Options for Funding Stormwater System Improvements Tennessee Funding Options for

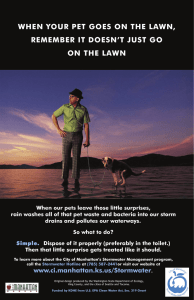

advertisement

Options for Funding Stormwater System Improvements Tennessee Funding Options for NPDES Phase I & Phase II Designated MS4’s STORMWATER MANAGEMENT: With Stormwater Management there are two critical issues: WATER QUANTITY & WATER QUALITY Stormwater Management The original concern, and hence, the major design consideration of stormwater management was to remove water ASAP, water quality was not a consideration. Storm Water Management And here! EPA’s National Pollutant Discharge Elimination System (NPDES) Phase II Program 6 MINIMUM CONTROLS 1. 2. 3. 4. 5. 6. PUBLIC EDUCATION & OUTREACH PUBLIC PARTICIPATION ILLICIT DISCHARGE DETECTION AND ELIMINATION CONSTRUCTION SITE RUNOFF POST CONSTRUCTION RUNOFF POLLUTION PREVENTION & GOOD HOUSEKEEPING However, stormwater… Can Still Lead to… Drainage Failure… Drainage Failure… Drainage Failure… Drainage Failure… Funding Options Your City is a designated MS4. Your Mayor signed an NOI. So, basically, your city has contracted with the State to implement an approved program. How will you fund your City’s program? Funding Options Some of the possibilities: 1. Do nothing. 2. Use Grants and Loans. 3. Fund the program with existing General Fund dollars. 4. Dedicate a property tax increase to your program and fund from General Fund. 5. Let development fund your program. 6. Make your program user funded; set up a Stormwater Utility. Let’s discuss these possibilities… 1. Do Nothing 1.Do nothing. “O.K., we got our permit, do what you can on the program without spending any money. After all, I don’t think they’ll really do anything. We’ll wait and see before we spend a bunch of money.” While this approach appears to be economical on the face of it, let’s look at how the State may respond: 1.Do nothing. Your City has basically signed a contract with the State, committing to accomplish certain program elements in accordance with agreed milestones. By failing to adequately fund the program, these milestones are not achieved. Possible State response: These regulations are mandated by the Environmental Protection Agency (EPA) and the Tennessee Department of Environment and Conservation (TDEC). 1. Do nothing. Penalties for non-compliance with the regulations could be as harsh as $10,000 per day in civil penalties. A TDEC Director’s Order could also result in spot fines of $1,000 or $2,000 for non-compliance and an order to complete the program anyway. Stormwater permit applications for new development in an MS4 that is non-compliant can be held without approval until the program is judged to be in compliance; EFFECTIVELY PLACING A MORITORIUM ON DEVELOPMENT. Current Enforcement Climate The following notes and table of enforcement actions might be enlightening for others in your organization and/or your elected officials. For questions about specific case number, such as the identity, violation details, etc., contact TDEC. Current Enforcement Climate Mr. Mark McAdoo TDEC-Water Pollution Control sent the following to me: Between November 1992 and April 2005, TDEC-WPC issued, at least, 670 formal enforcement actions that had either a construction and/or a stormwater component. The civil penalties associated with these enforcement actions are over 8 million dollars. However, you should be aware that TDEC-WPC was not consistently using the Enforcement Tracking Database until the year 1998. Therefore, you may want to sift through the attached spreadsheet from the Enforcement Tracking Database and re-calculate more representative numbers starting in 1998. The statutory maximum for civil penalties is $10,000 per day per violation and we have used the maximum calculation in some cases. A couple of the larger enforcement actions were 1) TDOT & Vaughn Contractors, Inc. for $800,000 and 2) Chattanooga - MS4 Program for $635,500. Mark told me that this year, TDEC is mainly: Looking for programs to have their stormwater ordinances implemented. Conducting on-site file audits to verify documentation for the information supplied by MS4’s in their annual reports. Conducting field inspections for construction permit violations and illicit discharges. All other aspects of the program, of course, are still actively being monitored. The following is a spreadsheet reflecting the enforcement data referenced above: Case Number Order Type Civil Penalty Date Issued Violation Type 05-003D Director's Order $9,150.00 21-Apr-05 ARAP 05-008D Director's Order $10,500.00 21-Apr-05 NPDES Stormwater 04-044D Director's Order $15,000.00 31-Mar-05 NPDES Stormwater 05-0038 Commissioner's Order $159,500.00 18-Mar-05 Multiple 05-010D Director's Order $12,150.00 11-Mar-05 ARAP 05-004D Director's Order $10,500.00 03-Mar-05 ARAP 04-015a Formal Complaint 24-Jan-05 NPDES Stormwater 04-014a Formal Complaint 06-Jan-05 ARAP 04-013a Formal Complaint 06-Jan-05 NPDES Stormwater 04-019D Director's Order $11,500.00 29-Dec-04 NPDES Stormwater 04-042D Director's Order $10,500.00 16-Dec-04 ARAP 04-030D Director's Order $7,125.00 16-Dec-04 NPDES Stormwater 04-011a Formal Complaint 09-Dec-04 NPDES Stormwater 04-051D Director's Order 23-Nov-04 NPDES Stormwater $3,000.00 04-010a Formal Complaint 18-Nov-04 Multiple 04-038D Director's Order $2,600.00 02-Nov-04 ARAP 04-0302 Consent Order $20,000.00 18-Oct-04 NPDES Stormwater 04-039D Director's Order $3,150.00 14-Oct-04 ARAP 04-0218 $78,000.00 05-Oct-04 NPDES Stormwater 04-027D Commissioner's Order Director's Order $5,000.00 22-Sep-04 ARAP 03-0215 Agreed Order $11,000.00 21-Sep-04 Multiple 04-026D Director's Order $12,500.00 08-Sep-04 NPDES Stormwater, ARAP 04-007a Formal Complaint 02-Sep-04 ARAP 04-032D Director's Order $15,000.00 31-Aug-04 Multiple 03-0061 Agreed Order $4,750.00 21-Jul-04 NPDES Stormwater 04-0114 $114,500.00 06-Jul-04 NPDES Stormwater 03-0709 Commissioner's Order Agreed Order $5,000.00 02-Jul-04 Multiple 03-0555 Agreed Order $11,000.00 22-Jun-04 ARAP 03-0757 Agreed Order $1,125.00 22-Jun-04 NPDES Stormwater 04-022D Director's Order $15,000.00 22-Jun-04 NPDES Stormwater 04-018 Director's Order $1,650.00 16-Jun-04 ARAP 04-018D Director's Order $1,650.00 16-Jun-04 ARAP 04-0138 $71,000.00 14-Jun-04 NPDES Stormwater 04-021D Commissioner's Order Director's Order $3,000.00 14-Jun-04 NPDES Stormwater 04-023D Director's Order $1,000.00 14-Jun-04 NPDES Stormwater 04-020D Director's Order $15,000.00 12-Jun-04 ARAP 03-0218 Agreed Order $3,750.00 03-Jun-04 ARAP 04-005D Director's Order $15,000.00 01-Jun-04 Multiple 03-087D Director's Order $4,500.00 01-Jun-04 NPDES Stormwater 04-011D Director's Order $3,050.00 24-May-04 ARAP 03-102D Director's Order $15,000.00 24-May-04 Multiple 03-0756 Agreed Order $11,000.00 18-May-04 NPDES Stormwater 03-0800 Agreed Order $2,300.00 18-May-04 NPDES Stormwater 04-002D Director's Order $12,000.00 17-May-04 Multiple 03-101D Director's Order $3,150.00 07-May-04 ARAP 03-0057 Agreed Order $10,000.00 20-Apr-04 ARAP 03-0168 Agreed Order $2,500.00 20-Apr-04 NPDES Stormwater 04-003a Formal Complaint 15-Apr-04 Multiple 04-005a Formal Complaint 07-Apr-04 ARAP 04-002a Formal Complaint 07-Apr-04 Multiple 03-106D Director's Order 06-Apr-04 ARAP 04-001a Formal Complaint 06-Apr-04 Multiple 03-103D Director's Order $3,500.00 30-Mar-04 ARAP 03-0798 Commissioner's Order $104,000.00 18-Mar-04 Multiple 03094D Director's Order $7,500.00 17-Mar-04 Multiple $12,000.00 03-0798 $104,000.00 18-Mar-04 Multiple 03094D Commissioner's Order Director's Order $7,500.00 17-Mar-04 Multiple 03-094D Director's Order $7,500.00 17-Mar-04 Multiple 02-0720 Consent Order $800,000.00 10-Mar-04 NPDES Stormwater 03-0533 $178,271.00 02-Mar-04 Multiple 03-0534 Commissioner's Order Agreed Order $7,375.00 13-Feb-04 Multiple 03-097D Director's Order $15,000.00 05-Feb-04 Multiple 03-092D Director's Order $15,000.00 29-Jan-04 ARAP 02-0651 Agreed Order $400.00 20-Jan-04 ARAP 03-0217 Agreed Order $3,150.00 20-Jan-04 ARAP 03-091D Director's Order $7,650.00 16-Jan-04 ARAP 03-093D Director's Order $3,000.00 31-Dec-03 NPDES Stormwater 03-0492 Agreed Order $3,200.00 23-Oct-03 Multiple 03-081D Director's Order $15,000.00 15-Oct-03 NPDES Stormwater 03-079D Director's Order $6,000.00 13-Oct-03 NPDES Stormwater 03-090D Director's Order $12,000.00 13-Oct-03 NPDES Stormwater 03-095D Director's Order $7,500.00 08-Oct-03 NPDES Stormwater 03-0062 Agreed Order $2,000.00 25-Sep-03 Multiple 03-086D Director's Order $12,000.00 05-Sep-03 Multiple 03-085D Director's Order $4,500.00 05-Sep-03 NPDES Stormwater 02-0017 Agreed Order $6,200.00 27-Aug-03 ARAP 03-005a Formal Complaint 27-Aug-03 ARAP 1. Do nothing. The field offices have been told that as this is now the 4th year of the permit, hand-holding time is over. The field offices have been directed to assume the regulator role, rather than the helper role. Fines and penalties are to be levied! AND REMEMBER: Stormwater permit applications for new development in an MS4 that is non-compliant can be held without approval until the program is judged to be in compliance; EFFECTIVELY PLACING A MORITORIUM ON DEVELOPMENT. 1. Do nothing. A new development this year, TDEC has received approval to add 29 new field positions. The understanding is that all of these positions are to be enforcement personnel, and that Stormwater is priority number one. 2. Grants and Loans Grant- 319 (h) Non Point Source The Tennessee Department of Agriculture Nonpoint Source Program, TDA-NPS, can assist with grants provided under section 319(h) of the Clean Water Act. Who Can Apply? Local governments, interstate and intrastate agencies, public and private nonprofit organizations and institutions, and agencies of state government are eligible to apply. Grant- 319 (h) Non Point Source TDA-NPS Priorities The highest priority for funding are projects that target waters of the state assessed as impaired from nonpoint source (NPS) pollution and published in the 303(d) List by the Tennessee Department of Environment and Conservation (http://www.state.tn.us/environment/wpc/publications/). Grant- 319 (h) Non Point Source The project’s objective should be to identify the specific sources of NPS pollution and seek to eliminate them so that the water fully supports its designated uses. Preference is given to projects targeting small watersheds, where measurable water quality improvements are most likely after the project is completed. A high priority will be placed on projects aimed at developing a watershed restoration plan for a given watershed. Grant- 319 (h) Non Point Source The expectation would be that once developed,the plan would be implemented in a subsequent project. Beginning in FY 2005, no watershed restoration project can be funded with 319 money unless it is based on a watershed plan developed for that particular watershed. Grant- 319 (h) Non Point Source NPS education is also a priority of the program and all proposals are encouraged to have an educational component. Educational projects that seek to increase the awareness of the citizens of Tennessee about the sources of NPS will be considered. Grant- 319 (h) Non Point Source Projects that involve training programs targeted at a specific group that have as a goal to raise the level of expertise about NPS solutions, or to affect management decisions to reduce NPS impacts will be considered. Grant- 319 (h) Non Point Source The Town of Jonesborough was funded by 319 for a Watershed Restoration Project in their town. In their plan they installed retention ponds and developed wetlands to reduce sediment and nutrient runoff. Grant- 319 (h) Non Point Source TDA, Nonpoint Source Program Holeman Bldg. Ellington Agricultural Center 440 Hogan Road Nashville, TN 37220 The email address is: Carole.Swann@state.tn.us sam.marshall@state.tn.us If help is needed, or there are questions, please call Carole Swann at (615) 837-5489 Sam Marshall at 615-837-5306 or by fax at 615-837-5025. Stormwater Revenue Bonds Municipalities are authorized to issue both revenue bonds (and presumably general obligation bonds) under the Stormwater Management Act [See Tennessee Code Annotated, § 68-221-1108], which expressly gives municipalities the authority to issue bonds for stormwater facilities under Tennessee Code Annotated, title 9, chapter 21. [Even in the absence of the former statute, municipalities would still have the authority to issue both revenue and general obligation bonds for stormwater facilities under the latter statute]. The same Act also provides that municipalities are authorized to pay for such facilities by using the procedures contained in Tennessee Code Annotated, §§ 68-221-208 and 68-221-209. Those statutes respectively authorize municipalities to establish and collect sewer user fees, and to require the owners or tenants of property to connect to the public sewers. Presumably, such charges would support the payment of revenue bonds. State Revolving Loan Fund State Revolving Loan Fund (SRF) Money is available for designated MS4’s for stormwater program: Planning Mapping Construction Equipment (integral and dedicated to stormwater program) State Revolving Loan Fund Eligibility: To be determined on a case by case basis. Application deadline: Open cycle. Loan Amount: Loans from $100,000 into the millions. Interest rate: Below market, on a sliding scale based on ability to pay index. State Revolving Loan Fund Loan period: Construction and/or Equipment: 20 years Planning and/or Mapping: 5 years State Revolving Loan Fund For additional information or a consultation without obligation, please contact: Mr. Jim Poff Tennessee Department of Environment and Conservation Division of Community Assistance (615) 532-0199 Jim.Poff@state.tn.us 3. Existing General Fund 3. Existing General Fund Existing General Fund $10 Million Annual Budget 2,000,000 2,000,000 2,000,000 2,000,000 2,000,000 Fire Police Administration Parks & Rec Public Works 3. Existing General Fund Existing General Fund $10 Million Annual Budget 1,666,667 1,666,667 1,666,667 1,666,667 1,666,667 1,666,667 Fire Police Administration Parks & Rec Public Works Stormwater 3. Existing General Fund Existing General Fund $10 Million Annual Budget 2,000,000 2,000,000 2,000,000 2,000,000 2,000,000 Existing General Fund $10 Million Annual Budget Fire Police Administration Parks & Rec Public Works Stormwater 1,666,667 1,666,667 1,666,667 1,666,667 1,666,667 1,666,667 4. General Fund with a Tax Increase General Fund with a Tax Increase Existing General Fund $10 Million Annual Budget 2,000,000 2,000,000 2,000,000 2,000,000 2,000,000 General Fund with Tax Increase $12 Million Annual Budget Fire Police Administration Parks & Rec Public Works Stormwater 2,000,000 2,000,000 2,000,000 2,000,000 2,000,000 2,000,000 General Fund with a Tax Increase Special Purpose Local Option Sales Tax Although there is no special purpose sales tax law in Tennessee, presumably municipalities have the authority under the local option sales tax law [See Tennessee Code Annotated, § 67-6-701 et seq.] to vote on a local option sales tax that would be directed solely to the payment for stormwater facilities. Several municipalities have held referenda in which the local option sales tax increase is devoted to specific municipal purposes. Thus far nobody has challenged those referenda. 5. Funding Program with Development Funding Program with Development Florida communities are examining a variety of secondary funding methods, not directly related to the service charges, as a means of generating additional charges to certain customers who receive special services and applying special charges to equalize financial participation among properties over time. These secondary funding methods would be incorporated directly into a service charge rate structure rather than established separately. Funding Program with Development Examples of secondary funding methods include: System Development Charges to equalize the financial participation in capital investments among ratepayers served by the systems at different points in time. Plan Review and Inspection Fees to recover a portion of the costs that the community expends to review development plans and inspect projects under construction to assure compliance with standards. Funding Program with Development Special Service Fees designed to recover the costs of services performed for specific clients, as opposed to the entire rate base, which may include annual inspections of onsite detention systems to verify compliance with design and operating standards, industrial stormwater discharge monitoring, water quality enforcement investigations against polluters and similar specialized activities which have evolved with the recent expansion of Federal, State and Regional regulatory programs. Funding Program with Development Development funding mechanisms are o.k. as a secondary funding source for dedicated program expenses… But it is short sighted to use development fees to fund the total O&M budget for a program. Sooner or later, development won’t fund the program, and/or development will be negatively impacted. 6. User Funding: A Stormwater Utility Stormwater Utility Tennessee Code Annotated, § 68-221-1101, provides that the purpose of the stormwater management statute is to facilitate municipal compliance with the Water Quality Act of 1977, and applicable EPA regulations, particularly those arising from § 405 of the Water Quality Act of 1987, and § 402(p) of the Clean Water Act of 1977, and to enable municipalities to regulate stormwater discharges, establish a system of drainage facilities, construct and operate a system of stormwater management and flood control facilities, and to “fix and require payment of fees for the privilege of discharging stormwater Model Ordinance Model Storm Water Utility Ordinance TABLE OF CONTENTS PAGE Section 1. Legislative findings and policy 2 Section 2. Creation of stormwater utility 3 Section 3. Definitions 4 Section 4. Funding of stormwater utility 7 Section 5. Stormwater fund 8 Model Storm Water Utility Ordinance TABLE OF CONTENTS Section 6.Operating budget PAGE 8 Section 7.Stormwater user=s fees established 8 Section 8.Equivalent residential unit (ERU) 8 Section 9.Property classification for stormwater user=s fee 9 Section 10.Base rate 10 Model Storm Water Utility Ordinance TABLE OF CONTENTS Section 11.Adjustments to stormwater user=s fees PAGE 10 Section 12.Property owners to pay charges 11 Section 13.Billing procedures and penalties for late payment 11 Section 14.Appeals of fees 12 APPENDIX A APPENDIX B 14 18 APPENDIX A Calculating Stormwater User Fees Calculating Stormwater User Fees can be done in a simple, equitable manner. The annual budget of the Stormwater Utility is divided by the total number of Equivalent Residential Units (ERU’s) in the Stormwater System limits. Division of the result by 12 would yield the monthly fee per ERU. An Equivalent Residential Unit is based on the average square footage of a detached single residential family property. This average can be obtained from a variety of sources. If the average is not available through your tax assessor or another internal department, averages may be obtained from the U.S. Census Bureau, your local Area Association of Realtors, or some other credible source. Each detached single residential family property would be one (1) ERU. Other developed proposer users would divide their total amount of impervious surface area (in square feet) by the number of square feet in an ERU, to get the number of ERU’s for that property. The sum of all other developed property ERU’s and single family residential ERU’s would be the total number of ERU’s. Annual Budget. The annual costs for the storm drainage system includes permitting, maintaining, planning, designing, reconstructing, constructing, environmentally restoring, regulating, testing, inspection of the system, management and administration, and the establishment of a reserve balance. Equivalent Residential Unit (ERU). The average square footage of a single family residential property is equivalent to one ERU.* Total ERU’s. The Total ERU’s within the limits of the stormwater utility is calculated according to the following formula: Total ERU’s = Other Developed Property ERU’s + Single Family Residential ERU’s Single Family Residential User Fee. The fee that residential users within the limits of the stormwater utility pay for their share of the annual budget. The fee is calculated according to the following formula: Single Family Residential User Fee = Annual Budget ÷ Total ERU’s within Stormwater Utility limits This number should be divided by 12 to establish the monthly User Fee: Single Family Residential User Fee ÷ 12 = Monthly Single Family Residential UserFee Other Developed Property User Fee. The fee that other developed property users within the limits of the stormwater utility pay for their share of the annual budget. The fee is calculated according to the following formula: Other Developed Property ERU’s = Impervious Surface Area square feet ÷ ERU square feet Other Developed Property User Fee = Single Family Residential User Fee x Other Developed Property ERU’s Other Developed Property User Fee ÷ 12 = Monthly Other Developed Property User Fee Example: VolVegas Stormwater Utility Department has an annual budget of $350,000. There are 10,000 homes in VolVegas, an apartment complex, Maxwell House Apartments, with a total impervious surface area of 5 acres, or 217,800 square feet (sq. ft.), a motel, Red Lite Inn, with a total impervious surface area of 2 acres, or 87,120 square feet, GoodDay Tire and Rubber Company with a total impervious surface area of 15 acres, or 653,400 square feet, and a SuperWallyWorld with a total impervious surface area of 10 acres, or 435,600 square feet. Per the VolVegas Area Association of Realtors, the average detached single family residential property has 1,800 square feet. 1 ERU = 1,800 square feet Single Family Residential ERU’s = 10,000 ERU’s Other Developed Property ERU’s = (217,800 + 87,120 + 653,400 + 435,600 sf) = 1,393,920 sf 1,800 sq ft 1,800 sq ft = 774 ERU’s Total ERU’s = 774 Other Developed Property ERU’s + 10,000 Single Family Residential ERU’s = 10,774 ERU’s Single Family Residential User Fee = $350,000 annually ÷ 10,774 ERU’s = $32.49 annually/ ERU OR ($32.49 annually/ERU) ÷ (12 mo./year) = $2.71 monthly/ERU = Monthly Single Family Residential User Fee Maxwell House Apartments: Maxwell House Apartment’s ERU’s: 217,800 sq ft ÷ 1,800 sq ft/ERU = 121 ERU’s Maxwell House Apartment’s Monthly User Fee: $2.71 monthly/ERU x 121 ERU’s = $327.91= Maxwell House Apartment’s Monthly User Fee Red Lite Inn: Red Lite Inn’s ERU’s: 87,120 sq ft ÷ 1,800 sq ft/ERU = 48.4 ERU’s Red Lite Inn’s Monthly User Fee: $2.71 monthly/ERU x 48.4 ERU’s = $131.16 = Red Lite Inn’s Monthly User Fee Super WallyWorld: Super WallyWorld’s ERU’s: 435,600 sq ft ÷ 1,800 sq ft/ERU = 242 ERU’s Super WallyWorld’s Monthly User Fee: $2.71 monthly/ERU x 242 ERU’s = $655.82 = Super WallyWorld’s Monthly User Fee GoodDay Tire and Rubber Company: GoodDay Tire and Rubber Company’s ERU’s = 653,400 sq ft ÷ 1,800 sq ft/ERU = 363 ERU’s GoodDay Tire and Rubber Company’s Monthly User Fee: $2.71 monthly/ERU x 363 ERU’s = $983.73 = GoodDay Tire and Rubber Company’s Monthly User Fee * The average square footage of a single family residential property should be determined by a recognized source. For example: The U.S. Census Bureau reports the median square footage in the South is 1,648 square feet. Or: In Jackson, Tennessee, the average square footage for all such properties sold in 2001 was 1,932 square feet, according to the Jackson Area Association of Realtors®. A comparable source should be used for setting ERU square footage. Stormwater Utility Funding for Phase II Stormwater Management A Telephone Survey Conducted by the MTAS Library December 2004 (31 cities surveyed) 22 of 31 Cities surveyed funded with General Fund $$$ 7 of 31 Cities surveyed funded with Stormwater Utility (either already established or in process) 2 of 31 Cities surveyed use combination of General Fund $$$ and Development Fees. Stormwater Utility Funding for Phase II Stormwater Management A Telephone Survey Conducted by the MTAS Library October 2005 (63 cities surveyed) 43 of 63 Cities surveyed funded with General Fund $$$ 14 of 63 Cities surveyed funded with Stormwater Utility 5 of 63 Cities surveyed establishing a Stormwater Utility 6 of 63 Cities surveyed use combination of General Fund $$$ and Development Fees. Stormwater Utility General Information Residential Customers Non-Residential Customers Frequently Asked Questions General Information The City of Greenville began looking at its Storm Drainage Program in 1997. With impending environmental regulations on the horizon initiated by the Federal Government and the State of North Carolina, it was very clear the City needed a more proactive approach to manage stormwater runoff. With the help of a Stormwater Advisory Committee appointed by City Council, the City developed a Stormwater Management program that will operate as a utility. City Council adopted the regulations in December, 2002, which established the Stormwater Utility. In order to implement these federal and state mandates a fee is charged, similar to other North Carolina cities our size. The stormwater utility fee began appearing on your Greenville Utilities Commission statement July 1, 2003. Through the utility, the City has increased our level of maintenance on open channels, storm drain pipe systems, and other storm drain related facilities. The City has also begun a more active Capital Improvement Program to upgrade old and failing drainage systems. Residential Customers All residential customers will be charged a fee. The fee is $2.85 for Frequently Asked Questions Q.How does stormwater runoff impact our lives? A.Stormwater is the primary source from which our natural watercourses are replenished. The water one sees in the rivers, lakes, and streams generally comes from stormwater runoff. The water you drink in Greenville comes from the Tar River and is treated and prepared for drinking by Greenville Utilities Commission. The condition of the stormwater runoff has a direct impact on the water quality in our streams, rivers, and lakes. As experienced in 1999, the quantity of stormwater runoff can also be of critical importance as too much stormwater runoff will result in flooding. Frequently Asked Questions Q.Why do we need to manage our stormwater runoff? A.Stormwater runoff needs to be managed just as any other natural resource. First, it is needed to maintain the quality of our natural watercourses as drinking water supplies and for recreational activities such as swimming, fishing, water skiing, etc. Secondly, stormwater also needs to be managed to minimize damages that may occur when stormwater runoff exceeds the capacity of the pipes and open channels used to carry stormwater to our rivers and streams. Frequently Asked Questions Q.How does Greenville propose to manage stormwater runoff? A.The City of Greenville began looking at our Storm Drainage Program in 1997. With impending environmental regulations on the horizon initiated by the Federal Government and the state of North Carolina, it was very clear we needed a more proactive approach to manage stormwater runoff. With the help of a Stormwater Advisory Committee appointed by City Council, we developed a Stormwater Management Program that will operate as a Utility. City Council adopted the regulations in late 2002, which established the Stormwater Utility. Through this Utility, the City will increase our level of maintenance of open channels, storm drain pipe systems, and other storm drain related facilities. We will also begin a more active Capital Improvement Program to upgrade old and failing drainage systems. Frequently Asked Questions Q.How will the new Stormwater Management Program be funded? A.As part of City Council's decision to establish a Stormwater Utility, the decision was also made to create a new fee solely to fund the Utility. The fee is dependent upon the amount of impervious cover (hard surface) one has on their property. Impervious cover is anything that covers the ground preventing it from absorbing water. Impervious cover may include such things as the rooftop of your house and other buildings, driveways, sidewalks, etc. The fee will be charged to all those owning or renting property with some form of impervious cover exceeding 200 square feet. The fee will be charged to all City property owners or renters to include residential properties, commercial properties, schools, churches, universities, hospitals, etc. In addition, governments (i.e., City, County, State) will be charged this fee. No one will be exempt from the fee. Frequently Asked Questions Q.How much is the fee? A.The fee is $2.85 for every 2,000 square feet (sf) of impervious cover you may have on your property. Residential properties (single-family and duplexes) fall in one of four tiers: Tier I 200 sf - 2,000 sf $2.85 per month Tier II 2001 sf - 4,000 sf $5.70 per month Tier III 4001 sf - 6,000 sf $8.55 per month Tier IV 6,001 sf or greater $11.40 per month All non-residential properties (all properties other than single-family and duplexes) will be charged $2.85 per 2,000 square feet of impervious cover actually existing on their property per month. Frequently Asked Questions Q.Why do I have to pay a stormwater fee? A.The City is responsible for compliance with new Federal and State regulations on water quality as well as providing stormwater management facilities and services. This includes installation and maintenance of storm drains, inlets, and ditches as well as ensuring State programs such as erosion and sediment control are provided on construction sites. All of these services are done to protect personal and public property as well as provide for a healthy environment. Funding is not provided by Federal or State government for these services. Frequently Asked Questions Q.How will revenues be used? A.All revenues will be used to support the stormwater program, which includes compliance with the Tar-Pamlico Nutrient Management State Regulations and the Federal National Pollutant Discharge Elimination System (NPDES) Regulations for water quality. It also includes maintenance of the drainage system such as pipes and ditches, protecting properties from flooding, protecting our streams and wetlands from erosion and pollution, and major capital investments for the drainage system as it ages. Frequently Asked Questions Q.Will revenues be spent throughout the City? A.Yes. The Stormwater Management Program is Citywide, and services will be provided throughout the City. Frequently Asked Questions Q.Why is the Stormwater Management Program not funded by tax revenues? A.The Stormwater Management Utility fee is fairer than a tax based on the assessed value of the property because of the following:The fee is based on each property's actual demand for stormwater service as measured by how much hard surface is on the property (i.e., building, parking lot, garages, and similar surfaces).Each property, including tax-exempt properties, will pay this fee, which contributes a fair and equitable share towards the overall cost of the Stormwater Management Program. Frequently Asked Questions Q.Why do I have to pay when I do not have any drainage problems? A.Everyone in the City benefits from the Stormwater Management Program. If stormwater runs off your property, the City must have a program and funding to manage the increase in runoff and pollutants. Direct benefits may include complying with Federal and State mandates, protecting your property from upstream runoff, protecting property downstream from your runoff, providing safe roadways, educating our children about pollution, and improving water quality. Dyersburg FAQ Q: Why am I charged a storm water utility fee? A: To meet regulatory requirements from an unfunded mandate from the Federal and State governments. (Phase II MS4 Permit) The state is requiring certain jurisdictions to better control storm water. Dyersburg fell into this jurisdiction and elected to create a storm water utility to be in compliance, and fund it by a utility fee that must be used for storm water activity. Q: What is the fee based on? A: The residential fee is the same for all residences. We used 1500 sq ft as the impervious area (or area that will not let water infiltrate) per ERU, which means Equivalent Residential Unit. This is the average size of a detached residential unit, based on the last city census, and all residences are charged the same one dollar fee. Dyersburg FAQ Q: What started this? A: The Clean Water Act of 1972, or to further that the amendments to it in 1987. This started Phase I MS4 permitting for metropolitan areas with a population of 100,000 people or more. The government saw that they were making progress, so they expanded the mandate in 1999 to include smaller cities. Dyersburg was one of the cities that this affected. Q: What will this fee be used for? A: The fee will be used exclusively to maintain numerous storm water activities, some of which are: public outreach programs aimed at educating the public and cleaning up our streams and rivers. It will be used for early detection and the elimination of illicit discharges. Inspection and enforcement of erosion control in the construction industry and new developments, and pollution prevention through education and good housekeeping in all government facilities. Dyersburg Fee Calculation APPENDIX A Calculating Storm water User Fees Single-Family Residential User Fee. The fee that residential users within the City limits will pay will be a flat charge of $1.00 per month. The average square footage of a single-family residential property is equivalent to one “ERU” and is determined to be 1500 square feet from recent U.S. Census Bureau reports. Developed Property Fee. The fee that developed property users within the City limits will pay will be determined from the following formula: Developed Property Fee/Month = Impervious Area x $1.00 x 50% (correction factor) 1500 sq. ft. La Vergne Rate Resolution La Vergne Rate Resolution Authority Funding Options We discussed these possibilities… • Do nothing- not a viable solution. • Use Grants and Loans- grants unpredictable and loans (includes bonds) must be repaid, neither good for O&M. • Fund the program with existing General Fund dollars-do your existing budgets have that much “fat” in them? • Dedicate a tax increase to your program and fund from General Fund-a good solution if the political will exists. • Let development fund your program-not a reliable long term solution for total program budget. • Make your program user funded; set up a Stormwater Utilityequitable and dependable, a dedicated revenue stream with no general fund budget battles. Funding Options General Fund -Not a new concept -Can be implemented comparatively quickly -Negligible overhead involved in tax increase/collectionmore of each dollar collected goes to program costs. Stormwater Utility Fee -New idea, citizen education required -Fast-track would be 18 months -Significant new overhead associated with implementing and administering utility fee -Dedicated revenue stream-no competing for general fund $$$ Storm Water Management And here! Or even here! THANK YOU PLEASE CONTACT THE PUBLIC WORKS CONSULTANTS AT MTAS IF YOU HAVE QUESTIONS Sharon Rollins, P.E. 423-282-0416 sharon.rollins@tennessee.edu John C. Chlarson, P.E. 731-423-3710 john.chlarson@tennessee.edu MTAS website http://www.mtas.utk.edu