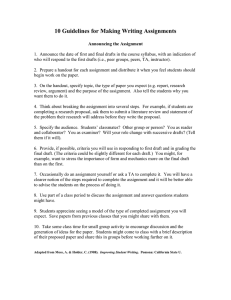

The Trade Cycle Exporter Importer Financing Foreign Trade

Finance 4328 (Moore) Chapter 18 Notes

Financing Foreign Trade

Chapter 18 Notes

The Trade Cycle and Risk

Exporter

Contract

Production

Types of Risk

Preshipment

Shipment

Postshipment

The Trade Cycle

Land Transport

Port of Departure

Importer

Port of Destination

Sea Transport

Land Transport and Delivery

Final Payment

Customs!

The Transaction over Time

7

- 1 -

Finance 4328 (Moore) Chapter 18 Notes

PAYMENT TERMS

I. PAYMENT TERMS

A. Four Principal Means:

1. Cash in advance

2. Letter of Credit

3. Drafts

4. Open Account

B. Cash in Advance

1. Minimal risk to exporter

2. Used where there is:

a. Political unrest

b. Goods made to order

c. New and unfamiliar customer

C. Letter of Credit (L/C)

1. A letter addressed to seller

a. Written and signed by buyer’s bank

b. Promising to honor seller’s drafts.

c. Bank substitutes its own commitment

d. Seller must conform to terms

2. Advantages of an L/C to Exporter

a. Eliminates credit risk

b. Pre-shipment risk protection

3. Advantages of L/C to Importer

a. Shipment assured.

b. Documents inspected.

c. May allow better sales terms.

d. Relatively low-cost financing.

e. Easy cash recovery if discrepancies arise.

4. Types of L/Cs

a. Documentary

b. Irrevocable

c. Confirmed

- 2 -

Finance 4328 (Moore) Chapter 18 Notes

D. DRAFTS

1. Definition:

- Unconditional order in writing

- Exporter’s order for importer to pay

- At once (sight draft) or

- In future (time draft)

2. Three Functions of Drafts

a. Clear evidence of financial obligation.

b. Reduced financing costs.

c. Can be a financial product for investors.

(i.e. May be converted to a banker’s acceptance)

3. Types of Drafts

a. Sight

b. Time

E. OPEN ACCOUNT

1. Creates a credit sale

2. To importer’s advantage

3. More popular lately because

a. Major surge in global trade.

b. Credit information improved.

c. More global familiarity with exporting.

4. Benefits of Open Accounts:

a. Greater flexibility in making a trade.

b. Lower transactions costs.

5. Major disadvantage:

- Highly vulnerable to government currency controls.

- 3 -

Finance 4328 (Moore) Chapter 18 Notes

DOCUMENTS

II. DOCUMENTS USED IN INT’L TRADE

A. Three most used documents

1. Bill of Lading (most important)

2. Commercial Invoice

3. Insurance Certificate

B. Bill of Lading

Three functions:

1. Acts as a contract to carry the goods.

2. Acts as a shipper’s receipt

3. Establishes ownership over goods if negotiable type.

C. COMMERCIAL INVOICE

Purpose:

1. Lists full details of goods shipped

2. Names of importer/exporter given

3. Identifies payment terms

4. List charges for transport and insurance.

D. INSURANCE

1. Two Categories:

a. Marine: transport by sea

b. Air: transport by air

2. Insurance Certificate issued to show proof of insurance.

- 4 -

Finance 4328 (Moore) Chapter 18 Notes

SHORT-TERM FINANCING TECHNIQUES

III. FINANCING TECHNIQUES

A. Four Types:

1. Bankers’ Acceptances

a. Creation: drafts accepted

b. Terms: Payable at maturity to holder

2. Discounting a. Converts exporters’ drafts to cash minus interest to maturity and commissions.

b. Low cost financing with few fees. c. May be with (exporter still liable) or without recourse

(bank takes liability for nonpayment).

3. Factoring: firms sell accounts receivable to another firm

known as the factor.

a. Discount charged by factor

b. Non-recourse basis: Factor assumes all payment risk.

c. When used:

1.) Occasional exporting.

2.) Clients geographically dispersed.

4. Forfaiting

a. Definition: Discounting at a fixed rate without

recourse for medium-term accounts receivable.

b. Use: Large capital purchases

c. Most popular in W. Europe

- 5 -

Finance 4328 (Moore) Chapter 18 Notes

GOVERNMENT SOURCES

IV. GOVERNMENT SOURCES OF EXPORT FINANCING AND

CREDIT INSURANCE

A. Export-Import Bank of the U.S.

-known as Ex-Im Bank

-Finances and facilitates U.S. exports only.

1. Ex-Im Bank Programs:

a. Direct loans to exporters

b. Intermediate loans to exporters

c. Loan guarantees

d. Preliminary commitments

e. Political and commercial insurance

2.

Restrictions:

At least 51% U.S. content

No armaments

Must be environmentally friendly

V. COUNTERTRADE

A. Three Specific Forms:

1. Barter: Direct exchange in kind.

2. Counter-purchase:

Sale/purchase of unrelated goods but with currencies.

3. Buyback:

Repayment of original purchase through sale of a related product.

B. When to Use Countertrade

1. With “soft-currency” developing countries.

2. When tariffs or quotas prevent trade.

- 6 -