Review notes 2 Econ 101 (Prof. Kelly) Fall 2002

advertisement

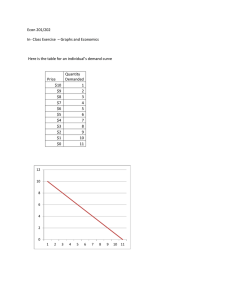

Review notes 2 Econ 101 (Prof. Kelly) Fall 2002 I. Elasticity Refer to Review notes 1. II. Real and nominal prices Real price (or wage) = [Nominal price (or wage) / consumer price index (CPI)] · 100. III. Consumer theory 2 good model (goods X and Y) Consumer’s goal is to maximize utility under budget constraint. A. Budget Budget constraint – The different combinations of goods a consumer can afford with a limited budget, at given prices. Budget line – The northeast boundary of a budget constraint: PX·X + PY·Y = I. The slope of the budget line indicates the spending trade-off between one good and another—the amount of one good that must be sacrificed in order to buy more of another good. The slope of the budget line is −PX /PY (negative of the relative price). Changes in income shift the budget line, keeping the slope fixed. Changes in a price of a good rotate the budget line, keeping the intercept on the axis of the other good fixed. B. Utility Rational preferences – satisfy (1) any two alternatives can be compared, and one is preferred or else the two are valued equally, and (2) the comparisons are logically consistent. For example, (1) any two bundles (X1, Y1) and (X2, Y2) can be compared, and (X1, Y1) is preferred to (X2, Y2), (X2, Y2) is preferred to (X1, Y1), or (X1, Y1) is indifferent from (X2, Y2), and (2) for any three bundles (X1, Y1), (X2, Y2), and (X3, Y3), if (X1, Y1) is preferred to (or indifferent from) (X2, Y2) and (X2, Y2) is preferred to (or indifferent from) (X3, Y3), then (X1, Y1) is preferred to (or indifferent from) (X3, Y3). Utility – pleasure or satisfaction obtained from consuming goods and services (a representation of rational preferences). 1 Indifference curve – represents all combinations of two categories of goods that make the consumer equally well off (a graphical representation of utility). Assumptions on indifference curves (ICs): (1) ICs are downward sloping (more is better). (2) ICs are curved toward the origin (variety is important). (3) there is an IC through every point and each IC represents a different but constant level of satisfaction (from condition (1) of rational preferences). (4) ICs never intersect (from condition (2) of rational preferences). Marginal rate of substitution of good Y for good X (MRSXY) – the slope of the indifference curve (a negative number). The MRSXY tells us the decrease in the quantity of good Y needed to accompany a one-unit increase in good X, in order to keep the consumer indifferent to the change. C. Consumer Decision Making The optimal combination of goods for a consumer is that combination on the budget line at which the indifference curve has the same slope as the budget line. That is, the optimality conditions are | MRSXY | = PX /PY and the bundle is on the budget line. Marginal Utility – the change in total utility an individual obtains from consuming an additional unit of a good or service. Let MUX be marginal utility of good X and MUY be marginal utility of good Y. It can be shown that | MRSXY | = MUX / MUY at any bundles (X, Y). This implies that one of the optimality conditions can be written as MUX / PX = MUY / PY. Law of diminishing marginal utility – As consumption of a good or service increases, holding everything else constant, marginal utility decreases (a plausible assumption on marginal utility). D. Changes in (PX, PY, I) In this subsection, suppose that optimal bundle is always chosen for each (PX, PY, I). i). Fix PY and I (or PX and I ). Price-consumption path is derived by connecting optimal bundles for each PX (or PY). If we focus on the relationship between PX (or PY) and demand for X (or Y), we can draw the demand curve for good X (or Y). Substitution effect – a change in the quantity of a good demanded, which results from a change in its relative price, eliminating the effect on real income of the change in price. Income effect – the effect on quantity demanded of a change in real income. A change in demand due to a change in PX (or PY) can be decomposed into substitution and income effects. Suppose we are given two budget lines BL1 (original) and BL2 (new) 2 which is tangent to indifference curves IC1 and IC2 at points A and B respectively. To do this, draw an imaginary budget line BL3 which is tangent to IC1 at point C and parallel to BL2. The move from A to C represents the substitution effect and the move from C to B represents the income effect. Demand curves are downward sloping because as a price of a good increases, the substitution effect for the good decreases the quantity demanded for the good and the income effect for the good decreases the quantity demanded for the good (if it is a normal good) or even if the income effect for the good increases the quantity demanded for the good (if it is an inferior good) this will offset by the substitution effect in almost all cases. ii). Fix PX and PY. Income-consumption path is derived by connecting optimal bundles for each income level. If both goods are normal, income-consumption path is upward sloping. If one of the goods is inferior, income-consumption path is downward sloping. (It is impossible for both goods to be inferior under our assumptions.) IV. Production and Cost Goal of a firm is to maximize profit. The firm needs to minimize cost in order to maximize profit. Firm A business firm is an organization, owned and operated by private individuals, that specializes in production. Production is the process of combining inputs to make outputs. The firm’s profit is defined by revenue minus costs. There are three types of business firms; sole proprietorship (a firm owned by a single individual), partnership (a firm owned and usually operated by several individuals who share in the profits and bear personal responsibility for any losses), and corporation (a firm owned by those who buy shares of stock and whose liability is limited to the amount of their investment in the firm). Most firms have employees to enjoy gains from specialization, to lower transaction cost (the time costs and other costs required to carry out market exchanges), to diversify risk (i.e., to reduce risk by spreading sources of income among different alternatives). However, as firms get bigger, they begin to encounter difficulties such as slow communication. A. Production Production function – a function that indicates the maximum amount of output a firm can produce over some period of time from each combination of inputs. Suppose that a firm has two inputs labor (L) and capital (K). Time periods are categorized as: Long-run (LR) – time period in which all inputs are variable; Q = F(L,K). Short-run (SR) – time period in which at least one input is fixed; Q = f(L) ≡F(L,K) where K is some fixed capital level. 3 C. Production in the short-run Marginal product – the addition to total product (TP) from hiring an additional unit of the input holding the amount of the other input: marginal product of labor (MPL) = ∆ TP / ∆ L; marginal product of capital (MPK) = ∆ TP / ∆ K (MPK makes sense only in the long-run). Increasing marginal returns to labor – the marginal product of labor increases as more labor is hired. Diminishing marginal returns to labor – the marginal product of labor decreases as more of labor hired. Law of diminishing (marginal) returns – as more and more of any input is added, holding the other inputs constant, its marginal product will eventually decline (a plausible assumption on production function). D. Cost A firm’s total cost of production is the opportunity cost of the owners—everything they must give up in order to produce output. Sunk cost – a cost that was incurred in the past and does not change in response to a present decision. Sunk cost should be ignored when making current decisions. Explicit costs – money actually paid out for the use of inputs. Implicit costs – the cost of inputs for which there is no direct money payment. E. Costs in the short run Total cost in the short run is obtained as the result of cost minimization under output constraint: if the firm needs L units of labor with K units of fixed amount of capital to produce Q units of output (by the short run production function Q = f(L)), then the firm’s total cost to produce Q units of output is wL(Q) + rK, where w is the wage rate, r is the rental rate of capital, and L(Q) is the amount of labor needed to produce Q (the amount of L depends on the amount of Q). Fixed costs – costs of fixed inputs. Variable costs – costs of variable inputs. Total cost (TC) = Total fixed cost (TFC) + Total variable cost (TVC) = rK + wL(Q). Total cost depends on Q, since total variable cost depends on L which depends on Q. 4 Average fixed cost (AFC) = TFC / Q = rK / Q. AFC decreases as Q increases. Average variable cost (AVC) = TVC / Q = wL(Q) / Q. The AVC curve is considered to have a U shape. Average total cost (ATC) = AFC + AVC = TC / Q = [rK + wL(Q)] / Q. The ATC curve is also considered to have a U shape. Since AFC declines as output increases, the ATC curve and the AVC curve must get closer together as we move rightward. Marginal cost (MC) – the increase in total cost from producing one more unit of output. Mathematically, MC is calculated by dividing the change in total cost by the change in output: MC = ∆ TC / ∆ Q = ∆ [rK + wL(Q)] / ∆ Q = ∆ wL(Q) / ∆ Q. Graphically, it is the slope of total cost curve (or the slope of the total variable cost curve). When MPL (the slope of f(L)) rises, MC (the slope of total cost = the slope of wL(Q)) falls. (You can verify this by drawing a picture. Take L on the horizontal axis and Q on the vertical axis. Draw a production function Q = f(L) such that the slope decreases as Q increases. Suppose w = 1. If you rotate your graph so that you regard Q as on the horizontal axis and L as on the vertical axis, then the slope of the graph L(Q) decreases as Q increases. Even if w ≠ 1, this relationship holds.) When MPL falls MC rises. (You can verify this also similarly.) Assuming the law of diminishing marginal returns to labor, MPL rises and then falls, MC will do the opposite—it will fall and then rise. Thus, in this case, the MC curve is U-shaped. At low levels of output, the MC curve lies below the AVC and ATC curves (because of increasing marginal return to labor), so these curves will slope downward. At higher levels of output, the MC curve will rise above the AVC and ATC curves (because of decreasing marginal return to labor), so these curves will slope upward. Thus, as output increases, the average curves will first slope downward and then slope upward. That is, they will have a U shape. The MC curve will intersect the minimum points of the AVC and ATC curves. F. Production and cost in the long run In the long run, there are no fixed inputs or fixed costs; all inputs and all costs are variable. The firm must decide what combination of inputs to use in producing any level of output. To produce any given level of output, the firm will choose the input mix with the lowest cost. Long-run total cost (LRTC) – the cost of producing each quantity of output when the least-cost input mix is chosen in the long run. Long-run average total cost (LRATC) = LRTC / Q. Long-run total cost of producing a given level of output can be less that or equal to, but never greater than, short-run total cost (LRTC ≤ TC). Long-run average cost of producing 5 a given level of output can be less than or equal to, but never greater than, short-run average total cost (LRATC ≤ ATC). In the short run, a firm can only move along its current ATC curve. In the long run, however, it can move from one ATC curve to another by varying the size of its plant. As it does so, it will also be moving along its LRATC curve. Constant returns to scale (CRTS) – when a firm multiplies the original amount of all the inputs by t (t positive), the new amount of output is also the original amount of output multiplied by t. The LRATC curve is flat. Increasing returns to scale (IRTS or economies of scale) – when a firm multiplies the original amount of all the inputs by t (t > 1), the new amount of output is more than the original amount of output multiplied by t. The LRATC curve is downward sloping. Decreasing returns to scale (DRTS or diseconomies of scale) – when a firm multiplies the original amount of all the inputs by t (t > 1), the new amount of output is less than the original amount of output multiplied by t. The LRATC curve is upward sloping. Remark: Like total cost curve in the short run, long run total cost curve is derived from cost minimization under output constraint. The derivation is similar to the indifference curves and budget lines argument. Given LRTC curve, we can find LRATC curve (and long run marginal cost curve) as in the case of short run. V. Profit maximization A firm is considered to be a single economic decision maker whose goal is to maximize its owners’ (economic) profit = total revenue – all costs of production = total revenue – (explicit costs + implicit costs). The firm faces constraints that limit its ability to earn profit. For each level of output the firm might choose, its demand curve determines the price it can charge and the total revenue it will receive. Its production technology and the price of its inputs determine the total cost it must bear. A. Profit maximizing output level In the total revenue and total cost approach, the firm calculates profit = TR − TC at each output level and selects the output level where profit is greatest. Marginal revenue (MR) is the change in total revenue from producing one more unit of output. Mathematically, MR is calculated by dividing the change in total revenue ∆ TR / ∆ Q by the change in output (∆ Q): ∆ MR = ∆ TR / ∆ Q. Graphically, MR is the slope of the total revenue curve. When a firm faces a downward-sloping demand curve, each increase in output causes a revenue gain—from selling additional output at the new price—and a revenue loss—from having to lower the price on all previous units of output. Marginal revenue is therefore 6 less than the price of the last unit of output. (Alternatively, recall that in the case of a linear demand curve as quantity increases (or as price decreases) revenue first increases, hits the maximum, and then decreases. Hence the TR curve has a ∩ shape. Since MR is the slope of the TR curve, it decreases as quantity increases.) An increase in output will always raise profit as long as marginal revenue is greater than marginal cost (MR > MC). An increase in output will always lower profit as long as marginal revenue is less than marginal cost (MR < MC). To find the profit-maximizing output level, the firm should increase output whenever MR > MC, and decrease output when MR < MC. To maximize profit, the firm should produce the quantity of output where the vertical distance between the TR and TC curves is greatest and the TR curve lies above the TC curve. Alternatively, to maximize profit, the firm should produce the level of output closest to the point where MR = MC (the slope of the TR curve = the slope of the TC curve)—that is, the level of output at which the MC and MR intersect. Sometimes the MR and MC curves intersect twice. The profit-maximizing level of output is always found where MC crosses MR from below (which corresponds that the TR curve lies above the TC curve). The marginal approach to profit states that a firm should take any action that adds more to its revenue than to its cost. B. Dealing with losses Let Q* be the output level at which MR = MC (the slope of the TR curve = the slope of the TC curve = the slope of the TVC curve). (Note that Q* in panel (a) of Figure 5 and Figure 6 in textbook should appear a little to the left.) Then, in the short run: If TR > TVC at Q*, the firm should keep producing. If TR < TVC at Q*, the firm should shut down. If TR = TVC at Q*, the firm should be indifferent between shutting down and producing. A firm should exit the industry in the long run when—at its best possible output level—it has any loss at all. C. The goal of the firm revisited A principal is a person or group who hires someone to do a job. An agent is the person hired to do that job. The principal-agent problem arises when an agent has interest that conflict with the principal’s, and the ability to pursue those interests. In business firms, there are two important principal-agent relationships—one between owners and managers and another between managers and workers. Each of these relationships can be plagued by conflicting goals. Still, firms’ owners have come up with a variety of incentives (such as stock options) to keep managers’ and workers’ eyes on profits. The assumption of profit maximization, while not completely accurate, is accurate enough to be useful. More on this topic when we talk about asymmetric information. 7