SKF Q4 results 2015 Alrik Danielson, President and CEO © SKF Group

advertisement

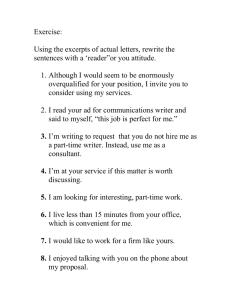

SKF Q4 results 2015 Alrik Danielson, President and CEO © SKF Group Q4 Summary Alrik Danielson, CEO Net sales Q4 summary Net sales and earnings affected by lower demand 18.2 bn 18.5 bn Q4 Q1 Q2 Q3 Q4 15 Operating profit* Sales SEK 18 215 M, -1.5% yoy Organic sales -5.2% Operating profit* SEK 1 726 M (2 078) Operating margin* 9.5% (11.2) Profit before tax SEK 653 M (1 293) 2.1 bn 1.7bn Q4 Q1 Q2 Q3 9.5% Operating margin* * Excluding one-time items © SKF Group © SKF Group Q4 15 Cash flow** Strong cash flow – balance sheet in focus 2.0 bn 2.2 bn Q4 Cash flow after investments before financing SEK 1 966 M (2 126) Successful reduction of inventories and trade receivables Net debt decreased by more than SEK 3 bn Proposed dividend SEK 5.50 per share (5.50) Q1 Q2 Q3 Q4 15 Net debt/equity 140% 120% 100% 100% 80% 60% 40% 20% 0% Q4 Q1 Q2 Q3 Q4 15 27.1% ** After net investments before financing, excluding acquisitions and divestments and EU payment in 2014 © SKF Group © SKF Group Net working capital as % of sales Sales development by geography Organic growth in local currency Q4 2015 vs Q4 2014 Europe +0.3% North America -12.7% Asia/Pacific -8.7% Latin America -0.5% © SKF Group © SKF Group Middle East & Africa +10.8% Sales development by Customer Industry © SKF Group Highlights - examples of new business in Q4 2015 China Oilfield Services Limited, China Propulsion shaft components and application engineering services The Åsgard gas field, Norway Magnetic bearings for the world’s first sub-sea compression system U.S. Steel, USA Integrated seals, lubrication and bearings solution © SKF Group Highlights As an example of activities to enhance our cost competitiveness, SKF’s vehicle service market distribution and packaging business in the US will be consolidated. As a consequence, the business in Hebron, Kentucky will be transferred to the distribution and packaging facility in Crossville, Tennessee. SKF’s issued a new EUR 500 million bond. The 7-year bond carries a fixed coupon interest rate of 1.625%, a record low rate for SKF. New products: - The new SKF Agri Hub unit enables deeper, heavier and faster operations in challenging soil conditions. - SKF introduced a new series of food industry compliant bearings. © SKF Group Q4 results – the details Christian Johansson, CFO Sales development 2015 Net sales, SEK bn 18.2 18.5 Q4 © SKF Group © SKF Group Q1 Q2 Q3 Q4 15 Percent y-o-y Q1 Q2 Q3 Q4 Organic 1.4 -1.5 -4.7 -5.2 Structure 0 -0.2 -0.8 -1.0 Currency 14.9 12.9 8.8 4.7 Net sales 16.3 11.2 3.3 -1.5 Organic sales growth 8 % change y-o-y 6 4 2 0 -2 -4 -6 -8 -10 2013 © SKF Group © SKF Group 2014 2015 3 12 2.5 10 2.1 1.8 2 8 1.7 1.5 6 1 4 0.5 2 0 0 2013 © SKF Group © SKF Group 2014 2015 Thousands Thousands Operating profit excluding one-time items Operating profit 1,800 1,600 1 608 +200 1,400 -220 +230 1,200 -35 1 039 1,000 -334 -410 800 600 400 200 0 Q4 2014 © SKF Group © SKF Group One-time items at 2014 exchange rates Organic sales Currency impact Savings from cost-reduction programme Divested/ aquired companies * Includes, manufacturing development costs for the UNITE IT project and general inflation. Other* Q4 2015 Industrial Market, Operating margin* 14.7% Operating performance per business area Net sales SEK 10 803 M Organic sales -8.6% Operating margin declined to 11.3% 11.3% Specialty Business, Operating margin* 14.1% 13.6% Net sales SEK 2 512 M Organic sales -1.6% Operating margin declined to 13.6% Net sales SEK 4 804 M Organic sales +1.2% Operating margin improved to 3.3% Automotive Market, Operating margin* 3.3% 1.5% * Excluding one-time items © SKF Group © SKF Group Cost reduction programme from December 2014 Cost reduction programme Q1 2015 Q2 2015 Q3 2015 Q4 2015 2015 Target Restructuring cost in the quarter 537 224 121 317 1 199 1 400 Full year savings from people that will leave SKF 460 173 307 247 1 187 1 200 Number of people that will leave 575 270 594 650 2 089 1 500 - 80 150 200 430 - Savings included in the 2015 Operating profit © SKF Group © SKF Group SKF Group – Q4 2015 Financial performance (SEKm) Net sales Cost of goods sold Gross profit Gross margin, % Selling and administrative expenses Other operating expenses Operating profit One-time items Operating profit excl. one-time items Operating margin, % Operating margin excl. one-time items, % Financial income and expense, net Profit before taxes Taxes Net profit Basic earnings per share, SEK © SKF Group © SKF Group 2015 2014 18 215 18 499 -14 214 4 001 -14 187 4 312 22.0 -2 874 23.3 -2 655 -88 1 039 -49 1 608 -687 -470 1 726 5.7 2 078 8.7 9.5 -386 653 -225 428 0.82 11.2 -315 1 293 -412 881 1.84 Strong cash flow after investments before financing Full year improved to SEK 5.7 bn* SEKm 3,000 12,000 10,000 2,000 8,000 6,000 1,000 4,000 2,000 0 0 -2,000 -1,000 -4,000 2013 2014 2015 * After investments before financing (excluding acquisitions and divestments and EU payment in Q2 2014.) 2013 and 2014 are restated © SKF Group © SKF Group Net working capital as % of annual sales 35 30 Total NWC 27.1% Target: 27% 25 20 Inventories 19.1% 15 Trade receivables 15.5% 10 Trade payables 7.4% 5 0 Q1 Q2 Q3 2013 © SKF Group © SKF Group Q4 Q1 Q2 Q3 2014 Q4 Q1 Q2 Q3 2015 Q4 Net debt decreased SEK 4.6 bn in 2015 Net debt Net debt/equity SEK bn % 0 160% -5 140% 120% -10 100% 100% -15 80% -20 60% -25 40% -30 20% -35 0% 2013 2014 2015 2013 Net debt: Loans and net provisions for post-employment benefits less short-term financial assets excluding derivatives. © SKF Group © SKF Group 2014 2015 Improved debt structure with extended maturity EURm 900 800 700 600 500 400 300 200 100 0 2016 © SKF Group © SKF Group 2017 2018 Available credit facilities: - EUR 500 million 2019 - SEK 3 000 million 2018 - EUR 150 million 2017 2019 2020 2021 No financial covenants nor material adverse change clause 2022 SKF issued EUR 500 million bond SKF issued a new EUR 500 million bond. The senior, unsecured bond matures on 2 December 2022 and carries a fixed coupon interest rate of 1.625%, an historically low rate for SKF. The proceeds of the issue were used for the refinancing of existing debt through the buy-back of parts of two outstanding bonds, maturing in 2018 and 2019, with coupon rates of 3.875% and 1.875%, respectively. The buy-backs had a one-time negative impact of SEK 276 million on the Group’s financial net for Q4 2015. The new bond has been listed on the Official List of the Luxembourg Stock Exchange and admitted to trading on the Luxembourg Stock Exchange's regulated market. 1.625% 7 year Record low coupon rate © SKF Group Maturity EUR 500 M Guidance for 2016* Q1 2016: Financial net: around -250 million Limited currency impact on operating profit vs 2015 Q1 based on exchange rates per December 31. 2016: Tax level: below 30% for 2016 Additions to PPE: around 2 000 million for 2016 * Guidance is approximate and based on current assumptions and exchange rates. © SKF Group © SKF Group SKF demand outlook - Definition The demand outlook for SKFs products and services represents management's best estimate based on current information about the future demand from our customers. The demand outlook is the expected volume development in the markets where our customers operate. © SKF Group © SKF Group February 2015: SKF demand outlook Q1 2016 Demand compared to the first quarter 2015 The demand for SKF’s products and services is expected to be slightly lower for the Group. Demand for the Automotive Market and Specialty Business is expected to be relatively unchanged, while demand for the Industrial Market is expected to be lower. Demand is expected to be relatively unchanged in Europe, slightly lower in Asia and Latin America and significantly lower in North America. Demand compared to the fourth quarter 2015 The demand for SKF’s products and services is expected to be relatively unchanged for the Group. Demand for the Automotive Market is expected to be higher, demand for Specialty Business to be slightly higher and demand for Industrial Market is expected to be relatively unchanged. Demand is expected to be higher in Europe, slightly lower in North America and lower in Latin America and Asia. © SKF Group © SKF Group Financial calendar Annual Report 2015 March 8 Annual General Meeting March 31 Report on the first quarter 2016 April 28 © SKF Group © SKF Group New financial targets New financial targets Valid from 2016 Changed targets for: Sales growth Operating margin Return on capital employed, ROCE Net working capital 5% Annual organic sales growth in local currencies 12% reported Operating margin 16% 25% 80% Return on capital employed Net working capital as % of sales Net debt as % of equity © SKF Group SKF Q4 results 2015 Q&A Cautionary statement This presentation contains forward-looking statements that are based on the current expectations of the management of SKF. Although management believes that the expectations reflected in such forward-looking statements are reasonable, no assurance can be given that such expectations will prove to have been correct. Accordingly, results could differ materially from those implied in the forward-looking statements as a result of, among other factors, changes in economic, market and competitive conditions, changes in the regulatory environment and other government actions, fluctuations in exchange rates and other factors mentioned in SKF's latest annual report (available on www.skf.com) under the Administration Report; “Important factors influencing the financial results", "Financial risks" and "Sensitivity analysis”. © SKF Group © SKF Group