R o b e r t T . ...

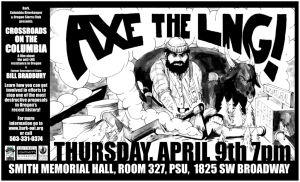

advertisement

Robert T. Manicke Experience Robert Manicke heads the firm's Benefits, Tax and Private Client group. His practice emphasizes state and local taxation, as well as employment tax issues. He regularly represents clients in the Oregon Tax Court and before state revenue authorities regarding income tax and property tax matters, and he also practices before the Portland Revenue Bureau and the Internal Revenue Service. His transactional practice includes state and local tax incentives, state and federal tax rulings, and state and local tax legislative projects. He has extensive experience with tax incentives for economic development, including the Strategic Investment Program, the Enterprise Zone Program, the former Business Energy Tax Credit and the eCommerce Credit. Robert also represents health care clients in matters relating to tax exemption, employment tax and insurance tax. Partner Representative Work Portland, OR Lead attorney in numerous cases in the Oregon Tax Court involving corporate and (503) 294-9664 direct personal income tax, as well as property tax. Representative subjects include: (503) 220-2480 fax Consolidated returns robert.manicke@stoel.com Public Law No. 86-272 and nexus Statutes of limitation Business/nonbusiness income and loss Property taxation of centrally assessed businesses Property tax exemption Education J.D., 1992, summa cum laude Order of the Coif Board of Editors, University of Illinois Law Review Selected by Best Lawyers® as Tax Law Lawyer of the Year, Portland, 2011; Litigation & Controversy-Tax Law Lawyer of the Year, Portland, 2014 Listed in Best Lawyers in America© (currently: Litigation & Controversy-Tax, Tax Law), 2007-2016 Listed in Oregon Super Lawyers® (Tax), 2008-2015 Member, American College of Tax Counsel Past Chair, Oregon State Bar Tax Section; Chair, Laws Committee Member, ABA Tax Section, including State Tax Committee, and Employment Tax Committee Presentations Willamette University, B.A., 1984, cum laude Professional Honors and Activities University of Illinois College of Law, Admissions Oregon California Idaho Washington Languages Dutch German Robert T. Manicke "2016 Oregon Tax Legislation Update," OSB Taxation Lunch Series, April 20, 2016 "Effective Telecommuting, Nontraditional Workplaces and BYOD Policies," SHRM/Stoel Rives 14th Annual Labor and Employment Law Conference, Mar. 2, 2016 "2015 Oregon Tax Update," Broadbrush Taxation Seminar, Oct. 16, 2015 "Oregon Legislative Update," OSB Taxation Lunch Series, Sept. 16, 2015 "Mostly Through the Session: What We Think We Know About 2015 Oregon Tax Legislation," Portland Tax Forum, May 14, 2015 "Multistate Audit Issues," Alaska Chapter of the Tax Executives Institute, February 4, 2015 "Oregon Legislative Update," OSB Taxation Lunch Series, Mar. 20, 2014 "2013 Oregon Tax Update," Broadbrush Taxation Seminar, Oct. 11, 2013 "Charitable Organization Real Property Tax Exemption: Slips and Trips," Oregon State Bar Nonprofit Section (co-presenter), Sept. 26, 2013 "2013 Oregon Tax Legislation Update," Oregon State Bar Tax Section Lunch Series, Sept. 18, 2013 "Oregon Legislative Developments," Tax Executives Institute, Portland, May 2013 "Payroll Taxes and Settling Employee Claims," Health Care Reform and Advanced Employee Law, Stoel Rives LLP Seminar, Anchorage, May 2013 "Hot Topics in Employment Law," 11th Annual Labor and Employment Law Conference, SHRM Oregon State Council, Feb . 2013 "Hot Topics for Employers With Out-of-State Employees," 2013 Employment Law Update, Stoel Rives LLP Seminar, Anchorage, Jan. 2013 "State Tax Issues," Tax Executives Institute, Anchorage, Jan. 2013 "2012 Oregon Tax Legislation Update," Oregon State Bar Tax Section, Portland, Sept. 2012 "2011 Oregon Tax Legislation Update," Oregon State Bar Tax Section, Portland and Salem, Fall 2011 "2010 Oregon Tax Legislation Update," Oregon State Bar Tax Section, Portland, Mar. 11, 2010 "Oregon Tax Amnesty Program," Oregon State Bar Tax Section, Portland, Sept. 3, 2009 "Oregon and Washington Update" (copresenter), Oregon Tax Institute, Portland, June 7, 2009 "Oregon Legislative Update," Oregon State Bar Tax Section, Portland, Apr. 9, 2009 "Tax Issues in Employment Settlements," Oregon Law Institute, Portland, June 6, 2008 "Financial Aspects of Green Building: Tax and Other Governmental Incentives for Green Projects," Lorman Seminar, Portland, Mar. 14, 2008 "Oregon Legislative Developments: What You Need to Know About 2007 Changes," Lorman Seminar, Portland, Mar. 11, 2008 "Solar Financial Incentives for Business Owners" (copresenter), Northwest Solar Expo, Portland, Sept. 14, 2007 Robert T. Manicke "Oregon Update," Oregon Tax Institute, Portland, May 18, 2007 "Oregon Legislative Update," Oregon State Bar Tax Section, Portland, 2007 Tax Executives International, Portland, June 2006 American Wind Energy Association, Pittsburgh, Pennsylvania, Feb. 2006 Panel presentation on Oregon's repeal of its discriminatory Section 1031 statute, ABA Sales, Exchanges & Basis Committee, San Antonio, Texas, Jan. 25, 2003 Publications "Property Tax Exemption for Low-Income Housing Judgment and Opinion in Corvallis Neighborhood Housing Case Vacated!" (coauthor), NOLS Newsletter, Non-Profit Organizations Law Section, Oregon State Bar, Spring 2015. "Taxation," Oregon Legislative Highlights, Oregon State Bar, 2007-2014 "Tax Issues" (coauthor), The Law of Marine and Hydrokinetic Energy: A Guide to Business and Legal Issues, Stoel Rives LLP, 2011 (formerly The Law of Ocean and Tidal Energy) "Centrally/Locally Assessed Properties Entitled to Same Oregon Tax Exemptions" (coauthor), Journal of Multistate Taxation, Aug. 2010 Contributor, Report of the Task Force on Business Activity Taxes (and co-author), Nexus of the ABA Section of Taxation State and Local Taxes Committee, The Tax Lawyer, 2009 Chapter on Oregon property tax (coauthor), ABA Property Tax Deskbook, annually since 1996 Survey of Oregon and Idaho tax developments (coauthor), Council on State Taxation, semiannually since 1995 for Oregon, since 2006 for Idaho "Tax Issues" (coauthor), The Law of Wind: A Guide to Business and Legal Issues, Stoel Rives LLP, 2005-2009 "Tax Issues" (coauthor), Lava Law: Legal Issues in Geothermal Energy Development, Stoel Rives LLP, 2005-2008 "Tax Issues" (coauthor), The Law of Biofuels: A Guide to Business and Legal Issues, Stoel Rives LLP, 2005-2008 "Tax Incentives" (coauthor), The Law of Building Green: Business and Legal Issues of Sustainable Real Estate Development, Stoel Rives LLP, 2007 "Property Tax Exemptions in Oregon: Slips and Tips," Oregon State Bar Taxation Section Newsletter, Spring 2005 "Oregon Pollution Control Facility Tax Credits: 2001 Legislative Changes" (coauthor), Oregon Insider, Issue 279, Sep. 1, 2001 Civic Activities Chair, Business & Finance Committee, for Oregon Business Association Honorary Consul, Federal Republic of Germany, for Oregon and Idaho Participated in the 2007 task force that worked with the City of Portland on development of a tax incentive for venture capital firms. Robert T. Manicke Board Member, German American School of Portland, 1999-2012 Board Member, Portland Symphonic Girlchoir, 2006-2009 Foreign Languages German Dutch (reading ability)