MEMORANDUM

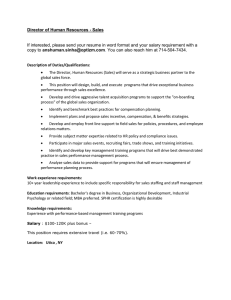

advertisement

MEMORANDUM FROM: Sid Hemsley, Senior Law Consultant DATE: July 21, 2003 RE: Insurance for Officers and Employees You have the following question: Can the city give members of the board of mayor and aldermen and its employees the following insurance options: - Provide to them health insurance under the city’s group policy; - Allow them to obtain individual life insurance policies from insurance providers of their choice, for which the city pays up to the cost of providing health insurance under the city’s group policy. The answer differs with respect to employees on the one hand and members of the board of mayor and aldermen on the other. Constitutional Limitations on Insurance For Municipal Officers and Employees Under Article IX, § 9, of the Tennessee Constitution, the General Assembly cannot pass a private act having the effect of altering the “salary” of local government officers. However, the Tennessee courts have distinguished between “salary” and “compensation,” and have further held that barring any constitutional limitation to the contrary, local governments have broad authority to provide “compensation,” to both their officers and employees. [See Peay v. Nolan, 157 Tenn. 222, 7, S.W.2d 815 (1928); Blackwell v. Quarterly County Court of Shelby County, 622 S.W.2d 535 (Tenn. 1981); Davis v. Wilson County, 2001 WL 434855 (Tenn. Ct. App. 2001.] There is no constitutional limitation that would prohibit the city from providing both its officers or employees with the above options. But the inquiry does not end there. Statutory Limitations on Insurance for Municipal Officers and Employees Employees. A general law, Tennessee Code Annotated, title 8, chapter 27, part 6, authorizes municipalities to provide group insurance of several kinds to their officers and employees, at up to 100% of the cost. [Tennessee Code Annotated, § 8-27-601 et seq.] However, that statute says that it is “supplementary” to the power and authority conferred by any other general or special law, and to any other express and implied powers and authority. [Tennessee Code Annotated, § 8-27-607]. Section 6 of the city’s charter gives the board of mayor and aldermen the right to “employ” a recorder and police officers after it has “first fix[ed] their compensation...” I can find no other provision in the city’s charter for the employment of other personnel, but it almost goes without saying that municipalities have the implied right to hire such employees as might be necessary to carry on the business of a modern city, and to compensate such employees. For those reasons, there is no reason the city could not give its employees the above two options with respect to insurance. Officers. Officers are not treated the same as employees for the purposes of compensation. While Peay and Blackwell distinguish between “salary” and “compensation” with respect to constitutional limitations on salary of public officers, any claim by a public officer to salary or compensation on the part of a public official must be based on legislative authority. It is said in 4 McQuillin, Municipal Corporations, Section 12.174, that: Where the Common Law imposed a duty upon an officer, he could not claim remuneration for fulfilling it unless the law had expressly conferred such a right. Unless the law provides a salary or compensation to the public officer none can be recovered. This sound rule is of general application, and steadily enforced by the courts. Any sort of claim against the public as salary, compensation, emolument, wage, fee, or expense must be authorized by law or contract, either express or implied. [Emphasis is mine] Similar language is found in 62 C.J.S., Municipal Corporations, Section 523: “A municipal officer rightfully holding an office is entitled to such compensation, and only such compensation, as is provided by law as an incident to the office.” That is also the rule in Tennessee. Peay, above, says that: Compensation attached to the office, wherever ‘salary’ or ‘per diem’ [citation omitted] is not given to the incumbent because of any supposed legal duty resting upon the public to pay for the service, [citation omitted] and a law creating an office without any provision for compensation carries with it the implication that the services are to be rendered gratuitously. Even more emphatic on that point is Bayless v. Knox County, 286 S.W.2d 579 (1955). There it was argued that even in the absence of statutory authority for the county to pay certain expenses of the county judge and county commissioners related to official county business the county had authority to pay those expenses. The Court rejected that argument, declaring: Considered on principle, the decisions of this State are directly contrary, as this Court views it, to that assertion. In State ex. Rel Vance v. Dixie Portland Cement Company, 151 Tenn. 53, 60, 267, SW. 595, 597, it is said: ‘It is a well settled policy of the state, determined by statute and judicial decree, that public officers can receive no fees or costs except as expressly authorized by law.’ To the same effect is State v. True, 116 Tenn. 294, 311, 95 SW. 1028; Shelby County v. Memphis Abstract Co., 140 Tenn. 74, 84, 203 SW. 339, L.R.A. 1918E, 939; Henry v. Grainger County, 154 Tenn. 576, 578, 200 SW. 2; Stone v. Town of Crossville, 187 Tenn. 19, 24, 213 S.W.2d 678; and many others which might be cited. There are no decisions to the contrary. [At 587] Both Peay and Blackwell explain that absent constitutional limitations, the legislative body is entitled to legislate with respect to salaries and compensation. But in both those cases, there was legislative authority supporting the contested payments to the public officials. Your City Charter, § 5, provides for a “salary” for the mayor and the members of the board of mayor and aldermen; it says nothing about compensation. For that reason, in order for the city to pay for insurance for its officers it must find some other legislative authority. The only other legislative authority I can find for municipalities to provide insurance to their officers is Tennessee Code Annotated, title 8, chapter 27, part 6. There is no authority found in that statute that supports the two alternative choices for officers; they must receive group insurance under that statute or not at all. Even the provision of that statute that makes it “supplementary” to any other general or special law, or any other implied power or authority of municipal corporations, does not help the mayor or aldermen because there is no such other general or special law that supports the alternative payment by the city, and there is no express or implied right of municipal officers to compensation unless it is authorized by legislation.