The Recent Evolution of Regional Economic Disparities: Professor Ron Martin

advertisement

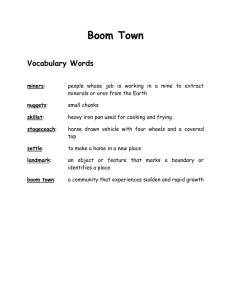

The Recent Evolution of Regional Economic Disparities: From Boom to Bust and Beyond Professor Ron Martin Department of Geography University of Cambridge Newcastle, December 2009 © Ron Martin 1 A Challenging Time for Thinking About Regional Economies • • • • • • • • Rapidly changing global economy The return of ‘boom and bust’ Problem of reforming finance system Prospect of sustained period of substantial public spending cuts Prospect of change in UK government Future of RDAs? The challenge of climate change New developments and debates in regional economic theory 2 A Challenging Time for Thinking About Regional Economies • The dramatic change in economic conditions - from boom to bust - over the past two years poses several questions: Claim is that the ‘longest boom’ on record has been followed by ‘deepest recession’ of post-war period How did the regions fare in the ‘longest boom’? Did regional inequalities narrow? How have regions been hit by the current recession? Are they being affected differently than in previous recessions? 3 A Challenging Time for Thinking About Regional Economies • These questions have provoked debate over regional growth: Boom has encouraged claims about benefits of spatial agglomeration of economic activity for regional growth: that there is a trade-off between regional equity and national economic growth But are such claims valid, and do they ignore the diseconomies of such agglomeration? How far is the pattern of long-run regional growth shaped by successive booms and recessions? Do regions differ in their resilience to major recessions? And how far does a region’s resilience influence 4 its long run growth? The Regional Anatomy of New Labour’s ‘Long Economic Boom’ • • Decade 1997-2007 claimed by New Labour as longest period of ‘non-inflationary continuous expansion’ (‘NICE’) on record Britain is today experiencing the longest period of sustained economic growth since records began in the year 1701 (Gordon Brown, Budget Statement, March 2005). In fact, boom began in 1993, pre-dating New Labour governments 5 The Regional Anatomy of New Labour’s ‘Long Economic Boom’ • Growth of GDP under New Labour was higher than under Thatcher, but lower than the best of the post-war boom Period Average Annual Real Growth Rate (Percent) 1949-1964 2.9 1964-1973 3.3 1973-1979 2.3 1979-1990 2.3 1990-1997 1.9 1997-2007 2.9 Source of data: National Statistics Online, http://www.statistics.gov.uk/statbase/ 6 The Regional Anatomy of New Labour’s ‘Long Economic Boom’ • • Brown repeatedly claimed that New Labour’s economic policies - controlling inflation, maintaining macroeconomic stability through ‘monetary and fiscal prudence’, and promoting productivity - had given economy strong growth fundamentals In fact, growth of UK economy over the ‘NICE’ period was product of several factors: General global expansion Low import prices (especially Indian and Chinese goods) Debt-financed consumer boom, financed by excess of cheap and easy credit And unprecedented asset price inflation in the housing market 7 The Regional Anatomy of New Labour’s ‘Long Economic Boom’ • • Three arguments were advanced to suggest economic growth would be more spatially even than in 1980s: 1. Deindustrialisation of the ‘North’ in 1980s had largely removed the source of that area’s problem (the ‘North-South divide’ was now ‘dead’): “The traditional ‘north-south divide’ unemployment problem has all but disappeared in the 1990s. This may prove to be a permanent development, since the manufacturing and production sectors, the main source of regional imbalance in the past, no longer dominate shifts in the employment structure to the same extent. Future shocks will have a more balanced regional incidence than has been the case in the past” (Jackman and Savouri, 1999). 8 The Regional Anatomy of New Labour’s ‘Long Economic Boom’ • 2. Emergence of ‘New Economy’ would provide all regions and cities with major growth opportunities: Low barriers to entry in many such activities (ICT available everywhere) The regeneration and reconfiguration of cities around ‘soft economy’ of knowledge-based, creative, cultural and service sectors Most cities are major markets for such activities, which can also compete in global markets from almost any location 9 The Regional Anatomy of New Labour’s ‘Long Economic Boom’ • 3. New Labour’s new regional policy model was aimed at raising regional and local growth By promoting and enhancing ‘indigenous potential’ of regions, cities and localities Focusing especially on knowledge-based and creative industries Devolving policy to sub-national levels to ensure delivery responsive to local opportunities and challenges All intended to improve productivity and competitiveness of regions and localities - and hence the national economy - in the global market place 10 The Regional Anatomy of New Labour’s ‘Long Economic Boom’ • • • The aim of New Labour’s regional policy model has been to close the growth gaps between the regions: “to make sustainable improvements in the economic performance of all English regions by 2008 and over the long term reduce the persistent gap in growth rates between the regions, demonstrating progress by 2006…” (DTI PSA Target 7; HM Treasury, Target 2.3; DCLG Target 2). How did the regions fare during the long boom? How much progress was made in ‘reducing the persistent gap in growth rates between the regions’? 11 Regional Cumulative Differential Growth in GDP per Head, 1980-2007 20 Rec'n Thatcher Boom Rec'n Long Boom London 15 South East 10 5 Northern Ireland South West 0 Scotland East Midlands Eastern West Midlands Yorks-Humberside Wales -5 -10 North West -15 North East 2006 2004 2002 2000 1998 1996 1994 New Labour 1992 1990 1988 1984 1982 -20 1986 Conservative 1980 Cumulative Differential Growth (from UK Average) in GDP per Head (2000 Prices) The Regional Anatomy of New Labour’s ‘Long Economic Boom’ Source of data: Cambridge Econometrics and Eurostat (2007 estimated) 12 The Regional Anatomy of New Labour’s ‘Long Economic Boom’ Average Annual Growth in Real GDP per Capita (Percent), 1997-2007 The Uneven Boom: Pulling Ahead and Falling Behind, 1997-2007 3.4 CATCHING UP PULLING AHEAD 3.2 South East 3 London South West N. Ireland 2.8 UK Average 2.77 Eastern 2.6 East Midlands North West Yorks-Humber 2.4 North East Wales 2.2 Scotland FALLING BEHIND West Midlands LOSING GROUND 2 60 80 100 120 140 Relative GDP per Capita, 1997 (UK=100) 160 13 The Regional Anatomy of New Labour’s ‘Long Economic Boom’ The Growth in Regional Inequalities (Disparities in GDP per head), 1980-2006 NUTS1 Regions NUTS2 Regions NUTS3 Regions 0.75 3.54 3.53 0.7 3.52 0.65 3.51 0.6 3.5 3.49 0.55 3.48 0.5 3.47 0.45 3.46 Long Boom Thatcher Boom 2006 2004 2002 2000 1998 1996 1994 1992 1990 1988 1986 1984 3.45 1982 0.4 Coefficient of Variation (Population Weighted) NUTS3 Regions 3.55 1980 Coefficient of Variation (Population Weighted) NUTS1 and NUTS2 Regions 0.8 Source of data: Cambridge Econometrics and Eurostat 14 The Regional Anatomy of New Labour’s ‘Long Economic Boom’ • • • • • Between 1980 and 1997, London had gained a 22 percent cumulative growth advantage over the North East and North West; and the South East an 18 percent advantage By 2007 this had increased to 30 percent in the case of London, and 25 percent in the case of the South East In general, the long boom produced divergent differential growth trajectories across the regions Some suggestion that regional growth advantage of London and South East may have stabilised after 2003 (as it did at end of Thatcher boom) But no evidence, overall, that regional growth gaps 15 were reduced during the long boom The Regional Anatomy of New Labour’s ‘Long Economic Boom’ • • • • • Nature of the boom helps explain its regional complexion Led particularly by rapid expansion in financial and business services Based mainly in London and South East, which already had comparative advantage in these sectors Whereas northern regions more dependent on public sector for their growth This difference also reflected in regional differences in productivity growth and wage growth 16 Banking & finance Other business services Transport & commsunications Retailing Hotels & catering Other services Distribution Conctruction Education & health Manufacturing Public admin. & defence Mining & quarrying Percentage Growth in Gross Value Added (2003 Prices) Finance and Banking in the Boom: Growth in GVA, 1993-2007 200 150 100 50 0 -50 17 South West North East Northern Ireland Wales East Midlands West Midlands Yorkshire-Humberside Source of data: Cambridge Econometrics Scotland Eastern North West South East London Percent Share of National Growth in Gross Value Added in Financial and Business Services (2003 prices) London’s Dominance of the Financial Services Boom, 1993-2007 40 35 30 25 20 15 10 5 0 -5 18 Different Modes of Regional Growth? 100 Total Growth in Regional GVA (Current prices) Public Sector Share of Total Growth 80 70 60 50 40 60 30 40 20 0 20 10 0 Public Sector Share of Growth (Percent) 120 Lo nd So on ut h Ea So st ut h W es N t Ir el an Ea d Ea st st er n M id W la es nd t M s id Yo l an rk sds H um N be or r th W es t W al Sc es ot la N nd or th Ea st Growth of Regional GVA, 1997-2006 Current Prices, Percent Economic expansion in high growth regions has been much more private sector based, and vice versa in slower growing regions Source of data: National Statistics Online,http://www.statistics.gov.uk/statbase/ 19 Regional Divergence in Productivity, 1997-2006 (Relative to UK) 35 30 25 20 15 10 1997 2000 2003 2006 5 0 Source of data: ONS and Cambridge Econometrics -5 -10 -15 N ot h Ea or st Yo th W rk es sH t Ea um st be M r W id es la nd t M s id la nd Ea s st er Lo n So ndo n ut h So E ut ast h W es t W a Sc les ot la n N Ir d el an d -20 N GVA per Worker Relative to UK (Percent Differential) London and South East pulled ahead; Eastern and South West regions achieved some catch up; but all other regions fell behind 20 Ea N st or Yo th rk sW H es um t be Ea rs id st e M i d W la es nd t s M id la nd s Ea st er n Lo nd on So ut h Ea So st ut h W es t W al es Sc ot la nd N Ir el an d or th N Gross Average Weekly Earnings Relative to UK (Percent Differential) Gross Average Weekly Earnings by Region, 1998 and 2007 50 40 30 1998 2007 20 10 0 -10 -20 Source of data: National Statistics Online, http://www.statistics.gov.uk/statbase/ 21 The Regional Anatomy of New Labour’s ‘Long Economic Boom’ • • • • • Together with the infiltration of NEG ideas, the long boom exerted influence on Government thinking on regional disparities NEG focuses on increasing returns affects of regional/spatial agglomeration of economic activity Theory argues that national growth enhanced by regional concentration of economic activity That there may be an ‘equilibrium level of regional disparity consistent with maximising national growth’ And that a ‘trade-off’ may thus exist between national growth and reducing regional disparities 22 The Regional Anatomy of New Labour’s ‘Long Economic Boom’ • We find the Treasury claiming that: “Theory and empirical evidence suggests that allowing regional concentration of economic activity will increase national growth. As long as economies of scale, knowledge spillovers and a local pool of skilled labour result in productivity gains that outweigh congestion costs, the economy will benefit from agglomeration, in efficiency and growth terms at least… policies that aim to spread growth amongst regions are running counter to the natural growth process and are difficult to justify on efficiency grounds, unless significant congestion costs exist” (HM Treasury, 2006) 23 The Regional Anatomy of New Labour’s ‘Long Economic Boom’ • And a more extreme, but not unrelated, view expressed by the Tory think tank, Policy Exchange: “There is no realistic prospect that our [northern] regeneration towns can converge with London and the South East. There is, however, a very real prospect of encouraging significant numbers of people to move from those towns to London and the south East… The implications of economic geography for the south and particularly South East are clear. Britain will be unambiguously richer if we allow more people to live in London and its hinterland. In addition, Oxford and Cambridge should the prime cities to see significant… expansion” (Cities Unlimited, Policy Exchange, 2008). 24 The Regional Anatomy of New Labour’s ‘Long Economic Boom’ • • • • • Despite its formal complexity, NEG theory is highly simplified view of regional development Which limits its plausibility and applicability as a basis for regional policy ‘Trade-off’ is therefore open to debate conceptually and empirically Further, one major effect of regionally imbalanced growth in UK has been periodic emergence of inflationary pressure in London/South East Precisely what happened over 1997-2007 which saw unprecedented house price bubble originate in these core regions 25 How London and South East Led the House Price Bubble (Average Dwelling Price) East Anglia East Midlands Greater London South West West Midlands North West North Yorks-Humberside South East Northern Ireland Scotland Wales Bubble begins in 300,000 250,000 200,000 150,000 London and South East 100,000 50,000 Bubble begins in North Source of data: www.hbosplc.com/economy/historicaldata 2008 2007 2006 2005 2004 2003 2002 2001 2000 1999 1998 1997 1996 1995 1994 1993 1992 1991 1990 1989 1988 1987 1986 1985 1984 0 1983 Average House Price (£), Seasonally Adjusted 350,000 26 How London and South East Led the Mortgage Boom 45,000 South East 40,000 Greater London North West 35,000 Yorkshire and Humberside East Midlands 30,000 East Anglia South West West Midlands 25,000 Wales Scotland 20,000 Northern Ireland 15,000 10,000 5,000 Source of data: Council of Mortgage Lenders 2008 2007 2006 2005 2004 2003 2002 2001 2000 1999 1998 1997 1996 1995 1994 1993 1992 1991 1990 1989 1988 1987 1986 1985 1984 0 1983 Value of Mortgage Advances (£million) Northern 27 From Boom to Bust: The Regional Anatomy of the Recession • • • • • • In output terms, current recession has been faster than either 1990-92 or 1979-83 And deeper than 1990-92 But may prove shorter-lived than both In employment terms, decline has been less than expected given drop in output Employment decline less pronounced than either of past two recessions Suggests that firms have hoarded labour more (and workers more prepared to take wage and hours cuts) 28 From Boom to Bust: The Regional Anatomy of the Recession How does the current recession compare? - GDP (2005 prices) 102 98 96 94 1979(2)-1981(4) 1990(2)-1992(2) 2008(1)- 92 90 18 17 16 15 14 13 12 11 10 9 8 7 6 5 4 3 2 88 1 Peak Quarter = 100 100 Quarters from Beginning of Recession Source of data: National Statistics Online, http://www.statistics.gov.uk/statbase/ 29 From Boom to Bust: The Regional Anatomy of the Recession How does the current recession compare? Employment 102 Peak Quarter =100 100 98 96 1979(4) -1983(1) 1990(2)-1992(4) 2008(1)-2009(2) 94 92 90 37 35 33 31 29 27 25 23 21 19 17 15 13 11 9 7 5 3 1 88 Quarters from Beginning of Recession Source of data: National Statistics Online, http://www.statistics.gov.uk/statbase/ 30 From Boom to Bust: The Regional Anatomy of the Recession • • • • • • Initially, talk was about the epicentre of the recession being in London as this was key node in financial crisis Predicted that London would lose at 70,000-100,000 financial jobs With negative multiplier effects on other jobs in London economy and surrounding areas in South East Also argued that the structural shifts of 1980s and 1990s removed much of the traditional vulnerability of northern regions to economic shocks And others have argued that the growing dependence of northern regions on public sector activity during the 1990s and 2000s should shield them from the worst of the recession Estimated that 66 percent of output in North East, and 70 percent in Wales, accounted for by State sector, compared to 36 percent in South East 31 A Manufacturing rather than Financial Services Recession Gross Value Added (2003-3 =100) 130 Fall in GVA 2008(1) to 2009(1) = 2.0% 125 120 115 Fall in GVA 2008(1) to 2009(1) = 3.0% 110 105 100 Fall in GVA 2008(1) to 2009(1) = 13.7% 95 90 Manufacturing 85 All Services Financial and Business Services 2009-1 2008-3 2008-1 2007-3 2007-1 2006-3 2006-1 2005-3 2005-1 2004-3 2004-1 2003-3 80 Source of data: National Statistics Online, http://www.statistics.gov.uk/statbase/ 32 From Boom to Bust: The Regional Anatomy of the Recession • What can we say about the regional impact of the recession thus far? Output decline has been more severe than employment decline Full employment impact across regions probably not yet felt But impact has been regionally uneven London has fared much better than predicted Midlands and North East hit harder than elsewhere These patterns have left regional unemployment disparities largely unaltered, with rate in North East double that in South East 33 Regional Impact of the Recession Output 2008(1)- 2009(2) Percent Change Employment 2008(1)- 2009(2) Percent Change London -4.8 -1.9 South East -4.9 -2.9 Eastern -4.8 1.3 South West -5.0 -2.5 West Midlands -8.2 -3.4 East Midlands -7.6 -4.4 Yorks-Humber -7.3 -3.5 North West -6.7 -2.3 North East -8.6 -3.6 Wales -6.9 -1.8 Scotland -4.7 -2.4 Ireland -5.3 NA Sources of data: Experian (Output estimates) and ONS (Employment) 34 The Regional Impact of the Recession: Unemployment Rate, 2007-2009 East South East 7.0 London South West East Midlands 6.0 West Midlands Yorks-Humberside North West 5.0 North East Wales 4.0 Scotland 3.0 2.0 1.0 -0 M 7 ar M 07 ay -0 7 Ju l0 Se 7 p07 N ov -0 Ja 7 n0 M 8 ar M 08 ay -0 8 Ju l0 Se 8 p08 N ov -0 Ja 8 n0 M 9 ar M 09 ay -0 9 Ju l0 Se 9 p09 0.0 Ja n Unemployment Rate (Claimant Count) 8.0 Source of data: National Statistics Online, http://www.statistics.gov.uk/statbase/ 35 From Boom to Bust: The Regional Anatomy of the Recession • Some Questions How does the regional impact of this recession compare to previous recessions? How quickly will the regions recover? Will some regions (eg London, South East, Eastern) recover sooner than others (eg Midlands, North West, North East)? Such questions raise the interesting issue of the economic ‘resilience’ of the regions 36 Comparing the Current Recession with Previous Downturns - Output (GVA, 2005 prices) Percent Change 1979-82 1990-92 London -5.3 -2.1 -4.8 South East -1.4 -1.0 -4.9 Eastern -2.2 -1.2 -4.8 South West -1.0 -1.6 -5.0 West Midlands -9.6 -1.2 -8.2 East Midlands -2.6 -1.1 -7.6 Yorks-Humber -1.3 -1.0 -7.3 North West -5.6 -0.9 -6.7 North East -3.6 -1.1 -8.6 Wales -5.5 -1.0 -6.9 Scotland -1.1 -0.1 -4.7 N Ireland -3.2 -0.3 -5.3 Source of data: Cambridge Econometrics and Experian 2008(1)2009(2)* *=Estimate 37 Comparing the Current Recession with Previous Downturns - Employment Percent Change 1979(4)1983(1) 1990(2)1992(4) 2008(1)2009(2) London -6.6 -11.2 -1.9 South East -2.2 -8.6 -2.9 Eastern -1.3 -7.5 1.3 South West -1.4 -4.6 -2.5 West Midlands -8.1 -9.6 -3.4 East Midlands -4.8 -5.2 -4.4 Yorks-Humber -8.0 -6.2 -3.5 North West -11.1 -5.7 -2.3 North East -11.8 -5.2 -3.6 Wales -10.4 -2.6 -1.8 Scotland -8.3 -1.3 -2.4 N Ireland -4.0 -1.0 NA Source of data: National Statistics Online, http://www.statistics.gov.uk/statbase/ 38 From Boom to Bust: The Regional Anatomy of the Recession • • Regions have not reacted in consistent way (in terms of employment) to last three recessions Pattern of response has varied: • • • • • Early-1980s recession most pronounced in industrial regions of North Early-1990s recession most pronounced in London, South East and West Midlands Current recession more mixed pattern, though London least affected, and North East and West Midlands more affected Does the severity of a region’s response to recession influence its recovery? Is a region’s reaction to recession influenced by its preceding growth phase? 39 The Issue of Regional Resilience • • • The notion of ‘resilience’ is relevant to such questions Resilience idea is attracting growing interest in regional studies (and indeed in other disciplines, where there is concern over how complex systems respond to shocks) Resilience - Latin resilire, “to leap back or rebound” the ability of a system to ‘recover form and position elastically’ following a shock or disturbance of some kind: “the ability of a region to recover successfully from shocks to its economy that either throw it off its growth path or have the potential to throw it off its growth path” (Hill et al, 2008) 40 The Issue of Regional Resilience • • • • But idea of resilience is not unambiguous Should notion refer not just to ability of regional economy to recover from a shock, but also the degree of resistance to the shock in the first place? Further, does the concept refer to the ability of a regional economy to retain its structure and function despite the shock to it; or to the ability of a region economy to change its structure and function rapidly and successfully in response to a shock - that is regional economic adaptability? Also does the resilience of a regional economy change over time? 41 The Issue of Regional Resilience • Two definitions in evolutionary ecology (where concept of resilience originated) • • • 1. ‘Engineering resilience’: stability of a system near an equilibrium or steady state, where resistance to disturbance and the speed of return to the pre-existing equilibrium are key 2. ‘Ecological resilience’: the magnitude of the shock of disturbance that can be absorbed before the system changes its structure and function and becomes shaped by a different set of processes - ie movement of system to new equilibrium (steady) state Both have counterparts in mainstream economics - (1) self-correcting return to unique equilibrium, and (2) hysteretic shift to new equilibrium (linked to idea of multiple equilibria) 42 Stylised Responses of a Regional Economy to a Major Shock Source: Martin and Simmie (2009) 43 The Issue of Regional Resilience • • Regions have had different, divergent long-run growth paths over past 40 years Consider long-run paths of employment growth in South East and North East: Between 1971 and 2007 South East increased its • • employment by 50 percent Over same period employment in North East showed no overall increase And the two regions have had quite different patterns of response to and recovery from successive recessions These patterns help explain the long-run divergence in employment between the two regions 44 Long Run Divergent Regional Growth, 1971(1)-2009(2) (GVA in 2005 prices, 1971(1)=100) 350 GVA 1971(1)=100 300 250 South East North East North West Eastern East Midlands West Midlands Yorks-Humber 200 150 100 19 71 19 Q1 73 19 Q1 75 19 Q1 77 19 Q1 79 19 Q1 81 19 Q1 83 19 Q1 85 19 Q1 87 19 Q1 89 19 Q1 91 19 Q1 93 19 Q1 95 19 Q1 97 19 Q1 99 20 Q1 01 20 Q1 03 20 Q1 05 20 Q1 07 20 Q1 09 Q 1 50 Source of data: Experian 45 Long Run Divergent Employment Growth, 1971-2007 (1971=100) 160 South East North East East Midlands West Midlands Eastern Yorks-Humber North West Employment Index 1971=100 150 140 130 120 110 100 90 80 70 Source of data: Cambridge Econometrics 2007 2005 2003 2001 1999 1997 1995 1993 1991 1989 1987 1985 1983 1981 1979 1977 1975 1973 1971 60 46 Contrasting (and Evolving) Regional Economic Resilience? South East and North East Source of data: Cambridge Econometrics 47 Manufacturing Employment Across Recessions and Recoveries: South East and North East 120 Recession Recession South East North East 80 60 40 20 2007 2004 2001 1998 1995 1992 1989 1986 1983 1980 1977 1974 0 1971 Employment 1971=100 100 48 Service Employment Across Recessions and Recoveries: South East and North East 200 150 125 100 South East North East 75 2007 2005 2003 2001 1999 1997 1995 1993 1991 1989 1987 1985 1983 1981 1979 1977 1975 1973 50 1971 Employment 1971=100 Recession Recession 175 49 The Issue of Regional Resilience • • • • • • In both regions, jobs lost in manufacturing in recessions have not been regained in subsequent booms Key difference is that South East has more than compensated by strong growth in service activities in the booms Put another way, South East economy has adapted much more and faster Adaptation in response to shocks is central to resilience Suggest we need to give much more attention to how regional economies adapt over time Increasing interest in adaptive growth within evolutionary economics - though as yet no definitive model or theory 50 The Issue of Regional Resilience • What makes for a resilient (adaptive) regional economy? Hysteretic and path dependence effects Economic diversity Skill and educational levels of workforce Innovative capacity Business and industry creation capacity Quality of infrastructures Institutional arrangements Influence over national economic policy priorities and spending 51 Conclusions • • • • Despite ‘long boom’, no convergence of regional growth rates or incomes Little progress towards New Labour’s regional policy aim to “reduce the persistent gap in growth rates between the regions…” (DTI PSA Target 7; HM Treasury, Target 2.3; DCLG Target 2) Even if growth rates could be equalised across regions, (ie growth rates of northern regions raised to those of South East and London), regional disparities in GDP per head would continue to widen Current recession looks as though it will further frustrate that aim 52 Conclusions • • • • • • Major differences in economic resilience across regions South East and London seem more able to recover from recessions - more adaptable economies Likelihood is that these regions will pull away faster than other regions from the current recession The task confronting regional policy remains as challenging as ever Need to question the increasing agglomeration of economic activity in London and South East And grip of London and South East over national policy 53 54 National Growth and Regional Disparity in NEG Theory National Growth SS g* g1 A1 A* Agglomeration r1 RR r* Regional Income Inequality 55 An ‘Adaptive Cycle’ Model of Regional Economic Resilience Reorganisation Phase of restructuring Emergence of new sectors Accumulation – low and varied Connectedness – low Resilience (adaptability) - increases Conservation Phase of stability and increasing rigidity Inertia of established sectors Accumulation – slows Connectedness – high Resilience (adaptability) - declines Shock Exploitation Phase of growth and seizing of opportunities Rapid growth of new sectors Accumulation – fast and focused Connectedness – low and rising Resilience (adaptability) - high Release Phase of contraction Sectors decline Accumulation – disinvestment Connectedness – declines Resilience (adaptability) - low 56 Gross Average Household Income and Poverty Rate by Postcode District, 2006 Source of data: CACI Equivalised Average Household Income (£000s) before tax and including benefits Percent Households with incomes less than 60% UK median 57 From Boom to Bust: The Regional Anatomy of the Recession “The traditional ‘north-south divide’ unemployment problem has all but disappeared in the 1990s. This may prove to be a permanent development, since the manufacturing and production sectors, the main source of regional imbalance in the past, no longer dominate shifts in the employment structure to the same extent. Future shocks will have a more balanced regional incidence than has been the case in the past” (Jackman and Savouri, 1999, p. 27). “Newcastle and areas like that have a large public sector which will at least shield traditionally very depressed areas from the battering the South East is going to get” (Vince Cable, Liberal Democrat Treasury Spokesman, 2009) 58