Old Colony Trust Co. v. Commissioner 279 U.S. 716 (1929)

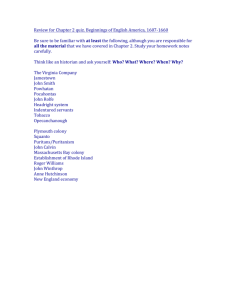

advertisement

Old Colony Trust Co. v. Commissioner 279 U.S. 716 (1929) Income Taxes When you earn income, you have to pay a percentage as income taxes to the federal government. This pays for federal government spending. Old Colony Trust Co. In the Old Colony Trust case, the Supreme Court held that when an employer pays the income taxes for an employee, that payment constitutes taxable income (meaning taxes have to be computed and paid on the tax itself). What does this mean? Suppose the employee’s salary is $100,000.00 per year. This is taxable income. If the tax rate is 25%, the employee owes $25,000.00 in taxes. If the employer pays these taxes, then the employee owes 25% of the additional $25,000.00 to the IRS. Is This Absurd? Lawyers for the company tried to argue that these payments would spiral out of control and become absurd. Were they Right?