Highway Robbery? A financial analysis of Design Build Finance

Highway Robbery? A financial analysis of Design Build Finance and Operate in roads in the UK

Jean Shaoul, Anne Stafford and

Pam Stapleton

University of Manchester

DBFO - the policy and the evidence

Background to the policy

Scale of DBFO

National Audit Office reports

Other literature

Credit ratings agencies

Financial analysis of Highways Agency and DBFO company accounts

DBFO - what it is

Some new build

Operation and maintenance of road for

30 years

Annual payments by government based on traffic volumes

Shadow tolls

DBFO - the rationale

Access to finance

Value for money- ambiguous concept - 3Es

Economy: greater private sector efficiency and risk transfer over life of project

VFM - comparison of discounted whole life financial flows - ex ante

Methodology and process critiqued in hospitals

Assumed to be unproblematic in roads

Little financial evaluation of roads

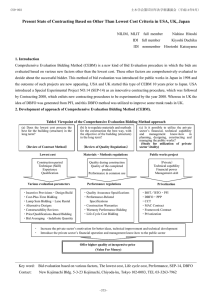

DBFO - scale

Little financial information

Inconsistent construction costs

Total capital cost of 14 schemes £1.3bn

56% of total new construction

No estimate of annual payments

Business Cases and Contracts unavailable commercial sensitivity

Highways Agency - description

After the first 8, only about 6 more

25% of 10 year plan will be DBFO

Research literature

Little analytical v descriptive research

World Bank project literature

Walker and Con Walker - Australian evidence

Lack of financial information commercial sensitivity

Snippets of information

Lack of transparency

NAO reports (i)

Cost of public < private finance before risk transfer

After RT, 2 out of 4 failed VFM test at 6%

Risk transfer crucial - methodology?

Only large construction projects were VFM

Uncertainties in quantifying Public Sector

Comparator

NAO reports (ii)

Gov guarantees payments

Who is carrying the risk?

Shadow tolls create extra risks when traffic volumes rising

Own calculations showed that little difference between PSC and DBFO in some cases

Conclusions did not follow own evidence

>>> DBFO expensive

Other Evidence

Haynes and Roden - VFM in aggregate at 8%, not when disaggregated at 6%

NPC of £1,093m

But little re methodology, assumptions, etc

Credit ratings agencies’ reports

Financial information to the capital markets

Now required to assume more risk

“Significant government support” to offset

“additional risk”

“Continue to offer a comparatively safe haven in times of economic downturn”

Main risk = construction risk, refinancing

Contracts complex, difficult to enforce, few penalties, eg January 2003

Highways Agency’s accounts (Table 2)

8 DBFOs for period of study

Information is limited and opaque

Total construction cost £590m

Payments not shown for 3 years 1997-1999

Changed from off to on balance sheet – risk?

About £210m p a - 3 elements to payments not broken down by contract

Payments rising due to traffic and payment profile

Highways Agency’s accounts

(Table 2)

In 3yrs 2000-2002, paid £618m

> £590m construction cost

Refutes the gov’s argument

£6bn cash cost over 30yrs

= NPC approx £2.2-2.5bn

Gov claimed NPC = £1.093bn

Costing more than expected?

Highways Agency’s accounts

(Table 2)

Estimated finance/capital costs = £1.723bn

= 3 x construction costs and 1/3 total cash costs

Most risk is construction risk, estimated

£100/400m risk = 25% premium - to build to time and budget

Gov guarantees payments- who is carrying the risk?

DBFO companies’ accounts

(Table 4)

Shell company, complex web of subcontracting,

95/5 debt/equity

Disclose little financial information

Rising income

Income less than shown in HA accounts

Operating profit = 68% of income in 2002 AFTER subcontracting to sister companies

Tax payable rate of 8% - but deferred, so less

Treasury methodology (2003) assumes 22%

Cost of private finance

Cost of capital = £103m (surplus less tax)

Effective interest rate of 11%

Post tax return on capital of 29%

Risk premium = cost of private less public debt

> 6 percentage points

Approx £56m (>50% of £103m) = additional cost of private finance

DBFO companies

Profit on construction, subcontracting and financing

Refinancing

Sale of equity stakes

Yorkshire Link - interest free loan to parent company

Front loaded payment stream - surplus not ring fenced

Must pay maintenance costs in future

Financial implications

High cost, affordability and implications for service provision elsewhere

Extra public finance and investment eaten up by cost of private finance

Shadow tolls >> direct tolls?

Risk transfer limited and creates additional risks

VFM methodology?

Outcomes are inconsistent with the claims

DBFO in roads no more ‘successful’ than in hospitals

PFI poor VFM in practice?

Accountability

Little financial information available to public

More to capital markets

Commercial confidential - smokescreen to hide cost from public

Makes scrutiny, control and accountability all but impossible

Creates potential for future liabilities and calls on public finance

Gives increasing wealth and political power over direction of public policy to financial elite