Third Party Liability and the TULIP Updated 01/26/2012

Third Party Liability and the TULIP

Updated 01/26/2012

What is Risk Management?

• Identification

• Assessment

• Evaluation

• Action

• Tracking and Report

Tenant-User Liability

• Refers to the legal obligation of outside users of institutional owned facilities

• Typically rent or use a facility for a single event

• Often times don’t have a general liability policy

Facility User Risk Mgt Techniques

• Hold Harmless

A promise to pay any costs or claims which may result from an agreement. Quite often this is part of a settlement agreement, in which one party is concerned that there might be unknown lawsuits or claims stemming from the situation, so the other party agrees to cover them.

• Indemnity Clause.

The obligation resting on one person to make good any loss or damage another has incurred or may incur by acting at his request or for his benefit, or a right which injures to a person who has discharged a duty which is owed to him but which, as between himself and another, should have been discharged by the other.

• Insurance Requirements

– Acceptable Certificates of Insurance

*

* From User’s Agent

From TULIP Program

When should we ask for 3

rd

party coverage?

• When any group, organization, individual, clubs, religious entities, companies, or third party use your facilities

• When it in is the financial interest of your school or organization to have a 3 rd party assume the risk of an event and include you as an additional insured

Why does a Facility User need

Liability Insurance

• To protect your organization (added as an additional insured)

• To protect the client contact personally

• To provide liability coverage and legal defense for claims

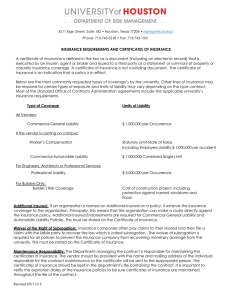

Certificates of Insurance

• A Certificate of Insurance shows facility user has purchased an insurance policy

• Allows the school to determine if the insurance requirements of the contract have been met

– pay for loss of or damage to property

– pay judgments or settlements

– protect the school if costs are incurred as a result of the insured's negligent acts or omissions

– support the indemnification provisions of the contract

It confirms that client does indeed have insurance

It tells you how much insurance

It tells by whom they are insured

It gives you the coverage date

What is an additional insured?

• As an additional insured the member institution has coverage under the facility user's insurance policy

– for claims and suits alleged by injured parties

– For legal representation for a claim or lawsuit in which the School is named

• Without this coverage, the member institution would have to provide its own defense in the event it was named in a suit

It adds your institution as an additional insured and certificate holder

How long should Certificates of Insurance be retained?

• Certificates should be retained for at least 3 years after the conclusion of the business for which the certificate was obtained.

• In some cases, the retention period must be longer: for instance in the case of a minor that is injured in a non school sponsored event

Acceptable Insurance?

• Users often have difficulty obtaining acceptable insurance

• Evidence of acceptable insurance is often questionable

• Limits may have been eroded, thus claims may not be paid

• Limited number of carriers

Tenant User’s Liability

Policy (TULIP)

• Tenant User’s Liability Insurance Program (TULIP) is a lowcost insurance policy that protects both the facility user and the owner

• The policy applies to bodily injury and property damage arising out of the use of the owner’s premises by external users

• These third parties have no relationship to the owner outside of a contractual arrangement for the use of the owner’s premises

• Premium costs will be paid by the third party unless other arrangements are made with the owner

• Premium costs are based on factors including: nature of the event, duration of the event, number of participants, level of risk of the event, and any special requirements such as liquor liability etc.

Who Can Use A TULIP

• TULIP Program covers activities and events of facility users that are privately or publicly owned and/or operated by municipalities, public agencies, colleges, universities, schools, hotel and convention complexes, fraternal organizations, and any other public or private organization

• Most owners will honor an acceptable certificate of insurance as a means of meeting their contractual obligation to indemnify and hold harmless the owner in the event of a covered financial loss

TULIP Advantages

• Serves as a promotion/sales tool for the facility to attract more users and increases revenues to the facility by having insurance readily available at reasonable rates

• Provides facility owners with direct knowledge of the insurance, its terms, conditions, limitations and insurer financial stability, without depending on the user to find acceptable insurance

• Eliminates the need and potential difficulties for the user to find acceptable insurance and provides a certificate of insurance

• Eliminates the last-minute rush to obtain certificates in order to book the facility

• Offers convenience and functionality to both the entity and its users

TULIP Advantages

• TULIP coverage is designed to be transactional non-bid business for the benefit of the carrier, user and owner

• This coverage is generally designed for short-term events with limited start-up and teardown time

• Rates are set per performance/per event/per day or per admission. TULIP programs group events by exposure and

(Class I, Class II and Class III)

• Since this business is high volume, an automated rating and quoting process would lower transactional costs, enhance response timing, and provide an efficient means of delivering this product

• Automatic internet program can deliver an acceptable policy for as low as $100 per event.

Special Consideration

Coverage

• Coverage excluded, but may be submitted for special underwriting consideration outside the TULIP program and written on a stand alone policy. The following are a few examples:

– Events with Animals

– Controversial Public Forums

– Events with Automobile Exposures (Racing)

– Aircraft

Sample TULIP Coverage

•

Limits of Liability

– Each occurrence - $1,000,000

– Aggregate - $2,000,000

– Personal/Advertising Injury - $1,000,000

– Damage to Premises - $300,000

– Deductible - None

• Excludes

– Abuse/Molestation (however our plan does offer this)

– Athletic participants for non sports events

– Premises Med Pay

•

Includes

– Host Liquor Liability (available)

– Facility owner as Additional Insured

– Products Liability provided for Food

– Beverage and Souvenirs

???????

• If you are not sure of whether a TULIP should be required, please contact your assigned risk management person within your institution to discuss in more detail

URMIA TULIP

• The URMIA TULIP (Tenants and Users Liability Insurance

to all URMIA members who subscribe to it.

• It is designed to provide low-cost general liability insurance to third party users of your facilities. It is web-based for most transactions.

• Liability coverage is administered by Gallagher EventPro underwritten by OneBeacon Insurance (Employers Fire

Insurance Company)

Basic Coverage

• Basic Coverage includes: Limits of Liability Aggregate: None

• Products-Completed Operations $1,000,000

• Personal and Advertising Injury $1,000,000

• Each Occurrence $1,000,000 Optional coverage available*

• Fire Damage $50,000 Any one fire

• Medical Payment excluded (Considered within the general liability coverage consideration)

• Liquor Liability $1,000,000 Additional cost*

• Athletic or Sports Participants excluded

• Abuse or Molestation $50,000

* may be required by institution

How Does it Work?

• This is a web-based program.

• See your risk manager for details

• Subscription is free of charge.

• The primary URMIA member (TAMUS) is responsible for the institution's subscription.

• Costs are based on the risk of the activity, the number of days of the activity, the number of participants, and if there are any special requirements, including alcohol liability, participant coverage, etc.

External Users

• External users (third parties with no relation to the institution and no institutional financial support) who need insurance

• Will be directed to the website https://tulip.ajgrms.com/ by the institution's designated person

• They will need to log in, complete an application form, and pay by credit card for their coverage. See this link for video demonstration

• Upon completion of the transaction, they will receive via e-mail a copy of their application and a binder of coverage.

• System Risk Management and Member designated person will each receive a copy of the application (describes the event) and a certificate of insurance.

• The designated person is responsible for checking the application against the agreement for facilities use to verify that the correct information was provided

Internal Users

• Internal users are typically student programs or events that involve a third party but which are "sponsored" by the institution.

• For example, the International Students' Union holds an international food fair, or the History Department sponsors the

Civil War Historians Association's Annual Conference. T

• There MUST be a third party user, vendor(s), or performer(s) to qualify.

• The institution should generally not be the policy holder, except to register events that are exclusively exhibitions, sales events, or performances that have no other third party organizer and to arrange for coverage for the exhibitors, vendors, and performers

under the TULIP .

• The institution is covered under sovereign immunity for its operational general liability risks

Internal Users Continued

• The institution or the third party will log in at the

Purchase Insurance website . The user will select the state of Texas and then The Texas A&M University

System as the location. The user will then select the venue (which is the System Member where the event will be held)

• To complete the transaction, the user will purchase using a credit card.

Upon Transaction Completion

• Upon completion of the transaction, the institution's risk management office and/or designated person will each receive a copy of the application (describes the event) and a certificate of insurance.

• The designated person will also receive an invoice if the transaction is "bill to account.“ Responsible for checking the application against the agreement for facilities use to verify that the correct information was provided.

• For all events , the institution will be named as

Additional Insured.

Risk Type

• Low-risk events will be automatically underwritten, and users should be able to complete their transaction in one web session if they pay by credit card or have authorization to bill to the institutional account. If they do not pay by credit card or bill to an account, their application will be held until payment is received.

.

• See this link for a list of activities which can be covered

Coverage Exclusions

• Exclusions/Excluded Activities

• For a complete, current list of all ineligible activites, please or access the web at this link for hazard class and exclusion activities lists

–

The following activities are some that are specifically excluded: Aircraft

Events; Bicycle Races, Rallies, and Events; Boat Shows; Circuses; Events with Attendance of Over 5,000; Events with Prior Losses; Fireworks;

Haunted Houses; Laser Tag; Mechanical Amusement Devices, such as mechanical bulls; Overnight Camping and Retreats; Marathons/Walkathons;

Political Rallies; Rodeo and Roping Events; Paint Ball; Pyrotechnics;

Rummage Sales (other than for charities); Skateboarding; Swimming and

Pool Facilities; Tractor Pulls; Water Events; Water Slides.

Coverage Exclusions Continued

• Other exclusions include, without limitation:

• Standard ISO GL Policy exclusions;

• Losses, injury, or property damage caused by: nonperforming animals, communicable diseases, property damage to premises rented for seven or fewer days (unless specifically purchased), athletic or sports participants, and employment-related practices.

• Other exclusions may apply.

Sample Policies

Sample General Liability Policy

Sample Excess Liability Policy

Sample Property Damage Policy

Gallagher Contact

• If you have any questions comments or concerns, you may contact us directly using the below information, or you may send us a message thru the website by clicking 'Contact Us

Form' on the left.

Tracy Paladino

Arthur J. Gallagher Risk Management Services, Inc.

6399 S. Fiddlers Green Circle, Suite 200

Greenwood Village, CO 80111

800.333.3231 ext 2614 tracy_paladino@ajg.com

Or

Jennifer Monteleone

Jennifer_Monteleone@ajg.com

800.333.3231 ext 2590

Office Hours

Monday - Friday 8:30 AM to 5:00 PM Mountain Time

Closed Saturday & Sunday

Live Demonstration

• For the management of your institution’s profile:

Please see this Link

• For video walkthrough of the Quick Quote process:

Please see this link