From: Sent: Subject:

advertisement

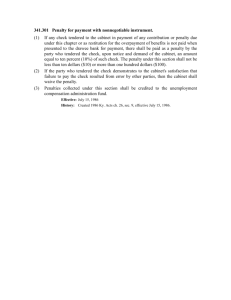

From: Ashburn, Melissa Ann Sent: Friday, January 04, 2013 9:00 AM Subject: tax penalty/bad check question Dear Sir, You asked which statute applies to taxes the County collects for the City, regarding penalties that apply for bad checks used for payment of taxes – either T.C.A. § 67-1-804 or T.C.A. § 9-1-109. Your county follows T.C.A. § 9-1-109, and this statute has different penalty provisions from those noted in Title 67. T.C.A. § 67-1-804 sets penalties that far exceed what may be charged for delinquent property taxes. On the issue of a bad check or money order being used for payment, this statute contains the following: (d)(1) If any check or money order in payment of any amount receivable under any law administered by the commissioner is dishonored, there shall be imposed a penalty upon the taxpayer in an amount equal to one percent (1%) of the amount of such check; provided, that the penalty imposed shall be in an amount equal to ten percent (10%) of the amount of such check for each dishonored check in excess of two (2) issued by any one (1) person within one (1) calendar year. The minimum amount of the penalty imposed under this subdivision (d)(1) shall be fifteen dollars ($15.00). This subdivision (d)(1) does not apply if the person tendered such check in good faith and with reasonable cause to believe that it would be duly paid. Tenn. Code Ann. § 67-1-804 (West) This is different than the statute followed by your County, T.C.A. § 9-1-109, which contains the following: If any check or money order so received is not duly paid, in addition to other penalties provided by law, there shall be paid as a penalty by the person who tendered such check or money order, upon written notice and demand by the state, county or municipal officer to whom such check was tendered, an amount equal to one percent (1%) of the amount of such check or money order, except that if the amount of the check or money order is less than two thousand dollars ($2,000), the penalty under this section shall be twenty dollars ($20.00) or the amount of the check, whichever is lesser. Tenn. Code Ann. § 9-1-109 (West) It is important to note where in our code these statutes appear, and the subject matter covered in those chapters. Title 9, chapter 1 discusses the fiscal year for counties and the state, and then contains provisions about the county collecting taxes for municipalities, in T.C.A. § 9-1-108. Title 67, chapter 1 is titled “Miscellaneous Provisions,” and contains sections addressing the statewide tax system and reports filed with the Commissioner of Revenue. Property taxes are not addressed in this chapter, but rather in chapter 5 of title 67. When reviewing these statutes, and the cases brought under each, it appears to me that T.C.A. § 67-1-804 contains penalties assessed by the Commissioner of Revenue for failure to file reports, or filing inaccurate reports, for sales and use taxes, probate taxes, and other taxes paid directly to the Commissioner of Revenue. This statute does not apply to property taxes as a separate statute exists setting penalties for delinquent real property taxes (T.C.A. § 67-5-2010). This leads me to conclude that your County is acting legally if they do follow T.C.A. § 91-109 in assessing those penalties for bad checks when collecting taxes for your City. In my opinion, T.C.A. § 67-1-804 does not apply to those taxes the county is collecting for the city. I hope this is helpful, Melissa Melissa A. Ashburn Legal Consultant University of Tennessee Institute for Public Service Municipal Technical Advisory Service (865)974-0411