The Effects of the Dysfunctional Spot Market for Electricity in California

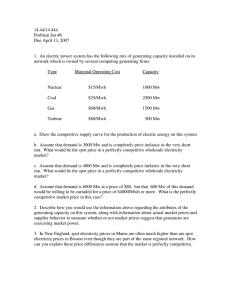

advertisement