CHAPTER 10 Measuring and Managing Translation and Transaction Exposure EASY (factual)

advertisement

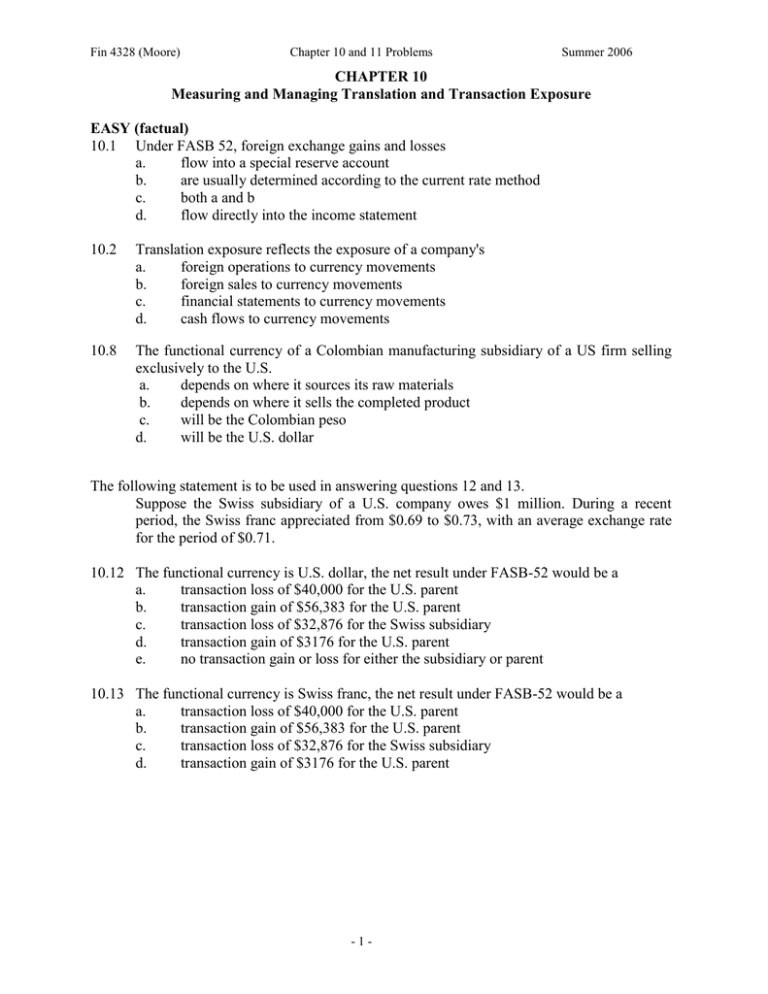

Fin 4328 (Moore) Chapter 10 and 11 Problems Summer 2006 CHAPTER 10 Measuring and Managing Translation and Transaction Exposure EASY (factual) 10.1 Under FASB 52, foreign exchange gains and losses a. flow into a special reserve account b. are usually determined according to the current rate method c. both a and b d. flow directly into the income statement 10.2 Translation exposure reflects the exposure of a company's a. foreign operations to currency movements b. foreign sales to currency movements c. financial statements to currency movements d. cash flows to currency movements 10.8 The functional currency of a Colombian manufacturing subsidiary of a US firm selling exclusively to the U.S. a. depends on where it sources its raw materials b. depends on where it sells the completed product c. will be the Colombian peso d. will be the U.S. dollar The following statement is to be used in answering questions 12 and 13. Suppose the Swiss subsidiary of a U.S. company owes $1 million. During a recent period, the Swiss franc appreciated from $0.69 to $0.73, with an average exchange rate for the period of $0.71. 10.12 The functional currency is U.S. dollar, the net result under FASB-52 would be a a. transaction loss of $40,000 for the U.S. parent b. transaction gain of $56,383 for the U.S. parent c. transaction loss of $32,876 for the Swiss subsidiary d. transaction gain of $3176 for the U.S. parent e. no transaction gain or loss for either the subsidiary or parent 10.13 The functional currency is Swiss franc, the net result under FASB-52 would be a a. transaction loss of $40,000 for the U.S. parent b. transaction gain of $56,383 for the U.S. parent c. transaction loss of $32,876 for the Swiss subsidiary d. transaction gain of $3176 for the U.S. parent -1- Fin 4328 (Moore) Chapter 10 and 11 Problems Summer 2006 The following information is to be used in answering questions 14-17. Ajax Manufacturing's German subsidiary has the following balance sheet: Cash, marketable securities Accounts receivable Inventory (at market. Fixed Assets DM 250,000 1,000,000 2,700,000 5,100,000 ----------------DM 9,050,000 Current liabilities Long-term debt Equity Total liabilities plus equity DM 750,000 3,400,000 4,900,000 --------------DM 9,050,000 Total assets Suppose the DM appreciates from $0.70 to $0.76 during the period. 10.14 Under the current/noncurrent method, what is Ajax's translation gain (loss).? a. a gain of $294,000 b. a gain of $192,000 c. a loss of $174,000 d. a loss of $12,000 10.15 Under the temporal method, what is Ajax's translation gain (loss).? a. a gain of $294,000 b. a gain of $192,000 c. a loss of $174,000 d. a loss of $12,000 10.16 Under the current rate method, what is Ajax's translation gain (loss).? a. a gain of $294,000 b. a gain of $192,000 c. a loss of $174,000 d. a loss of $12,000 10.21 Hedging cannot provide protection against ________ exchange rate changes. a. expected b. nominal c. real d. pegged 10.22 The basic hedging strategy involves a. reducing hard currency assets and soft currency liabilities b. increasing hard currency liabilities and soft currency assets c. reducing soft currency assets and hard currency liabilities d. converting soft currencies to hard currencies and lending hard currencies 10.23 Firms that attempt to reduce risk and beat the market simultaneously may end up with a. more risk, not less b. less risk c. a profit as well as reduced risk d. a loss as well as reduced risk -2- Fin 4328 (Moore) Chapter 10 and 11 Problems Summer 2006 10.25 In a forward market hedge, a company that is long a foreign currency will ____ the foreign currency forward. a. buy b. sell c. borrow d. lend 10.26. A ________ involves simultaneously borrowing and lending activities in two different currencies to lock in the currency’s value of a future foreign currency cash flow. a. forward contract b. currency collar c. money-market hedge d. currency option 10.27 A __________ involves offsetting exposures in one currency with exposures in the same or another currency, where exchange rates are expected to move in such a way that losses on the first exposed position should be offset by gains on the second currency exposure and vice versa. a. forward contract b. currency collar c. money-market hedge d. currency option MODERATE 10.28 Which of the following is NOT a basic hedging technique during a depreciation? a. buy local currency forward b. sell a local currency put option c. reduce levels of local currency cash and marketable securities d. loosen credit (increase local currency receivables) 10.31 American Airlines hedges a £2.5 million receivable by selling pounds forward. If the spot rate is £1 = $1.73 and the 90-day forward rate is $1.7158, what is American's cost of hedging? a. $142,000 b. $35,500 c. $8,875 d. it is unknown at the time American enters into its hedge 10.33 Suppose PepsiCo hedges a ¥1 billion dividend it expects to receive from its Japanese subsidiary in 90 days with a forward contract. The current spot rate is ¥150/$1 and the 90-day forward rate is ¥149/$1. If the spot rate in 90 days is ¥154/$, how much has this forward market hedge cost PepsiCo? a. $173,160 b. $44,743 c. Pepsi gains $173,160 from the forward contract d. Pepsi gains $217,903 from the forward contract -3- Fin 4328 (Moore) Chapter 10 and 11 Problems Summer 2006 DIFFICULT 10.34 If you fear the dollar will rise against the Spanish peseta, with a resulting adverse change in the dollar value of the equity of your Spanish subsidiary, you can hedge by a. selling pesetas forward in the amount of net assets b. buying pesetas forward in the amount of net assets c. reducing the liabilities of the subsidiary d. selling pesetas forward in the amount of total assets 10.35 On March 1, Bechtel submits a franc-denominated bid on a project in France. Bechtel will not learn until June 1 whether it has won the contract. What is the most appropriate way for Bechtel to manage the exchange risk on this contract? a. b. c. d. sell the franc amount of the bid forward for U.S. dollars buy French francs forward in the amount of the contract buy a put option on francs in the amount of the franc exposure sell a call option on francs in the amount of franc exposure CHAPTER 11 MEASURING AND MANAGING ECONOMIC EXPOSURE 11.2 Economic exposure is based on the extent to which the ______ of the firm will change when exchange rates change. a. value b. current assets c. long-term liabilities d. competitive advantages 11.4 With respect to home currency (HC) appreciation, the key issue for a domestic firm is its degree of ____. a. market share b. product differentiation c. marketing plan d. pricing flexibility 11.5 In the face of exchange rate volatility, developing a pricing strategy must address two key issues: a. market selection and segmentation b. market share and selection c. market share and profit margin d. market share and segmentation 11.7 During periods of exchange rate volatility, firms dealing in _______ products face more exchange rate risk than the firms selling _________ products. a. low demand, high demand a. low supply, high supply c. undifferentiated, differentiated d. differentiated, undifferentiated -4- Fin 4328 (Moore) 11.8 Chapter 10 and 11 Problems Summer 2006 With respect to production management of exchange risk, ________ and plant location are the principal variables that companies may change to manage the risk. a. product innovation b. product retirement c. market selection d. product sourcing MODERATE (applied) 11.12 A weak dollar will a. force American exporters to raise their foreign currency prices b. enable American importers to reduce their dollar costs c. enable American exporters to improve their profit margins d. cost American exporters market share abroad 11.13 A company producing an undifferentiated product and competing with internationally diversified competitors will face a relatively high___ for its products and possess a relatively low degree of ________. a. price elasticity of demand, pricing flexibility b. demand, pricing flexibility c. regulatory constraint, efficiency d. none of the above 11.14 Which one of the following would NOT be an appropriate response for a U.S. exporter to appreciation of the dollar? a. raise the foreign currency price if the dollar appreciation was expected to be temporary and the cost of regaining market share was minimal b. move some production offshore if the appreciation were expected to persist for an extended period c. keep the foreign currency price constant if demand is quite elastic d. hire more local workers and subcontractors 11.16 Which of the following strategies assumes that the MNC has already collected a portfolio of different facilities world wide? a. production shifting b. product innovation c. product sourcing d. raising productivity 11.17 When we examine operating exposure, the key issue for a domestic firm is its a. prior import competition b. pricing flexibility c. asset valuation adjustment d. low import content -5- Fin 4328 (Moore) Chapter 10 and 11 Problems Summer 2006 DIFFICULT (applied) 11.19 A company producing an undifferentiated product and competing with internationally diversified competitors will face a relatively __ price elasticity of demand for its products and possess a relatively ___ degree of pricing flexibility. a. high, low b. low, low c. low, high d. high, high 11.20 The appropriate response for a U.S. exporter to appreciation of the dollar would be to a. raise the foreign currency price if the dollar appreciation was expected to be temporary and the cost of regaining market share was minimal b. move some production offshore if the appreciation were expected to persist for an extended period c. keep the foreign currency price constant if demand is quite elastic d. all of the above 11.21 Suppose McDonald's charges Ptas. 25 for a burger in Madrid. Its costs are Ptas. 18 per burger and these costs are not expected to change with the exchange rate. If the peseta devalues from $0.107 to $0.096, what price will McDonald's have to charge for its burgers to maintain its dollar profit margin? a. Ptas. 25.80 b. Ptas. 27.86 c. Ptas. 22.43 d. Ptas. 24 11.22 Suppose Apple is selling Macintosh computers in Germany for DM 5,500 when the exchange rate is DM 1 = $0.68. If the DM rises to $0.71, what price must Apple charge to maintain its dollar unit revenue? a. DM 5,147 b. DM 6,361 c. DM 5,743 d. DM 5,268 11.24 In the face of an appreciating yen, Toyota should consider a. investing in U.S. production facilities b. raising its research and development investment c. coming out with new cars targeted at the low end of the market d. a and b only 11.25 A U.S. exporter that anticipates an appreciation of the dollar should a. sell foreign currencies forward b. borrow foreign currencies c. scout out possible foreign production sites d. consider raising dollar prices on exports -6- Fin 4328 (Moore) Chapter 10 and 11 Problems Summer 2006 11.28 Shorter product cycles can improve currency risk management by allowing the firm to a. incorporate more up-to-date technology in its products b. respond more quickly to changing market conditions c. reduce the average price elasticity of demand d. all of the above 11.29 Nissan, the Japanese car manufacturer, exports a substantial fraction of its output to the United States. What financial measures would be suitable for Nissan to take to reduce its currency risk? a. borrow only yen to finance its operations b. borrow dollars to finance part of its operations c. sell yen forward in the amount of its annual shipments to the U.S. d. buy yen forward in the amount of its annual shipments to the U.S. -7-