Chapter 2 Student Outline Business and Industry Strategy Analysis

advertisement

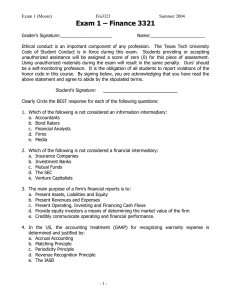

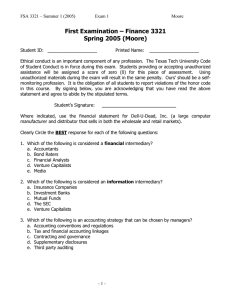

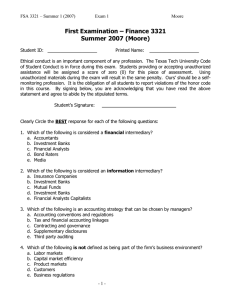

BS 7000-093 (Moore) Chapter 2 Student Outline Business and Industry Strategy Analysis http://www.rawlsbusiness.ba.ttu.edu/ http://finance.yahoo.com Key Learning Outcomes: Developing a Framework to Assess and Understand Critical Value Drivers, Opportunities, Limitations and Potential of a Firm and Industry Finding Sources of Information to efficiently and effectively analyze the firm and industry Understanding the main strategies firms can implement in order to maximize value. A. Linkage Between Financial Reports “Value-Creation”, Firms’ Activities Modigliani and Miller (Foundation of Finance) Free Cash Flow (Classical Finance Valuation Model) Residual Income (Accounting) -1- and BS 7000-093 (Moore) B. Factors to Consider for Industry Analysis (Five FORCES) 3. Sources of Information for Analysis a. 10-K’s from Main Firms in the Industry o For Multiple years, read management discussion: Business overview, Significant Business Risks, Results of Operations o Compare/Analyze across firms and within industry b. Financial Press (WSJ, Google, Yahoo Finance, ect.) Search for commentary/analysis/articles on industry and member firms. c. Keep in mind these are other peoples’ ideas and analysis. It is your job to critically analyze, evaluate and draw inferences. -2- BS 7000-093 (Moore) C. Competitive Advantages and Strategy Analysis (2 main Dimensions) First, Classify the Industry Structure 1. Cost Leadership, Product Differentiation, or Mixed Next, Identify the Value Drivers for the industry classification you developed (KSF’s) Finally, Identify the extent to which the company you are valuing is delivering value (KSF’s) -3- BS 7000-093 (Moore) D. Achieving and Maintaining Competitive Advantage(s) Next, given classification, Identify “Key Success Factors” or “Value Drivers” for your classification Different Strategies work for different types of industry types E. Assess consistency of the Company with the “optimal” strategies to create Value F. Value Creation at the Corporate Level 1. Conglomerate Portfolio 2. Mergers and Acquisitions 3. Consistency with overall Business Model -4- BS 7000-093 (Moore) Sample Questions 1. Which of the following is an element of the “Five-Forces” model? a. Cost Leadership b. Maintaining Competitive Advantage(s) c. Bargaining Power of Customers d. Product Differentiation e. Ability to supply the same product or service at a lower cost 2. An industry having a high degree of price competition would be characterized by: a. High Industry Concentration, Low Legal Barriers to Entry, Low Product Differentiation b. Few Exit Barriers, Low First mover advantage, Low Product Differentiation c. Low Industry Concentration, Easy Distribution Access, High Customer Switching Costs d. High Concentration, Low Fixed-Variable Cost Ratio, Low Firm Switching Costs e. Supply < Demand, Low Supplier Switching Costs, Steep Industry Learning Curves 3. Which of the following would lead to the lowest degree of industry price competition? a. Low Industry Concentration, Low Legal Barriers to Entry, Low Product Differentiation b. Few Exit Barriers, Low First mover advantage, High Product Differentiation c. Low Industry Concentration, Low Distribution Access, Low Customer Switching Costs d. High Industry Concentration, Low Fixed-Variable Cost Ratio, Low Customer Switching Costs e. Supply < Demand, High Legal Barriers to Entry, Steep Industry Learning Curves 4. Which of the following strategies are consistent with either pure cost leadership or pure product differentiation strategies? a. Economies of scale and scope, high R&D investment, tight cost control b. Superior product variety, lower input costs, High investment in R&D c. Lower input costs, flexible distribution, low investment in R&D d. Low investment in brand image, Low investment in R&D, Focus on Cost Control e. Simpler product designs, Tight cost control, superior product quality 5. Which of the following strategies are consistent with a mixture of cost leadership and product differentiation? a. Economies of scale and scope, simpler product design, tight cost control b. Superior product variety, more flexible delivery, High investment in R&D c. Lower input costs, low-cost distribution, high investment in R&D d. High investment in brand image, High investment in R&D, Focus on Creativity e. Simpler product designs, Tight cost control, Lower Input Cost -5- BS 7000-093 (Moore) 7. Determining whether the firm currently has the resources and capabilities to deal with the identified key success factors is an example of which? a. Competitive Strategy Analysis b. Differentiation Analysis c. Analysis of the Degree of Actual and Potential Competition d. Analysis of the Threat of Substitute Products e. Analysis of the Bargaining Power in Input and Output Markets 8. WalMart’s ability to dictate price & delivery terms to manufacturers is an example of: a. Buyer bargaining power b. Supplier bargaining power c. Product differentiation d. Fixed-Variable Cost ratios e. Exit Barriers 9. Which of the following does not necessarily create corporate value? a. Managing the value chain b. Maintaining a good fit between the company’s specialized resources and the portfolio of businesses in which the company is operating. c. Good allocation of decision rights between the headquarters office and the business units to realize all the potential economies of scope. d. Having internal measurement, information, and incentive systems to reduce agency costs. e. Investing significant resources to product advertising and marketing activities. -6-