Econ 522 Economics of Law Dan Quint Fall 2012

advertisement

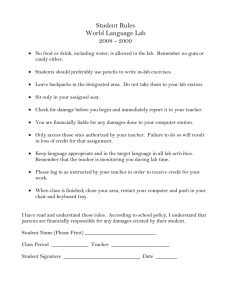

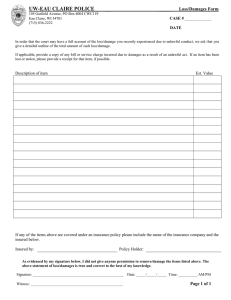

Econ 522 Economics of Law Dan Quint Fall 2012 Lecture 14 Reminders HW3 (contract law) due next Thursday Guest lecturer on Monday 1 Monday – more reasons a contract might not be enforced Duress and Necessity why is it efficient not to enforce? Impossibility How do we figure out who is efficient bearer of a particular risk? Bad information fraud, failure to disclose, frustration of purpose, mutual mistake why are contracts based on unilateral mistake enforced, when contracts based on mutual mistake are not? 2 Other reasons a contract may not be enforced 3 Vague contract terms Courts will generally not enforce contract terms that are overly vague Can be thought of as a penalty default “Punish” the parties by refusing to enforce contract… …so people will be more clear when they write contracts But some exceptions Parties may commit to renegotiating the contract “in good faith” under certain contingencies 4 Adhesion (I): “Shrink-wrap” licenses Back when software came on disks or CDs… Box was wrapped in cellophane Inside, “By unwrapping this box, you agree to the following terms…” “Due to the unscheduled trip to the autowrecking yard the school bus will be out of commission for two weeks. Note by reading this letter out loud you have waived any responsibility on our part in perpetuity throughout the known universe.” Contract is not binding if one party had no opportunity to review it before agreeing 5 Adhesion (II): What if a party chose not to review the contract? Source: http://www.foxnews.com/scitech/2010/04/15/online-shoppers-unknowingly-sold-souls/ 6 Adhesion (II): What if a party chose not to review the contract? British computer game retailer GameStation, on April Fool’s Day, added this to Terms & Conditions customers agreed to before buying online: “By placing an order via this website… you agree to grant us a non-transferable option to claim, for now and for ever more, your immortal soul. Should we wish to exercise this option, you agree to surrender your immortal soul, and any claim you may have on it, within 5 (five) working days of receiving written notification from gamestation.co.uk or one of its duly authorised minions. …If you a) do not believe you have an immortal soul, b) have already given it to another party, or c) do not wish to grant us such a license, please click the link below to nullify this sub-clause and proceed with your transaction.” 7 Adhesion (general) Contract of Adhesion: standardized “take-it-or-leave-it” contract where terms are not negotiable “Bogus duress” Not illegal per se, but might attract “closer scrutiny” A few state courts have adopted a rule: if I have “reason to believe that the other party would not agree if he knew the contract contained a particular term, the term is not part of the agreement” 8 What if you signed a contract that was dramatically unfair? Under bargain theory, courts should ask only whether a bargain occurred, not whether it was fair Hamer v Sidway (drinking and smoking) But both common and civil law have doctrines for not enforcing overly one-sided contracts Unconscionability/Lesion “Absence of meaningful choice on the part of one party due to one-sided contract provisions, together with terms which are so oppressive that no reasonable person would make them and no fair and honest person would accept them” When “the sum total of its provisions drives too hard a bargain for a court of conscience to assist” Terms which would “shock the conscience of the court” 9 Unconscionability: Williams v WalkerThomas Furniture (CA Dist Ct, 1965) “Unconscionability has generally been recognized to include an absence of meaningful choice on the part of one of the parties together with contract terms which are unreasonably favorable to the other party. …In many cases the meaningfulness of the choice is negated by a gross inequality of bargaining power.” 10 Unconscionability: Williams v WalkerThomas Furniture (CA Dist Ct, 1965) “Unconscionability has generally been recognized to include an absence of meaningful choice on the part of one of the parties together with contract terms which are unreasonably favorable to the other party. …In many cases the meaningfulness of the choice is negated by a gross inequality of bargaining power.” 11 Unconscionability: Williams v WalkerThomas Furniture (CA Dist Ct, 1965) “Unconscionability has generally been recognized to include an absence of meaningful choice on the part of one of the parties together with contract terms which are unreasonably favorable to the other party. …In many cases the meaningfulness of the choice is negated by a gross inequality of bargaining power.” Not normal monopoly cases but “situational monopolies” Think of Ploof v Putnam (sailboat in a storm), not Microsoft 12 Remedies for breach of contract 13 Three broad types of remedy for breach of contract Party-designed remedies Remedies specified in the contract Court-imposed damages Court may decide promisee entitled to some level of damages Specific performance Forces breaching party to live up to contract 14 Expectation damages Compensate promisee for the amount he expected to benefit from performance You agreed to buy an airplane for $350,000 You expected $500,000 of benefit from it Expectation damages: if I breach, I owe you that benefit ($500,000 if you already paid, $150,000 if you didn’t) “Positive damages” Make promisee indifferent between performance and breach 15 Reliance damages Reimburse promisee for cost of any reliance investments made, but not for additional surplus he expected to gain Restore promisee to level of well-being before he signed the contract You contracted to buy the plane and built a hangar If I breach, I owe you what you spent on the hangar, nothing else “Negative damages” – undo the negative (harm) that occurred 16 Opportunity cost damages Give promisee benefit he would have gotten from his next-best option Make promisee indifferent between breach of the contract that was signed, and performance of best alternative contract You value plane at $500,000 You contract to buy plane from me for $350,000 Someone else was selling similar plane for $400,000 By the time I breach, that plane is no longer available I owe you $100,000 – the benefit you would have gotten from buying the other seller’s plane 17 Example: expectation, reliance, and opportunity cost damages You agree to sell me ticket to Wisconsin-Ohio State football game for $50 Expectation damages: you owe me value of game minus $50 If I pay scalper $150, then expectation damages = $100 Reliance damages: maybe 0, or cost of whatever pre-game investments I made 18 Example: expectation, reliance, and opportunity cost damages You agree to sell me ticket to Wisconsin-Ohio State football game for $50 Expectation damages: you owe me value of game minus $50 If I pay scalper $150, then expectation damages = $100 Reliance damages: maybe 0, or cost of whatever pre-game investments I made When you agreed to sell me ticket, other tickets available for $70 Opportunity cost damages: $80 (I paid a scalper $150 to get in; I would have been $80 better off if I’d ignored your offer and paid someone else $70) 19 Ranking damages Contract I Sign Best Alternative Do Nothing = = = Breach + Expectation Damages Breach + Opportunity Cost Damages Breach + Reliance Damages Opportunity Cost Damages Reliance Damages Expectation Damages $100 $80 $15 20 Hawkins v McGee (“hairy hand case”) Hawkins had a scar on his hand McGee promised surgery to “make the hand a hundred percent perfect” Surgery was a disaster, left scar bigger and covered with hair 21 Hawkins v McGee (“hairy hand case”) + Opp Cost Damages + Reliance Damages Initial Wealth Opp Cost Damages Reliance Damages + Expectation Damages Expectation Damages $ Hand Hairy Scarred Next best doctor 100% Perfect 22 Other court-ordered remedies Restitution Return money that was already received Disgorgement Give up wrongfully-gained profits 23 Other court-ordered remedies Restitution Return money that was already received Disgorgement Give up wrongfully-gained profits Specific Performance Promisor is forced to honor promise Civil law: often ordered instead of money damages Common law: money damages more common; S.P. sometimes used when seller breaches contract to sell a unique good Like injunctive relief 24 Expectation damages vs. specific performance Peevyhouse v Garland Coal and Mining Co (OK Supreme Court, 1962) Garland contracted to strip-mine coal on Peevyhouse’s farm Contract specified Garland would restore property to original condition; Garland did not Restoration would cost $29,000 But “diminution in value” of farm was only $300 Original jury awarded $5,000 in damages, both parties appealed OK Supreme Court reduced damages to $300 25 Expectation damages vs. specific performance At first, sounds like a perfect example of efficient breach Performing last part of contract would cost $29,000 Benefit to Peevyhouses would be $300 Efficient to breach and pay expectation damages, which is what happened But… Most coal mining contracts: standard per-acre diminution payment Peevyhouses refused to sign contract unless it specifically promised the restorative work Dissent: Peevyhouses entitled to specific performance (Peevyhouses seemed to value condition of property much more highly than change in market value) 26 Think about Peevyhouse in terms of penalty defaults Contract promised restoration work, didn’t specify remedy if it wasn’t performed Which default rule works better: Default rule allowing Garland to breach and pay diminution fee? Default rule forcing Garland to perform restoration work? Ayres and Gertner: default rule should penalize the betterinformed party Garland routinely signed contracts like these Peevyhouses were doing this for the first time Default rule allows Garland to pay diminution fee: they have no reason to bring it up, Peevyhouses don’t know Default rule forces Garland to do cleanup: if that’s inefficient, they could bring it up during negotiations 27 In this case, specific performance would serve as a penalty default Party-designed remedies Remedy for breach could be written directly into contract But common law courts don’t always enforce remedy terms Liquidated damages – party-specified damages that reasonably approximate actual harm done by breach Penalty damages – damages greater than actual harm done Civil law courts are generally willing to enforce penalty damages But common law courts often do not 28 Penalty Damages Coal worth $70,000 Garland to pay $25,000 Restoration would cost $30,000 Liquidated damages are $300 Peevyhouses value restoration at $40,000 Peevyhouse v Garland Coal Peevyhouses only wanted farm strip-mined if it would be restored to original condition after Suppose coal extracted worth $70,000 Garland paid $25,000 for rights to mine it Restoration work would cost $30,000 Diminution of value was $300 So liquidated damages would be $300 Suppose Peevyhouses got $40,000 of disutility from land being left in poor condition 29 Liquidated damages Coal worth $70,000 Garland to pay $25,000 Restoration would cost $30,000 Liquidated damages are $300 Peevyhouses value restoration at $40,000 Peevyhouses Don’t Sign Garland Coal (0, 0) Restore property (25,000, 15,000) Don’t, pay damages (-14,700, 44,700) If damages limited to liquidated damages… Peevyhouses shouldn’t believe restorative work will get done So Peevyhouses better off refusing to sign Even though mining and restoring Pareto-dominates 30 Penalty damages Coal worth $70,000 Garland to pay $25,000 Restoration would cost $30,000 Liquidated damages are $300 Peevyhouses value restoration at $40,000 Peevyhouses Don’t Sign Garland Coal (0, 0) Restore property (25,000, 15,000) Don’t, pay penalty (25,000, 5,000) If penalty clauses in contracts were enforceable… Write contract with $40,000 penalty for leaving land unrestored Now restoration work would get done, so Peevyhouses willing to sign But if courts won’t enforce penalty damages, this won’t work 31 Penalty clauses Whatever you can accomplish with penalty clause, you could also accomplish with performance bonus I agree to pay $200,000 to get house built, but I want you to pay a $50,000 penalty if it’s late Alternatively: I agree to pay $150,000 for house, plus a $50,000 performance bonus if it’s completed on time Either way, you get $150,000 if house is late, $200,000 if on time Courts generally enforce bonus clauses, so no problem! 32 Penalty clauses Whatever you can accomplish with penalty clause, you could also accomplish with performance bonus I agree to pay $200,000 to get house built, but I want you to pay a $50,000 penalty if it’s late Alternatively: I agree to pay $150,000 for house, plus a $50,000 performance bonus if it’s completed on time Either way, you get $150,000 if house is late, $200,000 if on time Courts generally enforce bonus clauses, so no problem! Similarly, Peevyhouse example Peevyhouses get $25,000 for mining rights, $40,000 penalty if land is not restored Equivalently, get $65,000 for mining rights, pay $40,000 bonus if restoration is completed But, if intent of contract is too transparent, still might not be enforced 33 Effects of different remedies on… decision to perform or breach decision to sign or not sign investment in performing investment in reliance 34 Plane worth $500,000 to you Price $350,000 Cost: either $250,000 or $1,000,000 Remedies and breach Expectation Damages Specific Performance Costs Low – Perform Costs High – Perform Costs High – Breach I get 100,000 -650,000 -150,000 You get 150,000 150,000 150,000 Total 250,000 -500,000 0 Costs Low – Perform Costs High – Perform Costs High – Renegotiate I get 100,000 -650,000 -400,000 –650,000 + ½ (500,000) You get 150,000 150,000 400,000 150,000 + ½ (500,000) Total 250,000 -500,000 0 Transaction costs low either leads to efficient breach, but seller prefers “weaker” remedy Transaction costs high S.P. leads to ineff. performance 35 Remedies and breach Opportunity cost damages, or reliance damages Inefficient breach when transaction costs are high Renegotiate contract to get efficient performance when transaction costs are low Like nuisance law: any remedy leads to efficient breach with low TC But only expectation damages do when TC are high Unfortunate contingency and fortunate contingency 36 Efficient signing Specific Performance If costs stay low, I get $350,000 - $250,000 = $100,000 profit If costs rise, I take $400,000 loss Am I willing to sign this contract? Even expectation damages face this problem Expectation damages: costs stay low, same $100,000 profit Costs rise, $150,000 loss If probability of high costs is ½, I won’t sign contract Expectation damages lead to efficient breach, but may not lead to efficient signing 37 Reliance – did example a few days ago If reliance investments increase the damages you receive, we expect to get overreliance To get efficient reliance, need to exclude gains from reliance in calculation of expectation damages But then promisor’s liability < promisee’s benefit, leading to inefficient breach With low transaction costs, fix this through renegotiation But what about unobservable actions the promisor needs to take, to make breach less likely? Investment in performance Skip 38 Investment in performance Some investment I can make to reduce likelihood that breach becomes necessary Suppose probability of breach is initially ½… but for every $27,726 I invest, I cut the probability in half Invest nothing probability of breach is 1/2 Invest $27,726 probability is 1/4 Invest $55,452 probability is 1/8 Any investment z probability is .5 * (.5) z / 27,726 Wrote it this way so p = .5 e – z / 40,000 39 Investment in performance (continuing with airplane example) Suppose you’ve built a $90,000 hangar Increases value of performance by $180,000… …so value of performance is $150,000 + $180,000 = $330,000 Probability of breach = .5 e – z/40,000 Let D = damages I owe if I breach Same questions as before: What is efficient level of investment in performance? How much will I choose to invest in performance? 40 Investment in performance (continuing with airplane example) Suppose you’ve built a $90,000 hangar Increases value of performance by $180,000… …so value of performance is $150,000 + $180,000 = $330,000 Probability of breach = .5 e – z/40,000 Let D = damages I owe if I breach Same questions as before: What is efficient level of investment in performance? Enough to reduce probability of breach to 40,000/430,000 How much will I choose to invest in performance? Enough to reduce probability of breach to 40,000/(100,000 + D) 41 What do these results mean? What is the efficient level of investment in performance? Enough so that p(z) = 40,000/430,000 What will promisor do under various rules for damages? Enough so that p(z) = 40,000/(100,000 + D) So if D = 330,000, efficient investment in performance D = 330,000 is promisee’s benefit, including reliance So expectation damages, with benefit of reliance, leads to efficient investment in performance If D < 330,000, too little investment in performance If D > 330,000, too much Makes sense – think about externalities 42 Effects of different remedies on… decision to perform or breach decision to sign or not sign investment in performing investment in reliance 43 Paradox of compensation Expectation damages include benefit from reliance investments Expectation damages exclude benefit from reliance investments • Efficient breach • Inefficient breach • Efficient investment in performance • Underinvestment in performance • Over-reliance • Efficient reliance Is there a way to get efficient behavior by both parties? Skip 44 We already saw one possible solution Have expectation damages include benefit from reliance… …but only up to the efficient level of reliance, not beyond That is, have damages reward efficient reliance investments, but not overreliance Promisee has no incentive to over-rely efficient reliance Promisor still bears full cost of breach efficient performance Problem: this requires court to calculate efficient level of reliance after the fact 45 Another clever (but unrealistic) solution The problem: Damages promisor pays should include gain from reliance if we want to get efficient performance Damages promisee receives should exclude gain from reliance if we want to get efficient reliance Solution: make damages promisor pays different from damages promisee receives! How do we do this? Need a third party 46 “Anti-insurance” You (promisee) and I (promisor) offer Bob this deal: If you rely and I breach, I pay Bob value of promise with reliance (airplane plus hangar) Bob pays you value of promise without reliance (airplane alone) Bob keeps the difference You receive damages without benefit from reliance; I pay damages with benefit from reliance 47 “Anti-insurance” You (promisee) and I (promisor) offer Bob this deal: If you rely and I breach, I pay Bob value of promise with reliance (airplane plus hangar) Bob pays you value of promise without reliance (airplane alone) Bob keeps the difference You receive damages without benefit from reliance; I pay damages with benefit from reliance Offer the deal to two people, make them pay up front for it 48 Reminder: what do courts actually do? Foreseeable reliance Include benefits reliance that promisor could have reasonably anticipated 49 Repeated interactions 50 Repeated games 51 Repeated games Player 1 (you) Don’t Trust me Player 2 (me) (100, 0) Share profits (150, 50) Keep all the money (0, 200) Suppose we’ll play the game over and over After each game, 10% chance relationship ends, 90% chance we play at least once more… 52 Repeated games Suppose you’ve chosen to trust me Keep all the money: I get $200 today, nothing ever again Share profits: I get $50 today, $50 tomorrow, $50 day after… Value of relationship = 50 = 500 50 50 .9 50 .9 50 .9 ... = 1 .9 2 3 Since this is more than $200, we can get cooperation 53 Repeated games Suppose you’ve chosen to trust me Keep all the money: I get $200 today, nothing ever again Share profits: I get $50 today, $50 tomorrow, $50 day after… Value of relationship = 50 = 500 50 50 .9 50 .9 50 .9 ... = 1 .9 2 3 Since this is more than $200, we can get cooperation 54 Repeated games and reputation Diamond dealers in New York (Friedman) “…people routinely exchange large sums of money for envelopes containing lots of little stones without first inspecting, weighing, and testing each one” “Parties to a contract agree in advance to arbitration; if… one of them refuses to accept the arbitrator’s verdict, he is no longer a diamond merchant – because everyone in the industry now knows he cannot be trusted.” 55 Repeated games and reputation The first purpose of contract law is to enable cooperation, by converting games with noncooperative solutions into games with cooperative solutions The sixth purpose of contract law is to foster enduring relationships, which solve the problem of cooperation with less reliance on courts to enforce contracts Law assigns legal duties to certain long-term relationships Bank has fiduciary duty to depositors McDonalds franchisee has certain duties to franchisor 56 Repeated games and the endgame problem Suppose we’ll play agency game 60 times $50 x 60 = $3,000 > $200, so cooperation seems like no problem But… In game #60, reputation has no value to me Last time we’re going to interact So I have no reason not to keep all the money So you have no reason to trust me But if we weren’t going to cooperate in game #60, then in game #59… 57 Repeated games and the endgame problem Endgame problem: once there’s a definite end to our relationship, no reason to trust each other Example: collapse of communism in late 1980s Communism believed to be much less efficient than capitalism But fall of communism led to decrease in growth Under communism, lots of production relied on gray market Transactions weren’t protected by law, so they relied on long-term relationships Fall of communism upset these relationships 58 One other bit I like from Friedman 59 Friedman on premarital sex 60 Friedman on premarital sex 61 That’s it for contract law Purposes for contract law: Encourage cooperation Encourage efficient disclosure of information Secure optimal commitment to performance Secure efficient reliance Provide efficient default rules and regulations Foster enduring relationships End of material on second midterm Next week, we begin tort law 62