.1 AN ACT continuing in corporate existence of the City of... providing a complete new charter for the corporation, and repealing...

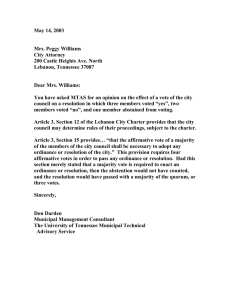

advertisement