From: Sent: Subject:

advertisement

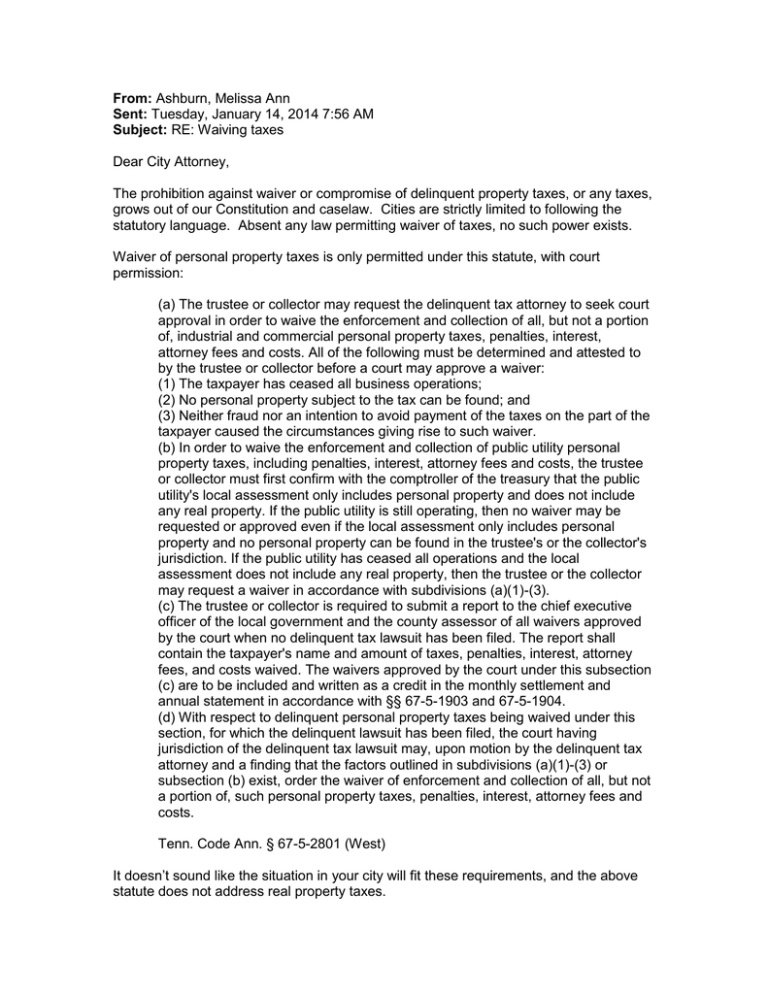

From: Ashburn, Melissa Ann Sent: Tuesday, January 14, 2014 7:56 AM Subject: RE: Waiving taxes Dear City Attorney, The prohibition against waiver or compromise of delinquent property taxes, or any taxes, grows out of our Constitution and caselaw. Cities are strictly limited to following the statutory language. Absent any law permitting waiver of taxes, no such power exists. Waiver of personal property taxes is only permitted under this statute, with court permission: (a) The trustee or collector may request the delinquent tax attorney to seek court approval in order to waive the enforcement and collection of all, but not a portion of, industrial and commercial personal property taxes, penalties, interest, attorney fees and costs. All of the following must be determined and attested to by the trustee or collector before a court may approve a waiver: (1) The taxpayer has ceased all business operations; (2) No personal property subject to the tax can be found; and (3) Neither fraud nor an intention to avoid payment of the taxes on the part of the taxpayer caused the circumstances giving rise to such waiver. (b) In order to waive the enforcement and collection of public utility personal property taxes, including penalties, interest, attorney fees and costs, the trustee or collector must first confirm with the comptroller of the treasury that the public utility's local assessment only includes personal property and does not include any real property. If the public utility is still operating, then no waiver may be requested or approved even if the local assessment only includes personal property and no personal property can be found in the trustee's or the collector's jurisdiction. If the public utility has ceased all operations and the local assessment does not include any real property, then the trustee or the collector may request a waiver in accordance with subdivisions (a)(1)-(3). (c) The trustee or collector is required to submit a report to the chief executive officer of the local government and the county assessor of all waivers approved by the court when no delinquent tax lawsuit has been filed. The report shall contain the taxpayer's name and amount of taxes, penalties, interest, attorney fees, and costs waived. The waivers approved by the court under this subsection (c) are to be included and written as a credit in the monthly settlement and annual statement in accordance with §§ 67-5-1903 and 67-5-1904. (d) With respect to delinquent personal property taxes being waived under this section, for which the delinquent lawsuit has been filed, the court having jurisdiction of the delinquent tax lawsuit may, upon motion by the delinquent tax attorney and a finding that the factors outlined in subdivisions (a)(1)-(3) or subsection (b) exist, order the waiver of enforcement and collection of all, but not a portion of, such personal property taxes, penalties, interest, attorney fees and costs. Tenn. Code Ann. § 67-5-2801 (West) It doesn’t sound like the situation in your city will fit these requirements, and the above statute does not address real property taxes. There is no other process or circumstance which can legally lead to waiver of penalties or interest: Penalty and interest are incurred on delinquent taxes pursuant to Tenn.Code Ann. § 67–5–2010; once suit to enforce a tax lien is filed, additional penalties, fees and costs accrue in accordance with Tenn.Code Ann. § 67–5–2410.6 There is no provision in either statute for the court to waive interest, penalties or costs or, indeed, which gives the court any discretion in this regard. To the extent the trial court had discretion to waive any of the penalties, fees or costs, our review of the record does not show an abuse of the court's discretion. State, ex rel. Williamson Cnty. v. Jesus Christ's Church at Liberty Church Rd., M200902439COAR3CV, 2011 WL 251212 (Tenn. Ct. App. Jan. 13, 2011) Some other language, confirming no tax remedy exists for proven financial hardship: With equal reason it may be said that TCA § 67–5–2410 clearly implies a legislative intent that a 10% penalty upon all delinquent land taxes upon which suit is filed. (The imposition and collection of the penalty raises a strong inference that suits had been filed in the present case, thereby rendering the above jurisdictional comment applicable.) Appellant has presented no authority requiring, or even authorizing remission of penalty, interest or attorneys’ fees on taxes due from one who was financially unable to pay because of blameless misfortune. The misfortunes of plaintiff evoke the natural sympathies of this Court, but do not invoke any rule of law or equity to support relief. Even though the complaint demonstrates a situation of financial reverses, it does not adequately explain failure to pay the tax. Daniel v. Metro. Gov't of Nashville & Davidson Cnty., 696 S.W.2d 8, 12 (Tenn. Ct. App. 1985) The main problem or barrier to waiving taxes is found in Article II, Section 28 of the Tennessee Constitution. This language provides in part: “In accordance with the following provisions, all property real, personal or mixed shall be subject to taxation…” Tenn. Const. art. II, § 28. From this Constitutional language, the requirement that all property be taxed equally has grown, along with clear limitations on the powers of local governments to levy and collect those taxes, as provided by state statute. “Under the Constitution and statutes of the state, the city had no power to exempt property from ad valorem taxation, but was expressly prohibited from doing so.” City of Nashville v. Cumberland Tel. & Tel. Co., 1906, 145 F. 607, 76 C.C.A. 297, certiorari denied 27 S.Ct. 776, 203 U.S. 589, 51 L.Ed. 330. A former statute, since repealed, that authorized cities and counties to provide tax relief to low income property owners was found to be unconstitutional. Op. Tenn. Atty. Gen. No.’s 89-111 (9/5/89) and 79-124 (7/13/79). See also, Perkins v. Alexander, unpublished opinion of the Tennessee Supreme Court, January 12, 1981. Cities are limited to following the statutory framework set by the State when levying and collecting taxes. As long as there exists no statute permitting waiver or compromise of property taxes, cities have no such power. Hope this helps, Melissa A. Ashburn Legal Consultant University of Tennessee Institute for Public Service Municipal Technical Advisory Service (865)974-0411