Chapter 10 Introduction to Ratio Analysis

advertisement

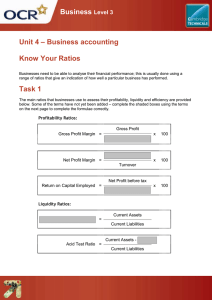

Chapter 10 Introduction to Ratio Analysis Introduction A major purpose of accounting is to provide useful information to make informed decisions. One way to assist with this is to examine financial ratios. A financial ratio matches two or more pieces of monetary data and presents them in the form of a percentage, proportion, or in relation to a period of time (e.g. per month, per quarter, per year). Profitability Ratios These measure the firm’s potential to obtain and maintain revenues that exceed expenses. Examples include: – – – – Gross mark-up Gross margin Net profit margin Return on capital employed Liquidity Ratios These measure the firm’s ability to meet its short term debts as they arise. Examples include: – – – – – Current ratio Acid-Test ratio Debtors’ turnover Creditors’ turnover Rate of stockturn Stock Turnover (Turnover) Ratio Cost of sales ÷ Average stock, where Average stock= (Opening stock + Closing stock) ÷ 2 Measures the speed at which merchandise is sold. It may be shown in “times” or “days”. Current (Working Capital) Ratio Current assets ÷ Current liabilities A test of the ability to pay short term debts as they arise. Acid-test (Quick) Ratio Current assets (less closing stock) ÷ Current liabilities A better test of the ability to pay short term debts as they arise. Debtors’ Turnover Ratio Closing debtors (before provision for bad debts) ÷ Net sales Demonstrates how quickly money has been received from debtors. Creditors’ Turnover Ratio Closing creditors ÷ Net purchases The speed at which creditors are being paid the amount owed to them. Gross Margin Ratio Gross profit ÷ Net sales The value of gross profit being earned from every dollar of sales. Gross Mark-up Ratio Gross profit ÷ Cost of sales The value of gross profit being generated from every dollar spent on getting the items in a state suitable for sales. Net Profit Ratio Net profit (before interest and tax) ÷Net sales x 100 The value of net profit being earned from every dollar of sales. Return On Capital Employed (ROCE) Net profit (before interest and tax) ÷ Capital employed x 100 For an unincorporated business, the capital employed = (Opening Capital + Closing Capital)÷2 This percentage is the overall test of management's ability to efficiently utilise its scarce resources.