Exam 1 – Finance 3321

advertisement

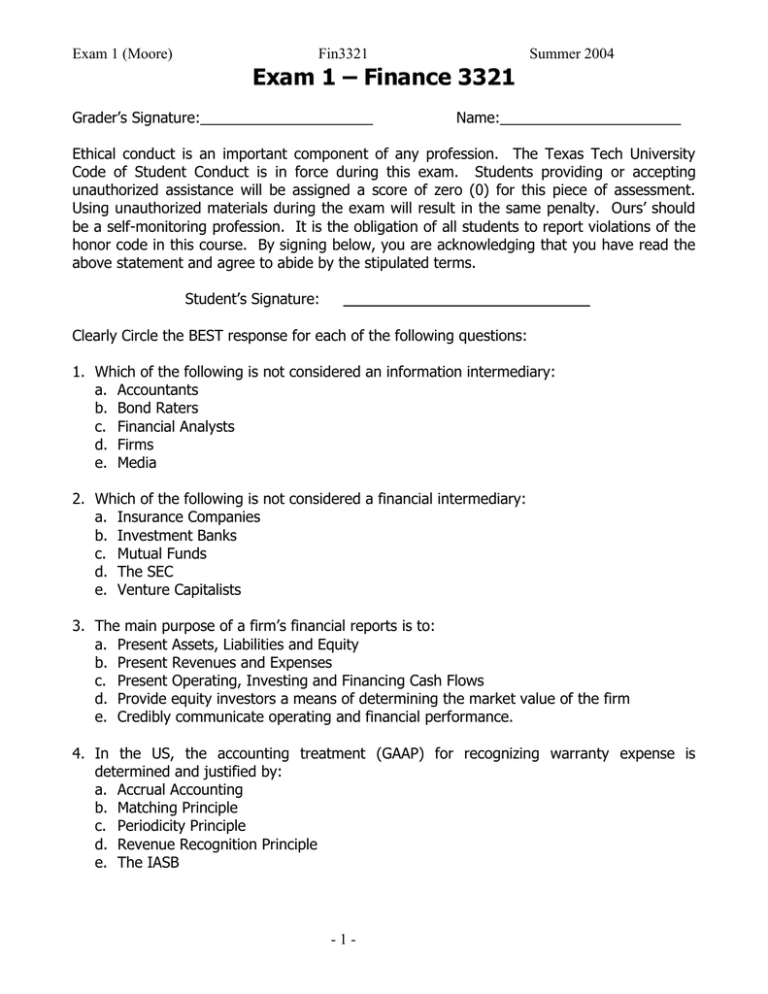

Exam 1 (Moore) Fin3321 Summer 2004 Exam 1 – Finance 3321 Grader’s Signature:_____________________ Name:______________________ Ethical conduct is an important component of any profession. The Texas Tech University Code of Student Conduct is in force during this exam. Students providing or accepting unauthorized assistance will be assigned a score of zero (0) for this piece of assessment. Using unauthorized materials during the exam will result in the same penalty. Ours’ should be a self-monitoring profession. It is the obligation of all students to report violations of the honor code in this course. By signing below, you are acknowledging that you have read the above statement and agree to abide by the stipulated terms. Student’s Signature: ______________________________ Clearly Circle the BEST response for each of the following questions: 1. Which of the following is not considered an information intermediary: a. Accountants b. Bond Raters c. Financial Analysts d. Firms e. Media 2. Which of the following is not considered a financial intermediary: a. Insurance Companies b. Investment Banks c. Mutual Funds d. The SEC e. Venture Capitalists 3. The main purpose of a firm’s financial reports is to: a. Present Assets, Liabilities and Equity b. Present Revenues and Expenses c. Present Operating, Investing and Financing Cash Flows d. Provide equity investors a means of determining the market value of the firm e. Credibly communicate operating and financial performance. 4. In the US, the accounting treatment (GAAP) for recognizing warranty expense is determined and justified by: a. Accrual Accounting b. Matching Principle c. Periodicity Principle d. Revenue Recognition Principle e. The IASB -1- Exam 1 (Moore) Fin3321 5. The last line item reported on the income statement is: a. Net Revenue b. Operating Income c. Comprehensive Income d. Income from Continuing Operations e. Gross Profit Summer 2004 6. Which of the following components of the annual financial report is not audited: a. Balance Sheet b. Income Statement c. Management discussion and Analysis d. Statement of Cash Flows e. Statement of Owners Equity 7. One of the main reasons that firms are allowed flexible financial accounting standards under GAAP is: a. It provides firms a better opportunity to report the underlying economic substance of transactions and events. b. It gives the firms the opportunity to reduce the volatility of earnings so that investors can provide better forecasts of future performance. c. It allows managers to better tie earning to performance for compensation purposes. d. It gives firms the opportunity to mark-to-market the physical assets so that balance sheet values are more relevant to decision makers. e. Flexibility is required by the SEC. 8. Which of the following statements is incorrect: a. The SEC has the legal authority to proscribe GAAP. b. Transparent financial reporting practices allow users to get a true and fair picture of the firm. c. Conservatism of financial reporting standards may reduce valuation relevance. d. Prospective analysis involves forecasting future events and outcomes. e. The external auditor certifies the financial statements are correct. 9. Which of the following is incorrect regarding “Value-Added” and Value creation? a. They are economic concepts. b. They can be represented with theoretical models grounded in financial theory. c. They are best measured or estimated using the Capital Asset Pricing Model d. They incorporate and excess return component e. They are consistent with the Modigliani and Miller view of firm valuation. 10. Which of the following is not an element of the “Five-Forces” model? a. Potential and Actual Competition b. Maintaining Competitive Advantage(s) c. Bargaining Power of Customers d. Threat of New Entrants e. Threat of Substitute Products -2- Exam 1 (Moore) Fin3321 Summer 2004 11. WalMart’s ability to dictate price and delivery terms to manufacturers is an example of: a. Buyer bargaining power b. Supplier bargaining power c. Product differentiation d. Fixed-Variable Cost ratios e. Exit Barriers 12. An a. b. c. d. e. industry having a high degree of price competition would be characterized by: Low Industry Concentration, High Legal Barriers to Entry, Low Product Differentiation Few Exit Barriers, High First mover advantage, High Product Differentiation High Industry Concentration, Low Distribution Access, High Switching Costs Low Concentration, High Fixed-Variable Cost Ratio, Low Switching Costs Supply < Demand, Low Supplier Switching Costs, Steep Industry Learning Curves 13. Which of the following strategies would lead to a mixture of cost leadership and product differentiation? a. Economies of scale and scope, simpler product design, tight cost control b. Superior product variety, more flexible delivery, High investment in R&D c. Lower input costs, low-cost distribution, low investment in R&D d. High investment in brand image, High investment in R&D, Focus on Creativity e. Simpler product designs, Tight cost control, superior product quality 14. Determining whether the firm currently has the resources and capabilities to deal with the identified key success factors is an example of: a. Competitive Strategy Analysis b. Differentiation Analysis c. Analysis of the Degree of Actual and Potential Competition d. Analysis of the Threat of Substitute Products e. Analysis of the Bargaining Power in Input and Output Markets 15. Which of the following does not necessarily create corporate value? a. Managing the value chain b. Maintaining a good fit between the company’s specialized resources and the portfolio of businesses in which the company is operating. c. Good allocation of decision rights between the headquarters office and the business units to realize all the potential economies of scope. d. Having internal measurement, information, and incentive systems to reduce agency costs. e. Investing significant resources to product advertising and marketing activities. 16. Which organization has been delegated the authority to establish US GAAP? a. AICPA b. CPA c. FASB d. IASB e. SEC -3- Exam 1 (Moore) Fin3321 Summer 2004 17. Investors will find forward-looking information in which component of the financial report? a. Management Discussion and Analysis Section b. Balance Sheet c. Income Statement d. Footnotes to Financial Statements e. The Auditor’s Opinion 18. Who has the ultimate responsibility for the accounting choices of the firm? a. CEO b. CFO c. CPA d. Corporate Controller e. Chairman of the Board of Directors 19. Channel Stuffing is associated with: a. Earnings Management b. Selling unwanted merchandise c. Intense marketing plans d. Flexible Accounting e. Conservative Accounting 20. Which of the following is not a factor that affects managers’ accounting choices? a. Regulatory concerns b. Compensation c. Capital Market perceptions d. Inaccurate estimates e. Debt Covenants 21. Which of the following elements of accounting quality is not controllable by the firm? a. GAAP quality b. Segment Reporting Quality c. Level of detail of disclosure in supplemental footnotes d. Choice of GAAP quality e. Level of dis-aggregation 22. What is the first step of the method for a structured accounting analysis (per text) a. Identify potential “red flags” b. Assess the degree of potential accounting flexibility c. Evaluate the actual accounting strategy d. Evaluate the quality of disclosure e. Identify key accounting policies 23. Which is not considered a “red-flag” in terms of potential poor accounting quality? a. Large asset write-offs b. Many 4th quarter adjustments -4- Exam 1 (Moore) c. Related party transactions d. Special purpose entities e. Increased Revenues Fin3321 -5- Summer 2004