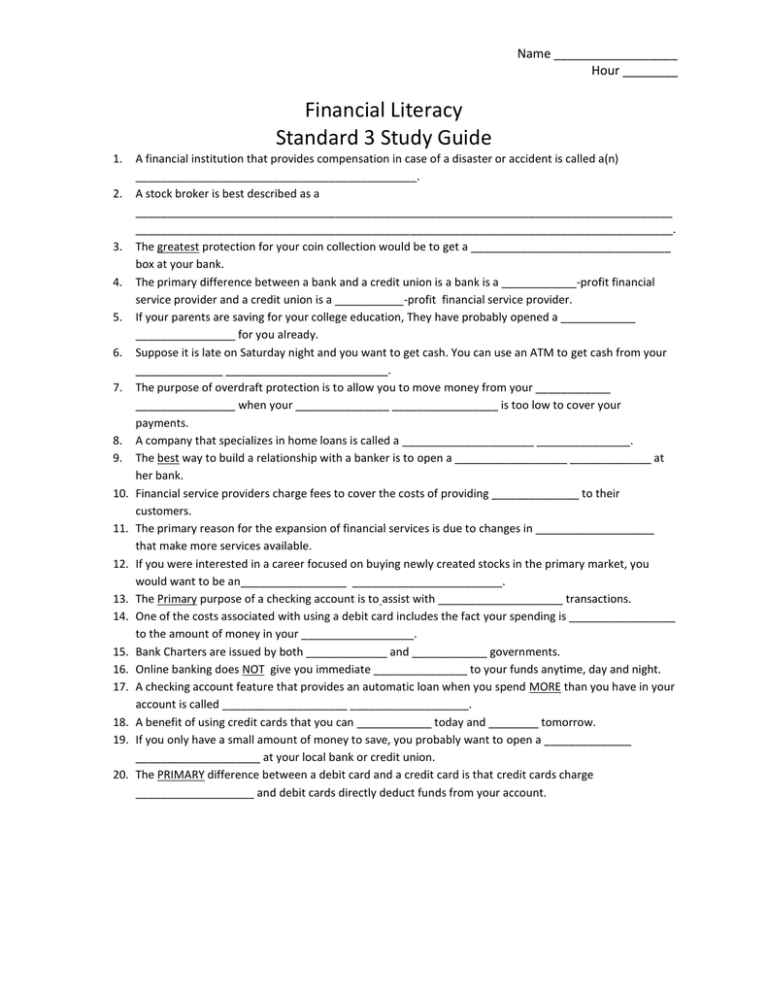

Financial Literacy Standard 3 Study Guide Name __________________ Hour ________

advertisement

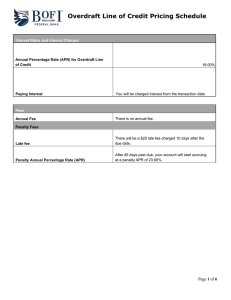

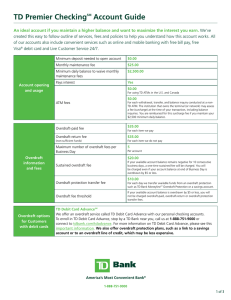

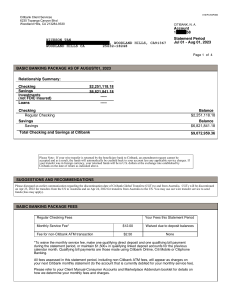

Name __________________ Hour ________ Financial Literacy Standard 3 Study Guide 1. 2. 3. 4. 5. 6. 7. 8. 9. 10. 11. 12. 13. 14. 15. 16. 17. 18. 19. 20. A financial institution that provides compensation in case of a disaster or accident is called a(n) _____________________________________________. A stock broker is best described as a ______________________________________________________________________________________ ______________________________________________________________________________________. The greatest protection for your coin collection would be to get a ________________________________ box at your bank. The primary difference between a bank and a credit union is a bank is a ____________-profit financial service provider and a credit union is a ___________-profit financial service provider. If your parents are saving for your college education, They have probably opened a ____________ ________________ for you already. Suppose it is late on Saturday night and you want to get cash. You can use an ATM to get cash from your ______________ __________________________. The purpose of overdraft protection is to allow you to move money from your ____________ ________________ when your _______________ _________________ is too low to cover your payments. A company that specializes in home loans is called a _____________________ _______________. The best way to build a relationship with a banker is to open a __________________ _____________ at her bank. Financial service providers charge fees to cover the costs of providing ______________ to their customers. The primary reason for the expansion of financial services is due to changes in ___________________ that make more services available. If you were interested in a career focused on buying newly created stocks in the primary market, you would want to be an_________________ ________________________. The Primary purpose of a checking account is to assist with ____________________ transactions. One of the costs associated with using a debit card includes the fact your spending is _________________ to the amount of money in your __________________. Bank Charters are issued by both _____________ and ____________ governments. Online banking does NOT give you immediate _______________ to your funds anytime, day and night. A checking account feature that provides an automatic loan when you spend MORE than you have in your account is called ____________________ ___________________. A benefit of using credit cards that you can ____________ today and ________ tomorrow. If you only have a small amount of money to save, you probably want to open a ______________ ____________________ at your local bank or credit union. The PRIMARY difference between a debit card and a credit card is that credit cards charge ___________________ and debit cards directly deduct funds from your account.