WHY THE HENRY REVIEW FAMILY TAX REFORMS ARE UNSUSTAINABLE

advertisement

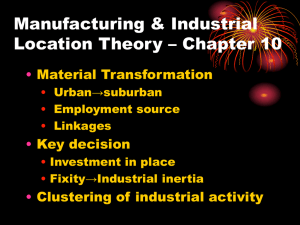

The University of Sydney WHY THE HENRY REVIEW FAMILY TAX REFORMS ARE UNSUSTAINABLE Women and Tax Seminar, 30 July 2010 Patricia Apps Faculty of Law, University of Sydney, ANU, UTS and IZA HENRY REVIEW FAMILY TAX REFORMS Focus on HR recommendations for: • Personal Income tax: a simplified rate scale with a “high tax free threshold with a constant marginal rate for most people” to replace Personal Income Tax scale, Low Income Tax Offset (LITO) and Medicare Levy (ML) • Family Tax Benefits: replace Family Tax Benefit A and B by “a single family per-child payment … withdrawn with a single means test defined on family income … at a single taper rate of 15-20 per cent ”. ORDER OF PRESENTATION 1 HR reforms are “more of the same”: Joint family income tax system with high MTRs and ATRs on married mothers as second earners 2 “Targeting fallacy” – the idea that universal child payments are more costly than targeted payments 3 HR reforms: negative effects on labour supply contract the tax base. System is unsustainable in an ageing population. 4 Joint taxation is unfair: shifts tax burden to low and average wage two-earner families, and increases the gender wage gap. 5 Negative effects on household saving and GDP growth. 1 HR REFORMS: “MORE OF THE SAME” Australia’s family tax system in 1980s: Highly progressive rate scale on individual incomes and universal child payments 2009-10: joint taxation with an inverted U-shaped scale for most working families due to changes in rate scale on individual incomes and withdrawal of child payments on family income. HR proposals - a consolidation and perpetuation of reforms since the mid 1980s 2009-10 and HR rate scale on individual incomes Personal Income Tax (PIT) – progressive and simple – 5 MTRs PIT + LITO – complicated and not strictly progressive. Medicare Levy (ML) – a partial joint tax policy instrument - omitted 2009-10 PIT scale HR scale Taxable Income $pa $0-15,000 $15,001 - $30,000 $30,001 - $35,000 $35,001 - $63,750 $63,751 - $80,000 $80,001 - $180,000 $180,000 + PIT + LITO ($1,350) 0.00 0.15 0.19 0.34 0.30 0.38 0.45 Taxable Income $pa $0 - $25,000 $25,001 - $180,000 $180,000 + Review 0.00 0.35 0.45 2009-10 and HR rate scale on individual incomes MTRs – Income tax rates + LITO .5 .4 .3 -.1 0 .1 .2 ATR .2 .1 0 -.1 MTR .3 .4 .5 ATRs Income tax rates + LITO 0 50000 100000 Taxable income, dollars pa MTR 2009-10 MTR HTR 150000 0 50000 100000 Taxable income, dollars pa ATR 2009-10 ATR HTR 150000 Lower income earners above $15,000 gain. Small loss from $72,700 - $85,100 (includes ML) Gains from $85,100. Consistent with incremental changes in PIT scale and expansion of the LITO over successive budgets. When considered in isolation, each rate scale change appears so small as to be unimportant, and to benefit low income earners. As part of a cumulative process, the overall shift in the tax burden towards the middle income earners has been substantial. .2 -.1 0 .1 ATR .3 .4 .5 ATRs: 2007-08, 2008-09, 2010-11 and proposed 2013-14 rate scales. 0 50000 150000 100000 Taxable income, dollars pa 200000 ATR 2007-08 ATR 2008-09 ATR 2010-11 ATR 2013-14 250000 Downward shifts in the ATR profiles indicate a disproportionate shift in the tax burden towards “middle”. Income earners from around $60,000-$80.000 have been denied an equi-proportional rate of compensation for the failure to index tax bands. Income tax + Family Tax Benefits Example: 3-child family: children aged13 to 15 years. Maximum rate per child 13-15 years: $6,033.45 pa, withdrawn at 20 cents on family income over $44,165 up to the base rate. Base rate per child: $2,018 pa, withdrawn at 30 cents in the dollar at a family income thresholds $101,908. HR reports estimates of costs for 13-15 yrs equal to FTB A Supplements are larger than FTB B for child aged under 6. HR recommend cutting child care payments for the second earner These reforms need to be modeled together: rate structures omits FTB B and supplements. ATRs and MTRs of single and two-earner families Joint taxation - tax rates of partners are interdependent. MTRs and ATRs depend on partner’s earnings as well as own income. We show how tax rates change when a family switches “type” by changing the labour supply of the female partner as second earner. Two types: • TYPE SE Single-earner family: male, as primary earner, works full time in market and female works full time in untaxed work at home • TYPE FT Two-earner family: both partners work full time in taxed market work and earn the same incomes. Non-labour incomes are zero and no intra-household wage gap. 3-child family HR PIT + family payments excl. supp. .4 .2 MTR .4 0 .2 0 -.2 -.2 MTR .6 .6 .8 .8 2009-10: PIT+ML+LITO+FTB A9 0 50000 100000 Primary income, dollars pa MTR SE MTR2 150000 0 50000 100000 Primary income, dollars pa MTR SE 150000 MTR2 FT MTRs strongly to the left of SE MTRs – joint taxation Individual taxation: FT family pays twice as much tax as SE family Joint taxation: FT family pays more than twice as much tax as SE family 3-child family HR PIT + family payments excl. supp. .2 MTR .4 -.2 -.2 0 0 .2 MTR .4 .6 .6 .8 .8 2009-10: PIT+ML+LITO+FTB A 0 50000 100000 Primary income, dollars pa 0 50000 100000 Primary income, dollars pa MTR2 MTR SE 150000 MTR2 -.4 -.4 -.2 -.2 0 0 ATR ATR .2 .2 .4 .4 .6 .6 MTR SE 150000 0 50000 100000 Primary income, dollars pa ATR SE ATR FT ATR2 150000 0 50000 100000 Primary income, dollars pa ATR SE ATR FT ATR2 150000 3-child family -.4 -.2 0 ATR .2 .4 .6 HR PIT + family payments excl. supp. 0 50000 100000 Primary income, dollars pa ATR SE 2009-10 ATR SE HTR ATR FT 2009-10 ATR FT HTR 150000 2009-10 system: Impact on “in-work” families Quintiles of primary income SE Taxes if zero 2nd earnings Net tax $pa Lost revenue $pa ATR % PT Second earnings $pa Tax on second earnings $a ATR2 % FT Second earnings $pa Tax on second earnings $pa ATR2 % 30386 49122 64534 82842 172722 All -9149 3577 -30.1 -1092 5894 -2.2 5969 6806 9.2 13248 9588 16.0 45135 9685 26.1 10822 7110 13.3 12808 4576 35.7 18385 6106 33.2 19466 5885 30.2 22110 7095 32.1 26046 9588 36.8 19763 6650 33.6 17055 6106 35.8 27744 9006 32.5 36761 11652 31.7 49224 16649 33.8 50486 15809 31.3 36985 11844 32.0 “Lost revenue” - tax on increment in h’hold income due to second earnings. Average of $7110 represents 40 per cent of total income tax revenue collected from working families. 2 TARGETING FALLACY Single person household • Hypothetical economy: average earnings rise from $20,000 in quintile 1 to $200,000 in quintile 5. Fixed labour supplies. • Progressive rate scale funds a universal cash transfer of $20,000. • Reform: government withdraws transfer at 25 cents in dollar above $20,000 to reduce “cost” to tax revenue. Income $pa 1. Pre-reform 2. Reported Reform 3. True reform MTR % Cash transfer MTR % Cash transfer MTR % Cash transfer 20,000 0.0 20,000 0 20,000 0.0 20,000 40,000 25.0 20,000 12.5 15,000 37.5 20,000 60,000 25.0 20,000 12.5 10,000 37.5 20,000 80,000 25.0 20,000 12.5 5,000 37.5 20,000 200,000 50.0 20,000 25.0 0 25.0 20,000 Reform replaces progressive MTRs with an inverted U-shaped scale TARGETING FALLACY Couple households: single and two-earner Household can switch type from single to two-earner. Assume equal split between types: Single-earner household. Male partner as primary earner works full time in the market and the female works full time at home providing child care and related services. Two-earner household: Both partners work full time in the market and buy in substitute services for child care and home production. Primary income rises from $20,000 in quintile 1 to $200,000 in quintile 5. Second income rises from $20,000 in quintile 1 to $100,000 in quintile 5. Pre-reform: progressive individual income tax funds $20,000/household Note increase in tax base with second earner. Universal $20,000 can now be financed by lower MTRs. TARGETING FALLACY Couple households: single and two-earner Reform: government withdraws transfer of $20,000 at a rate of 25 cents in the dollar above a threshold joint income of $20,000. Assuming no behavioural effects, government can claim a “cost” saving of 65 per cent. Single-earner household: MTRs and cash transfers Primary income $pa MTR % 1. Pre-reform Cash transfer MTR % 2. Reported Cash transfer Reform 3. True reform MTR % Cash transfer 20,000 0.0 20,000 0 20,000 0 20,000 40,000 20.0 20,000 7.0 15,000 32.0 20,000 60,000 20.0 20,000 7.0 10,000 32.0 20,000 80,000 20.0 20,000 7.0 5,000 32.0 20,000 200,000 40.0 20,000 14.0 0.0 14.0 20,000 TARGETING FALLACY Couple households: single and two-earner Cash transfer is fully withdrawn at a primary income of $100,000 for the single-earner household, but at only $50,000 for the two-earner household. The much greater loss for the low and average wage two-earner family can be concealed by reporting the reform by household income. Two-earner household: MTRs on 2nd income and cash transfers Second income $pa MTR% 2nd inc 1. Pre-reform Cash transfer MTR% 2nd inc 2. Reported Cash transfer Reform 3. True reform MTR% 2nd inc Cash transfer 20,000 0.0 20,000 0 15,000 25.0 20,000 40,000 20.0 20,000 7.0 5,000 32.0 20,000 60,000 20.0 20,000 7.0 0 7.0 20,000 80,000 20.0 20,000 7.0 0 7.0 20,000 100,000 20.0 20,000 7.0 0 7.0 20,000 WHY TARGETING MAKES NO ECONOMIC SENSE Since 1980s: • Significant widening in underlying inequality • Rise in overall wage level due to productivity gains Q1: Why switch to a less progressive individual income tax? More equal incomes make it harder to redistribute income – need lower elasticities – put simply, most of the income is in the middle and taxing the top other doesn't raise much revenue. This changes with increased inequality and a higher wage level. The top has more income and taxing it raises a lot more revenue. Q2: Why raise taxes on second earners with high wage elasiticities? Reduces female labour supply and household saving. Makes no sense with declining fertility. Declining fertility: Average cost of a child is greater than that of a retiree. Overall per capita cost of dependency falls. 1961 TDR=63.46%; 2050 TDR=66.20 – almost the same. Min. around 2010. From 1961 to 2010 we should have seen large increases in resources for funding education, child care, health, and infrastructure, due to productivity gains and a larger tax base with rising female labour supply and saving. Family tax, poor child care and other policies have undermined this mechanism for redistribution to future generations. Our “ageing crisis” is policy driven. Child 0-14 Working age 15-64 Aged 65+ 3 HR REFORMS Labour supply and saving disincentive effects Time use data show: 1 Allocation of time to home child care, especially by the female partner, is a major form of time use when children are under school age. Choice between home child care and market work + bought in child care drives female (or second earner) labour supply elasticities. 2 High degree of heterogeneity in female time use choices across households with similar demographics and wage rates. 3 Labour supply decisions in the child-rearing phases tend to persist after the children have left home. Expenditure data show: 4 Family income and saving track female labour supply FAMILY LIFE CYCLE Disincentive effects become evident when the data are organised according a family life cycle defined on presence and ages of children, rather than age of “head” as in economics literature. Five phases: 1 pre-child phase 2 child 0 – 4 phase 3 child 5 – 17 phase 4 post-child phase 5 retirement ABS 2005 Time Use Survey - Time uses categories: Labour supply Household production: home child care and domestic work Leisure 0 0 1000 2000 3000 Domestic and child care hours pa 4000 4000 3000 2000 1000 Market hours pa LABOUR SUPPLY AND HOUSEHOLD PRODUCTION 1 2 3 Life cycle phase Male labour supply 4 5 Female labour supply 1 2 3 Life cycle phase Male dom+ccare hrs Male domestic hrs 4 5 Female dom+ccare hrs Female domestic hrs Time use profiles show pivotal relationship between female labour supply and the demand for child care. Phase 1 fall in female labour supply tracks a large rise in home child care hours Male labour supply changes very little. FEMALE LABOUR SUPPLY HETEROGENEITY Preceding profiles represent the “average”. High degree of heterogeneity in female employment emerges in phase 2 and continues to the retirement phase. Phase 1: Pre-children 80 60 0 0 20 40 Frequency % 60 40 20 Frequency % 80 100 100 Phase 2: Child 0-4 0 1-34 Males 35+ 0 Females 35+ Females Phase 4: Post-children 0 60 40 0 20 20 40 60 Frequency % 80 80 100 100 Phase 3: Child 5+ Frequency % 1-34 Males 0 1-34 Males 35+ Females 0 1-34 Males Employment status - phases 1 to 4. 35+ Females “Race to the bottom” Effective rate structure of family taxation defines a non-convex piecewise linear tax system – drives lower average hours and heterogeneity. Two households can be equally well off at either high or low hours, and so small differences in characteristics can be transformed in to large difference in labour supply and, over time, in labour productivity. The HR reform is unsustainable with a rising TDR from around 2010: A change in policy that lifts female labour supply and productivity and, in turn, the tax base, is required to sustain the present levels of family benefits without increasing tax rates. With no change in policy, a rise in tax rates can be expected to contract the tax base further, and set in train a “race to the bottom”. 4 JOINT INCOME: AN UNFAIR TAX BASE Household income is an unreliable measure of living standards when families with similar characteristics make different second earner labour supply choices. The degree of error in a ranking defined on household income (or consumption) will depend on the shape of the distribution of primary income as well as the degree of heterogeneity. To illustrate: we rank households by primary income and split the records in each primary income quintile into two types: • Type H1: second earner works at/below median second earner hours • Type H2: second earner working above median second earner hours Labour supply heterogeneity and ranking errors 0 50000 100000 150000 Takes only a small increase in second earnings to shift the family from a low percentile of household income to a significantly higher point in the distribution. 1 2 4 3 Primary income quintiles Primary H1 Second H1 Primary H2 Second H2 5 To justify using household income at the tax base it is it is necessary to assume either that bought-in child care is costless or that home child care makes little to no contribution to the welfare of the H1 household. Saving Primary income quintiles SE: Saving if zero 2nd earnings H1: Saving $pa 2nd earnings $pa H2: Long term saving 2nd earnings $pa Household income quintiles All: Saving $pa H1: Saving $pa H2: Saving $pa 1 -12306 -11900 2005 -8196 12051 1 -12223 -12209 -12268 2 -6506 -4649 7812 1608 27028 2 -3866 -3821 -3941 3 -1514 358 9323 8005 32832 3 3282 3381 3191 4 3194 5921 12815 15878 42773 4 11509 11664 11428 5 26514 29344 12912 39068 47266 5 37850 38103 37733 All 1575 3423 11227 9681 32457 All 7325 3427 11227 If all second earners withdrew from work after the arrival of children, their annual earnings up to retirement would fall by over 25 per cent. Household saving would fall by over 75 per cent, from an average of $7,325 pa to $1,575. Concluding comment • Female labour is arguably the most mobile factor of production in the economy, because of its high degree of substitutability with household production, mostly child care, in the early phases of the life cycle. • High tax rates can be expected to have large disincentive effects on female labour supply – losses of around 40 per cent Strong negative effects on saving, far more so than a tax on saving directly or a tax on capital income saving of prime working ages couples – losses of around 30 per cent • • A fair and sustainable family tax policy: a strongly progressive individual based income tax and universal family payments.