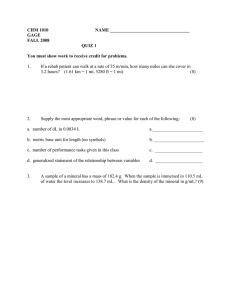

Recording the ownership of mineral-related assets London Group Rome, December 2007

advertisement

Recording the ownership of mineral-related assets London Group Rome, December 2007 Peter Comisari Australian Bureau of Statistics SEEA 2003 Characterised by multiple treatment options for some issues If SEEA is to become a statistical standard, these ‘options’ must be reconstituted as clear accounting recommendations Box 10.3 (SEEA, Ch.10) presents 3 options for recording ownership of mineral-related assets Overview • Who ‘owns’ mineral related assets – legal owner or economic owner? – or partitioned (split) between these? • Mineral-related assets: – mineral exploration knowledge asset – mineral resource SEEA suggests 2 options: • SEEA option [D1] shows mineral exploration in the balance sheet of the extractor and the value of the deposit in the balance sheet of the legal owner. If the agreement between the owner and the extractor allows for the extractor to retain some of the resource rent coming from the asset, the ownership of the asset should be partitioned accordingly. SEEA suggests 2 options: • SEEA option [D2] shows both the mineral exploration and deposit as being in the de facto ownership of the extractor. In addition, the extractor has a financial liability towards the owner corresponding to his share of the resource rent. This amount is also shown as a financial claim in the balance sheet of the owner. Two distinct assets • We are trying to determine ownership of 2 distinct assets: • 1. mineral exploration knowledge asset • 2. mineral resource Mineral exploration asset • typically produced and distributed in the following ways: • 1. produced (and used) ‘in-house’ as own-account production by extractor • 2. produced by a specialist exploration company then sold to an extractor Mineral exploration asset • LG decided in Johannesburg that mineral exploration asset and mineral resource are separate assets – decision endorsed by UNCEEA – consistent with draft SNA93Rev.1 Mineral exploration asset, continued… • can therefore assign ownership of mineral exploration and mineral resource to different entities • i.e. treatment of mineral exploration independent of treatment of the mineral resource Legal & economic ownership • Legal owner – the entity with claims to ownership under law • Economic owner – the entity accepting the risks and rewards of ownership • assigning ownership to economic owner is more analytically useful. Mineral exploration asset – allocating ownership • own account production: legal owner = economic owner • where specialist exploration company produces the asset, stays on their balance sheet until sold • therefore always recorded on the balance sheet of the legal owner Using mineral resources 1. owner may permit use of the resource to exhaustion 2. owner may allow extended use of resource where user controls the resource 3. owner may extend / withhold permission to use from one year to the next Using mineral resources, continued • under the second set of conditions, 3 possible options to allocate ownership on the balance sheet: 1. with the legal owner 2. with the extractor; or 3. partition ownership between legal owner and extractor Options outlined in the paper: 1. ownership with legal owner 2. ownership with the extractor (SEEA option D2) 3. simple partition of ownership (SEEA option D1) 4. partition of ownership – financial lease approach What does SNA say? • Draft SNA93Rev.1 states that – in principle, partition the asset using a financial lease approach – default option is to record ownership with the legal owner Record with legal owner • legal owner has clear ownership claims • existing practice of most countries? • simple to implement – many resource-rich countries have limited statistical capacity Table 1: Recording ownership on the balance sheet of the legal owner Balance sheet: legal owner Legal owner NPV expected rentals Assets Liabilities 910 Record with legal owner, continued • rentals (royalties) are paid by the user to the owner • In cases where extractor avoids decommissioning bond, legal owner takes on risks of ownership Record with legal owner, continued • BUT net worth of legal owner may be inflated inappropriately • depletion charge against output and income of extractor – at same time, reducing the balance sheet value of legal owner’s mineral resource asset Record with extractor • recognises extractor’s acceptance of risks/rewards of ownership during life of extractive licence – pre-agreement on how payments made – licence often transferable • some compatibility with commercial accounting? Record with extractor, continued… • BUT extractor suffers decline in asset wealth and makes rental (royalty) payments • wealth of legal owner remains zero (unaffected by extraction activity) • productivity analyses affected – compare extractor’s output only with relevant economic asset Record with extractor, but financial liability for expected rentals (SEEA option D2) • results in a simple asset ‘partition’ – reflecting that both legal owner and extractor have claims • recognises extractor’s future obligation to make rental payments • both legal owner and extractor show some net decline in wealth Table 2: Recording ownership on the balance sheet of the extractor (SEEA option D2) Legal owner Assets NPV expected rentals Liabilities 270 Extractor Assets Mineral resource NPV expected rentals Liabilities 910 270 ‘Partitioning’ mineral resources • mineral resources usually valued as NPV of expected future benefits – benefits during extractive licence = extractor – benefits beyond extractive licence = legal owner SEEA option D2, continued… • BUT option D2 implicitly assigns expected benefits beyond the extractive agreement to the extractor – productivity analyses SEEA option D2, continued… • ‘expected rentals’ – somewhat contingent in nature • rentals not usually equal to resource rents earned – if so, inappropriate partition will result Partitioning mineral resource – SEEA option D1 • record mineral resource on balance sheet legal owner – but, where extractor retains share of resource rent… • this share represents extractor’s part of the mineral resource • relatively simple Table 3: Partition ownership legal owner and extractor – SEEA option D1 Legal owner Assets Mineral resource Liabilities 700 Extractor Assets Mineral resource Liabilities 210 Partitioning mineral resource – SEEA option D1, cont’d… • BUT • if rentals are less than the resource rent earned by extractor, extractor’s share is understated • why is the extractor paying rentals for an asset they ‘own’? Partition: financial lease arrangement • Partitioned according to: – benefits during extractive licence = extractor – benefits beyond extractive licence = legal owner • i.e. extractor ‘owns’ the resource for life of extractive licence – an appropriate partition Partition: financial lease arrangement, continued… • rental payments form basis for imputed interest/principal to pay for resource ‘acquisition’ • supports appropriate depletion adjustments – to extractor’s output, income etc. – to extractor’s share of asset • aids analyses of productivity etc. Partition: financial lease arrangement, continued… • New discoveries / reappraisals – flow accounts will reflect revised benefits secured by the extractor • (i.e. based on changed expected rentals) Table 4: Partitioning – financial lease approach Legal owner Assets Mineral resource Loan, mineral resource Liabilities 430 270 Extractor Assets Mineral resource Loan, mineral resource Liabilities 480 270 Partition: financial lease arrangement, continued… • BUT relatively complex – significant assumptions about expected prices, extraction rates etc. – would require very detailed mine-level data, or else use of assumptions at macro level – if revisions are large and / or frequent, analytical usefulness is reduced Determining the ‘best’ option • need to reflect environmental / economic realities underlying the legal constructs • consistent with SNA principles • information systems should meet important analytical needs • should be practically achievable Attraction of a ‘simple’ method • produced capital is mainly located in countries with sophisticated statistical agencies – but not true for natural capital • ideally, method should be achievable by as many countries as possible • allocating ownership of the mineral resource to the legal owner is straightforward Discussion points • Should mineral exploration be attributed to the legal owner? • What is the preferred approach to attributing mineral resource ownership? • Should a default approach be suggested (especially if the preferred approach is complex)?