Publications for Richard Vann 2016

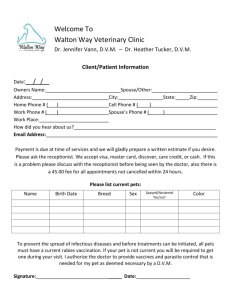

advertisement

Publications for Richard Vann Publications for Richard Vann 2016 Vann, R. (2016). Australia: Hybrid entities Resource Capital Fund III LP Case. In Michael Lang, Alexander Rust, Jeffrey Owens, et al. (Eds.), Tax Treaty Case Law around the Globe 2015, (pp. 3-13). Vienna: Linde Verlag Ges.m.b.H. Vann, R. (2016). Australia: Royalties - Task Technology and Seven Network Cases. In Michael Lang, Alexander Rust, Jeffrey Owens, et al. (Eds.), Tax Treaty Case Law around the Globe 2015, (pp. 183-202). Vienna: Linde Verlag Ges.m.b.H. 2015 Cooper, G., Frost, T., Vann, R. (2015). BEPS Deliverables: Some Comments and Australian Takes. Weekly Tax Bulletin, 2015 (23 October), 1645. Vann, R. (2015). Current Trends in Balancing Residence and Source Taxation. In Yariv Brauner, Pasquale Pistone (Eds.), BRICS and the Emergence of International Tax Coordination, (pp. 367-392). Amsterdam: International Bureau of Fiscal Documentation (IBFD). Vann, R. (2015). Is BEPS good policy? Japanese Tax Association / International Fiscal Association, Japan Branch 2015, Tokyo, Japan: Presentation. Boyd, T., Nash, P., Gropp, L., Smith, G., Vann, R. (2015). Roundtable on 'The company tax system'. Tax Reform Summit: Towards a better tax system - Australian Financial Review, Sydney, NSW: Presentation. Vann, R. (2015). Structure of Australian SME Taxation. Looking forward at 100 Years: Where next for the Income Tax? - Crawford School of Public Policy ANU, Canberra, ACT: Presentation. 2014 Vann, R. (2014). A stocktake of work to date and an assessment of the future. Finalising and Implementing the BEPS Agenda: University of Sydney, Sydney, NSW: Presentation. Sasseville, J., Vann, R. (2014). Article 7: Business Profits - Global Tax Treaty Commentaries. In Richard Vann, Brian J. Arnold, Hugh Ault, Makesh Butani, et al (Eds.), Global Tax Treaty Commentaries. The Netherlands: International Bureau of Fiscal Documentation (IBFD). Vann, R., Arnold, B., Ault, H., Butani, M., et al (2014). Global Tax Treaty Commentaries. The Netherlands: International Bureau of Fiscal Documentation (IBFD). <a href="http://www.ibfd.org/IBFD-Products/Globa l-Tax-Treaty-Commentaries">[More Information]</a> Vann, R. (2014). Policy Forum: The Policy Underpinnings of the BEPS Project-Preserving the International Corporate Income Tax? Canadian Tax Journal, 62(2), 433-441. Hill, J., Cooper, G., Dirkis, M., McCracken, S., Stumbles, J., Tolhurst, G., Vann, R. (2014). Regulation and Reforms to Enhance Financial Stability in the Post-GFC Era - Report for the Centre for International Finance and Regulation (CIFR). Vann, R. (2014). Update on Treaty developments. International Masterclass 2014: The Tax Institute, Sydney, NSW: Presentation. Vann, R. (2014). What is happening with BEPS and what we can expect. International Tax Day Perth 2014: The Tax Institute, Perth, WA: Presentation. 2013 Vann, R. (2013). Base erosion and profit shifting: Policy assumptions, evidence, theory. University of Lausanne 2013, Lausanne, Switzerland: Presentation. Vann, R. (2013). Beneficial Ownership: What Does History (and Maybe Policy) Tell Us. In Michael Lang, Pasquale Pistone, Josef Schuch, Claus Staringer, Alfred Storck (Eds.), Beneficial Ownership: Recent Trends, (pp. 267-331). Amsterdam, The Netherlands: International Bureau of Fiscal Documentation (IBFD). Vann, R. (2013). BEPS Action Plan: Policy and Realism. International Bureau of Fiscal Documentation (IBFD) 2013, Amsterdam, The Netherlands: Presentation. Vann, R. (2013). Corporate Tax Reform in Australia: Lucky Escape for Lucky Country? British Tax Review, 1, 59-75. Vann, R. (2013). Future of International Taxation and BEPS. University of Navarro 2013, Madrid, Spain: Presentation. Vann, R. (2013). Hill on tax treaties and interpretation. Australian Tax Forum: a journal of taxation policy, law and reform, 28(1), 87-122. Vann, R. (2013). Liable to tax and taxes covered under tax treaties. Tax Research-in-Progress Seminar 2013: Sydney Law School, Sydney, NSW: Presentation. Vann, R. (2013). Myanmar: Improving Capacity in International Tax. AusAID ALAF Program 2013: Sydney Law School, Sydney, NSW: Presentation. Publications for Richard Vann Vann, R. (2013). Tax Base Erosion: Emerging and Likely Developments. The Tax Institute: International Taxation Conference 2013 and Corporate Tax Conference 2013, Sydney, NSW: Presentations. Vann, R. (2013). Tax policy and international tax organisations. Permanent Scientific Committee of International Fiscal Association: 75th anniversary celebrations of International Fiscal Association 2013, The Hague, The Netherlands: Presentation. Vann, R. (2013). Tax treaties and investment income. International Fiscal Association South African Branch 2013, Johannesburg and Cape Town, South Africa: Presentations. Vann, R. (2013). Topical Tax Treaty Issues for the Finance Sector. Financial Services Taxation Conference 2013, Sanctuary Cove, Qld: Presentation. Vann, R. (2013). Transfer of Shares and Anti-Abuse under the OECD Model Tax Convention. In Guglielmo Maisto (Eds.), Taxation of Companies on Capital Gains on Shares under Domestic Law, EU Law and Tax Treaties, (pp. 231-257). Amsterdam, The Netherlands: International Bureau of Fiscal Documentation (IBFD). 2012 Hendriks, R., Cardwell, J., Vann, R. (2012). Australia. In Peter Blessing (Eds.), Tax Planning for International Mergers, Acquisitions, Joint Ventures and Restructuring, (pp. 1-123). Alphen aan den Rijn, The Netherlands: Kluwer Law International. Burgess, P., Cooper, G., Stewart, M., Vann, R. (2012). Cooper, Krever & Vann's Income Taxation: Commentary and Materials - Seventh Edition. Australia: Thomson Reuters. Molenaar, D., Tenore, M., Vann, R. (2012). Red Card Article 17? Bulletin for International Taxation, 66(3), 127-137. Vann, R. (2012). Tax Reform and Tax Expenditures in Australia. In Y Brauner and MJ McMahon Jr. (Eds.), The Proper Tax Base: Structural Fairness from an International and Comparative Perspective - Essays in Honor of Paul McDaniel, (pp. 87-105). The Netherlands: Wolters Kluwer Law & Business (Kluwer Law International). Vann, R. (2012). The UN Model and Agents: "Wholly or Almost Wholly". In Guglielmo Maisto, Angelo Nikolakakis, John M. Ulmer (Eds.), Essays on Tax Treaties: A Tribute to David A. Ward, (pp. 67-79). Toronto, Canada: Canadian Tax Foundation. Vann, R. (2012). Transfer pricing disputes in Australia. In Eduardo Baistrocchi and Ian Roxan (Eds.), Resolving Transfer Pricing Disputes: A Global Analysis, (pp. 359-414). New York: Cambridge University Press. 2011 Avery Jones, J., Baker, P., De Broe, L., Ellis, M., van Raad, K., Le Gall, J., Goldberg, S., Blessing, P., Ludicke, J., et al, Vann, R. (2011). Art. 24(5) of the OECD Model in Relation to Intra-Group Transfers of Assets and Profits and Losses. World Tax Journal, 3(2), 179-225. Avery Jones, J., Baker, P., De Broe, L., Ellis, M., van Raad, K., Le Gall, J., Goldberg, S., Blessing, P., Ludicke, J., et al, Vann, R. (2011). Article 24(5) of the OECD Model in Relation to Intra-group Transfers of Assets and Profits and Losses. British Tax Review, 5, 535-586. Vann, R. (2011). Never-ending tax reform and financial services. Tax Specialist, 14(4), 186-198. 2010 Vann, R. (2010). Australia. In S van Weeghel (Eds.), Tax Treaties and Tax Avoidance: Application of Anti-Avoidance Provisions, (pp. 79-98). Netherlands: Sdu Uitgevers. Vann, R. (2010). Australia. In H Ault, B Arnold (Eds.), Comparative Income Taxation: A Structural Analysis, 3rd edition, (pp. 3-25). Netherlands: Wolters Kluwer Law & Business (Kluwer Law International). Vann, R. (2010). Bamford in the High Court: Short and Sweet. Taxation in Australia, 44(10), 556-560. Vann, R. (2010). Taxing International Business Income: Hard-Boiled Wonderland and the End of the World. World Tax Journal, 2(3), 291-346. Vann, R. (2010). Travellers, Tax Policy and Agency Permanent Establishments. British Tax Review, 2010 (6), 538-553. 2009 Vann, R. (2009). "Liable to Tax" and Company Residence Under Tax Treaties. In Guglielmo Maisto (Eds.), Residence of Companies Under Tax Treaties and EC Law, (pp. 197-271). Amsterdam: International Bureau of Fiscal Documentation (I B F D). Vann, R. (2009). Australia's Future Tax Treaty Policy. In Chris Evans, Richard Krever, Peter Mellor (Eds.), Australian Business Tax Reform in Retrospect and Prospect, (pp. 401-416). Australia: Thomson Reuters. Vann, R. (2009). Commentary on Roche Products (2008) 10 International Tax Law Reports 682-687. International Tax Law Reports, Publications for Richard Vann 11, 92. Vann, R. (2009). Commentary on Undershaft (No 1) Ltd v Commissioner of Taxation, Undershaft (No 2) BV v Commissioner of Taxation. International Tax Law Reports, 11, 653-672. Vann, R., Cooper, G., Burgess, P., Krever, R., Stewart, M. (2009). Income Taxation: Commentary and Materials (6th edition). Sydney: Thomson Reuters. Avery-Jones, J., Baker, P., De Broe, L., Ellis, M., van Raad, K., Le Gall, J., Goldberg, S., Blessing, P., Ludicke, J., Maisto, G., Vann, R., et al (2009). The Definitions of Dividends and Interest in the OECD Model: Something Lost in Translation? British Tax Review, 2009 (4), 406-452. 2008 Vann, R. (2008). Commentary on Deutsche Asia Pacific Finance Inc v Commissioner of Taxation. International Tax Law Reports, 11, 366-375. Vann, R. (2008). Commentary on Roche Products Property Ltd and Another. International Tax Law Reports, 10, 682-687. Vann, R. (2008). Commentary on Roche Products Property Ltd and Another (Final Decision Extracts). International Tax Law Reports, 11, 93. Ryan, M., Vann, R., Stutsel, M. (2008). Tax Considerations in Structuring International Licensing and Technology Transfer Arrangements - Australia. In A Liberman, P Chrocziel & RE Levine (Eds.), International Licensing and Technology Transfer: Practice and the Law, (pp. 1-54). The Netherlands: Wolters Kluwer Law & Business (Kluwer Law International). Vann, R. (2008). The history of royalties in tax: treaties 1921-61: Why? In John A. Jones; Peter Harris; David Oliver (Eds.), Comparative Perspectives on Revenue Law, (pp. 166-196). Cambridge, UK: Cambridge University Press. 2006 Vann, R. (2006). Tax Treaties: The Secret Agent's Secrets. British Tax Review, 2006 (3), 345-382. Avery Jones, J., De Broe, L., Ellis, M., van Raad, K., Le Gall, J., Goldberg, S., Killius, J., Maisto, G., Miyatake, T., Torrione, H., Vann, R., et al (2006). The Origins of Concepts and Expressions Used in the OECD Model and their Adoption by States. Bulletin for International Taxation, 60(6), 220-254. 2005 Cooper, G., Vann, R., Krever, R. (2005). Income Taxation: Commentary and Materials (5th edition). Sydney: Australian Tax Practice. Vann, R. (2005). Interpretation of Tax Treaties in New Holland. In Henk van Arendonk, Frank Engelen & Sjaak Jansen (Eds.), A Tax Globalist: The search for the borders of international taxation. Essays in honour of Maarten J Ellis, (pp. 144-162). The Netherlands: IBFD. 2004 Vann, R. (2004). Australia. In H Ault, B Arnold (Eds.), Comparative Income Taxation: A Structural Analysis, 2nd edition, (pp. 3-22). The Hague: Kluwer Law International. Vann, R. (2004). Australia's new international tax rules promote simplification and the competitiveness of Australian companies. Tax Management International Journal, 33(8), 451-458. Ault, H., Arnold, B., Gest, G., Harris, P., Melz, P., Nakazato, M., Nishikori, Y., Repetti, J., Schon, W., Tiley, J., Vann, R., et al (2004). Comparative Income Taxation: A Structural Analysis, 2nd edition. The Hague: Kluwer Law International. Vann, R., Oliver, J. (2004). The New Australia-UK Tax Treaty. British Tax Review, 3, 194-233. 2003 Vann, R. (2003). Reflections on business profits and the arm's-length principle. In Arnold, Sasseville, Zolt (Eds.), The Taxation of Business Profits Under Tax Treaties, (pp. 133-170). Canada: Canadian Tax Foundation. Avery Jones, J., Vann, R., et, A. (2003). Treaty confilcts in categorizing income as business profits: differences in approach between common law and civil law countries. In Arnold, Sasseville, Zolt (Eds.), The Taxation of Business Profits Under Tax Treaties, (pp. 133-170). Canada: Canadian Tax Foundation. Avery Jones, J., De Broe, L., Ellis, M., van Raad, K., Le Gall, J., Torrione, H., Miyatake, T., Roberts, S., Goldberg, S., Vann, R., et al (2003). Treaty conflicts in categorizing income as business profits caused by differences in approach between common law and civil law. Bulletin for International Taxation, 57(6), 237-248. Vann, R. (2003). Trends in company/shareholder taxation: single of double taxation? General Report. In Vann, Couzin, Derouin, Gammie (Eds.), Cahiers de Droit Fiscal International: Studies on International Fiscal Law, (pp. 21-70). The Netherlands: Wolters Kluwer Law & Business (Kluwer Law International). Publications for Richard Vann Vann, R. (2003). What the US-Australia Tax Treaty Offers. International Tax Review, Septmeber 2003, 36-38. 2002 Vann, R. (2002). Australia's Budget provides Temporary Respite from Ongoing Tax Reform. Tax Notes International, 2002(26), 912-915. Black, C., Vann, R. (2002). Blended Learning in the Masters of Corporate Taxation. Synergy, 18. Vann, R., Avery Jones, J., De, B., Ellis, M., van, R., Le, G., Torrione, H., Miyatake, T., Roberts, S., Goldberg, S., et al (2002). Characterisation of Other States' Partnerships for Income Tax. Bulletin for International Taxation, 56(7), 288-320. Cooper, G., Vann, R., Krever, R. (2002). Income Taxation: Commentary and Materials (4th edition). Sydney: Australian Tax Practice. Crock, M., Saul, B., Ruddock, P., Yale-Loehr, S., Hoashi-Erhardt, C., Martin, S., Lowell, B., Martin, P., Hugo, G., McCallum, R., Vann, R., Allars, M., et al (2002). NationSkilling: Migration, Labour and the Law. 2001 Vann, R. (2001). Australia's Policy on Entity Taxation. Australian Tax Forum: a journal of taxation policy, law and reform, 16(1), 33-66. Vann, R. (2001). Australian High Court Takes Both Sides in Consolidated Press Case. Tax Notes International, 2001(22), 2953-2955. Vann, R. (2001). Improving Policy for the Taxation of Expatriate Employees in Australia. New Zealand Journal of Taxation Law and Policy, 7, 70-79. Vann, R. (2001). Proposed Changes to Australian Tax Law Would Affect Inbound, Outbound Investment. Tax Notes International, 2001(22), 2009-2013. Vann, R. (2001). Thin Capitalisation Reform in Australia: Another Milestone or a Millstone? Tax Notes International, 2001(24), 1209-1218. 2000 Cooper, G., Vann, R. (2000). A Few Myths About the GST. University of New South Wales Law Journal, 23(2), 252-263.