F UPMIFA, adopted by Washington in 2009, allows funds to be spent from an underwater endowment. 32. T F When restricted funds are spent, they are shown as expenses in the temporarily restricted column. 33. T F A university’s unrestricted current fund is similar to a city’s special revenue fund. 34. T F Hospitals benefited from the government’s creation of DRGs because this led to the cost-plus reimbursement system we have today. 35. T F John Bennet became a hero when he discovered the Ponzi scheme run by Albert Meyer. 36. T F Walla Walla Community College may elect to follow the FASB standards if they don’t materially conflict 37. T F 38. T F 39. T F 40. T F 41. T F 42. T F 43. T F 44. T F 45. T F 46. 47. T T F F 48. T F 49. T F 50. 51. 52. T T T F F F 53. 54. 55. T T T F F F 56. T F 57. T F 58. T F 59. 60. 61. 62. T T T T F F F F 63. T F 64. T F 65. T F 66. T F with the GASB standards. A school can only be considered “public” if all of the following are true: the school’s officers are publicly elected or appointed by the government, the government can unilaterally dissolve the school, and the school can levy taxes and issue tax-exempt bonds. At the beginning of each quarter, WWU should record student account receivable and tuition revenue for the entire quarter’s tuition. A men’s student residence hall and a university-owned dairy (which primarily serves the public) should both be classified as auxiliary enterprises on a university’s financial statements. The costs of running Positive Life Radio (WWU-owned Christian radio station) should be classified as a Public Service function on WWU’s Statement of Activities because its primary purpose is to serve the public. If WWU’s intercollegiate athletics program were totally self-funded, it should be classified as an auxiliary enterprise on WWU’s financial statements. At a college or university, the salaries of both the VP for Academic Affairs and the VP for Student Life should be classified as Institutional Support. When Washington State University receives an appropriation from the state, it should show it as operating revenue (because it subsidizes tuition, which is considered operating revenue). Because the College Place Pentecostal Church has gross receipts of $2 million per year and total assets of $1 million, it is required to file the full IRS Form 990. If The Express (corner gas/convenience store) were to have taxable income of any amount (e.g. $500), WWU would have to file a Form 990-T tax return and pay UBIT. Over the last few years, WWU has paid a significant amount of UBIT. An unethical controller at WWU who is attempting to minimize UBIT would want to allocate a large amount of overhead (e.g. security personnel costs) to The Express. Unlike most charities and religious organizations, colleges/universities are not considered to be 501(c)(3) organizations. If you donated $1,000 to a 501(c)(21) organization, you would be able to deduct the gift as an itemized deduction on your federal income return. For FYE 2015, the net tuition/fees earned by WWU did not even pay for employee compensation. All expenses in a non-governmental, nonprofit organization should be classified as unrestricted. HIPA (which stands for Health Information Protection Act) was passed by Congress for the sole purpose of ensuring that sensitive patient information (such as the identity of AIDS patients) was kept strictly confidential. Walla Walla General Hospital (WWGH) has a high debt-to-total assets ratio. Hospitals generally rely more heavily on donations to keep afloat than do college and universities. Harvard’s endowment is so big that it if it earned 10%, it would generate more income per student than tuition and fees. NFP organizations should depreciate all exhaustible property and equipment, even if the assets were donated and therefore cost the organization nothing. Under UPMIFA, when endowment assets lose value, temporarily restricted net assets are reduced first, followed by unrestricted net assets. Both private and public universities must show an operating measure (i.e. net increase from operations) in their Statements of Activities. WWU School of Business will definitely have an endowed chair within the next 15 years. WWU’s endowment spending policy is to spend about half of its anticipated endowment earnings. Last year, WWU’s endowment increased by a greater percentage than Harvard University’s endowment. A nonprofit incurs more risk entering a life income agreement with a donor than entering a charitable gift annuity agreement. Per Walla Walla General Hospital’s charity care policy, a four-member family with income of $20,000 would qualify for 100% discount. On 6/28/16, WWU received from a donor a promise to give $1,000 of cash just over one year later on 7/1/17. WWU has a cost of funds of 10% APR. The journal entry to record the pledge should book Donation Revenue-Temporary Restricted of $909. A NFP that generates huge profits (e.g. Stanford Medical Center) should be considered very successful at achieving its mission. WWU’s tuition discount rate has been increasing, although it is far below the national average. III. MATCHING Place the appropriate letter on each line below. The letters represent different functional expense areas reported by a college/university such as WWU. One function can be used twice. Not all functions have to be used. I - Instruction R - Research PS - Public Service SS - Student Services AS - Academic Support IS - Institutional Support OMP - Operation & Maintenance of Plant SF - Scholarships & Fellowships AE - Auxiliary Enterprises IO – Independent Operations _____1. Accountant’s salary _____7. Dave Richardson’s salary (VP for Student Affairs) _____2. ASWWU sponsored concert (student association) _____8. Library operations _____3. Accounting teacher’s huge salary _____9. Janitorial Services _____4. Foreman Hall activities (women’s dormitory) _____5. Career Center _____10. Videos purchased by School of Business for classroom use _____6. University Bookstore _____11. Campus Security IV. MULTIPLE CHOICE. Complete the questions below by highlighting or bolding the correct answer. 1. An actress states at the Oscar awards ceremony that she will donate $1,000,000 to her alma mater if she wins the Oscar. Based on this oral pledge, the alma mater should record a. Contribution Revenue – Unrestricted c. Contribution Revenue - Permanently Restricted b. Contribution Revenue- Temporarily Restricted d. Nothing 2. A donor promises the local Cancer Society that he will give them $10,000 in eleven months. This $10,000 promise is a(n) a. conditional contribution c. temporarily restricted contribution b. unrestricted contribution d. promise to give to disclose in a footnote 3. During the year, a CPA provides 100 hours of free audit service to a local museum that is valued at $150 an hour. The CPA also spends 100 hours on weekends cleaning the museum grounds, valued at $10 per hour. The museum should record contribution revenue of a. $15,000 c. $16,000 b. $1,000 d. none of the above 4. The Statement of Functional Expenses (which divides naturally-classified expenses by function) is required for a. art museums c. voluntary health and welfare organizations b. r religious organizations d. all not-for-profit organizations 5. A hospital activity that is subject to the Unrelated Business Income Tax would be a. sale of pharmaceuticals to patients c. a visitor parking lot that charges fees b. sale of pharmaceuticals to the public d. a cafeteria for patients, visitors, and employees 6. Other operating revenue of a health care organization includes a. sale of pharmaceuticals c. investment income b. gift shop revenue d. all of the above 7. Charity care is a. provided to a patient unwilling to pay b. a the same as bad debt expense c. d. provided to a patient unable to pay all of the above 8. A public university bills $80,000,000 in tuition and fees and provides $23,000,000 in financial aid. Of this $23 million, the university pays $1,000,000 directly in cash to students who can use it for whatever purpose they want. What amount will the university report as net tuition and fee revenue? a. $80,000,000 c. $58,000,000 b. $79,000,000 d. $57,000,000 9. WSU, with fiscal year end June 30, offers summer courses which bridge two fiscal years. The university must a. record all of the revenue in the first fiscal year c. record all of the revenue in the next fiscal year b. allocate the revenue between the two fiscal years d. record half in one fiscal year and half in the on the accrual basis next fiscal year 10. A hospital would show Contractual Adjustments from insurance companies and Medicare Adjustments as a) A non-operating gain b) A liability c) A deduction from revenues (contra-revenue) d) An expense 11. Which of the following hospital volunteers would cause both an income and expense to be recorded? a) Volunteers in the gift shop who work a few hours a day stocking shelves. b) Candy stripers (volunteers who run errands and help visitors find their destinations, etc.) c) Community members who plant flowers on the grounds once a year in the spring. d) A doctor donates time to help with public health screenings for diabetes and heart disease. 12. Investments in equity securities that have a readily determinable market value and all debt securities of a nongovernmental nonprofit organization are reported on the balance sheet at a) Lower of cost or market. b) Fair value. c) Cost. d) Amortized cost 13. Which of the following would not be considered a health care organization? a) A medical clinic. b) An independent living retirement center. c) An assisted living retirement center (nursing home). d) A hospital 14. Which of the following nonprofit organizations is (are) most likely to be tax-exempt under IRC Sec. 501(c)(3)? a) Walla Walla Chamber of Commerce b) Blue Mountain Credit Union c) Walla Walla University Church of SDA d) All of the above. 15. Which of the following is a true statement? a) For FYE 2014, Whitman College’s endowment generated more investment income than WC’s tuition & fee income. b) Although WWU’s recorded endowment is rather small, it essentially has an “off-balance sheet” endowment worth about $50 million, courtesy of SDA church members in the North Pacific. c) If an endowment has a spending policy of 4% and the endowment earns a return of 6%, the extra 2% is added to unrestricted net assets. d) None of the above is a true statement. 16. Colleges and universities record tuition and fee revenue in the a. Restricted current fund c. General fund b. Restricted operating fund d. Unrestricted current fund 17. A contribution is conditional if the donor specifies a. a remote event that might prevent the c. contribution from occurring b. a future or uncertain event that must occur d. before the contribution is made the contribution is paid upon death the contribution is to be paid at a future time 18. A member of the Bird-Watchers Society notifies the organization that he will contribute $2,000 when he sees a live Ivorybilled Woodpecker on his bird-watching expedition. The Bird-Watchers Society will record a. Contribution Revenue – Temp. Restricted c. Contribution Revenue - Unrestricted b. Contribution Revenue – Perm. Restricted d. nothing because it is conditional 19. A donor promises to give $50,000 cash to the WWU Physics Department to be used as scholarships for physics majors. The university will record a. Contribution Revenue - Unrestricted c. Contribution Revenue - Permanently Restricted b. Contribution Revenue – Temp. Restricted d. nothing 20. In its fund-raising drive, the Humane Society received total pledges of $55,000; it also contacted other possible donors who were still considering whether to make pledges of $8,000. What amount of contribution revenue should be recorded? a. $55,000 c. $8,000 b. $63,000 d. Zero 21. A woman cleans out her attic and takes her 33-year old clothes to the local Goodwill store. Goodwill workers sort the clothes and determine they cannot be used or sold. Goodwill should record a. a loss equal to amount of the dumping fee c. Nothing b. a $50 unrestricted contribution d. a $50 unrestricted contribution net of the dumping fee 22. Supporting services to a charity would include a. fund-raising activities b. program activities c. d. management and general activities both a and c 23. The basic required financial statements for the American Red Cross include a. Statement of Cash Flows c. Statement of Budget to Actual b. Statement of Functional Expenses d. Both a and b 24. A university has tuition and fee revenue of $20,000,000 for the summer semester that bridges two fiscal years. Sixty percent of the instruction takes place in the next fiscal year and the university decides to allocate the revenue on that basis. The journal entry to record this transaction in the current fiscal year will include a. $12,000,000 in deferred revenue c. $12,000,000 in revenue b. $20,000,000 in revenue d. $8,000,000 in deferred revenue 25. Some shares of common stock were donated to WWU. The gift should be recorded as contribution revenue at a) the par value of the stock. b) the fair market value at the date of the gift, or the donor's cost basis, whichever is lower. c) the fair market value at the date of the gift, or the donor's cost basis, whichever is higher. d) the fair market value at the date of the gift. e) zero value, since this is a conditional gift. V. SHORT PROBLEM. A comparison of two international relief and development charities (Charity A and Charity B) appears below. (1) For each ratio, indicate which charity has the superior ratio (from a donor’s perspective) by writing either A or B in the boxes on the last row. (a) Fundraising cost (b) Contributions (c) Program output (d) Current asset ratio reliance ratio ratio turnover Charity A 5% 90% 60% 2x Charity B 15% 50% 80% 5x Superior Charity: A or B? VI. SHORT PROBLEM The Wild Animal Care Society (WACS) is a private non-profit that takes cares of sick or injured wild animals and also displays the animals for public viewing and education. The Society receives the following donations during the fiscal year ended Dec. 31, 2014. For each case, determine the amount, if any, of contribution revenue that should be recognized by the Society, and if it is unrestricted (UR), temporarily restricted (TR), or permanently restricted (PR). One transaction may generate more than one class of net assets. If not applicable, put N/A. a. Transaction $20,000 in pledges are received in response to a phonathon conducted by volunteers. b. 3,000 hours of volunteer services are received from retirees who drive tram vehicles or serve as guides, valued at $5 an hour for such services. c. 1,000 hours of volunteer services are received from veterinary clinics valued at $50,000. d. $1,000,000 from a black-tie dinner (called “Zoo Ball”) that cost $100,000. This will raise a major portion of WACS annual revenue. e. A supportive local butcher cancels a $10,000 invoice for meat for the animals. The trade of butchering is considered to be a professional trade. f. A pledge to pay $20,000,000 is received for animal exhibits if the Society can get the city government to donate 5 acres of land on which to construct the exhibits. g. Refer to letter f above. The city government does indeed donate the 5 acres of land valued at $5,000,000 and requires that it be used to construct animal exhibits and cannot ever be sold or transferred without permission of the city. The $20 million pledge is received (letter f). $$ Amount of Contribution Revenue to be Recorded If recorded, is it UR, TR, PR, or N/A? VII. PROBLEM College Place Academy is a private, religious high school that started in July, 2015. It has the following transactions during the fiscal year ended 6/30/16. 1. Founding board members contributed $1 million of cash, $200,000 of which the board set aside for a maintenance “endowment.” The rest of the donation was unrestricted. 2. A CPA firm assisted in getting incorporated and obtaining tax-exempt status from the IRS. The value of the services was $12,000 but the firm only billed $8,000. The bill included a note stating that the $4,000 difference was a “gift” to the school. The $8,000 bill was paid. 3. Paid $600,000 for a building. 4. Received $100,000 cash from Blue Mountain Foundation for a permanent scholarship endowment. 5. Tuition bills of $400,000 were sent out to parents, of which $395,000 was received in cash. 6. Paid $450,000 of faculty/staff wages by using $440,000 cash and $10,000 from a bank credit line (LOC Payable). 7. Paid $20,000 for supplies, all of which were used up before 6/30/16. 8. Interest income of $22,000 was received, $5,000 of which was earned by the scholarship endowment. 9. Granted $4,000 of student scholarships to those students whose parents can’t pay by applying $4,000 to their receivable accounts. 10. A donation of $12,000 was received for faculty professional development, consisting of $3,000 cash ($2,000 of which was spent right away on seminars) and a $9,000 unconditional promise to give before the fiscal year ended. 11. Recorded depreciation on the building of $16,000. Instructions: Complete the following in the space below and on the next page, if needed. If you use Excel, please delete the table below and paste your answers into this Word document. 1. Prepare a Statement of Financial Position for CP Academy in good form according to GAAP, as of 6/30/16. 2. Prepare a Statement of Activities for CP Academy in good form according to GAAP, for year-ended 6/30/16. 3. Briefly evaluate the health of this charity after its first year (including its sustainability). VIII. PROBLEM Go to http://nccsweb.urban.org/PubApps/search.php and search for “Breast Cancer Society” in Mesa, AZ. Download the latest Form 990 available (FYI 12/31/14). This organization has been canvassing for donations in your area. Because of your expertise, you have been asked by the local newspaper to evaluate this charity so that donors can make intelligent choices with their dollars. (A) Your analysis should, at a minimum, involve completion of the ratios in the table below. Also, quality journalists will research their subject from all angles. Search the internet for any recent developments about this charity. Your key search terms should include the name of the charity and the name of the president for the first nine months of the year. (B) Write your newspaper article explaining your conclusions on the basis of your ratios and other analysis from the Form 990 and on the basis of your internet research. Please don’t write more than 3 paragraphs. National Ratio Breast Cancer Society Average Contributions reliance ratio 83% Fundraising cost ratio 7% Program output ratio 84%