IJAIYA, Muftau Adeniyi Accounting & Finance Senior Lecturer

advertisement

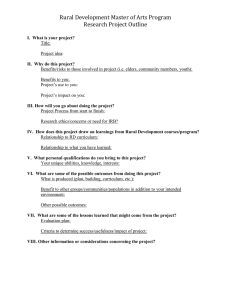

IJAIYA, Muftau Adeniyi Accounting & Finance Senior Lecturer Informal Micro Credit and Economic Activities in Rural Nigeria: A Framework for Policy Analysis. In Democracy and Development in Nigeria, Saliu, H.A. et al. (eds.) 2: 172-191, (A Publication of Faculty of Business and Social Sciences, University of Ilorin, Ilorin). Chapter 9 Informal Microcredit and Economic Activities in Rural Areas: A Framework for Policy Analysis *Muftau A. Ijaiya Introduction AFRICA'S development challenges go deeper than low income, falling trade shares, low savings and low growth, but also include inequality and uneven access to productive resources, social exclusion and insecurity (Pitamber, 2003). However, more specific concern is raised in Nigeria due to rural-urban disparities in income, access to education, health-care services and prevalence of ethnic or boundary conflicts, in particular. The apparent dearth of productive resources, most especially credit from the formal financial sector for rural dwellers to improve their welfare, has attracted significant attention. (Aryeetey, 1998). The dearth of formal credit in rural areas arises from low population densities, poor infrastructure, policy and institutional problems, remote difficult terrain, and the small value of individual savings and loan transactions. Besides, the cost of providing Ijaiya is of the Department of Accounting and Finance, University of Ilorin, Ilorin. 172 services to rural areas is high, since the cost of opening branches in villages and small towns is not justified by the business that can be generated, and these are the reasons why formal banks could not really purvey microcredit (Garuba, 19SS; Akanji, 2001; World Bank, 1989). The Nigerian Government has also designed various programmes to deliver micro-credit in rural areas. These programmes have individually and collectively been unable to provide a sustainable micro-credit delivery system in the rural areas because of their inability to meet credit demand, sources of which depend on government subvention which has been very irregular in recent times (Okafor, 2000). However, Yaron, Benjamin and Piprek (1997) posit that rural communities, like their urban counterparts, have a bankable demand for formal credit which they say contributes significantly to their welfare by mitigating the impact of seasonably and natural disaster on their income. Puglielli (2002), however, argues that formal finance. is customarily inaccessible to rural dwellers in a form conducive to efficient productive investment; or, worst still, credit is unavailable altogether. He posits that this credit starvation of rural areas is an economic development tragedy. Therefore, there is need for a financial institution, different from the formal financial institution, that would operate within the peculiarities of the rural areas. In searching for alternatives to finance, attention is increasingly being paid to informal and semiformal microcredit for meeting rural people's credit demands to offer small loans which are suitable for rural small businesses. More importantly, informal micro-credit suits the needs of borrowers .in terms of: their simplicity in the procedure of obtaining credit; personal guarantee requirements in place of collateral which is consistent with the ability of borrowers; the 173 absence of controls and restrictions on the use to which loans can be put; the fact that loans can be granted at any time, non-payment of interest and flexibility in terms of payment and repayment (Mabogunje, 1980; Chipeta and Mkandawire, 1991;. And Aryeetey, 1998). Drawing from the above, this paper addresses the following question: How significant is the role of the informal microcredit to the economic activities of the rural dwellers in Nigeria? Conceptual Issues: Microfinance Rural Areas and Informal Ledgerwood (1999 cited in Wilson, 2001) defines microfinance as the provision of financial services that may include credits, savings, insurance and payment services intended to benefit low-income women and men. Yaron, et al (1997) see it as communitymanaged credit-and-saving associations that are established to improve members' access to financial services. While Okafor (2000) defines microcredit as a programme designed to provide financial support and ancillary services to the very poor, Wilson (2001) classifies microfinance into formal, semi-formal and informal. Formal microfinance is defined as public and private financial institutions that are most active in micro and small-scale finance intermediation. These institutions are not subject to central banking regulation and supervision and they draw their clientele from their local catchment areas and their minimum capital requirement is significantly lower. Examples include People's Bank of Nigeria, Grameen Bank in Indonesia, Budan Kredit Kecamatan [BKK] in Indonesia, etc. The World Bank (2004) defines semi-formal finance institutions as those formally registered by banking authorities but are subject to supervision by government agencies where government supports them with funds, technical assistance and policy guidance. Examples of such institutions include credit unions, group lending 174 institutions, etc. Informal microfinauce, on the other hand, is defined by Goodland, Onumah and Araadi (1999) as an institution that comprises a multitude of different institutions and activities, which together play significant roles in many Sub-Saharan African economies with high rate of poverty, and where individuals, households and regions remain isolated from the markets and from the mechanism for borrowing and lending or insuring against risk. These institutions are often created by the people themselves without any external intervention and legal status. The major types of informal microcredit institutions include Accumulated Savings and Credit Associations [ASCRAs], Rotating Savings and Credit Associations [ROSCAs], money lenders, trade credits, self-help groups, personal loans from friends, etc. (World Bank, 1989; Chipeta and Mkandawire, 1991). Parker and Nagarajan (2000) say that informal microcredit are characterized by small loans; reduction in cost of transactions; physical proximity to clients; regular i'ace-to-face meeting with clients; prompt loan collection procedure; and the use of peer lending system through which clients cross-guarantee each other's loans, among others. These characteristics make the informal microcredit institution a uniquely high-potential, vehicle for reaching and organizing rural communities (see also Edgcomb and Barton, 1998). Discussing the importance of informal microcredit, Steel and Aryeetey (1994) assert that they help in mobilizing savings in rural areas through their daily collection of deposits, which are used for school fees, medical expenses and working capital to restock supplies which enable clients earn a stream of profits. Besides, the amount mobilized is also important because it protects rural people from incessant appeals from families and friends. Goodland, et al. (1999) posit that the savings facilities provided enable households to. put aside precautionary funds which they 175 use in times of problems such as death and diseases like HIV/ AIDS, malaria fever, blindness, etc., and permanent disability (see also Ledgerwood, Burand and Brown, 2002). The World Bank (1989) observes that informal microcredit institutions provide savings opportunities for rural savers in countries where community banks are ill-equipped to accept small deposits of illiterate savers. While Goodland, et al. (1999) opine that they also play an important role by providing consumption credits to augment consumption shortfalls; majority of rural people depend largely on agriculture for their livelihood. The seasonal nature of their resources leads to fluctuating labour and capital demands, and to uneven production and income flows. During these periods, informal microcredit provides consumption credits needed to make up for the temporary shortfalls. Besides, rural households also use informal microcredits to increase income by investing on non-farm sources as well as saving part of the credit disbursed for the lean season (see also Morduch, 1998, Rutherford 1999; and Zaman, 1999). Dreze and Sen (1989) also say that informal microcredit plays an important role in the achievement of livelihood promotion and livelihood protection in rural areas. Livelihood promotion is concerned with improving standards of living principally through increased income while livelihood protection is essentially social security which maintains the living standards and income earned through the informal micro-credit (see also Zellor, et al. 1997). Quereshi, et al. (1996) observe that access to informal microcredit in rural Pakistan has enabled farmers purchase agricultural inputs which have improved their productivity. The World Bank (1989) also asserts that the informal microcredits provided for 398 rural households in Niger Republic accounted for 84 per cent of total loans in these rural areas and was equal to 17 per cent of the agricultural income of the farmers. 176 Pitt, Khandker and Cartwright (2003) reiterate that many of the informal microcredits in Bangladesh specifically target women, based on their view that women are more likely than men, to be credit-constrained, have restricted access to the wage labour market, and have an inequitable share of power in household decisionmaking. The Grameen Bank of Bangladesh is the best known example of these informal microcredit programmes, and over 90 per cent of its clients are women. Pitt and Khandker (1998) find that the flow of consumption expenditure increases by 18 'taka' for every 100 'taka' borrowed by women, but by only 11 'taka' for every 100 'taka' borrowed by men. Pitt, et al. (2003), also using a totally different approach to parameter identification, find that microcredits provide women with significantly improved health and nutrition for both .boys and girls, while credits provided for men have no significant effect. Bolnick and Mitlin (1980) also report that informal microcredit institutions provide members with housing loans. For instance, the Grameen Bank in Bangladesh provided over 330,000 housing loans to its saving scheme members, while the Self-Employment Women Association (SEWA) in India also provided housing loans to their members. The Fundacion Carvajah in Latin America also initiated a housing loan programme which benefited their members substantially (see also Anzorena, 1996, and Cruz, 1994). Johnston (1986) defines a rural area as an area where the inhabitants' livelihood depends on the exploitation of the soil. Mabogunje (1980) says that it is not only an aggregation of farming population but also the physical manifestation of both the social relations of land, the ecological, technological and organizational basis of its utilization, that depict what a rural area is. For instance, in a rural area, the land holding is small and owned by family members. The area is usually built around lineages with a compound comprising individual huts, or a continuous building 177 of many rooms. Areas around the compound are manured with domestic refuse or animal droppings, which are intensively cultivated and cropped every year. Footpaths or tracks of various widths link the farms to the villages and hamlets, and these, in turn, to the population market towns. The World Bank (1989) observes that majority of the population engaged in fanning and other micro activities such as handicrafts, trading, which the World Bank calls non-corporate business. Rural areas in Nigeria account for about 54.9 per cent of the total population of the country (African Development Bank, 2002). Discussing the importance of rural areas, Afolabi and Osota (1999) assert that the areas constitute a great reservoir of indigenous technical knowledge, acquired through centuries of concrete experience, and their contribution to national economy include generating resources to feed medium and large-scale enterprises; enhancing the development of the entire nation, laying the foundation for sustainable self-reliance, and guaranteeing optimum development of agro-based industries. Whynne-Hammond (1979) also opines that rural areas' role is extremely important as contributors to the nation's wealth. Their businesses serve as important connecting points between the various sectors of the economy where flexible product and service supply play a crucial role in the commercial network of the country. Economic activities are any kind of work people engage in for the purpose of making profit: the economic activities in the rural areas are farming and nonfarming activities. Fanning activities are the major occupation of the rural people where grain crops such as millet, maize, rice, etc., and root crops such as yams, cocoyams, sweet potatoes, bulbs, cassava and fruits are grown. Some of the rural people also engage in animal husbandry such as the rearing of cattle, goals, sheep and poultry. The non-farming Activities include bandicrafts, tailoring, petty trading, black and goldsmithery, etc. (Olaloku ct al, 1984). 178 Efforts at Microcredit Delivery to the Rural Areas in Nigeria The government, private individuals and community-based groups have designed some microcredit programmes that have enhanced rural dwellers' access to credit for increased productivity and improvement in their economic status. For instance, at the government level, between 1986 and 1999, several microcredit programmes were attempted at purveying microcredits to the rural people. These programmes include the Agricultural Development Projects (ADPs), the Better Life for Rural Dwellers (later renamed the Family Support Programme) and the Directorate of Food, Roads and Rural Infrastmcture (DFRRI). Other institutions that also purvey microcredits were the Rural Banking Scheme (19771980), People's Bank (1987-1990) and Community Banks (1990-date). In addition to the above is the Central Bank of Nigeria (CBN) microcredit scheme tagged the Agricultural Credit Guarantee Scheme (ACGS) which came into existence in 1977 (Akanji, 2001). These institutions have provided microcredit to the rural people to improve their economic activities. For instance, community banks gave loans and advances worth N14.621 million between 1999 and 2000 to agriculture, food processing and trading (Aderibigbe, 2001; Okafor, 2000) while the Agricultural Credit Guarantee Scheme (ACGS) guaranteed loans worth N27, 687,169 million for the development of agriculture in the country. On the part of the People's Bank, the bank granted loans and advances worth N3.490 billion to the rural people. (Phillips, 1991; Okafor, 2000; Aderibigbe, 2001 and Akanji, 2001). However, these formal microfinance institutions have suffered from a number of the volume of funds they could supply was limited, arid it was impossible for these lending institutions to meet the demands of their clients. Okafor (2000) notes that the fundamental source of 179 this problem is the absence of autonomous sources of funds for the institutions. , These institutions, especially those owned by the government, depend largely on government subvention, which has become very erratic these days. Besides, most of the credit systems are tailored towards meeting the needs of the elite rather than the poor, and this makes it easy for the wealthy household to annex the benefits of the institutions. Also, the fact that the poor cannot provide the collateral demanded by banks continues to make microcredit delivery to rural dwellers elusive (Olashore, 1979; Aderibigbe 2001; and Akanji, 2001). Okafor (2000) also reiterates that community and rural banks are avoiding credit delivery to productive activities in rural areas by siphoning local savings for portfolio investment outside the rural areas. From the foregoing, therefore, it can be deduced that the formal' financial institutions have not been able to provide a reliable independent credit delivery system in the rural areas because, despite the huge amount invested in the formal financial institutions, it has proved to be irrelevant and cannot meet the economic needs of the areas. Furthermore, there is a breach of mutual trust between the formal financial institutions and the rural dwellers because the savings mobilized in these areas are used to support credit delivery operations to choice customers in urban areas. Therefore, there is need for a financial institution that would operate within the peculiarities of the rural areas. That financial institution is the informal finance institution like the informal microcredit, the institutions whose formation must be based on the concept of social capital that emphasizes mutual trust. Analytical Framework on the Impact of Informal Microcredit on the Economic Activities of Rural Dwellers in Nigeria The analytical frameworks that discuss issues relating to finance are usually based on trust, and these are better discussed under 180 the social capital theory. For instance, financial intermediation depends upon trust between the borrower and the lender that contracts will be honoured (Bennett, 1996a:3). The basis for that trust depends on two crucial elements: the applicant's reputation as a person of honour and the availability of collateral against which claims can be made in case of default. The first two elements -reputation and character - were assessed based on the lender's intimate knowledge of the borrower, or on the witness of other reliable persons and a documented history of the borrower's behaviour. But these are the two elements that are lacking between the formal financial institutions and the rural dwellers. The consequence of these barriers are what the formal lender perceives would make administrative costs of gathering information and processing application for the rural people to be too costly compared to the small size of the loans and their expected profit. These barriers made the formal financial institutions to abandon the delivery of microcredit to the rural dwellers. Therefore, something needs to be created to overcome, these barriers so as to improve the economic activities of the rural dwellers. That something is a financial institution that is based on social capital (Edgcombe and Barton, 1998; and Goodland, et al. 2001). According to Narayan (1999), Bebbington and Carroll (2001:1), Collier (1998), Gugerty and Kremer (2000), Knack (1999), Krishna and Uphoff (1999) and Woolcook and Narayan (2000:226), social capital is the norms and social relations embedded in the social structures of the society that enable people to co-ordinate action collectively in order to achieve desired goals (sec also Ijaiya, 2002). According to Putnam (1995:3), social capitals are those features of a social organization such as networks, norms and trust that facilitate co-ordination and co-operation of mutual benefits, which enhance the benefits of investment in physical and human capital (Bennett 1991:1). 181 Funkiyama (undated) (cited in Edgcomb and Barton, 1998) further defines networks, norms and trust as "local clubs, temple, associations, work groups and other forms of association beyond the family and kinship groups', and large, publicly owned corporations. This made Grotaert (1999:4-10) to opine that social capital is relevant at macro, mcso and micro levels. Social capital at the macro level includes large and public institutions like government, with the rule of law, civil and political liberties, etc. At meso and micro levels, social capital can take place at local clubs, work groups, and other forms of association beyond the family and kinship groups. Therefore, social capital refers to the networks and norms that govern interactions among individuals, households and communities. Ostrome (1994) cited in (World Bank ,1999) observes that networks are social capital in the form of rudimentary "insurance companies" or 'banking institutions' for the people lacking fundamental assets like collateral for loans. Such people, he argues, may draw on their social capital as a substitute. Discussing the importance of social capital, Bennett (1996b:2) says that social capital is important because both civil and commercial associations which reach beyond the family depend on - and foster on - traditions of collaboration and a certain level of trust between members of society. This level of trust allows the society to reduce what economists call the transaction cost of doing business in that society. The World Bank (1999:91) also opines that access to social capital turns out to be indispensable to successful “entrepreneurs” in order to improve their living conditions through their own efforts. The lack of social capital, the absence of connectedness and relationships with the formal financial institutions, have been identified as the root problems of the rural people. For these people, the slightest worsening of their situations, whether as a 182 result of sickness or a deteriorating economy, may plunge them into crisis from which they may never recover. Therefore, they need a source of finance through which the people can relate to others in the society and through which members can develop a substitute for the collateral they lack. This would enable them have access to credit that would improve their economic activities. For instance, the guarantee mechanism, a major characteristic of the informal microcredit, introduces shared liability and pressure from social groups which serve as a replacement for the formal finance security and business appraisals. This guarantee mechanism slashes administrative cost of the informal lender since they gather information about borrowers. This enables informal lenders to shift the cost of loan processing and loan approval tasks to the people. Also, shared liability and the promise of repeat loans in increasing amount are recognized as key factors in motivating repayments (Ryne and Otero, 1994). In effect, a village bank or a savings and credit co-operative creates an "information asset" for the people. That information asset is first and foremost the collective endorsement-of character that each member of the group provides for the other, which is accepted by the financial intermediary in lieu of other assets. Secondly, the knowledge that each member has knowledge of each other's economic activities (and household situations) which support an accurate assessment of ability to pay is another information asset. Ostrom (1994, 1997) cited in World Bank (1999) also says that social capital prevents the deterioration of common pool resources or ensures members' contributions to the maintenance of local infrastructure. Thus, a change in economic conditions has to be accompanied by investments in economic activities that stabilize and prolong the regulator)' function of the existing social capital. To allow the functioning of the existing social capital, the participation of the people in the whole process of identifying and managing community-based projects to the needs of the people 183 is considered essential. It is critical to ensuring local commitments and sustainability. Apart from the fact that such social capital would enable people to build assets, it will also improve their consumption pattern and general economic activities. However, even if societies are rich in social capital, i.e., have a well-functioning mechanism for mutual co-operation, there is still no guarantee that banks or other formal financial institutions will recognize, co-operate, or work with groups of marginalized men and women. Edgcomb and Barton (1998:5) say there is need for transformation within the groups. This transformation involves using the groups to expand access to social services (like health, adult literacy, and family planning) and production of support services like agricultural extension, trade, etc., if needed. The second step is financial intermediation, involving training of members to participate in management, accounting, and basic financial management, which help groups to establish good record and audit systems to "keep score." This grouping will enable the rural dwellers to benefit more from the social services, using the informal microcredit in their reach to improve their economic activities (see also Goldberg, 1988). However, Bennett (1996b) maintains that successful informal microcredit efforts (particularly those working through groups) should seek to create sustainable access to financial services for micro entrepreneurs, create locally controlled systems that will bridge the gap between formal financial institutions and the people (Berenbach and Guzman, 1992). These systems should also" include institutions that work together to deliver and regulate social and financial intermediation services to the people. In some instances, it could be an institution that consists of one organization that delivers both types of services., with the clients organized into some form of groups with varying degrees of 184 autonomy and control, to regulate social interactions effectively (see also World Bank, 1999). That institution is the informal financial institution that formed the basis of our analytical framework of determining its role in the growth of economic activities in rural Nigeria. Figure 1 depicts the analytical framework to show the interaction of the rural dwellers with the informal microcredit institutions. It is important to note that the success of this framework in achieving its goals depends on the following assumptions: (i) that the informal microcredit will not use concessional interest rate (often negative in real terms); (ii) that the informal microcredit will not favour only agriculture but all rural economic activities, which include non-farming activities; (iii) that the informal microcredit will not ignore or oppress the creation of saving deposits, i.e., will provide saving with real returns; (iv) that the informal microcredit will not implement costly and inefficient service deliver)' mechanism; (v) that the informal microcredit will favour long-term loan that would allow rural dwellers to invest in long-term productive activities. The framework, as depicted by the diagram, shows the link between the informal micro-credit and the economic activities (measured in terms of the volume realized). Put differently, the framework shows how the informal microcredit, through credit facilities, savings facilities, insurance facilities, leasing facilities, warehouse receipt facilities, housing facilities, combating diseases like malaria, fever, blindness, HIV/AIDS, etc., relief materials, including contingencies and provision of social services, could improve the economic activities of the rural dwellers. 185 The framework also indicates a feedback loop from the gains through the role of the informal microcredit by rural dwellers to the boost in their economic activities. This feedback is necessary if the activities of the informal microfinance are to be sustained. It is assumed that as the rural dwellers income improves, they would return the amount borrowed and also save part of their earnings in the informal microcredit programmes to keep the process moving. This process applies to all categories of individuals that benefit from the programmes as they would also return the amounts borrowed and also save part of their earnings to enhance the sustainability of the programme. This process will allow others to take loans from the pools, thus boosting the economic activities of all the rural dwellers. Therefore, the schematic flow is established and maintained, to make a continuous process of the operation of the microcredit and improvement in the economic activities of the rural dwellers possible. Functions of the Informal Microfinance Institutions * * * * Credit facilities Savings facilities Insurance facilities Leasing facilities Informal Microfinance * Housing facilities Inslutitions (Types) * Warehouse Receipt facilities * Rotating Savings and Cred its * Combat diseases Associations (ROSCAS •* Secure donor fund * Distribution of relief known as "esusu" materials, including * Money lenders contingencies * Trade creditors * Social services * Self-help groups * Friends and relations Fig. 1: A Schematic Link between the Informal Microfinance Institutions and Economic Activities 186 Outcome of Economic Activities * Income generation * Asset accumulation * Job creation Conclusion The insufficient delivery of microcredit to rural areas in Nigeria has been traced partly to the inability of the formal financial institutions to deliver microcredit because of the problems enumerated earlier. These shortcomings from the formal financial institutions are increasing, as rural areas are involved in agriculture, trading and other small enterprises which represent about 75 per cent of the rural economic activities in Nigeria. Therefore, providing an analytical framework that is based on the role of informal microcredit to the rural areas becomes necessary, as this would improve the delivery of informal microcredit to the rural areas, which accommodate more than 70 per cent of the total population of Nigeria. References Aderibigbe, J. O. (2001). "The Role of the Financial Sector in Poverty Reduction." Central Bank of Nigeria. Economic and Financial Review, 39(4):135-158. Afolabi, J. A. and O. O. Osota (1999). "Overview of the Implementation of the Family Economic Advancement Programme (FEAP) and its Implication for the Banking System andBeneficiaries'BankingHabits in Nigeria." Nigeria Deposit Insurance Corporation, 9(l&2):33-63. African Development Bank (2002). Selected Statistics in African Countries, Abidjan: ADB. Akanji, O. O. (2001). "Microfinance as a Strategy for Poverty Reduction." Central Bank of Nigeria Economic and Financial Review. 39(4):111-134. Ansorena, J. (1996). SELAVIPNewsletter (Latin American and Asian Low Income, Housing Service), April. Aryeetey E. (1998).' 'Informal Finance for Private Sector Development in Africa'' African Development Bank Economic Research Paper No. 41. Aryeetey, E. (1994). "The Relationship between the Formal and Informal Sector Financial Market in Ghana." African Economic Research 187 Consortium Paper No. 10. Nairobi, L. Kenya. Bebbinglin and Carroll, T. F. (2000). "Induced Social Capital and Federation of the Rural Poor." World Bank Social Capital Initiative Working Paper. Bennett, L. (1996a). "Social Intermediation: Building Systems and Skills for Sustainable Financial Intermediation with the Poor." In Tlic World Bank Sustainable Banking with the Poor Project, Rural Finance Seminar. Washington, D.C., May 1. Bennett, L. (1996b). "Microfmance and the Creation of Social Capital Sustainable Banking with the Poor." ASTHER, Washington, D.C.: The World Bank, October 9. Berenbach, S. andD. Guzman, (1992). The Solidarity Group Experience Worldwide. Washington D.C.: ACCION International. Bolnick, J. and D. Mitlin (1980). "Finance and Empowerment: Shack Dwellers." International Conference on Financing Low Income Communities, South Africa. Chipeta, C. and M. L. Mkandawire (1991). The Informal Financial Sector and Macweconomic Adjustment in Malawi. Nairobi: Africa Economic Research Consortium (AERC). Collier, P. (1998). "Social Capital and Poverty." World Bank Social Capital Initiative Working Paper No. 4. Cruz, L.F. (1994). "Fundacion Carvajal: The Carvajal Foundation." Environment and Urbanization, Vol. 6, No. 2, pp!75-182. Dreze, J. and A. Sen (1989). Hunger Public Action. Oxford: University Press. Edgcomb, W. and L. Barton (1998). Social Intermediation and Microfmance Programmes: A Literature Review. Bethesda, MD: Microcntcrprisc Best Practices Development Alternatives Inc. Garuba, G. I. (1998). "Comparative System for Supporting Agricultural Credit and Rural Finance Delivery in Nigeria and India. "Lagos, Central Bank of Nigeria, 12(2). Goodland, A., G. Onumah, and J. Amadi (1999). Rural Finance. Policy Series I, U. K: Charham. Goldberg, M. (1998). Memo on Social Intermediation February 8. Grootaert, C. (1999). "Social Capital, Household Welfare and Poverty in Indonesia." Local Level Institutions Working Paper No. 6. 188 Gugerty, M.K. and M. Kremer(2001). "Docs Development Assistance Help Build Social Capital?" World Bank Social Capital Initiative Working Paper No. 10. Ijaiya, G T. (2002). "The Role of the Informal Sector in Alleviating Poverty in llorin Metropolis." Unpublished Ph.D. Dissertation. Department of Economics, Usman Dan Fodio University, Sokoto. Johnston, R.J. (1986), (ed.). The Dictionary of Human Geography. Oxford: Basil Black\vell Limited. Knack, S. (1999). "Social Capital, Grov/th and Poverty: A Survey of Crosscountry Evidence." World Bank Social Capital Initiative PaperNo. 1. Krishna, A. andN. Uphoff, (1999). "Mapping andMeasuring Social Capital: A Conceptual and Empirical Study of Collective Action for Conserving and Developing Watersheds on Rajasthan, India." World Bank Social Capital initiative Working Paper No. 13. Ledgerwood, J.; D. Burand, and G. Braun(2002). The Micro Deposit-Taken Institution Bill 2002. Summary of Workshops and Information Exchanged Events. Kampala, SPEED-USAID. Mabogu'nje, A. L. (1980). The Development Process: A Spatial Perspective. London: Hutchinson Publishing Group. Morduch, J. (1998). Does Microfmancc Really Help the Poor: New Evidence from Flagship Programmes in Bangladesh. Department of Economics and HID, Harvard University and Hoover Institute, Stanford University. Narayan, D. (1999). "Bonds and Bridges Social Capital and Poverty." World Dank Policy Research Working Paper No. 2161. Olaloku, F.A; P.O. Fajana; O. Tomori; and Ukpong, II (1984), (eds.). Structure of the Nigerian Economy. London and Basingstockc: Macmi1lan Publishers. Okafor, F. O. (2000). "Microcredit: An Instrument for Economic Grov/th and Balanced Development." Journal of flic Chartered Institute of Bankers of Nigeria. July-December, pp. 38-45. Olashore, O. (1979). "Rural Banking Strategies and Policies of Government and the Central Bank of Nigeria." Bullion. Parker, J. and G. Nagarajan, (2000). Can Microfmancc Meet the Poor's Financial Needs in Times of Natural Disaster? Bethesda, MD: 189 MicrofmanceBest Practices (MBP) Development Alternative Inc.. Phillips, T. (1991). "The Role of the Banking System in the Management of the Economy." Central Bank of Nigeria, 15(2): 8-24. Pitambcr, S. (2003). "Factors Impeding the Poverty Reduction Capacity of Macrocrcdit: Some Field Observations from Malawi and Ethiopia" Abidjan: African Development Bank, Economic Research Paper? No. 74. Pitt, M.; S. Khandker and J. Cartwright, (2003). "Does Microcredit Empower Women? Evidence from Bangladesh."Policy Research Paper No. 2998. Washington DC: The World Bank. Pitt, M. and S.R. Khandker, (1998). "The Impact of Group-Based Credit Reforms on Poor Households in B angladesh: Does the Gender of the Participant Matter?" Journal of Political Economy 106, pp 958-996. Puglielli, D. (2002). "The World Bank and Microfinance: An Elephant Trying to Build a Bird's Nest. Putnam, D. (1995) "The Prosperous Community: Social Capital and Public Life." The American Prospect. No. 13, Spring, pp 35-36. Quereshi.S.; I.Nabi and R.Famqee (1996). "Rural Finance for Growth and Poverty Alleviation." Policy Research Working Paper No. 7593.Washington DC: The World Bank Rutherford, S. (1999). The Poor and Their Money. An Essay about Financial Services for the Poor People. University of Manchester: Institute of Development Policy and Management. Ryne, E. (2001). Commercialization and Crisis in Bolivian Microfinance. Bethesda, MD: Microfinance Best Practices Development Alternatives Inc. Ryne, E and M. Otero (1994). The New World of Microenterprises Finance: Building HeallJiy Financial Instit;;tionsfor the Poor. West Hartford, C. T: Kumanan Press. Sagbama, J. E. (1997). "Community Banking: The Nigerian Experience." Central Bank of Nigeria (CBN), 21(2):27-45." Steel, W. and E. Aryeetey (1994). "Informal Savings Collectors in Ghana: Can They Intermediate?" IMF/ World Bank Finance and Development, Vol. 31, No. 1:36. 190 Vonb Pischke, J. D. (1991). Finance at the Frontier: Debt Capacity and the Role of Credit in the Private Economy. Washington DC: The World Bank. Whyme-Hammed (1979). Elements of Hitman Geography. London: George Allen and Unv/in. Wilson, T. (2001), (ed.) Microfir.ancc. during and after Armed Conflict: Lessons from Angola, Cambodia, Mozambique and Rwanda Durham: The Springfield Centre for B usiness in Development Mountjoy Research Centre. Woolook, M. andD. Narayan, (2000). "Social Capital: Implication for Development Theory, Research and Policy." World Bank Research Observer 15(2), pp 225- 250. World Bank (1989). "Financial Systems and Development." World Development Report 1989. New York: Oxford University Press. World Bank (1999). "Inclusion, Justice and Poverty Reduction." Villa Borsig Workshop Series, Washington DC: The World Bank. World Bank (2004). Micro and Rural Finance in Ghana: Evolving Industry and Approach to Regulation Findings Washington DC: The World Bank. Yaron, J., (1994). Successful Rural Finance Institutions: Finance and Development. Washington DC: IMF/The World Bank. Yaron, J.; M. P. Benjamin and G. L. Piprek (1997). Rural Finance: Issue, Design and Best Practice Washington DC: The World Bank. Zaman,'H. (1999). "Assessing the Impact of Microcredit on Poverty and Vulnerability in Bangladesh." World Bank Policy Research Working Paper No 2145, July. Zellor, M.; G. Schneder; J.Von Braun and F. Heldhues (1997). Rural Finance for Food Security for the Poor: Implications for Research and Policy Review 4, Washington DC: International Food Policy Research Institute. 191