(5)

advertisement

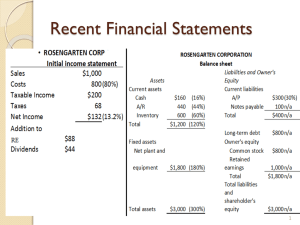

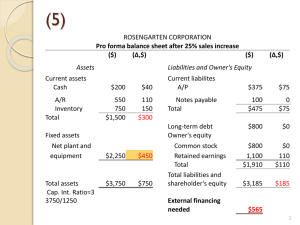

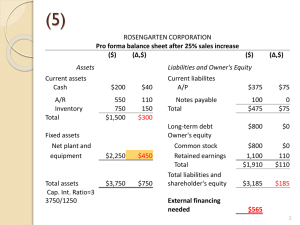

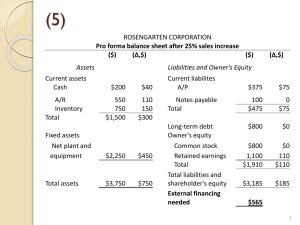

(5) ROSENGARTEN CORPORATION Pro forma balance sheet after 25% sales increase ($) (Δ,$) ($) Assets Current assets Cash A/R Inventory Total Liabilities and Owner's Equity $200 $40 550 750 $1,500 110 150 $300 Fixed assets Net plant and equipment Total assets Cap. Int. Ratio=3 3750/1250 (Δ,$) $2,250 $450 $3,750 $750 Current liabilites A/P $375 $75 Notes payable Total 100 $475 0 $75 Long-term debt Owner's equity $800 $0 $800 1,110 $1,910 $0 110 $110 $3,185 $185 Common stock Retained earnings Total Total liabilities and shareholder's equity External financing needed $565 1 EFN and Capacity Usage (overhead 27) Suppose Rosengarten is operating at 80% capacity: 1. sales at full capacity 1000/.8=1250 2. What is the capital intensity ratio at full capacity? 3300/1250 =2.64 3. What is EFN? 300-185=115 565-450=115 Conclusion: excess capacity reduces the need for external financing and capital intensity ratio 2 (5) ROSENGARTEN CORPORATION Pro forma balance sheet after 25% sales increase if no Δ FA needed ($) (Δ,$) ($) (Δ,$) Assets Current assets Cash A/R Inventory Total Liabilities and Owner's Equity $200 $40 550 750 $1,500 110 150 $300 Fixed assets Net plant and equipment Total assets $1800 0 $3,300 $300 Current liabilites A/P $375 $75 Notes payable Total 100 $475 0 $75 Long-term debt Owner's equity $800 $0 $800 1,100 $1,910 $0 110 $110 $3,185 $185 Common stock Retained earnings Total Total liabilities and shareholder's equity External financing needed 115 3 EFN and Capacity Usage (Homework) Suppose Rosengarten is operating at 86.95% capacity: 1. What would be sales at full capacity? 2. What is the capital intensity ratio at full capacity? 3. What is EFN (sales increase 25%)? 4 Operating at 86.95% 5 (5) ROSENGARTEN CORPORATION Pro forma balance sheet after 25% sales increase if no Δ FA needed ($) (Δ,$) ($) (Δ,$) Assets Current assets Cash A/R Inventory Total Liabilities and Owner's Equity $200 $40 550 750 $1,500 110 150 $300 Fixed assets Net plant and equipment Total assets 1956.52 156.52 3,456.52 456.52 Current liabilites A/P $375 $75 Notes payable Total 100 $475 0 $75 Long-term debt Owner's equity $800 $0 Common stock Retained earnings Total Total liabilities and shareholder's equity External financing $800 $0 1,110 $1,910 110 $110 $3,185 $185 needed 271.52 6 Solution 1000/.8695=1,150 1800/1150*100=156.52 (∆ FA) 456.52-185=271.52 7 Chapter 12 SOME LESSONS FROM CAPITAL MARKET HISTORY HTTP://WWW.YOTUBE.COM/WATCH?V=MZJMTCYMO9G HTTP://WWW.EFINANCIALCAREERS-CANADA.COM/ HTTP://WWW.GLOBAL- DERIVATIVES.COM/INDEX.PHP?OPTION=COM_CONTENT&TASK=VIEW&ID=54&ITEMID=36 8 Chapter Overview Return of an investment: arithmetic and geometric The variability of returns Efficiency of capital markets 9 Return from a Security (1) Dollar return vs. percentage return Two sources of return ◦ dividend income ◦ capital gain (loss) realized or unrealized Div Pt 1 Pt Ri Pt Pt Dividend Yield Capital Gain 10 Mean Assume the distribution is normal Mean return - the most likely return A measure of centrality Best estimator of future expected returns 11 The First Lesson The difference between T-bills and other investment classes can be interpreted as a measure of the excess return on the risky asset Risk premium = the excess return required from an investment in a risky asset over a risk-free investment 12 Arithmetic vs. Geometric Averages (1) Geometric return = the average compound return earned per year over multiyear period Geometric average return = T (1 R1 ) * (1 R2 ) *...* (1 RT ) 1 Arithmetic average return = the return earned in an average (typical) year over a multiyear period 13 Arithmetic vs. Geometric Averages (2) The geometric average tells what an investor has earned per year on average, compounded annually. The geometric average is smaller than the arithmetic (exception: 0 variability in returns) Geom. average ≈ arithmetic average – Var/2 14 Which Average to Use? Geometric mean is appropriate for making investment statements about past performance and for estimating returns over more than 1 period Arithmetic mean is appropriate for making investment statements in a forward-looking context and for estimating average return over 1 period horizon 15 The Variability of Returns Variance = the average squared deviation between the actual return and the average return (R R ) Var ( R) 2 i T 1 Standard deviation = the positive square root of the variance Var 16 Standard Deviation Measure of dispersion of the returns’ distribution Used as a measure of risk Can be more easily interpreted than the variance because the standard deviation is expressed in the same units as observations 17 The Normal Distribution (1) A symmetric, bell-shaped frequency distribution Can be completely described by the mean and standard deviation 18 The Normal Distribution (2) 19 Z-score For any normal random variable: X Z Z – z-score X – normal random variable - mean http://www.mathsisfun.com/data/standardnormal-distribution-table.html 20 Yet Another Measure of Risk VaR = statistical measure of maximum loss used by banks and other financial institutions to manage risk exposures • How much can a bank lose during one year? • Usually reported at 5% or 1% level 21 The Second Lesson The greater the potential reward the greater the risk Which types of securities have higher potential reward? 22 Capital Market Efficiency Efficient capital market - market in which security prices reflect available information Efficient market hypothesis - the hypothesis that actual capital markets are efficient 23 What assumptions imply efficient capital market? 1. Large number of profit-maximizing participants analyze and value securities 2. New information about the securities come in random fashion 3. Profit-maximizing investors adjust security price rapidly to reflect the effect of new information 24 Forms of Market Efficiency Weak form – the current price of a stock reflects its own past prices Semistrong form – all public information is reflected in stock price Strong form – all information (private and public) is reflected in stock prices 25 Weak Form Efficiency Current stock price reflects all security market information You should gain little from the use of any trading rule that decides whether to buy/sell security based on the passed security market data Major markets (TSX, NYSE, NASDAQ) are at least weak form efficient January effect 26 Semistrong Form Efficiency Mutual fund managers have no special ability to beat the market Event studies (IPO, stock splits) support the semistrong hypothesis Quarterly earnings surprise – test results indicate abnormal returns during 13-26 weeks following the announcement of large unanticipated earnings change (earnings surprise) in a company 27 Strong Form Efficiency No group of investors has access to private information that will allow them to consistently experience above average profits Evidence shows that corporate insiders and stock exchange specialists are able to derive above-average profits 28 29