CARGO ON THE MOVE: OPTIONS FOR INFRASTRUCTURE AND AIR QUALITY

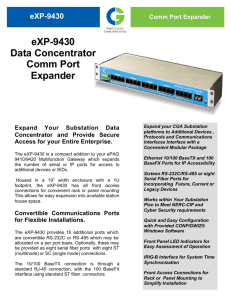

advertisement